A death benefit is the amount of money a life insurance company pays to a policy’s beneficiaries when the insured person dies. Although it’s pretty straightforward, there are some important details and common questions to be aware of.

Whether you’re a policy owner or a beneficiary, this guide will answer your questions about the life insurance death benefit.

Table of Contents

- What Is a Death Benefit?

- How Death Benefits Work

- Death Benefit Payout Options

- Death Benefit Claims: How to Submit & Requirements

- Death Benefit FAQs

Learn more about reviewing your life insurance policy to ensure your beneficiaries are updated and your coverage is appropriate.

What Is a Death Benefit?

When purchasing a life insurance policy, you select a coverage amount known as the face value. This amount can range from $50,000 to millions of dollars and represents the financial protection you provide for your loved ones.

In the policy, you designate beneficiaries who will receive this coverage amount upon your death. This payout is called the death benefit.

The primary purpose of life insurance is to provide financial security for those you leave behind in the event of your passing. The death benefit is designed to replace the income you once earned and support your loved ones in your absence.

Different Types of Death Benefits in Life Insurance Policies

Standard life insurance policies, such as term, whole, and universal life insurance, pay a death benefit no matter how death occurs. But there are other types.

Most common death benefit types include:

- All-cause death benefit: Most life insurance policies provide this standard death benefit. It always pays out, except for a few rare cases, such as death by suicide within the first two years of policy ownership.

- Accidental death benefit: Beneficiaries only receive a death benefit payout if the insured dies from an accident, such as a car crash or drowning.

- Accidental death and dismemberment: Besides paying the death benefit due to accidental death, this policy will also pay out if the insured suffers from a significant injury, such as blindness or paralysis.

- Graded death benefit: Policies with a graded death benefit, such as final expense insurance, have limited payouts if the insured dies of natural causes within the first year or two. Once the graded period has passed, the policy will pay out the full benefit.

How Death Benefits Work

Life insurance is a contract between a policy owner and insurance company. The policy owner agrees to pay premiums on time, and, in return, the insurance company agrees to pay out a death benefit upon the death of the insured.

When you buy a policy, you choose the dollar amount of the death benefit. However, depending on the type of policy you purchase and the features it has, your beneficiary’s death benefit may be impacted by certain actions.

The Death Benefit in a Term Life Insurance Policy

A term life insurance policy provides coverage for a specific time, usually 10-40 years. If you, the insured, die at any time during this term, your beneficiaries receive the death benefit.

There are many rider options available that you can add to a term policy that provide living benefits. If you access these benefits, the amount used is deducted from your beneficiary’s death benefit total.

Common living benefits riders for term policies:

- Terminal Illness Rider: If you’re diagnosed with a terminal illness, you can request a portion of your policy’s death benefit to use however you wish.

- Chronic Illness Rider: If you’re diagnosed with a chronic illness, such as Alzheimer’s, or unable to perform two out of six activities of daily living (ADLs), you can request a portion of your policy’s death benefit to use however you wish.

- Critical Illness Rider: If you’re diagnosed with a critical illness, such as cancer or stroke, you can request a portion of your policy’s death benefit to use however you wish.

If you outlive your term policy, your beneficiaries will not receive the death benefit.

Learn more about what happens if you don’t die while your term policy is inforce and the options you have to extend coverage.

The Death Benefit in a Permanent Life Insurance Policy

A permanent policy provides coverage for your entire life, as long as premium payments are current. As a result, your beneficiaries are guaranteed to receive a death benefit payout no matter what.

Permanent life insurance policies have living benefits riders, just as term policies do. If you take advantage of these living benefits, the amount used will reduce your beneficiary’s death benefit payout.

Furthermore, permanent policies have additional features that term policies don’t, which can further impact the death benefit.

- Dividends: If you own a participating whole life insurance policy, you can earn dividends based on the insurance company’s financial performance.

- Policy Loans: Both whole and universal policies accrue cash value separate from the death benefit. After enough cash accumulates, you can borrow against it.

- Withdrawals: Universal life insurance policies offer the option to withdraw money from the cash value account. A withdrawal is a permanent reduction of the cash value and death benefit. It cannot be paid back.

Designating Beneficiaries

Generally, you can name anyone a beneficiary and list as many beneficiaries as you want. When you first purchase the policy, the insurance company wants to know your relationship with the designated beneficiaries to ensure there is insurable interest. Once the policy is inforce, you can update and change beneficiaries.

Important things to consider:

- Primary and contingent beneficiaries: Name both primary beneficiaries (who will receive the death benefit first) and contingent beneficiaries (a backup person if the primary beneficiaries cannot claim).

- Clear identification: Provide sufficient information to identify each beneficiary, such as full legal names, birth dates, and Social Security numbers.

- Multiple beneficiaries: If naming multiple beneficiaries, specify the percentage of the death benefit each should receive, ensuring the total adds up to 100%.

- Regular updates: Review and update beneficiary designations periodically, especially after major life events like marriage, divorce, the birth of a child, or the death of a beneficiary.

- Trusts and minors: If naming minor children as beneficiaries, consider setting up a trust to manage the death benefit until they reach a specified age.

- Government benefits: If you have a loved one who receives government benefits, like a child with special needs, it’s better to set up a trust so they don’t become ineligible for Medicaid or SSI.

- Charitable organizations: If you want a portion of the death benefit left to a charity, provide the organization’s full legal name and tax identification number.

- Communication: Inform your beneficiaries about the life insurance policy, its details, and where they can locate the policy documents in case of your death.

Tax Implications

In most cases, life insurance death benefits are not taxable to beneficiaries. Proper planning and structuring of the policy can help avoid taxes.

Here are some scenarios in which death benefits may be taxed:

- Goodman Triangle: This refers to a scenario where three different parties are involved: one individual owns the insurance policy, another person is the insured party, and a third person is the designated beneficiary. Upon the insured’s death, the IRS considers the policy owner to be gifting the death benefit to the beneficiary; as a result, the amount is subject to gift taxes.

- Interest income: If the death benefit payout is delayed or the beneficiaries choose to receive the payout in installments, any interest earned on the death benefit may be subject to income taxes.

- Estate taxes: If the death benefit is included in the insured’s estate and the estate’s value exceeds the federal estate tax exemption limit, the death benefit may be subject to estate taxes. This can occur if the insured had incidents of ownership in the policy or did not properly set up an irrevocable life insurance trust.

- Transfer-for-value rule: If the life insurance policy was sold or transferred to another person or entity for valuable consideration, the death benefit might become taxable. Exceptions to this rule do exist, so it is essential to consult a tax professional when dealing with such transactions.

- Policy loans and withdrawals: If the policy owner has taken loans or withdrawals from the cash value of a permanent life insurance policy (like whole or universal life) and dies with an outstanding loan balance, the beneficiaries may owe taxes on the loan interest when the loan is repaid using the death benefit proceeds.

Death Benefit Payout Options

If you choose, you can select how you want your beneficiaries to receive the death benefit payout. If you don’t, your beneficiaries can choose when filling out the death benefit claim.

Most death benefit claims are paid out in a single, tax-free payment. But there are other options.

Death benefit payout options:

- Lump-sum payment: Payout is a single, tax-free payment to the beneficiaries. This is the most common and straightforward option.

- Installment payments: Payout is divided into smaller payments, disbursed to the beneficiaries over a specified period.

- Life income option: The death benefit is used to purchase an annuity, providing the beneficiary with regular income payments for the rest of their life.

- Joint and survivor annuity: Regular payments to the primary beneficiary for their lifetime. Upon their death, a secondary beneficiary (usually a spouse) continues receiving a percentage for the rest of their lives.

- Specific income provision: Paid as a fixed amount over time. If the beneficiary dies before the end of the term, the remaining payments may be passed on to a contingent beneficiary.

- Interest income option: The insurance company keeps the total and pays the beneficiary interest. The principal can be paid out later or upon the beneficiary’s request.

If you choose a lump-sum payment, there is no income tax. If you choose a payout option that generates interest, the beneficiary may be responsible for income tax on the interest.

See what you’d pay for life insurance

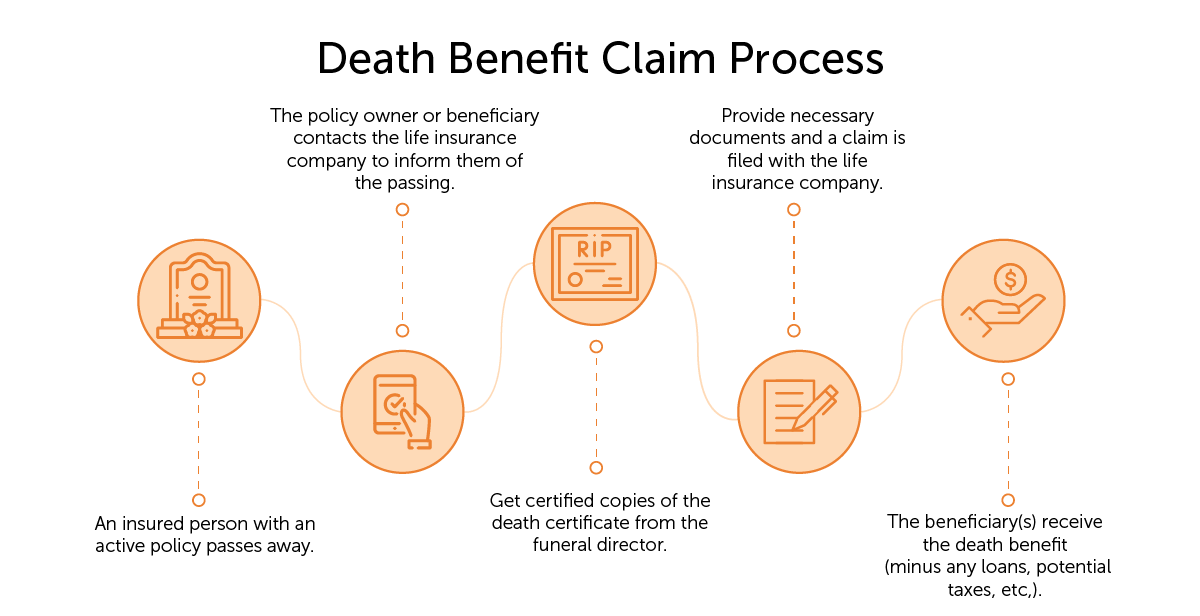

Death Benefit Claims: How to Submit and Requirements

Only policy beneficiaries and certain legal representatives can file a death benefit claim. Life insurance policies are confidential, and insurance companies will not disclose information to unauthorized individuals.

Upon the death of an insured person, a beneficiary needs to contact the life insurance company. The life insurance companies do not automatically know when one of their policyholders dies.

The insurance company will require a few documents to start the death claims process. Sending them together helps speed things along.

Documents required for a life insurance claim:

- Certified Death Certificate: Get certified copies of the death certificate from the funeral director. Life insurance companies won’t take photocopies.

- Claim Form: Many insurance companies have a claim form on their website that you can submit electronically or print off and return via mail. If not, call the company and ask what is required to file a claim.

Learn more about the life insurance claims process and get details on how payouts work.

Death Benefits FAQs

The death benefit is the most consequential part of a life insurance policy. As a policy owner or beneficiary, we understand that you may have questions. Here we address some of the most frequently asked questions to provide you with the necessary information.

Can You Access a Death Benefit Before Death?

In certain circumstances, you may be able to use life insurance while alive.

When a policy owner accesses a portion of their life insurance death benefit before they pass away it’s often called a “living benefit.”

Some policies include this at no extra cost, while others offer it as a paid add-on. Accessing a portion of the death benefit early will reduce the amount available to beneficiaries upon the insured’s death.

Beneficiaries cannot access the death benefits before the insured’s death.

What Happens to the Cash Value of Life Insurance at Death?

In most cases, the beneficiaries will receive the policy’s face value, which does not include any additional cash value accumulated over time.

The cash value remains with the insurance company, and any outstanding loans or interest against the cash value may be deducted from the death benefit before it’s paid to the beneficiaries.

What Happens to Life Insurance With No Beneficiary?

If there are no living or named beneficiaries, the death benefit is paid to the insured’s estate. If a will exists, the proceeds will be distributed according to the document. If there is no will, the death benefit will be distributed according to state laws.

There are downsides to having the death benefit paid to the estate, such as the potential for estate taxes or the need to go through probate, which can be time-consuming and costly. To avoid these complications, review and update beneficiary designations regularly, ensuring your policy matches your wishes.

Who Gets the Death Benefit if the Beneficiary Is Deceased?

If the primary beneficiary is deceased at the time of the insured’s death, the death benefit will typically be distributed as following:

- Other primary beneficiaries: If multiple primary beneficiaries were named and one is deceased, the death benefit will be divided among the surviving primary beneficiaries according to the specified allocation percentages.

- Contingent beneficiaries: If the policy owner named contingent or secondary beneficiaries, the death benefit will be paid to them.

- The policy owner’s estate: If no surviving or contingent beneficiaries were named, the death benefit would go to the policy owner’s estate. The proceeds will then be distributed according to the provisions of the insured’s will if one exists or the state’s intestacy laws if there is no will.

Can Death Benefits Be Denied or Delayed?

Yes, there are certain situations in which death benefit claims can be denied or delayed.

- Contestability period: Every life insurance policy has a contestability period that typically lasts the first two years of the policy. If the insured passes away within the contestability period, the insurance company has a right to investigate the claim more thoroughly to ensure there were no misrepresentations or omissions on the insurance application.

- Policy exclusions: Life insurance policies may have specific exclusions, such as death due to suicide within the first two years of the policy or death resulting from dangerous activities or illegal actions.

- Suspicious death: In the event of the insured’s unexpected or suspicious demise, the insurance company may temporarily withhold payouts to verify the named beneficiary’s innocence.

- Premium payment lapse: If the policy owner failed to pay the required premiums, the policy may have lapsed, resulting in the denial of the death benefit. Some policies have a grace period during which the policy owner can make the premium payment and reinstate the policy, but if this grace period has passed, the death benefit may not be paid.

Get a Life Insurance Quote in Minutes Through Quotacy

Need life insurance to protect your loved ones? It’s easy through Quotacy.

Get term life insurance quotes instantly without providing any contact information. When you’re ready to apply, the online application only takes a few minutes to complete.

Once you submit your application, you’re assigned a dedicated agent whose primary job is to help ensure you get approved at the best price possible. With over 25 of the nation’s top insurance companies at our disposal, we can shop around on your behalf.

Unsure how much death benefit to leave your loved ones? Our life insurance calculator can help.

0 Comments