Life insurance is a safety net for your loved ones, and as a parent, it’s natural to consider naming your children as beneficiaries. But can a minor be a beneficiary of a life insurance policy?

While it seems straightforward, the realities are often complex due to legal implications and practicalities.

This guide will explain everything you need to know about minor beneficiaries and potential alternatives to make an informed decision to secure your children’s financial future.

Table of Contents

- Can a Minor Be a Beneficiary of Life Insurance?

- Alternatives to Naming a Minor as a Beneficiary

- What are UGMA and UTMA?

- How to Designate Your Policy’s Beneficiary

Can a Minor Be a Beneficiary of Life Insurance?

Yes, they can, but life insurance companies will not write death benefit checks to children.

What happens instead?

If you name your child beneficiary to your policy and they’re not yet a legal adult when you die, the court will appoint a property guardian to manage these funds until your child reaches the age of majority.

Furthermore, the process requires:

- Legal fees

- Court proceedings

- Court supervision of life insurance benefits

In short, naming a child as your beneficiary will cost them time and money, and create unnecessary stress during an already difficult time.

Alternatives to Naming a Minor as a Beneficiary

To avoid all the court hassles there are three other options we recommend.

1. Name a trusted adult instead.

You can name a trusted adult who will use the money for your children’s benefit to be your policy’s beneficiary. If you are confident that this adult will not waver from his/her duty, this might be the easiest option.

2. Use a living trust.

If you have a living trust, you can name your minor child beneficiary to its assets. Then you can name the trust the beneficiary of your life insurance policy and the designated trustee will manage the funds on behalf of your child.

3. Use a UTMA/UGMA.

You can name your minor children as your life insurance policy beneficiaries under your state’s Minors Act.

See what you’d pay for life insurance

What are UGMA and UTMA?

The Uniform Gifts to Minors Act (UGMA)

The Uniform Gifts to Minors Act (UGMA) was created to overcome problems associated with making gifts to minors, by providing a simple and inexpensive method of transferring certain property to minors by means of a custodian arrangement.

- It enables the transfer of money and financial securities to minors without a trust

- It allows a custodian to manage the property until the minor reaches a specified age

- Gifts up to $15,000 are tax-exempt, anything beyond that is taxed based on the minor’s tax rate

- UGMA ownership may impact financial aid eligibility

Generally, UGMA allows the gifts of money and securities, however, some states have amended their statues to permit gifts of life insurance and annuities.

How Does UGMA Work?

- Similar to a trustee with one exception; custodians don’t take ownership of any property, the minor maintains that title.

- If they pass away before their state’s age of maturity (18 or 21), it will be included in their estate.

- Some states allow any adult to act as custodian while other states restrict custodians to the child’s legal guardian, parents, grandparents, siblings, uncles and aunts.

- When a custodian dies, the minor may designate another if they are at least 14 and there isn’t already a successor.

- If the custodian dies while the minor is under the age of 14, their guardian fills in or the court appoints a new custodian.

- To resign, the custodian must petition the court to designate a successor.

The Uniform Transfers to Minor Act (UTMA)

The Uniform Transfers to Minors Act (UTMA) expands on UGMA by allowing a wider range of assets to be transferred to minors.

- It enables the transfer of riskier, tangible assets, like real estate

- It grants control to a custodian until the minor reaches a certain age

- Exempts gifts up to $15,000 from federal taxes

- May or may not affect the minor’s eligibility for financial aid

UTMA has been adopted in 49 states while UGMA still remains in effect in South Carolina.

How Does UTMA Work?

The only major difference between UTMA and UGMA is that the former removes property limitations and restrictions.

It allows gifts from:

- Trusts

- States

- Depository institutions

- Insurance companies.

To summarize:

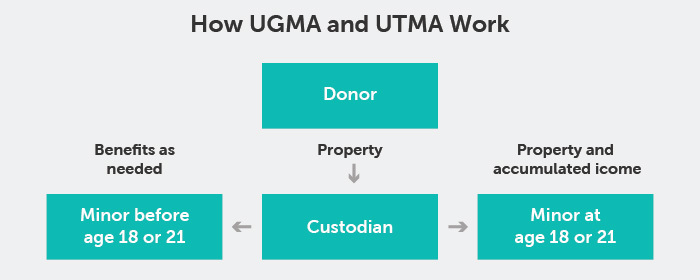

Step 1 – Donor transfers property to a custodian to be held for the benefit of the minor.

Step 2 – Custodian can use the property and any income that property produces on behalf of the minor.

Step 3 – At age 18 or 21, the custodian must transfer the property outright to the (former) minor.

How to Designate Your Policy’s Beneficiary

When designating a minor as the beneficiary of a life insurance policy, the following language is typically used.

Example:

I, John Smith (donor), have delivered to Jane Doe, as custodian for Sam Smith (minor), a life insurance policy on my life in the face amount of $500,000 issued by the ABC Life Insurance Company and payable to Sam Smith. The transfer is made under the Minnesota Uniform Transfers to Minor Act.

_________________________

(Donor’s signature and date)

I, Jane Doe (custodian), acknowledge receipt of the life insurance policy described above, and agree to hold this policy as custodian for Sam Smith under the Minnesota Uniform Transfers to Minor Act.

___________________________

(Custodian’s signature and date)

Some choose to forgo UTMA/UGMA in lieu of a trust. With a trust, you can specifically state how much will be transferred to the beneficiary and when.

With UTMA/UGMA, the minor beneficiary will receive the entire sum as soon as they reach legal age. If the sum is quite large, many opt not to let an 18-year-old or 21-year-old have all that money in one fell swoop.

Ready to get life insurance in place to protect your children? Start the process by running a term quote or using our life insurance needs calculator to determine how much coverage you should buy.

0 Comments