When it comes to life insurance, there are two broad categories: permanent and term. Term life insurance refers to policies that last a certain amount of time, while permanent life insurance refers to policies that last your entire life. There are several different types of these permanent policies you should know about before making any decisions.

You may have heard of whole life insurance, the most common type of permanent life insurance, but what about the others? In this guide, you’ll learn about all permanent life insurance so you can make the best choice.

Table of Contents

- What Is Permanent Life Insurance?

- 5 Types of Permanent Life Insurance Explained

- Term vs Permanent

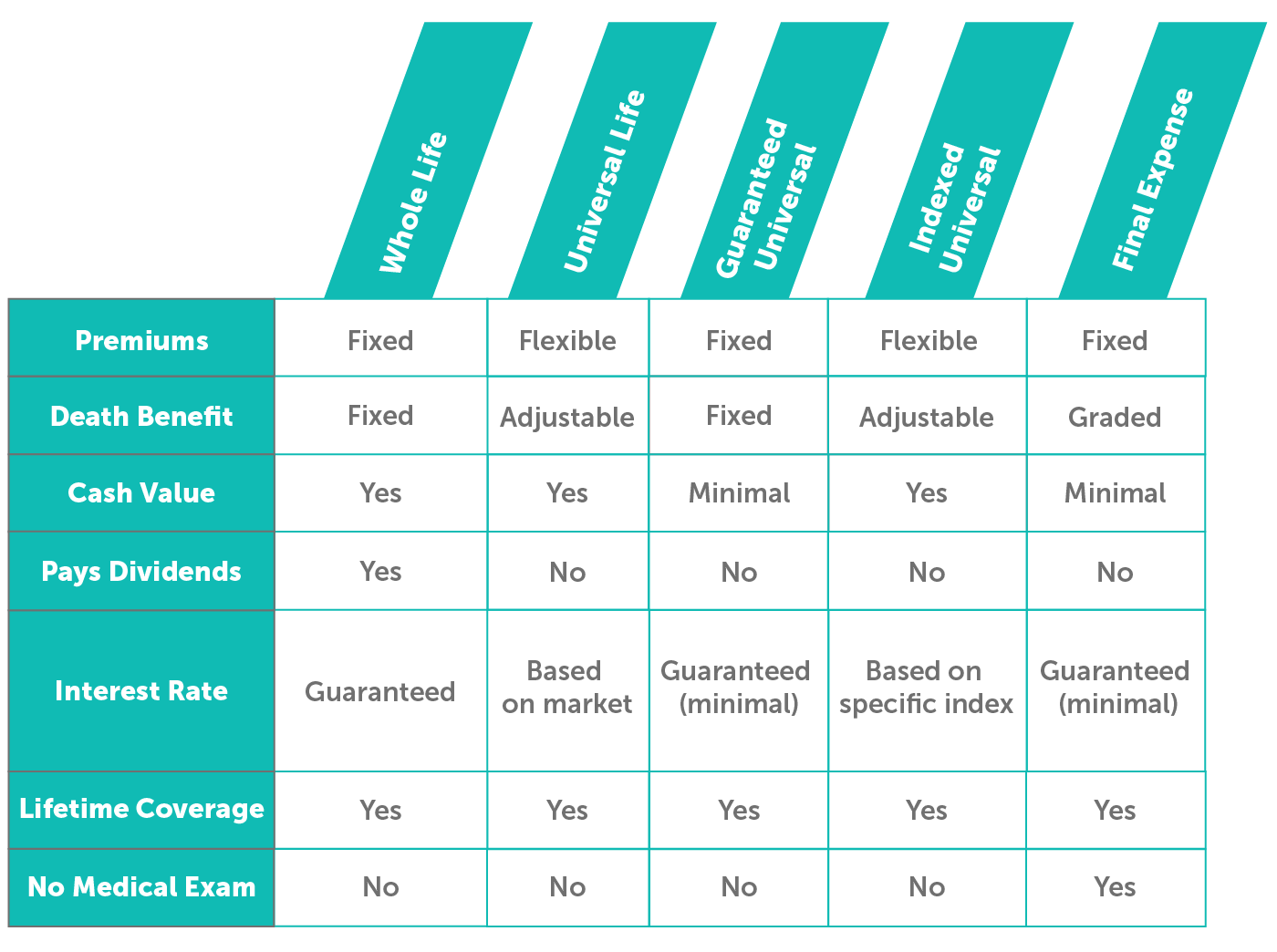

- 5 Types of Permanent Life Insurance (infographic)

Not sure if permanent or term life insurance is best for you? Learn the differences between term and whole life.

What Is Permanent Life Insurance?

Unlike term life insurance, permanent life insurance refers to policies with no expiration date. They’re designed to last until the day you die.

Some permanent life insurance policies also accumulate cash value and earn dividends. Due to these features, permanent life insurance premiums can be costly.

Permanent insurance is helpful if you have long-term insurance needs. For example, if you have a family member who will be financially dependent on you their entire life. Another scenario where permanent may be best is if you have a large estate and are looking for tax-advantaged products for your financial portfolio.

- Permanent life insurance lasts your entire life.

- Permanent life insurance can accumulate cash value that you can access while living.

- Permanent life insurance may pay dividends.

- Permanent life insurance is more expensive than term life insurance.

How Does Permanent Life Insurance Work?

If you buy a permanent life insurance policy and keep up with your premium payments, the insurance company must pay the death benefit when you die.

The death benefit is paid income tax-free to your beneficiaries, who can use it however they wish.

If your permanent policy accumulates cash value, you can access it via policy loans or withdrawals. But know that doing so can impact the guarantees linked to your policy and the death benefit payout for your beneficiaries.

If your permanent policy earns annual dividends, you have options in which to use them. Dividend earnings can boost your cash value, pay premiums, buy more insurance, or you take the earnings as cash in your pocket.

Permanent Life Insurance Pros and Cons

If you’re considering buying permanent life insurance, it’s essential to know the pros and cons.

Pro:

- Coverage lasts your entire life

- Ensures your funeral and end-of-life expenses are covered

- Accumulates cash value you can borrow against or withdraw from

- Earns dividends (if a participating whole life policy)

Con:

- Costly premiums

- Canceling a policy after a few years can be expensive

Unsure if permanent life insurance is the right choice? Learn if permanent life insurance is a good or bad idea for you.

See what you’d pay for life insurance

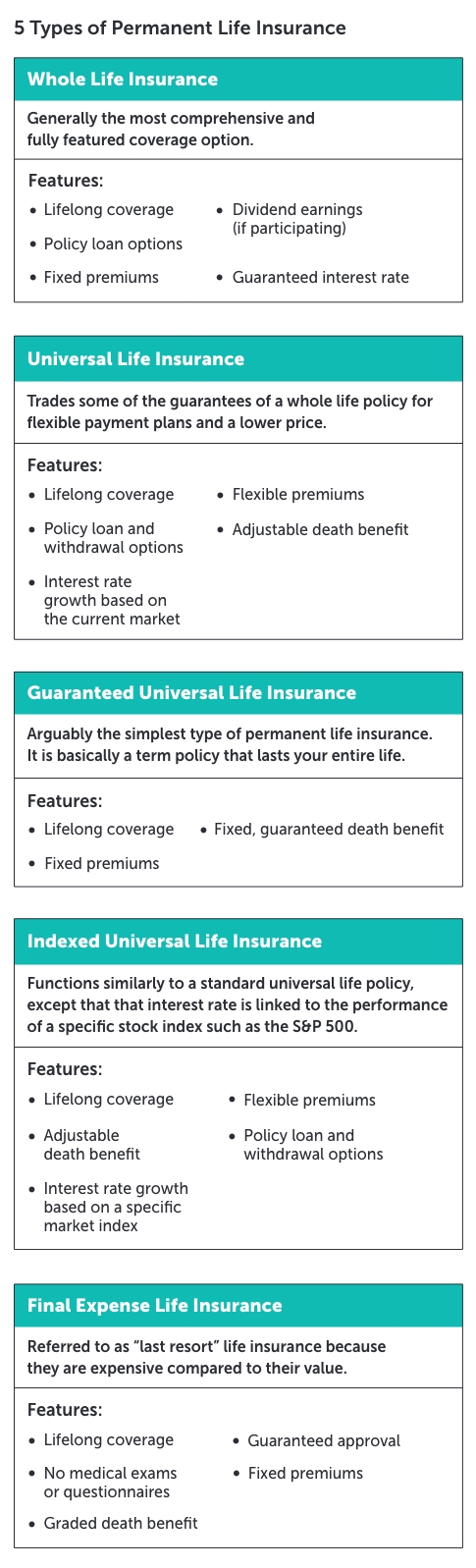

5 Types of Permanent Life Insurance Explained

The various types of permanent life insurance have different features and costs. Some are very complex. It’s understandable to be unsure which type is best for you.

Here we’ll explain the five most common permanent life insurance options.

Whole Life Insurance

A common misconception about whole life insurance is that it’s the same thing as permanent life insurance. In truth, whole life is just one of several types of permanent life insurance.

Whole life insurance is generally the most comprehensive and fully featured coverage option. This means that it typically has the highest premiums as well.

Because of this, life insurance advisors sometimes refer to whole life as the highest cost, highest reward path for permanent coverage.

Features of whole life policy:

- Lifelong coverage

- Fixed premiums

- Guaranteed interest rate

- Policy loan options

- Dividend earnings (if participating)

Whole life is more of a set-it-and-forget-it permanent product. You’d only need to monitor your policy if you took out a policy loan and didn’t pay it back.

You aren’t required to pay back the policy loan while alive, but it does accrue interest. Your policy will lapse if the loan amount plus interest exceeds your policy’s cash value. In addition, if you don’t pay back the loan while you’re alive, the total balance is deducted from your beneficiary’s payout.

Universal Life Insurance

Universal life (UL) insurance trades some of the guarantees of a whole life policy for flexible payment plans and a lower price.

Universal life insurance policies are issued with a target premium amount. This amount is merely a suggestion. After the first year, you can choose how much you want to pay. Many find the flexible nature of a universal policy attractive, but there’s risk involved.

The suggested premium is based on the policy’s assumed investment earnings. Because a UL policy’s investments are tied to the market, there is a risk that the earnings end up too little to support the policy. If the payments aren’t enough to cover the insurance cost and the cash value is too low, the policy can lapse unless you increase the premium or lower the death benefit amount.

Flexibility features extend to the death benefits of a universal life insurance policy. You can increase the benefit amount during times of need and decrease it when things return to normal.

Features of universal life insurance:

- Lifelong coverage

- Flexible premiums

- Adjustable death benefit

- Policy loan and withdrawal options

- Interest rate growth based on the current market

If you anticipate your income fluctuating throughout the years or insurance needs changing, a universal life insurance policy may be something to consider if you’re willing to monitor it.

For more in-depth information, read our guide discussing the difference between whole life and universal life insurance policies.

Guaranteed Universal Life Insurance

A guaranteed universal life (GUL) policy is arguably the simplest type of permanent life insurance. It is basically a term policy that lasts your entire life.

When you buy a GUL plan, you get a policy with a set amount and regular payment. If you pay the premium on time, your rate and death benefit are guaranteed to stay the same.

Other universal life plans can see costs rise over time because of possible changes in interest rates or insurance costs, but a GUL policy will always remain the same.

Compared to term life insurance, GUL policies have a higher premium because they cover an extended period. However, guaranteed universal life policies are often relatively inexpensive compared to other permanent life plans. Additionally, the consistent prices make a GUL plan far easier to budget for in the long run.

Features of guaranteed universal life insurance:

- Lifelong coverage

- Fixed premiums

- Fixed, guaranteed death benefit

If you have lifelong insurance needs but can’t afford the premiums of whole or universal, look into guaranteed universal life insurance. You can get an instant guaranteed universal life insurance quote by using our online life insurance quoting tool and sliding the Length of Coverage to Forever.

Indexed Universal Life Insurance

An indexed universal life (IUL) insurance policy functions similarly to a standard universal life policy, except that that interest rate is linked to the performance of a specific stock index such as the S&P 500.

The benefit of using an IUL policy instead of simply investing in an index yourself is that there is a guaranteed 0% floor for your investment risk. If the stock market doesn’t perform well, your policy won’t lose value.

The downside is that when the market is strong, an IUL policy has a cap on the interest rate it can earn—typically around 10%-15%.

Features of indexed universal life insurance:

- Lifelong coverage

- Flexible premiums

- Adjustable death benefit

- Policy loan and withdrawal options

- Interest rate growth based on a specific market index

There is more risk with an IUL and the potential for more reward. If you have a large windfall and have maxed out other traditional retirement accounts, an indexed universal life insurance policy may benefit you. However, be aware that you must closely monitor an IUL policy to avoid fees and lapsing coverage if you take advantage of the flexible premium payments.

Final Expense Life Insurance

If you’re between 50 and 80, you may want to consider final expense life insurance, especially if you have a pre-existing medical condition. This type of insurance is also known as guaranteed issue life insurance, guaranteed whole life insurance, funeral insurance, burial insurance, and guaranteed acceptance life insurance.

Features of final expense life insurance:

- Lifelong coverage

- Guaranteed approval

- No medical exams or questionnaires

- Fixed premiums

- Graded death benefit

These policies are often referred to as “last resort” life insurance because they are expensive compared to their value. People buy final expense life insurance if they have exhausted all other routes and don’t want to leave their family covering their end-of-life expenses.

Term vs Permanent Life Insurance

Term life insurance can be customized to fit most budgets, which makes it ideal for most people. It’s designed to provide protection during your family’s most vulnerable years—the years you’re working hard to provide for them and saving for retirement.

Permanent life insurance is ideal for those who need life long financial protection for their loved ones. If you’re a high-net-worth individual, it can provide money for estate taxes. Cash values can also provide supplemental retirement income. If you own a business, a permanent life insurance policy can provide many benefits, such as collateral for a loan and funding a buy-sell.

| Permanent Life Insurance | Term Life Insurance |

|---|---|

|

|

If you need permanent life insurance, the best strategy is to buy term life insurance to cover the most significant items and supplement it with a smaller permanent policy.

Learn more about supplementing a term life policy with whole life insurance.

Get a Permanent Life Insurance Quote from Quotacy

Permanent life insurance can be complex, and the type that’s best for you depends on your unique circumstances.

If you’re interested in buying permanent life insurance, complete this form, and an agent will contact you to review your needs and provide personalized quotes.

As a broker, we are obligated to serve you, the client. And our agents are not commission-based. With Quotacy, you don’t have to worry about being upsold or given biased advice.

If you’re just beginning your life insurance buying journey, learn more about your options in our wise buyers’ guide.

I want to cancel my policies with you cash builder plus and home call plan

Hi Hannah, did you purchase your policies through Quotacy? If so, feel free to call us and an agent can help you. Alternatively, you can call the insurance company and they can complete the process more directly.

I want to cancel my policy with my policy number *******

Hi Batsa, for your privacy I removed the policy number. However, I did look it up and we do not have that policy number in our system.