One of the most important steps in setting up your life insurance policy is listing beneficiaries — the individual(s)/entity(ies) to whom you leave your policy’s proceeds.

You’re only required to name one, but how many beneficiaries can you have? Usually, as many as you want, but check your policy documents to ensure there are no exceptions in the fine print.

Why List More Than One Beneficiary?

Typically, your life insurance beneficiaries are the reason to get coverage in the first place. People have countless personal reasons to name multiple beneficiaries.

While you only need to have one beneficiary, we recommend multiple.

If the entire death benefit goes to one person and they have already passed away or are otherwise unable to accept it, the proceeds revert back into your estate and may go through probate, where the court decides how the funds are distributed.

There are two aspects of beneficiary designation:

- You can list a primary beneficiary who will receive 100% of the proceeds and then name a secondary (or contingent) beneficiary to receive 100% of the proceeds in case your primary can’t accept benefits for any reason.

- You can elect to have multiple beneficiaries split the proceeds. Percentages received don’t have to be the same; you just need to ensure 100% of the benefits are accounted for.

Of course, you can also deploy a mix of these strategies. No matter how you designate beneficiaries, doing it correctly is critical to ensure they receive benefits.

Primary, Secondary & Tertiary Beneficiaries

The most straightforward way to designate beneficiaries is to have 100% of your death benefit go to one primary beneficiary. However, if you want all the proceeds to go to one person or entity, you should really name secondary (or contingent) and tertiary beneficiaries.

Secondary: The beneficiary listed is second in line for the payout if your primary beneficiary is unable to receive it.

He also names his brother as secondary beneficiary in case he and his wife die at the same time.

Tertiary: This beneficiary is the back-up if both the primary and secondary beneficiaries are unable to receive the death benefit.

He also names his brother as secondary beneficiary in case he and his wife die at the same time. John lists his local animal shelter as a tertiary beneficiary should both his wife and brother be unable to receive the death benefit.

While you’re only required to name a primary beneficiary, it’s always a good idea to name at least a secondary beneficiary just in case your primary dies before you do.

How to Split Proceeds Between Multiple Beneficiaries

You can leave 100% of the life insurance death benefit to one person, business, or charity, or split the proceeds between multiple.

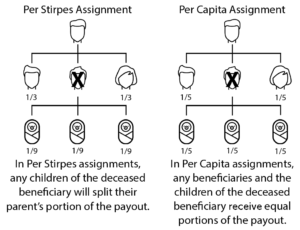

When naming beneficiaries you may assign proceeds to be distributed per stirpes or per capita.

- Per stirpes means that proceeds are divided by rank in the family

- Per capita means that proceeds are divided by the number of people

These distribution options help the claims process if any beneficiary were to die before the policyowner.

Of the two options, per stirpes is more common.

If you have a fairly large estate, be sure to work with an estate planner to ensure that you avoid any unnecessary estate taxes.

Review your term life insurance policy annually as life events occur, including:

Taking the time for a policy review is the best way to ensure what happens upon your death is exactly what you wish.

We’re here to help you protect your family with the best term life insurance policy for your unique financial situation. Get a quote in seconds without providing any contact information.

My Primary life insurance beneficiaries are designated as follows (with no Contingent beneficiaries):

Spouse – 50%

Child 1 – 25%

Child 2 – 25%

If my spouse dies, will the children equally split his 50% share? What happens if one of the children die – will their 25% share be split equally between my husband and my surviving child?

Hi Lisa,

Beneficiary designations can be divided per stirpes or per capita. “Per capita by surviving beneficiaries” is typically the default if you haven’t specified a designation rule on your policy. This means, the deceased beneficiary’s share will be divided equally between the remaining surviving beneficiaries.

To answer your question directly, yes, you’re correct. The children would split the 50% share and your husband and surviving child would split the 25% share.

If you prefer to have a different outcome, you can do so. Reach out to your agent to update the beneficiary designation rules, if desired.

My father recently passed. His life insurance policy has 3 primary beneficiaries.

My stepmother – 50%

My brother – 25%

Me – 25% My brother and I are both over 21

However, the insurance company issued the whole check to my stepmother. She now wants to pay some bills before she splits up the money.

I have talked with the insurace company and they will not talk with either my brother or me. I don’t get it.

Linda, I’m sorry to hear of your father’s recent passing. How do you know that’s how the beneficiaries are setup? It’s possible your father changed the beneficiary designations prior to his passing.

Hi Natasha,

Trying to understand, if I Designate my grandchild and daughter as primary beneficiaries, both at 50%.

Than designed my sister as the Contingentat 100%.

I am confused ,if I die first the daughter &grandchild get 50% each.

If i died an the daughter died will the grandchild get 100%?

My sister the continent gets 100% only if we all die..right?

Hi Gwendolyn, you are correct. Your contingent beneficiary only receives death benefit proceeds if all primary beneficiaries have predeceased you or are otherwise unable to claim the death benefit upon your death.

If there are two beneficiaries. Are two seperate checks sent out?

Yes, each beneficiary is sent a check.

My father is in hospice and his wife wants to borrow against his life insurance policy to cover medical expenses. She is designated to receive 70% and my brother and I are each designated to receive 15%. She has power of attorney. Can she borrow against our portion or dust her own?

Hi Alicia, I’m sorry to hear your dad is on hospice. To answer your question, a policy loan actually has nothing to do with the beneficiary designation. The policy owner (or power of attorney in this case) is able to take out loans if they wish. It doesn’t matter who the beneficiaries are or what the distribution percentages are. If the policy loan is not paid back prior to your dad’s death, the 70/30 distribution will be taken from whatever remains after the loan balance is paid.

Hi my dad recently passed and had life insurance through his employer. According to the rep at his job he listed me as his primary beneficiary, but only put 50% and my 2 younger siblings that are minors as secondary and tertiary receiving 25% each. From my understanding I thought the total is supposed to equal 100% no matter how you divide it out. If I’m the only primary will I get 100% instead of the 50% he listed out since I am the only primary? From my understanding the secondary will inherit something if I am not available to get the inheritance, can you provide an answer to this?

Santerria, I’m sorry to hear about the passing of your father. In regards to your questions, your understanding is correct. Primary receives the death benefit and the secondary and tertiary beneficiaries receive the death benefit if the prior are unable to. However, policy owners can name more than one primary beneficiary as well. This may be the situation with your father’s policy. I suggest that you call the insurance company directly and ask them to explain the beneficiary designations.

Hi my husband work insurance policy has me the wife of 24 years and his daughter my step daughter listed. Please explain how that works? So does that mean if my husband dies both me and my step daughter split 50/50

Hi Lois, if you and your stepdaughter are both listed as primary beneficiaries with no distribution percentages specified, the insurer will pay out the proceeds 50/50 as default.

John, previous comment regarding 70% vs 30% beneficiary payouts. It is whole life policy for $25,000 after death $7500 paid for funeral cost leaving balance $17,500.

How is payoff determined 70% beneficiary received $10,000 secondary beneficiary at 30% received $7500.

70% of $17,500 = $12,500 not $10,000

30%of $17,500 = $5250 not $7500

Who is correct trans insurance or 70% primary beneficiary?

John, the policy owner may have had an unpaid loan balance against the policy. The insurance company would take this balance plus interest from the death benefit before paying the beneficiaries. Since we did not help write this policy, we don’t have a way of looking up the policy specifics. I cannot explain with 100% certainty why the insurance company paid out the proceeds as they did. I recommend you call their customer service line and ask for an explanation. I’m sure they will be more than happy to assist you.

I am primiary beneficiary on policy 70%,other 30%. Policy amount $25,000 . After funeral cost $7525 balance $17475. I received a check for $10,056, other beneficiary received remaing amount or $7419 for 30%. Are these amount correct at 70% 2X more than 30%..

How is payment distributed if secondary beneficiary at 30% receives $7419 or nearly 43%, primiary beneficiary 57%?

Both of you beneficiaries are primary beneficiaries, you just receive a larger distribution of 70%. A secondary beneficiary would only receive the death benefit if you were unable to claim any of it.

I don’t know the details of your specific policy. Was this a pre-paid burial plan you bought through a funeral home? Or is this a type of life insurance? If so, what type of life insurance is it?

I have a group policy through work let’s use 100k. I have a daughter and son and ten grandchildren. I want to leave 5% to each grandchild and 25% to each my son and daughter. Is this possible, to list and distribute this as I wish?

Yes, but if your grandchildren are minors (under the age of 18) you may wish to go a different route. The life insurance companies will not write a death benefit check made out to a child. Take a look at this article for more information: Can a Minor Be a Beneficiary?

So I have a policy naming my husband as beneficiary.

If we both die, I would like the $ to go partly to my daughter and partly to my sister for my daughters care.

IF my daughter were to die with my husband and I, I would like the money to go to my dad. Is that possible? How would I go about it?

Ashley,

What you want to accomplish would be very difficult with life insurance policy beneficiary designations. Whether or not your daughter is a minor and the state you live in also affects the route you should take. If your daughter is a minor, don’t name her as a beneficiary of the policy. The money would get tied up in the court system because a life insurance company won’t write a check to a minor child. This article can help shed some light on that: Can a Minor Be a Beneficiary?

Here are some suggestions for you to consider:

1) If your daughter is a minor, name your sister, as guardian for your daughter, as the contingent beneficiary for the benefit of your daughter with 100% of the death benefit going to your sister.

2) Depending on the state you live in, if your daughter is not a minor and you name both she and your sister as contingent beneficiaries with split percentages, if your daughter died at the same time as you and your husband, your daughter’s share of the death benefit may likely go to your father anyway. Again, this depends on the laws of your state though.

3) If you create a trust, you could accomplish everything you want, but hiring a lawyer to draw it up is an additional cost to think about.

Hi my Mother passed away in July 1987 my Mother had life insurance from my Father work of employment Lackland Airforce Base, I think my father received all the money, is there any way to check the beneficiaries list for her. Also my father passed away April 2007 and life insurance MetLife was divided between his three sons. The total amount I am not sure but I want to check amount, and beneficiaries list plus any additional policies That we are not aware of I have always felt my father may have left additional policy to be distributed at later time after his death to insure security for his three Kings. Any help you can help me will bring a bit of peace of mind, I know there are criminals on the prowl searching for there next victim. Any assistance will help thanks. I would also like to check if there is a policy in my name anywhere, the criminals are crafty in their wicked game of greed. Thank you! Fool me once shame on you fool me twice , blood line protected!

Roland, to check to see if you are a beneficiary on a life insurance policy there are a couple different websites you can check: Missingmoney.com and unclaimed.org. With assistance in locating lost life insurance policies, the policy locator tool at the NAIC.org website may be helpful.

My mother carried a insurance policy on my sister. My mother was the beneficiary on the policy. My sister passed away in July of 2015. My mother passed in April of 2016. Does the money go into my mother’s estate or my sisters. I knew nothing of the policy until I received a letter from the insurance company about changing the policy to a term policy. My mother lived with us for three years after having a stroke before she passed. I sent in all the information that they wanted. They sent a check in the name of my sisters estate. My lawyer told me the money should have gone to my mother’s estate in witch I am my mother’s only living heir.

Hi Harold,

I agree with your lawyer—the death benefit should have gone to your mother’s estate. I recommend that you contact the life insurance company and ask for justification as to why they sent a check in the name of your sister’s estate instead.

Hi,

I would like to leave the majority of my life insurance to my wife and a small portion to my father and my siblings. If something were to happen to my wife and me simultaneously, would the remainder go to our children or would it go to my father and siblings?

Thanks

Hi David,

What happens to the death benefit payout is up to you. Without adding any additional language and simply leaving your beneficiaries as your wife, father, and siblings, the payout would be split between your father and siblings if you and your wife died simultaneously. If you prefer your wife’s portion go to your children, then you need to add in per stirpes language. Per stirpes would mean that your wife’s portion would be divided equally among your children versus it going to your father and siblings.

My daughter-in-law insists that a person can only have one beneficiary and one contingent beneficiary on a life insurance policy. She has named her brother as her contingent beneficiary as opposed to the children. She said her job limited her to 1 primary and 1 contingent beneficiary. Can your employer limit your beneficiary’s

Hi Gertrude,

The employer would not be the ones limiting the policy beneficiaries, but the insurance carrier offering the plan through the employer. And it is possible that an insurance carrier would do this. A policy with only one beneficiary is less expensive to administer and therefore would have lower costs than policies that offer a more fully rounded beneficiary designation.

Gertrude – If the children are under 18 she should not leave money directly to them. She should actually leave the money to the children under the states Unifrom Transfer to Minors act (UTMA) and can name the brother as custodian. If under age depending on the amount the death benefit could wind up in probate. If she calls HR department they can provide forms that allow for more complex beneficiary designations. The form is just something that your company keeps in their filing cabinet or document imaging system. The carriers count on the forms that the employers have on file to pay the death claim.

Hello!

I am revising my life insurance, because I am now divorced:

Primary: 100%

Continents:

sister #1: 20%

Sister #2: 20%

Sister #3: 20%

Mother: 20%

If me and primary passed away, and contingent mother passed away too, can mother’s share be divided between the 3 sisters?

Another example, if me, primary, and sister#1 passed away, will the share of sister #1 proceed to her children “per stirpes”?

I just want to make sure that it will be equally divided to contingent beneficiaries and/or their children

Also, can list them as contingents if they are citizen of another country? So they have no ssn.

Hi Dani,

You will want to make sure your divided shares equal 100, so designate 25% to each contingent beneficiary instead of only 20%.

To answer your first question, yes, if your primary beneficiary and your mother passed away, your mother’s share would be divided between your remaining contingent beneficiaries unless you designate otherwise.

If your primary and sister #1 passes away, and you designate “per stirpes” then yes your sister’s share would be divided equally between her children.

You may name someone who lives in another country as a beneficiary even if they do not have a SSN. Just be sure to provide the insurance company enough information so that they can easily contact them: their date of birth, address, phone number, and email address.

My uncle recently passed and my grandmother was his primary beneficiary. My mother, his sister was his contingent beneficiary who has also passed. He was never married and had no children, only siblings. Where would the insurance money go from here? To split between siblings or to the children of the contingent beneficiary.

Hi Jeannie,

I’m sorry to hear about the death of your uncle and your mother.

Is your grandmother still alive? If she is, she would get the entirety of the insurance money (death benefit). A contingent beneficiary only gets the death benefit if the primary beneficiary has died or for some other reason is unable to receive the money.

If your grandmother has also passed and there are no other named beneficiaries, then the death benefit will be paid to your uncle’s estate. It will go through a court process called probate. If your uncle had a will and he stated how he would like his assets distributed, the court will proceed in accordance with this. If your uncle did not have a will, the court will determine who gets the insurance death benefit.

Thank you so much. My grandmother had passed 31 years ago. My mother 11 years ago. My uncle had no will. My mother had helped my uncle many times over the years and he died suddenly. My sister and brother found the policy among his papers. We weren’t sure if it would come directly to my mothers heirs. There are 5 siblings left of 8 now. Two have passed. My mother had 3 heirs and my uncle had 5 heirs. Would it still be distributed among the 13 relatives?

Hi Jeannie,

First, I would advise you to call the insurance company that is listed on your uncle’s policy in order to a) determine if your uncle’s policy is inforce (active) and b) inform the insurance company that your uncle has passed away. If the policy is still inforce, the insurance company will send out claim forms to the appropriate parties.

Second, if the policy is still inforce and there is a death benefit to be distributed, how it gets distributed will depend on the intestacy laws of the state in which your uncle lived. This article Understanding Intestacy: If You Die Without an Estate Plan may be helpful to you. Hope this helps.

I received a beneficiary letter from Metlife following the passing of my father. It identifies the amount of insurance at the top of the letter as 118,000.00. Is this typically the total amount to be dispersed among multiple beneficiaries, or is this the amount designated to me as his daughter? I’m just wondering if I’ll be able to share with my family members or if they may be getting their own funds.

Hi Nicole,

I’m sorry to hear about the passing of your father. I would advise that you call MetLife, explain your situation, and ask if you are the sole beneficiary or if your father named multiple beneficiaries on his policy. I lost my dad two years ago and when I called the insurance carrier to inquire about the same thing you’re wondering, they were very kind and did explain to me the beneficiary designations. Not all life insurance companies follow the same procedures, but hopefully the representative you speak to at MetLife will be able to assist you.

My father passed away in 2014. He left my mothers sister as Beneficiary on the life insurance policy as my mom had passed away in 2010 and he trusted her to divide the remaining funds after funeral costs amongst his three children. She took care of the funeral and then kept 20,000 remaining to her self and said he wanted her to have it. We live in the state of Maryland there was no will that we could find (pretty sure he gave it to her) and is not registered with registrar of wills… is there anything we can to dispute this?

Hi Vicky,

I’m sorry to hear about the struggles you and your siblings are going through with your aunt. If you believe your aunt has your father’s will, you can ask her to file it with the probate court. In Maryland, wills of deceased individuals are public records and your aunt is required to file it. If she refuses, you may need to take legal action.

However, that being said, life insurance policies trump wills. So, even if in his will, your father stated that he wanted you and your siblings to receive life insurance death benefits, but the actual life insurance contract names your aunt as the sole beneficiary, the life insurance contact supersedes what he says in the will.

So, unfortunately, you legally do not have any rights to the life insurance death benefit, but you do have the right to view his will. If no will actually exists, as your father’s closest relatives, you are likely entitled to any property he owned. You may wish to hire an attorney to help you with these issues.

My father passed away and put all 8 of his children as the beneficiaries on his policy how will the insurance company distribute the remaining balance on his policy

Hi Xavier,

No matter how many beneficiaries are named in a life insurance policy, the distribution percentages need to add up to 100%. There wouldn’t be any benefit remainder. For example, if your father chose to divide the death benefit amount equally between his 8 children – each of you would receive 12.5% of the benefit.

Did your father have a permanent life insurance policy? Like a whole life policy that accumulated a cash value? If you’re inquiring as to what happens to the cash value balance, this does not get added to the death benefit amount.

My partner of 25 years died. I have 2 children with him. He has 3 all the children by previous marriage. He left his two oldest sons as beneficiaries to his life insurance policy from work. He did not include his daughter or my two children. I was just wondering if there’s anyway they can contest it to receive a part of the insurance policy?

Hi Linda,

I’m sorry for your loss. In order to help you further, could you answer two questions for me? First, were you and your partner legally married? I assume no only because you didn’t call him husband, but just wanted clarification. Second, which state do you live in? Your relationship status and the state you live in may affect whether or not you or the children have any legal standing to challenge the death benefit payout.

If there are two contingent beneficiaries on life insurance policy can one file for his share or do both have to file to receive benefits? What happens if one can’t be found? Thanks

Hi Georgia,

Most life insurance companies will require beneficiaries to fill out and send in their own claim forms. If there are two, one beneficiary cannot file for both beneficiaries.

Regarding your next question, as an example, if there are two beneficiaries, each designated to receive 50% of the death benefit, and one beneficiary has not yet filed, the life insurance company will sit on that beneficiary’s portion until the rightful beneficiary comes forward and to claim the benefit.

What if my uncle’s wife filed the insurance claim for his life policy. To be told that it was denied and that all parties have to agree. When asking the insurance for the benefeciaries name that told her they could not give her that information because my uncle has passed and that inforamtion is private. What does this mean??

Hi Jennifer,

From what I gathered from your comment, your aunt is not the beneficiary of your uncle’s life insurance policy. Because she’s not a beneficiary, she cannot file a claim. The life insurance company is protecting the privacy of your deceased uncle by not releasing any beneficiary information. Your aunt could try calling the insurance company a few more times to see if anyone there will grant her more information, but that’s about all she can do.

I have a question. my sister had two sons that she listed as beneficiaries, 50/50,of her life insurance policy through work. she died may 11th, her one son then passed away on June 4th. Does all her insurance now pass to her only child or does half still pass through the other kid to his next of kin?

George,

My condolences to you and your family. That is a lot of pain and suffering in a short period of time. Your question on whether or not the insurance will go to her now deceased son or all to the other brother is a question we hear often. When someone is named a beneficiary and dies with the insured in a car accident or within a very short period of time (hours, not days, but that is driven by each state), then sometimes the money will go around that person and to the contingent beneficiary. But in this case there are two beneficiaries and even that rule would not be applied.

For your sister’s policy, the insurance will flow according to her wishes. So the money will go 50/50 to one son and the other proceeds will go to the other son’s estate. How it gets distributed from his estate will be determined on multiple factors including: Does he have a will? Is he married? Is he a minor? Does he have children? Those are the big questions that his estate will utilize to direct his half of the funds.

thanks for getting back to me. He has no kids, no will, and was only engaged to be married. So I guess his next of kin would get the $$, which I guess is his father and not his brother?

George,

States have some differences in how they label next of kin. That being said, every time we have researched it, the answer has been the same. Next of kin in this scenario is mom and dad, not brother of fiancé. So your guess is exactly what I would guess as well. The money will flow to his father.

Typically the way life insurance proceeds go is first to a spouse. If no spouse, then it will go to the children. If no children then it goes to parents. If there are no surviving parents, then the money will go to the siblings. After that link of the chain it gets very complicated. So yes, his father will be the one who claims the death benefit. That’s been our experience.

His father has the right to give the money to his surviving son if he likes (he may have to use gift tax exclusions). And even if the parents were divorced, that doesn’t change anything. The money is actually flowing through the son’s estate to his dad, not from the mom’s estate to the dad directly.

One thing to note is that the life insurance will be claimed by the estate of the deceased son, not the father. The estate will most likely pay out exclusively to the father, but there may be a state or two in the union where a piece of an estate goes to the siblings as well. The attorney who handles the estate will know the state specific laws for settling the estate of the son.

My mom passed recently, I and my brother received beneficiary information but the insurance company would not tell us the amount of the policy. They said we have to file our claims and receive the pay out. Is this normal? They sent us beneficiary info so why not tell us the policy amount?

Hi Velda,

I am sorry about the recent loss of your mom. To answer your question, if your mom did not list you and your brother’s dates of birth or Social Security numbers on the original life insurance application, the life insurance company may simply be withholding information because of privacy issues. Once you and your brother complete what is called a Claimant Statement and send in a certified copy of the death certificate, you will be able to get the payout information.

If two beneficiaries are listed on an employment life insurance policy split up 50/50, and one of the beneficiaries are not found (due to no contact information or last name etc) would the other beneficiary receive the 100% or only the 50% originally placed?

401k and PTO is included as well. In CA if that helps.

Thanks 🙂

Tony,

Great question! The short answer is no, the 100% would not be sent to the other beneficiary. The reasoning behind this is that a beneficiary designation is a contract, the actual wishes of someone who has passed away. That money from the other 50% beneficiary would sit in the insurance company until the person comes forward to claim it. There have been many articles written in the last few years about how insurance companies aren’t spending enough resources to actively look for these not found beneficiaries and now the insurance companies are sitting on many billions of dollars. This money will then stay with the insurance company until such a time as the hard to find individual stakes their claim.

In the event of my death, I would like to give a small amount of my life insurance proceeds to my brother as well as a dear family friend- but the bulk should go to my significant other. However, in the event that my significant other and I should die in the same incident (or he 10 days after me using the “common disaster clause”), I would then like to see the split quite differently.

Here is the what I am trying to verbalize on the beneficiary form:

Significant other: 90%

Brother: 7%

Friend: 3%

BUT- if significant other and I die in same incident (or within 10 days, I will use “common disaster clause”), then I would like to see

Brother: 90%

Friend: 10%

How would I articulate this on a beneficiary form?

Hi Tammy,

Wow, what a great question. There is only one way of doing this that I know of, and that is to make your wishes known in a will. A beneficiary form is not agile enough to accomplish what you desire. Please bear with me as a I explain.

First, the way that you laid out the beneficiaries with your significant other receiving 90% and the remaining split between your brother and your friend at 7% and 3%. What happens upon your death if your significant other also passes around the same moment, is that the life insurance policy will not pay out any benefit to your significant other. Instead the contract will divide the proceeds per your wishes identified on the form. So, your brother would receive 70% and your friend would receive 30%.

A beneficiary designation form is really a decision tree, and is just not flexible enough to play out every scenario. If you truly wish the split in benefit at a 90/10 in case of a mutual tragedy with you and your SO, then my suggestion is to draw up a will. In the will you can specify exactly what you want to happen. So you would make your estate the beneficiary of the other 10% and parcel it out how you wish.

One other thing to note; some carriers will no doubt have trouble establishing an insurability link between an insured and your sibling and/or friend. You may need to put this coverage in place using your significant other or estate as beneficiary anyway. Once it is in force you can of course change the beneficiary to whomever you choose.

My apologies for not providing you a very clear answer to this request. This is the way to go about making it happen though. Otherwise, you can always have your brother at 9% and your friend at 1% in the designations and that would also accomplish your end goal if you and your SO passed away at the same moment.

I am one of four beneficiaries. Will the insurance claim wait for all beneficiaries to submit their paperwork or will they pay out my portion when received and approved?

Essentially could one of the four hold out and keep the others from receiving their payment?

State of Indiana if that matters

Hi Ed,

When there are multiple beneficiaries, life insurance companies will generally wait until all paperwork has been received before they issue death benefit payouts. In the case that one or more beneficiaries delay this process or they cannot be located, insurers will just issue payments to those whom have submitted the claim paperwork. The timeline on this varies by life insurer, however.

Why would the insurance company wait until all have submitted a claim. They know how much goes to each beneficiary and I believe there is no time limit for a beneficiary to make a claim so why not pay out the claims of the people that have done the paperwork. What if it is taking over 6 months and there are over 10 beneficiaries? What is a reasonable timeline.

In the case that one or more beneficiaries delay the claims process or a beneficiary cannot be located, insurers will just issue payments to those whom have submitted the claim paperwork.

Hello. I got a Death Benefit Claim- for Life Insurance. If there is more than one primary beneficiary on that policy will they both each have their own Death Benefit claim or will they each get their own?

Hi Hope,

Each life insurance company’s procedures vary, but oftentimes each beneficiary will need to complete a separate claim form. I recommend that you call the insurance company listed on your claim form to verify.

curious. I know of a situation where a life insurance policy lists two people… one as Primary (check boxed) and one as secondary (checked boxed) but in the “primary” column it has 50% and 50% on the line by both person’s names and mentions somewhere that if the Primary dies then the secondary would get 100%. The paper (sent with a disput(?) about this situation) didn’t look like an actual copy of a policy to me. The insurance company did distributed 50% to each of the listed people a couple of months ago some time following the unexpected death. I’m guessing they know what they are doing with the policies they give out but of course mistakes are made.

Jim,

You are correct that sometimes mistakes are made, but it is quite rare. Here is how I see it from what you have shared in your comment. There are many times where there is more than one primary listed as the beneficiary. For example, two children of an insured may both be listed as primary beneficiaries. If the insured dies and both beneficiaries are alive, then the proceeds will be split two ways. If one of the beneficiaries has passed and one is still alive, then all the proceeds will go to the surviving primary beneficiary.

There are also secondary (aka contingent) beneficiaries, who will receive the proceeds if there are no living primary beneficiaries, which is the box you referenced. It is important to think through beneficiary designations to make sure the insurance company fulfills your wishes. There are many ways to designate beneficiaries with wording for minors, and utilizing commands like per stirpes and per capita. Here is a blog detailing out beneficiary designations: Designating Beneficiaries on Your Life Insurance Policy.

From what you described though, it sounds as if the policy was meant to be split two ways (per the 50% language) and I would assume it was correctly implemented.

what is your listed as the primary on a life insurance policy and then there are 2 more beneficiary’s but there not listed as primary, but the percentage is split 3 ways, 33.33%. what does this mean? Who gets the life insurance policy, the primary or they split it 3 ways.

Laura,

It sounds as if you are listed as a primary beneficiary and there are lines underneath the primary designation with the two other individuals. The 33% split makes me lean towards thinking the policy has three primary beneficiaries that are splitting the proceeds 3 ways. Since I haven’t seen the document I cannot say for certain this is the case though. In a policy there can be multiple primary beneficiaries. If the other two individuals are contingent or secondary beneficiaries then they wouldn’t receive the death proceeds unless the primary(ies) are not alive to accept them. They would clearly be marked this way in the contract.

If I have both my children named as beneficiaries and my sister as contingent beneficiary and one of my children dies before me. Does my other child get 100% of the proceeds or does my sister get the deceased child’s share and my other child get his share? One of my children has a child, but the other does not. I’m confused as to whether both primary beneficiaries have to be deceased before the contingent gets anything.

Hi Molly,

Great question! If you list more than one primary beneficiary on your application, you will be required to list what percentage of the death benefit each beneficiary is to receive. Whether that is split 50/50 70/30 etc… is up to you. If your sister is listed as a contingent beneficiary, she will only receive the death benefit if both of your children die first. If one child dies, the surviving child will receive 100% of the death benefit.

My brother recently passed away leaving a wife and two adult children. His wife received a check for 50% of the policy amount and was told there is “another beneficiary” that is not the children. What circumstances could there be, if any, that would require the insurance company not to reveal the identity of the other beneficiary to his wife?

Bill,

It is always heart wrenching to hear about families who have lost their loved ones. It is good to see that he planned for his families future with life insurance though. Let’s tackle your question in two parts.

First, to answer your question about whether there are circumstances that will require an insurance company to disclose who the other beneficiary is – I have not seen that happen before. It is possible in a court of law, and with good reason, the other beneficiary’s name might be shared. But the crux of the issue is that the insurance company had a contract with the policy holder, your brother, and not with the beneficiary. They are not legally obligated to share that information, and most likely they are legally obligated to NOT share.

Two. If this were me and I really wanted to know the answer I would go about it a different way. I would call the agent who sold your brother the policy. Now the agent isn’t legally obligated to share, but they may be willing to give the name of the other beneficiary to the family. This is a grey zone for the agent. They shouldn’t share that info either, but it never hurts to ask. The agent is bound by the same rules and regulations as the insurance company so asking them potentially puts them in harm’s way. But if your brother changed beneficiaries after the policy was sold though, then the agent wouldn’t even know the answer to the question.

Short answer then is that insurance companies have a legal agreement with the policy holder and the beneficiary is just that, a beneficiary. The beneficiary didn’t sign an agreement with the company and wasn’t party to the legal document for insurance coverage.

Naming a contingent beneficiary is a great Natasha! What are your thoughts on setting up a trust for your minor children to be the beneficiary, or contingent benefiary?

Hi Tanya!

Thank you for your question. A trust is a great way to pass along inheritance, property, life insurance, etc… to a minor child. With a trust, you name a trustee to manage the funds for your child until that child becomes of age, and then ownership will be transferred to your child. You can specify exactly when and how much your child will receive. As an example, you can state that you wish ownership be transferred once your child is 25 years old and only want 50% of the death benefit to be given at this time and then for the remaining 50% to be given at age 30.

There are a number of different types of trust options, so working with someone who is knowledgeable in estate planning is advisable.

A simpler way of passing along life insurance, etc… to a minor is setting up an UTMA account. These are easy to set up, but you have less control and flexibility than you would with a trust. With a UTMA account, ownership of the account is automatically transferred to your child at age 18 or 21, depending on your state. You cannot dictate wishes for the when or how the money is distributed to your child.

Hope this helps! Let us know if you have any other questions.