Life insurance is an important tool for protecting your loved ones’ financial future. We understand the process can be overwhelming, but with this guide, you’ll learn how to buy life insurance wisely.

Life insurance is not a one-size-fits-all product. The type and amount of life insurance you need depends on your unique situation. We’ll explain your options, help you determine what you need, and show you how easy it can be to buy life insurance.

What to Know Before Buying Life Insurance

Life insurance is for anyone who has someone depending on them. It can replace your income and ensure those you leave behind don’t struggle financially.

Seven common reasons why people buy life insurance:

- Replace lost income and secure your family’s standard of living

- Ensure family doesn’t need to sell their home

- Take care of childcare or school tuition

- Repay debt left behind (credit cards, student loans, medical bills)

- Prevent forced selling of assets (car, stocks, jewelry)

- Prevent early withdrawal from survivor’s retirement funds

- Pay for your end-of-life expenses (funeral, burial, medical bills, and taxes)

How to Purchase Life Insurance

The concept of life insurance has been around since Ancient Rome. Luckily, types of life insurance and how they are purchased have changed with the times.

Buying life insurance in the 21st century is easier than ever. You can do the whole process online.

Let’s look at a few different ways to buy life insurance.

- Independent brokers represent you. Brokers have contracts with many insurance companies and can shop the market to offer more options.

- Captive agents represent one insurance company — their employer. They only offer products from that insurance company.

- Direct – People assume you can buy straight from the insurance company and save money by ‘cutting out the middleman.’ Because insurance rates are regulated by state laws, discounted rates don’t actually exist. Applying on an insurance company’s website directs you to one of their captive agents.

- Financial advisors provide financial advice, which includes life insurance. Some advisors are licensed to sell life insurance policies to their clients.

- Your Employer – Many employers offer life insurance as part of their employee benefits package. Typically, employees are eligible for a small amount of group life insurance coverage with premiums paid for by the employer. Employees may also have the option to buy supplemental coverage at an additional cost.

Step 1: Understand Your Options

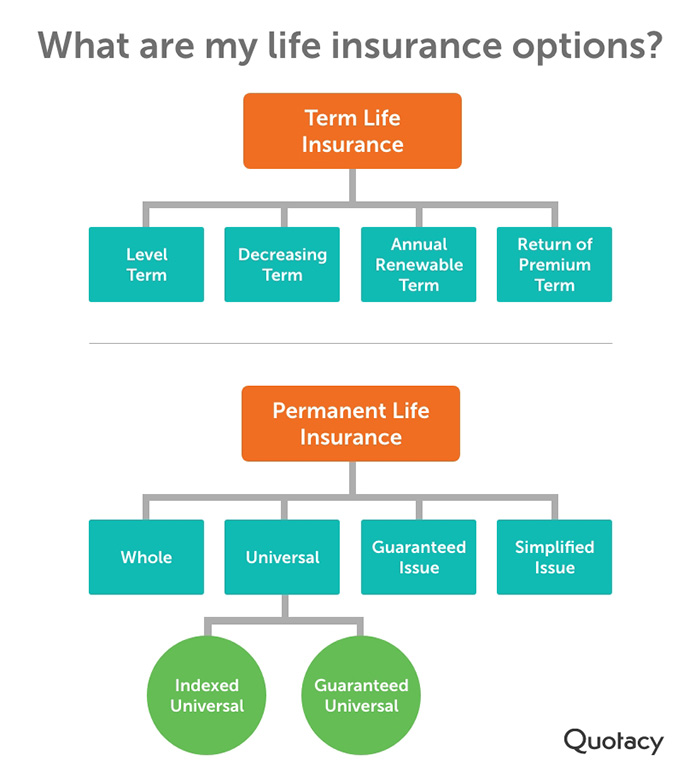

The first step in purchasing life insurance is education. Life insurance policies can be sorted into two categories: term life insurance and permanent life insurance. What you need depends on your circumstances. Both types can be further customized through optional add-ons, called policy riders,

Term Life Insurance

Folks often purchase term life insurance as income replacement to protect their families against the what-ifs.

Term life insurance provides coverage for a specific period. If the insured individual dies within the term, the policy’s beneficiaries will receive a payout from the life insurance company, which will equal your policy’s face amount (or death benefit).

When the term is over, the coverage expires. If you decide you need more coverage before the term ends, you may have some options.

Term life insurance is more affordable than permanent life insurance due to its simple, temporary coverage.

Let’s review the different types of term life insurance.

- Level-term life insurance is often just called term life insurance because it’s the most common choice. It’s the best type of life insurance for families because it’s easily customizable and affordable. With this option, your premiums remain the same.

- Decreasing term life insurance coverage decreases over time. The premium will be a fixed rate, but you will pay less for this type of policy because of the decreasing coverage. It’s usually purchased to help secure a mortgage or business loan.

- Annual renewable term life insurance (ART) allows you to purchase one year of coverage at a time. You lock in a set number of years you can renew annually without proof of insurability. During this time, your premiums are assessed annually and increase as you get older.

- Return of premium term life insurance refunds your premiums if you outlive the policy term. Like level-term, the premiums are fixed but much higher due to the potential refund.

Permanent Life Insurance

Permanent life insurance provides coverage for your entire life as long as the premiums are paid. Because it covers your whole life, whole life insurance, a type of permanent life insurance, is often used interchangeably with “permanent life insurance.”

Many permanent life insurance policies have savings components that generate a cash value you can borrow against as policy loans or withdraw from. Certain permanent policies also pay dividends to policy owners.

Because of the policy features, permanent life insurance premiums are much higher than term life premiums.

Let’s examine the different types of permanent life insurance.

- Whole life insurance lasts your entire life, usually has fixed premiums, and accumulates cash value over time. It is the most comprehensive permanent coverage option, which also means the highest premiums.

- Universal life insurance (UL) offers fewer value growth benefits in exchange for a lower price and flexible payment options. UL policies have a savings component that accrues cash value based on market interest rates.

- Indexed universal life insurance (IUL) accumulates value through investments in a stock market index. There is a guaranteed 0% floor for your risk, but there is a cap.

- Guaranteed universal life insurance (GUL) is one of the least complex options. A GUL policy has a set face amount and regular payment. As long as you make payments on time, your rate and death benefit are locked in and guaranteed to stay the same. This is the best budget option for permanent life insurance.

- Guaranteed issue life insurance offers guaranteed acceptance. To qualify, you do not need to take a medical exam, answer any medical questions, or have your medical records reviewed. In exchange for this simple guaranteed coverage, the premiums are high, coverage is limited, and there is an age range requirement.

- Simplified issue life insurance doesn’t require a medical exam, but you need to answer a few medical and lifestyle questions to be approved. It’s more expensive than most permanent policies but less expensive than guaranteed issue.

Learn more about the differences between term and permanent life insurance policies.

Step 2: Find a Policy that Best Fits Your Needs

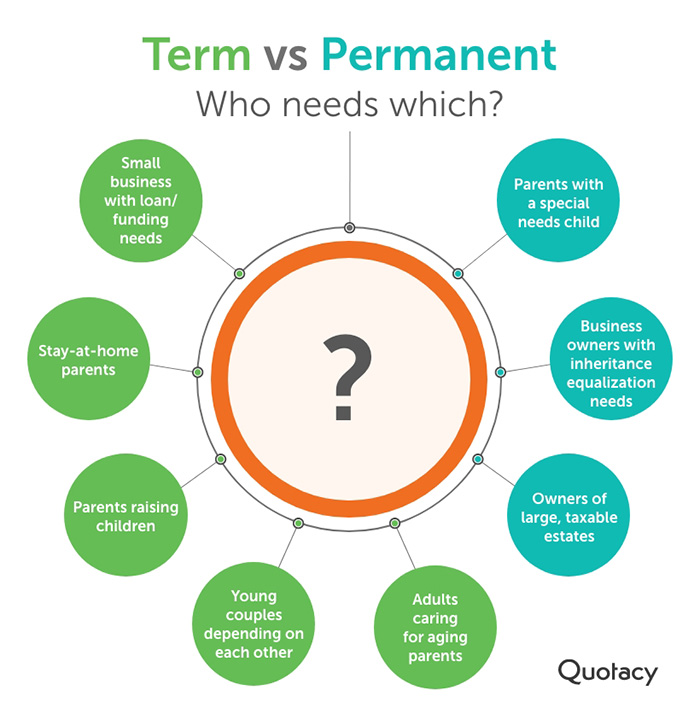

Your family situation, finances, and goals will help determine which policy is best for you. A level-term life insurance policy is the best option for most families. For others, permanent life insurance or a mix of both is the ideal solution.

Term Life Insurance

Term life insurance is ideal if you have specific years you need to provide financial protection. In many cases, these are the 20-30 prime earning years before retirement.

Term life insurance can replace your income, pay off debt, and protect your family’s standard of living.

Term life insurance can benefit the following individuals:

- Young couples that rely on each other financially.

- Parents raising children.

- Sole financial providers whose spouse is a stay-at-home parent.

- Stay-at-home parents.

- Adult children caring for their aging parents.

- Individuals who have significant debt their family will inherit upon their death.

- Small business owners with loan requirements or buy-sell agreement funding needs.

Permanent Life Insurance

While permanent life insurance is 10-20 times more expensive than its term counterpart, it has many benefits and can be the right fit for some circumstances.

Permanent life insurance can benefit the following individuals:

- Parents of a child with a life-long disability or special needs

- Individuals with a large, taxable estate

- Business owners

Step 3: Determine How Much Life Insurance You Need

One of the most critical steps in the buying process is figuring out how much life insurance you need. The right amount is different for everybody.

Think through your life insurance goals and, most importantly, consider what you can afford over time. Everyone loses if their life insurance premiums are too high to pay long-term, and the policy lapses.

Term Life Insurance

Term life insurance is ideal for covering significant temporary financial responsibilities because the coverage is affordable and finite. Your term options range from 10-40 years.

When choosing life insurance, pick a term length that equals your longest financial obligation. This varies from person to person and includes things like your mortgage loan, the number of years until you retire, or years until your youngest child is financially independent.

It’s common for people to buy $250,000, $500,000, or even millions of dollars of term life insurance. It may sound like a lot, but it’s more affordable than you may think, especially for healthy individuals.

If you die unexpectedly, you want your policy to ensure your family can pay for your funeral and debt left behind and also keep their standard of living.

Permanent Life Insurance

Permanent life insurance, if needed, is typically purchased in lower face amounts because of the high price tag. Using it to cover all of your life insurance needs would be far too expensive.

We recommend having more than one life insurance policy if you have permanent needs.

Buy a more comprehensive term policy to cover all your big-ticket responsibilities and a supplement it with a smaller permanent policy.

The table below provides an idea of the difference in term and whole life insurance pricing. The example applicant is a healthy, non-smoking man paying monthly premiums.

Try our free life insurance needs calculator to assess your coverage needs.

See what you’d pay for life insurance

Step 4: Decide Where to Buy Your Policy

In today’s digital world, it’s common for people to research, apply for, and purchase life insurance online in the comfort of their own homes. But with so many options, how do you know the best way to shop for life insurance? Here’s what to consider when buying life insurance.

- Look for a company with strong financial ratings.

- Shop around to get the best price.

- Work with a company that has your best interests at heart.

Working with a trusted independent life insurance broker will hit all three criteria. A good broker will have contracts with multiple top-rated life insurance companies, can shop your case, and ensure you’re matched with the insurer offering the best policy and rate.

Step 5: Complete the Application Process

When completing a life insurance application, expect to enter sensitive information. It’s required to verify your identity and ensure someone else isn’t illegally attempting to buy life insurance on you.

You’ll also need to provide medical information. Your health is one of the most impactful factors in determining your life insurance policy’s cost.

Lying on your life insurance application has consequences. The most important thing to do is be honest. Your agent or broker won’t be able to set realistic expectations or effectively shop your case if you don’t tell the truth.

If you get away with misstatements initially and are approved for coverage, know that your beneficiaries may be the ones to pay the price later on. Death benefit claims can be reduced or denied altogether if it’s discovered that you lied on your application.

Step 6: Get Your Medical Exam

For most applicants, a medical exam will be required. A life insurance medical exam is nothing to be nervous about. It only takes 20-30 minutes, and the examiner will come to your home or office, wherever is most convenient.

The medical exam involves recording your height, weight, blood pressure, and pulse. The exam will also require blood and urine samples.

Your results are only sent to the insurance company. They are not sold or even shown to your life insurance agent.

Step 7: Await Underwriting Results

The life insurance application timeline varies. It can be almost instant if you’re healthy, or it may take months if you have extensive medical records to review.

Underwriting is when the insurance company evaluates your application, records (such as medical records, driving records, financial background, criminal history), and medical exam results to determine your risk.

If you’re perfectly healthy with a clean record, you can qualify for the best rates, Preferred Plus. People with average health or a lifestyle factor that carries some risk, such as a dangerous job or hobby, may qualify for Standard rates. Individuals with a not-so-clean background check or pre-existing health conditions may have to pay higher rates.

This is where a broker truly becomes your advocate. Not all life insurance companies underwrite risk factors in the same way. Some are more lenient on different factors than others.

A good broker will review your entire application before handing it off to an insurance company. They will shop your case to find out which insurance company will underwrite most favorably, inform you of your options, and then submit the official application.

When your agent submits your application, they will set expectations. Your agent will share what they believe you’ll be approved at, based on the information in your application, and provide a quote. Their quote may be the same or different from your initial online quote.

After the life insurance company completes its underwriting process, you’ll receive one of three outcomes:

- Approved as applied means your coverage is approved at the same price as your initial quote.

- Approved better than applied means your coverage is approved at a better price than your initial quote.

- Approved other than applied means your coverage is approved at a higher price than your initial quote.

You can accept the insurer’s offer, go with one of your agent’s options, or walk away altogether. There is no obligation to buy the policy after you apply.

Quotacy’s team of experts specializes in matching applicants with the insurer who will view them most favorably. However, if you’re worried about being denied life insurance, there are additional options to explore.

Step 8: Get Your Policy

Once you accept the policy, your coverage is active as soon as you make your first payment. Paying your premiums on time is vital to keep your policy inforce. If you allow your coverage to lapse, your beneficiaries lose this financial protection.

Save your documents in a secure place. Make sure your beneficiaries know about the policy and the insurer. In too many cases, someone buys life insurance but fails to tell the beneficiaries. If beneficiaries don’t know a policy exists, they won’t know to make a claim when you die.

We recommend that you review your life insurance coverage every year. Life changes may also change your life insurance needs and goals.

Explore Your Life Insurance Options with Quotacy

If you have anyone who depends on you, life insurance is one of the most important financial tools you can own. It can be life-saving for your family if you die unexpectedly.

Quotacy is your advocate in the life insurance world. Get a life insurance quote now and apply online in just a few minutes. Your agent will keep you updated every step of the way. After purchasing your policy, we’ll also be here as a resource for advice and customer service needs.

Note: Life insurance quotes used in this article are accurate as of July 14, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments