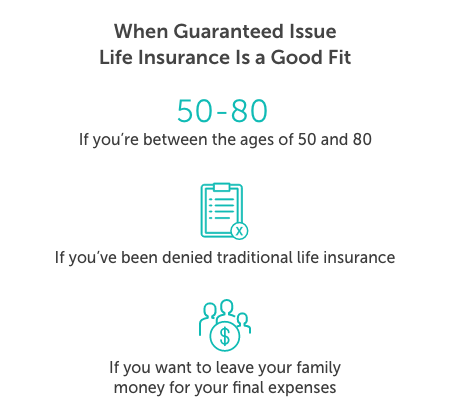

Guaranteed issue life insurance is a good option for people who cannot qualify for traditional life insurance such as term, whole, or universal life insurance. The primary advantage of guaranteed issue life insurance is that insurers can’t turn people ages 50-80 down for it.

Guaranteed issue life insurance is essentially a policy you get as a last resort so you can leave your loved ones money for your end-of-life expenses. In this guide, you’ll learn the ins and outs of a guaranteed issue life insurance policy and if it makes sense for you.

Table of Contents

- What Is Guaranteed Issue Life Insurance?

- How Does Guaranteed Issue Life Insurance Work?

- Pros and Cons of Guaranteed Issue Life Insurance

- Is Guaranteed Issue Life Insurance Right for You?

Understand the main differences between term vs permanent life insurance to figure out which is best for you.

What Is Guaranteed Issue Life Insurance?

Guaranteed issue life insurance is a small whole life insurance policy that requires no medical questions, no medical exam, and provides instant coverage. Most guaranteed issue life insurance companies have a minimum age requirement of 50 and a maximum of 80. Typical coverage amounts range from $5,000 to $50,000.

People also refer to guaranteed issue life insurance as:

- Final expense life insurance

- Guaranteed acceptance life insurance

- Guaranteed whole life insurance

- No questions asked life insurance

- Guaranteed approval life insurance

- Burial insurance

- No-exam life insurance

Guaranteed issue life insurance offers guaranteed acceptance to those who qualify.

To be eligible, these are the typical requirements:

- Ages 50-80

- U.S. citizen or permanent resident (Green Card holders acceptable but not Visas)

- No major cognitive issues (applicant must be able to complete the application and understand the contract)

- Insured must be the owner (different payor is acceptable)

If you are interested in guaranteed life insurance simply because it doesn’t require a medical exam, look into accelerated underwriting term life insurance. This is traditional life insurance that allows qualified individuals to skip the medical exam. Traditional life insurance offers better coverage options than guaranteed issue life insurance.

How Does Guaranteed Issue Life Insurance Work?

While the “guaranteed acceptance” feature sounds very attractive, you need to know some details about guaranteed issue life insurance before you buy.

You are guaranteed approval as long as you meet the eligibility requirements discussed in the previous section. However, guaranteed issue life insurance policies have a graded death benefit.

A graded death benefit means benefits are limited during the first two years of the policy. If you die in that time, your beneficiaries only receive a refund of the premiums you paid. Many policies will pay out the full benefit during the graded period if death results from an accident.

Most guaranteed issue life insurance policies have fixed premiums. This means the cost of your policy won’t increase as you age. However, compared to traditional life insurance, the premium is very high relative to the death benefit amount. Below is a sample of guaranteed issue policy pricing.

| Applicant: Male, Age 60 | |

|---|---|

| Coverage (Death Benefit) | Monthly Rate |

| $5,000 | $32.40 |

| $10,000 | $63.89 |

| $12,000 | $76.49 |

| $15,000 | $95.38 |

| $20,000 | $126.87 |

| $25,000 | $158.36 |

| Applicant: Male, age 60 | |

|---|---|

| Coverage (Death Benefit) | Monthly Rate |

| $5,000 | $32.40 |

| $10,000 | $63.89 |

| $12,000 | $76.49 |

| $15,000 | $95.38 |

| $20,000 | $126.87 |

| $25,000 | $158.36 |

The coverage amounts available for guaranteed issue products are minimal. We recommend first applying for traditional life insurance because you can get more coverage at a better price.

See what you’d pay for life insurance

Guaranteed Issue vs Whole vs Universal Life Insurance

Guaranteed issue, whole, and universal life insurance are all types of permanent life insurance. Each type of policy will last until the day you die as long as the coverage is kept active.

Guaranteed issue is the only one that offers guaranteed acceptance. Medical underwriting is required to qualify for whole or universal life insurance.

- Whole Life Insurance: Most comprehensive coverage. Guaranteed cash value growth. May earn dividends. Fixed premium.

- Universal Life Insurance: Cash value growth based on market interest rates. Flexible premiums. Adjustable death benefit.

- Guaranteed Issue Life Insurance: No medical questions or exams. Age requirements. Fixed premiums. Limited death benefit and waiting period.

Learn more about buying traditional life insurance in our guide: How to Buy Life Insurance Wisely: A Step-by-Step Guide

Are Guaranteed Issue and Final Expense Insurance the Same Thing?

A guaranteed issue policy is a form of final expense insurance. “Final expense” refers to a policy that provides a small amount of money to your beneficiaries to cover your final expenses, like a funeral and burial—although your beneficiaries can use the money however they wish.

Final expense insurance is different from insurance offered through a funeral home. These are pre-need insurance policies. You decide on your funeral choices with the funeral home and purchase a policy with a benefit to cover the costs. The funeral home is often the beneficiary and the proceeds are used to carry out your funeral wishes.

Pros and Cons of Guaranteed Issue Life Insurance

There are advantages and disadvantages to all life insurance products. Before buying, consider the pros and cons of guaranteed issue life insurance.

Pros:

- No medical questions or exams

- Death benefit is paid income tax-free to your beneficiaries

- Beneficiaries can use the money however they want

- Coverage is approved quickly

Cons:

- Age limitations

- More expensive for less coverage compared to traditional life insurance

- Waiting period of two years before beneficiaries would be eligible for full death benefit

Is Guaranteed Issue Life Insurance Right for You?

There are a few pre-existing conditions that can make it quite difficult to qualify for traditional life insurance.

These conditions can include the following:

- Cancer

- Dialysis

- Vital organ transplants

- Heart conditions

- HIV or AIDS

If you’ve been denied traditional life insurance, guaranteed issue life insurance is a good option. The death benefit of a guaranteed issue policy can help your loved ones pay for your funeral and any medical bills.

Guaranteed issue life insurance for seniors can be beneficial to many families. If health conditions arise with age and retirement funds are depleted, guaranteed life insurance can protect the family’s finances when death occurs.

Alternatives to Guaranteed Issue Life Insurance

Guaranteed issue life insurance isn’t suitable for everyone. Consider the following options if you don’t want guaranteed issue but aren’t eligible for traditional life insurance.

- Group life insurance – If you’re still employed and have been declined traditional life insurance, buy as much group life insurance as you can afford. Be sure to find out if it’s convertible to an individual policy if you leave the company.

- Convert or renew your term policy – If you already own term life insurance and realize you need more, find out if your term policy has conversion or renewability options. These options are particularly beneficial if you have developed new risk factors. They let you extend life insurance coverage without any medical underwriting.

- Accidental death insurance – Accidental death insurance pays benefits to your beneficiaries if your death results from an accident. This coverage is quick and easy to apply for. There are just a few questions, but no medical exam is required.

Talk to a Quotacy Agent to Discover the Best Policy for You

As an independent broker, Quotacy can help you find the right type of life insurance. We work with over 25 of the nation’s top life insurance companies and can help you buy term, whole, universal, guaranteed issue, or accidental death life insurance.

As an independent online broker, we’re your advocate. If you aren’t sure which kind or how much life insurance you need, your dedicated agent can provide unbiased advice.

If you’re ready to get quotes, we can also help with that. It’s easy to get term life insurance quotes online. Plus, you can see quotes instantly without giving away any contact information.

If permanent life insurance, including guaranteed issue, is more in line with your needs, contact us directly or fill out this form. An agent will reach out to you shortly after to discuss your needs and offer personalized quotes.

Note: Life insurance quotes used in this article are accurate as of February 1, 2023. These are only estimates and your life insurance costs may be higher or lower.

Watch the Guaranteed Issue Life Insurance Video

I am 48 and a mother of two. I have cirrhosis of the liver but all of my blood work is within normal range. Is it possible for me to qualify for any other kind of life insurance besides guaranteed life insurance? If so where’s the best place to look?

Hi Elizabeth, the cause of your cirrhosis will affect your life insurance options. The treatment options you’re undergoing will also be taken into consideration.

If alcohol is the cause, an applicant needs to be abstinent for 3 years or more. If approved, the premiums will be high, but will be lower than a guaranteed-issue life insurance policy.

It’s worth filling out an application on the Quotacy website and having one of our underwriters shop the market for you. Keep in mind, in your specific case, the price you see on the quote page will be much lower than the final cost.

Can I purchase final expense ins on my ex husband? I would like to financially assist my step children with his final arrangements.

Thank you.

Diane,

You can buy a final expense policy on your ex-husband but you would need his consent. Another option would be for one of the step-children to own the policy and you can gift them the premium payments.

My husband has ALS not sure how much time he has left can I get guaranteed issued life insurance for him

Hi Michelle,

Yes, you would be able to buy this type of policy on your husband. Guaranteed issue life insurance does not factor in medical conditions – it’s guaranteed coverage. Please feel free to contact us if you want to discuss more about it.