Life insurance isn’t one-size-fits-all. We all have different coverage needs and reasons for purchasing it. Sometimes, trying to meet all your needs with one policy is tricky. Thankfully, you can have more than one.

Buying more than one life insurance policy is a great way to ensure your coverage is adequate, while saving money in the long run. Keep reading to find the best way to layer multiple life insurance policies.

Table of Contents

- How Many Life Insurance Policies Can You Have?

- Reasons to Own Multiple Life Insurance Policies

- Owning Group Life Insurance and Personal Life Insurance

- Laddering Life Insurance Policies

- Supplementing Term With Permanent

- Assessing Your Coverage Needs

If you’re wondering ‘When should I get life insurance?’ Costs rise as you age, so we recommend purchasing coverage sooner rather than later.

How Many Life Insurance Policies Can You Have?

Technically, you can have as many life insurance policies as you want. What does this mean?

- You can own more than one term life insurance policy.

- You can own more than one permanent life insurance policy.

- You can mix and match different types of life insurance policies.

- You can own life insurance policies from various insurance companies.

What’s the catch? Sure, you can have as many policies as you want, but you can only have up to a certain dollar amount of coverage.

While there is no cap on the number of policies you’re allowed to own, there are limitations on how much life insurance coverage you can have.

If you want to own 10 life insurance policies with face amounts of $100,000 each, you probably can. But that seems overly complicated and unmanageable. We don’t recommend it.

But owning 2-3 policies at one time or overlapping policies can be very beneficial in certain situations.

If you have various reasons for buying life insurance, buying more than one policy to cover different needs can save you money.

Reasons to Own Multiple Life Insurance Policies

There are many reasons why you may need life insurance. Common motivations include:

- Financial protection for a dependent spouse/partner

- Financial protection for your children

- Financial protection for dependents with a disability

- Covering your debt (e.g., mortgage, student loans, etc.)

- Cover end-of-life expenses (e.g., medical bills, funeral costs)

- Liquidity needs for estate settlement

- Building cash value

- Funding for business needs (e.g., loan collateral, buy-sell funding)

If you need life insurance for one or more reasons, buying one policy to cover all needs may not be the right strategy. Why? The cost could be prohibitive in the long run.

For example, let’s say you and your spouse have three children, one of which has special needs and will financially rely on you his entire life. You also have a 30-year mortgage you’re slowly paying off.

Consider these two hypothetical buying options:

Option 1

- Buy one $500,000 guaranteed universal life insurance policy

-

- Monthly cost of $361.58 for a healthy 40-year-old male

- Provides financial protection that can pay off the mortgage and help the surviving spouse with the costs of providing for children

- Pays out no matter when you die

Option 2

- Buy a 30-year $250,000 term life insurance policy

-

- Monthly cost of $28.11 for a healthy 40-year-old male

- Provides financial protection to pay off the mortgage should you die during the 30-year term

- Buy a $250,000 guaranteed universal life insurance policy

-

- Monthly cost of $180.81 for a healthy 40-year-old male

- Provides money for surviving spouse to help with the costs of providing for your child with special needs

- Pays out no matter when you die

With the first option, you’ll have a large amount of coverage for your entire life. But you’ll pay high premiums for this protection.

With the second option, you’ll have a large amount of coverage for 30 years. Then the term policy expires, and, ideally, your mortgage is paid. After, you’re left with the remaining $250,000 guaranteed universal life (GUL) policy that provides financial protection for the lifelong needs of your child.

You may be wondering, “Shouldn’t I buy the large permanent policy to leave my family with more money?” If you can comfortably afford the premiums, sure. A sizeable permanent policy can be very beneficial.

However, an expensive permanent policy isn’t affordable long-term for most families. In addition, you can typically get more bang for your buck if you invest your money instead.

See what you’d pay for life insurance

When Is Owning More Than One Policy a Good Idea?

Typically, people own more than one policy in 3 different scenarios:

- You own an employer-provided life insurance policy and a personal life insurance policy.

- You’re laddering various life insurance policies.

- You’re supplementing a term policy with a permanent policy.

These strategies can save you money in the long run.

Supplementing Employer-Provided Life Insurance

Owning a personal policy is always a good idea, even if your employer offers life insurance.

Getting group life insurance through your employer is a nice benefit, but it’s usually a small amount and ends if you leave your job.

Group coverage is never a guarantee. Employers can change benefits programs at any time.

Don’t wait to get a personal life insurance policy. You could become uninsurable or develop a medical condition rendering a personal policy unaffordable.

We recommend buying a personal life insurance policy in addition to your company’s coverage because:

- You own an individual policy. Your employer controls a group policy.

- Your personal policy follows you. If you leave the company, your group coverage likely ends.

- Your individual premiums don’t increase as you age. Group premiums do.

Laddering Life Insurance Policies

Laddering policies is when you buy separate policies to cover different needs. It’s a smart way to reduce costs without compromising value.

Two common laddering strategies:

- Stacking policies on top of each other that have varying lengths of coverage.

- Buying policies at different stages of your life so coverage overlaps.

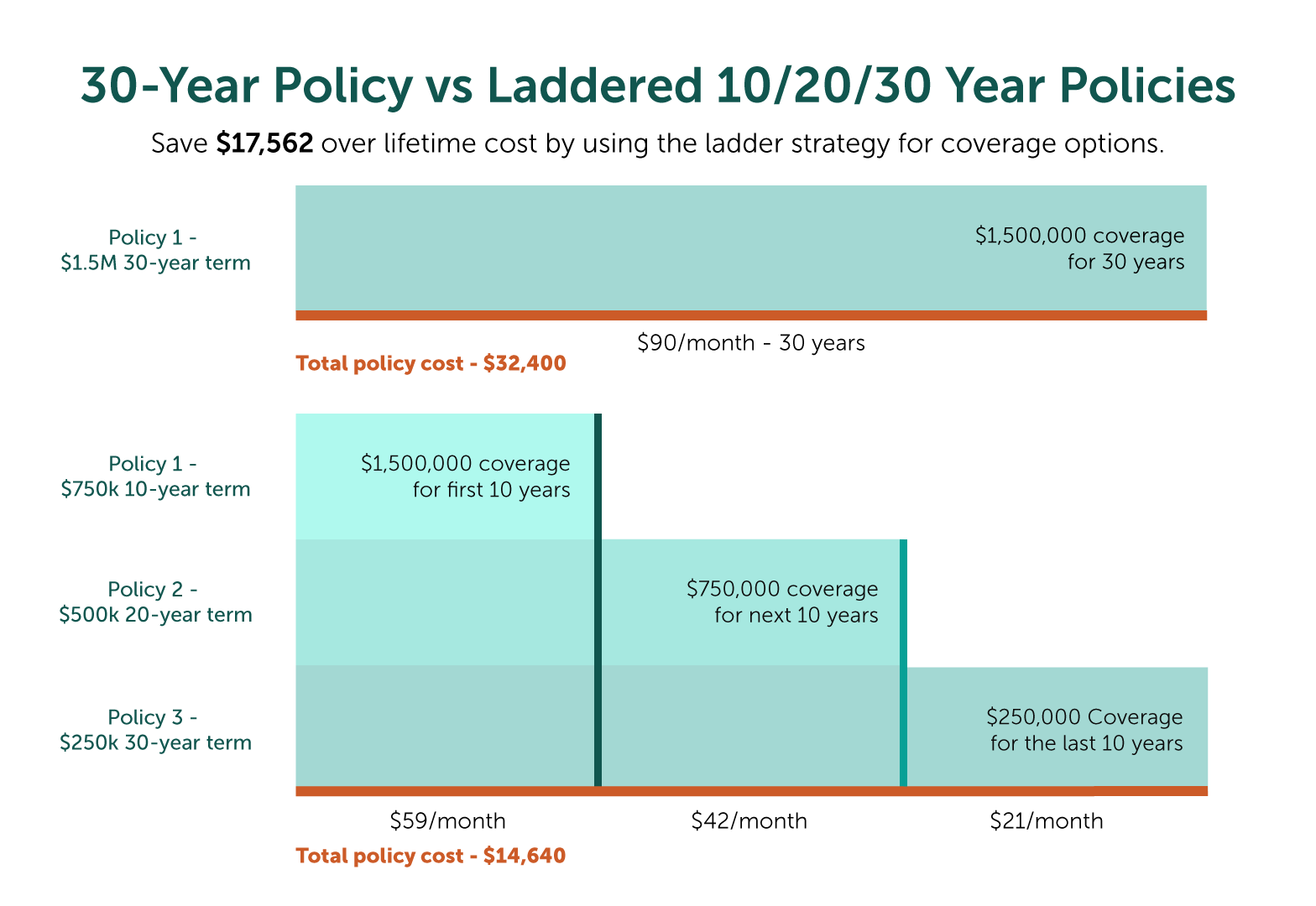

Example of Laddering Policies at the Same Time

You’re 35, married, and have two children. You want life insurance coverage to ensure your children can go to college, the mortgage is covered, and provide income replacement for your spouse should you die unexpectedly.

Instead of purchasing a single $1,000,000+ policy, you can layer multiple policies to save money and avoid being over-insured.

Breakdown of coverage length and amount for each policy*:

-

Policy 1: $750,000, 10-year term to cover your children until they reach adulthood

-

- Monthly cost = $17.17

-

-

Policy 2: $500,000, 20-year term to cover your mortgage and daily expenses

-

- Monthly cost = $21.22

-

-

Policy 3: $250,000, 30-year term to replace your income until your spouse reaches retirement

-

- Monthly cost = $21.82

-

By layering these policies, for the first 10 years, you will have $1,500,000 in coverage. Then the amount of coverage will decrease as your insurance needs decrease.

Instead, you could buy a 30-year $1,500,000 that costs $89.45 per month. But you’d save money by laddering.

*Rates shown are for a healthy, non-smoking male.

Example of Overlapping Coverage

You get married and rent a house with your spouse. As 28-year-old newlyweds, your budget is tight and you rely on both paychecks to pay bills.

You each purchase inexpensive 20-year $250,000 term policies. As you’re working towards building a life together, this coverage provides financial protection should either of you die suddenly.

Ten years later, your family has grown to a family of four. You’ve also purchased a larger home.

You both decide you need more life insurance since you have more financial responsibilities. You each buy a 20-year $500,000 term policy.

Breakdown of coverage length and amount for each policy*:

- From ages 28-38, you each own $250,000 of life insurance coverage, paying $12.21 monthly.

- From ages 38-48, you each own $750,000 of life insurance coverage, paying a total of $36.91 monthly.

- At age 48, the $250,000 policies expire. You’re both left with $500,000 in coverage (paying $24.70 per month since the first policy dropped off) that will financially protect your family for another ten years.

Overlapping policies help keep costs minimal while also covering different financial obligations throughout your life.

*Rates shown are for a healthy, non-smoking male.

Supplementing a Term Policy with Permanent

The primary reason for life insurance is to replace your income so your loved ones can continue their standard of living without financial struggle.

Many significant financial obligations are temporary, like a mortgage or raising children.

Luckily, these responsibilities don’t last forever, making term life insurance is the best option for most families.

Term life insurance is customizable and can fit into most budgets. But a small permanent policy can cover end-of-life expenses and provide long-term peace of mind for your loved ones.

You may consider getting a comprehensive term life insurance policy and supplementing it with a modest amount of permanent coverage.

Example of Supplementing Term with Perm

Anna is 30 years old. She works hard and contributes 6% of every paycheck to her 401(k).

At 32, Anna gets married. She and her husband each purchase a $500,000 30-year term life insurance policy naming one another primary beneficiaries. Her premiums are $30 per month.

At 33, she and her husband also each purchase a $50,000 whole life insurance policy naming one another primary beneficiaries. Her premiums are $51 per month.

When Anna is 34, they have their first child.

At 35, Anna and her husband buy their first home. In this same year, she’s promoted and receives a raise. She also opens an IRA account and contributes $200 each month.

When Anna is 36, they have their second child.

At 53 years old, Anna’s $50,000 whole life insurance policy has a cash value of $12,221. If she desired, Anna could access these funds by borrowing against her cash value.

At age 55, Anna and her husband are officially empty nesters.

At age 60, she and her husband send in their last mortgage payment.

At age 62, their term life insurance policies end. Their whole life insurance policies are still active.

At age 67, Anna retires.

Policy cost breakdown:

- Age 32 – Anna buys a $500,000 20-year term policy for $30 monthly.

- Age 33 – Anna buys a $50,000 whole life policy for $51 monthly.

- Age 62 – Anna’s term policy expires. Her whole life policy coverage continues.

As the owner of a life insurance policy, you have several responsibilities to be aware of.

Pros & Cons of Owning Multiple Policies

Like anything else, owning multiple life insurance policies has advantages and disadvantages.

On the one hand, you can save money. On the other hand, each comes with an annual fee called a fixed policy charge (usually around fifty dollars).

The more comprehensive the coverage, the lower the cost—similar to discounts for buying in bulk. Buying several narrow policies comes with a high price tag.

Pros:

- You can save money in the long run

- You can rest easy knowing all of your insurance needs have adequate coverage

Cons:

- You pay annual fees for every policy you own

- There are more details and accounts to manage

- You may miss out on “bulk” discounts

Our quoting tool automatically includes all policy fees and band discounts in the calculations. Compare rates for multiple policies and explore how much you can save by laddering.

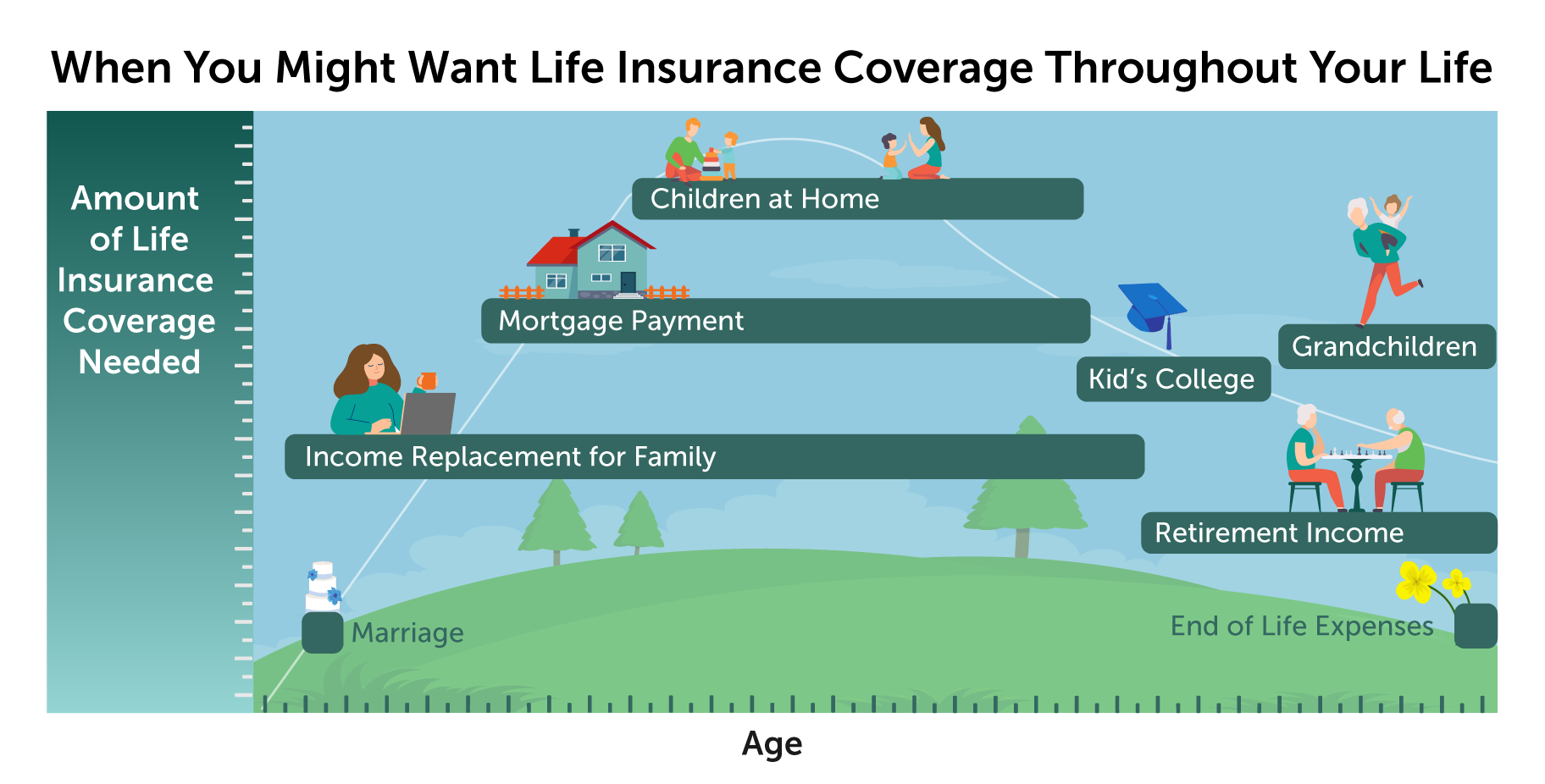

Assessing Your Coverage Needs

The right amount of life insurance is different for everyone. Your family, finances, and goals all play a role in determining how much you buy.

Term Life Insurance

Term life insurance is straightforward and affordable financial protection for the people you care about.

Coverage length can last from 10-40 years. The amount should replace your income so your family can continue their same standard of living even if you were to die unexpectedly

We advise choosing a term that matches your longest financial responsibility or the longest you can afford..

Many term policies allow you to convert your coverage to whole life if you later realize your needs are lifelong.

This option can be beneficial if you become disabled or are diagnosed with a chronic illness and need to extend your policy but are no longer insurable.

If you aren’t sure how much coverage you need, our free life insurance calculator can help.

Permanent Life Insurance

Permanent life insurance needs are often much different from term life insurance.

Typically, people use it for:

- Business needs

- Estate planning

- Inheritance planning

Life insurance needs are highest in your prime earning years.

For example, anywhere between the ages of 25-65 when you’re working hard in your career, building a family, and saving for retirement.

During these years, your death is more likely to create financial devastation for your loved ones if you pass away. It’s why term life insurance is ideal since it’s temporary and can be structured to provide coverage for these vital years.

If your life insurance need last longer than your prime earning years, you likely need permanent coverage. We recommend buying a smaller permanent policy to supplement a larger term one.

Unsure if you which policy option is best for you? Or do you need some of both? Explore the differences between term and permanent life insurance.

Easily Compare Life Insurance Quotes From Top-Tier Carriers

Ready to protect what matters most? Compare life insurance quotes, apply online, then talk with your dedicated Quotacy agent about your needs and if you’ve made the right choice.

As a life insurance broker, we are legally obligated to act in your best interest. What’s more, our agents don’t earn commission, so you can count on them for trustworthy, unbiased advice.

At Quotacy, we’ve worked with thousands of families of every type to find the best possible coverage for their goals. We can help you too.

Note: Life insurance quotes used in this article are accurate as of April 12, 2023. These are only estimates and your life insurance costs may be higher or lower.

I have a reverse mortgage, ($350,000) and I want my daughter to be able to pay off the loan after I pass on. I have no insurance but I want multiple policies. Any suggestions?

Hi Pamela,

If you’re interested in buying multiple policies, we recommend contacting us directly to go over your different needs. One of the policies should have a face amount equal to the approximate value of your home.

As for the other policies, many factors play into what would make the most sense, for example your age, other debt you may have, and your income and additional assets. An advisor can help you make a plan that is best for your unique situation.

Is the any personal risk to the employee if a company want to take a COLI policy out on them? Would rates be higher or coverage offered be lowered by this?

Katie,

When a company takes out corporate owned life insurance (COLI) on their executives or even all employees, there isn’t an impact to the insurability for the employees. Any coverage the company owns is viewed as business coverage and doesn’t impact the amount of insurance the employee can receive personally.

Rates won’t be impacted for a personal policy either. Life insurance rates are determined from many criteria (including age, gender, smoking status, lifestyle, health, etc.) Rates are not determined based on whether or not a business owns insurance on the employee, and the amount of personal coverage is not impacted either.

If you have to separate life insurance policies with the same life insurance company will

There be to separate checks issued to the beneficiaries?

Hi Sandy,

Because the two different policies have two different policy numbers, it’s likely that the insurance company will send out two separate checks.

Purchasing multiple life insurance policies is a great strategy. It allows you to start where you can afford to start and to increase your total coverage over time. Don’t get stuck in a procrastination waiting for the perfect policy. Start with something and add more later. Great article.