Life is filled with beautiful moments, but it also holds numerous uncertainties. If you want to protect your loved ones from these what-ifs, life insurance is the perfect financial tool.

In this guide, you’ll learn about the advantages of life insurance for your family, the different types available, and how to determine the best coverage for your family’s needs.

Table of Contents

- Why Is Family Life Insurance Important?

- What Is the Best Life Insurance for Families?

- How to Choose the Best Family Life Insurance Policy

- Calculate How Much Life Insurance You Need

- Family Life Insurance FAQs

Did you know you can buy life insurance on your children? There are a few different ways to insure their lives, as well as your own.

Why Is Family Life Insurance Important?

Life insurance provides a financial safety net for those you love most. Anyone with financial dependents needs life insurance, but it’s absolutely essential for parents.

As a parent, one of your most important goals is fostering emotional and economic security for your children into adulthood. The death of a provider or stay-at-home parent is mentally and financially devastating.

Family life insurance protects your loved ones from a provider’s death. Consider everything your income provides:

- Clothing

- Food

- Housing

- Utilities

- Education

- Extracurricular activities

- Medical care

- Family vacations

What happens if you die unexpectedly? Can your family continue to afford the same standard of living on top of funeral and end-of-life expenses? This is when life insurance becomes life-saving.

The death benefit from a life insurance policy allows the surviving parent time to privately grieve and support their children without worrying about bills. The death benefit provides stability by ensuring your children:

- Stay in their home and familiar neighborhood

- Don’t have to change schools

- Maintain their standard of living

What Is the Best Life Insurance for Families?

Life insurance is primarily designed to replace the household provider’s income. In many families, there are specific years when your earnings stretch to support various expenses to support your children’s development and well-being.

That’s why term life insurance is often the most suitable option for families. A term life insurance policy can fit into most budgets and lasts a specific period of your choosing.

Let’s review why term is ideal for various types of families.

Young Families

Term life insurance policies can provide coverage anywhere from 10 to 40 years, depending on your age—40-year terms are only available to people aged 45 and younger.

A term policy’s wide range of coverage allows you to provide financial protection for your spouse and young children as they become independent adults.

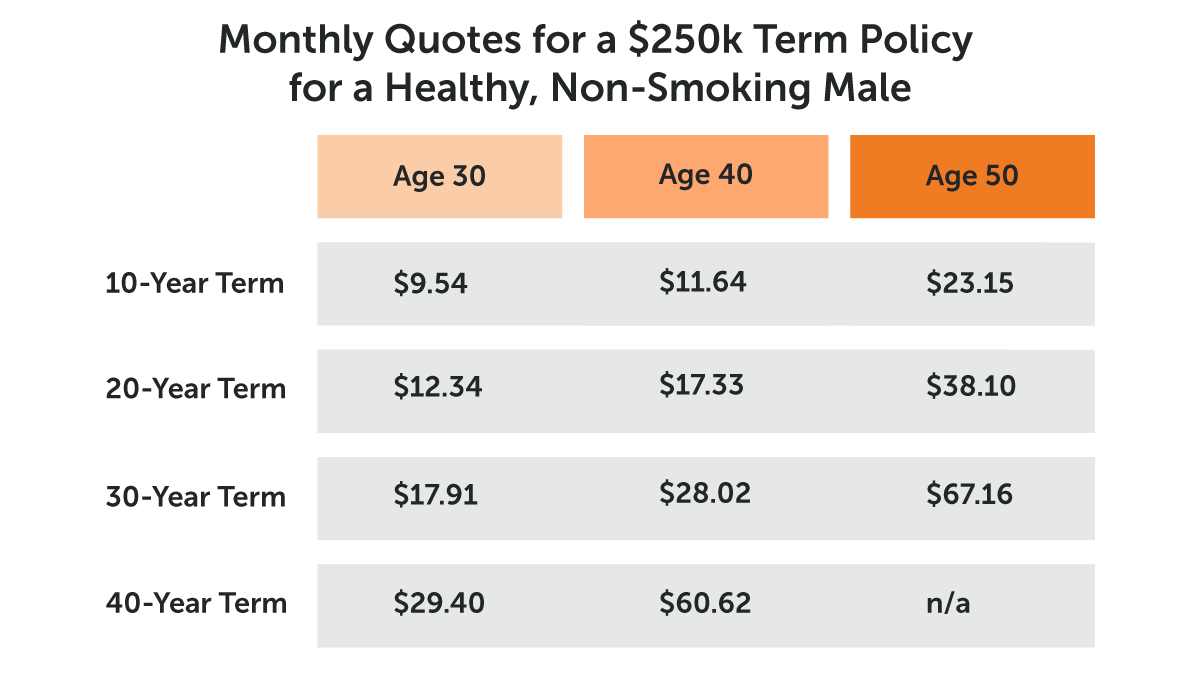

The younger you are when you apply, the cheaper life insurance is. The table below provides rate examples for a man who qualifies for Preferred Plus pricing, the best life insurance risk classification possible.

If you die during the term, the insurance company pays the tax-free death benefit to your family. The death benefit amount is equal to the face value of your policy. In the table above, it’s $250,000.

Blended Families

If your family consists of your partner, biological children, and stepchildren, term life insurance can provide financial security for everyone.

Life insurance policies can have multiple beneficiaries, so you can list your current and ex-partners. You can also establish a trust if you want to exclude your ex as a beneficiary, yet still ensure you’re protecting your children.

A trust gives you more control. It can specify the terms and conditions of how the death benefit proceeds are paid and whom they’re paid to. Even minor children can be included in a trust with a trustee managing the funds on their behalf.

If your blended family has a wide age range of children, consider laddering term policies. This strategy lets you buy more than one life insurance policy to cover different financial needs of varying amounts and timeframes while saving money in the long run.

Adoptive Parents

When going through the adoption process, your personal background, finances, and home are thoroughly examined. Adoption agencies want to see that you have the financial means to provide for a child adequately. Taking care of and raising a child is no small feat.

Ideal candidates for adoption will also have plans in place if one or both parents die unexpectedly. This is where life insurance comes into play. It shows you’re committed to providing for a child even if the worst should happen. Many adoption agencies require prospective parents to own life insurance.

Term life insurance allows you to affordably own a reasonable amount of life insurance to protect your growing family.

Same-Sex Parents

Same-sex parents have the same rights and privileges as opposite-sex parents. However, laws and regulations can change, and it’s wise for same-sex parents to plan ahead.

Life insurance is a contract. If you name your partner as your beneficiary, only you can change it. Purchasing coverage ensures that regardless of your and your spouse’s rights under state, local, or federal law in the future, you can financially protect each other and your children.

Divorced Parents

Life insurance for divorce settlement is often required. You can purchase term life insurance to cover alimony and/or child support.

The party responsible for paying alimony and/or child support would buy a policy on themselves and name the ex-spouse the beneficiary.

Courts often rule that these policies have irrevocable beneficiaries — meaning the person who owns the policy would need the ex-spouse’s permission to change the policy.

It’s also common to use an irrevocable life insurance trust (ILIT) in divorce situations. If you establish a trust and purchase life insurance on yourself or your ex (whoever is wealthier), there are two primary benefits:

- Your ex cannot change the policy

- The policy is excluded from the insured’s taxable estate

Learn why life insurance for single parents is uniquely important.

Do Both Parents Need Life Insurance?

Yes. Both parents should have life insurance. You can’t predict death. What happens if only dad has life insurance, but mom dies?

Unfortunately, mothers are underinsured compared to fathers. In a survey from LIMRA, 51% of mothers stated that they believe they have insufficient life insurance coverage.

Historically, fathers are the breadwinners and manage family finances. Over time, women have become an essential part of the workforce, and traditional roles have evolved. Now, mothers are breadwinners too. Managing household finances can be a joint effort or one parent’s individual responsibility.

Ensuring that both parents have adequate life insurance coverage safeguards the family’s financial well-being, protects against potential income loss, covers outstanding debts, and provides for the family’s future needs.

What About Permanent Life Insurance?

Life insurance policies are available in two broad categories: term and permanent.

Because of its affordability and simplicity, term policies are often the best choice for families.

Although it’s less popular, permanent policies are ideal for some.

Permanent coverage lasts your entire life. The two most common types are whole and universal.

Permanent policies have benefits you can use while alive, and proceeds to leave behind no matter when you die. Features may include:

- Lifelong coverage

- Cash value accumulation

- Dividend earnings (if a participating whole life policy)

- Optional tax-free policy loans against the cash value

- Optional withdrawals against the cash value (if a universal policy)

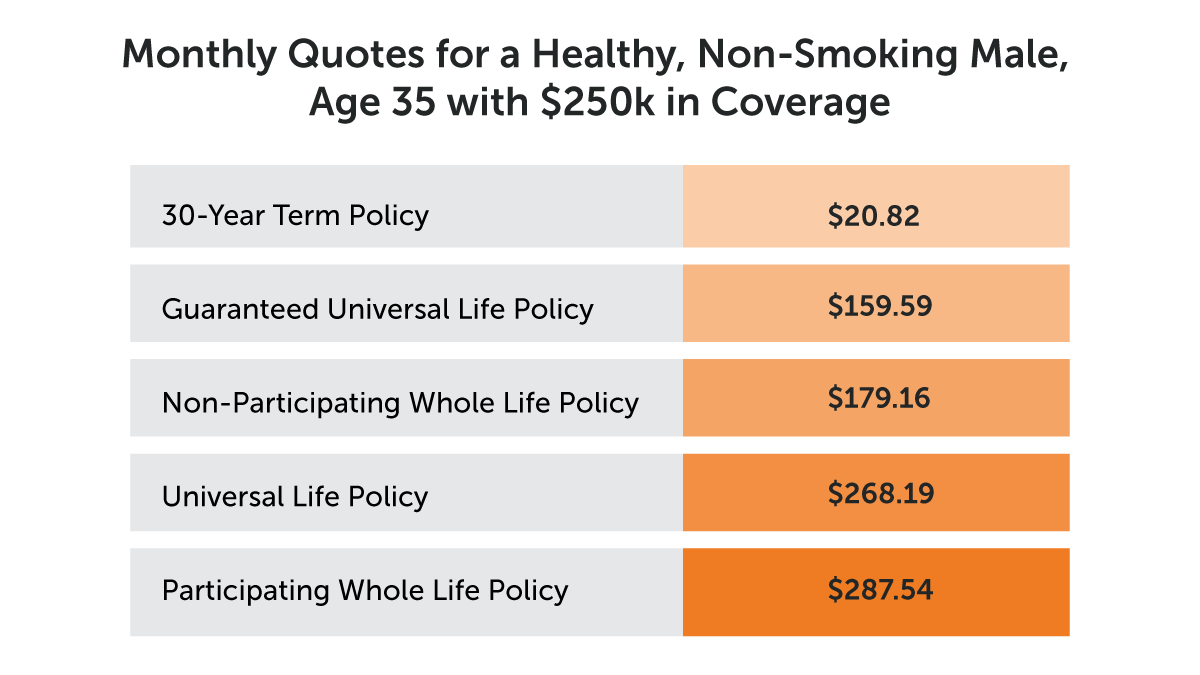

These features make permanent policies much more expensive than term. Consider the table below.

If your family needs long-term coverage, a more affordable option would be to buy a larger term policy to cover big-ticket items, such as your mortgage and children’s education, and supplement it with a smaller permanent policy.

Example

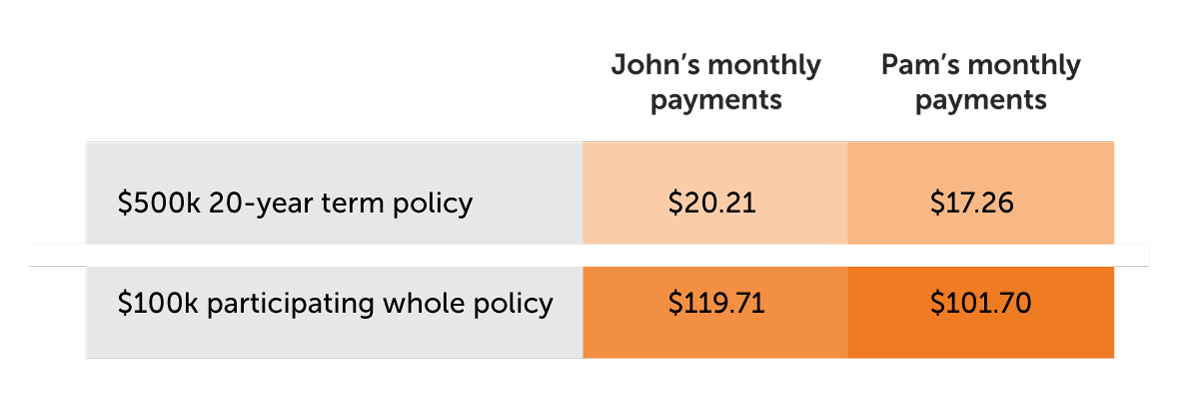

John and Pam, both 35, have two children: George (5 y/o) and Michael (3 y/o). Michael was born with Down syndrome, which requires lifelong support from his parents.

John and Pam get life insurance to protect each other and the futures of their children:

- 20-year $500,000 term life insurance policy to ensure they have financial back-up through George’s college years

- $100,000 participating whole life insurance policy to ensure Michael is taken care of no matter what.

John and Pam name each other as primary beneficiaries. They name their sons’ godparents as secondary or contingent beneficiaries.

In the unfortunate event of either John or Pam passing away within the next 20 years, $600,000 is paid to the surviving spouse. Should they die at the same time, the godparents receive $1,200,000 to provide support and care for George and Michael.

If John and Pam outlive their term policies, the coverage expires, and payments end. However, the $100,000 whole life insurance policy for each of them continues indefinitely, accruing cash value and earning dividends over time.

The whole life insurance policy will pay out no matter when John and Pam die. These funds will support and maintain Michael’s quality of life for the rest of his years.

Have a loved one with special needs? Learn how to plan for their future while preserving their eligibility for government benefits.

See what you’d pay for life insurance

How to Choose the Best Family Life Insurance Policy

The first step to your family’s life insurance plan is to decide between term or permanent insurance (or perhaps you need a little of both). To determine the most suitable life insurance option for your needs, consider the following factors:

When to choose term life insurance:

- Affordable coverage is a priority for you.

- You have young children who depend on your financial support.

- Your spouse or partner relies on your income.

- You have outstanding debts that need to be addressed.

- You are focused on saving for retirement.

When to choose permanent life insurance:

- You possess a substantial estate that may be taxed.

- You are a business owner and need coverage for business-related matters.

- You have a child who will always rely on your financial assistance.

- You have significant wealth and extra disposable income to allocate towards cash value insurance.

How Much Life Insurance Coverage Is Needed for a Family?

The rule of thumb is to buy coverage equal to 10 times your income, but this isn’t the right amount for everyone.

Buy enough life insurance so that your family can pay off your debt, funeral expenses, and maintain their same standard of living.

The amount of life insurance you need depends on individual circumstances. Do any of the following pertain to you? The more that apply, the more life insurance you need.

- Are you married?

- Do you have a mortgage?

- Do you have children?

- Do you plan on paying for your children’s college education?

- Is your spouse a stay-at-home parent?

- Do you own a business?

- Do you have debt that a loved on will inherit if you die?

- Do you take care of any aging relatives or long-term dependents?

- How big is your estate? Will you owe taxes?

If you choose term life insurance, you must also decide what term length to buy.

The most common term lengths available are 10, 20, and 30 years, although some insurance companies may also offer 5- and 40-year terms. When determining the appropriate term length for your needs, there are two approaches you can consider:

- Option 1: Choose a term length equal to your longest financial obligation, like a mortgage.

- Option 2: Select the longest term length you can afford.

The main thing to remember is that your premiums need to be affordable in the long term.

You may wish to leave your family millions of dollars, but if you can’t afford the premiums until you die, you lose money paying premiums, and your family gets nothing.

Unsure how much life insurance you need? Try our life insurance calculator.

Family Life Insurance FAQs

If you’re new to life insurance, you may want more information. Below we answer some common questions. For personal advice, feel free to contact us directly. Our agents are happy to give you unbiased advice.

What Happens if I Stop Paying My Life Insurance Premiums?

All life insurance policies have a grace period of approximately 30 days. Your policy will lapse if you don’t pay your premium, and the grace period has expired.

Some permanent life insurance policies have optional automatic premium loan provisions. With this feature, if you don’t pay your due premium, instead of the policy lapsing, your premium will be automatically taken from your cash value as a loan.

Can I Change My Policy Later On?

Yes, policy changes after purchase can include:

- Ownership changes: Generally, policy owners can transfer ownership at any time.

- Beneficiary changes: Policy owners can add, remove, and modify beneficiary designations at any time unless the beneficiary is irrevocable.

- Converting term coverage to permanent: Many term life insurance policies allow owners to convert all or a portion of it to permanent without providing evidence of insurability, as long as it’s requested during the specific conversion period.

- Rider changes: Policy riders are optional add-ons to enhance or customize coverage. Many riders are available at purchase, but you can add some later once the policy is active.

- Adjusting the death benefit: After buying a policy, policy owners have limited options to change the policy’s face amount (death benefit). Partial conversions would change the policy’s death benefits. And some riders allow modification to the face amount.

How Long Does It Take for Beneficiaries to Receive the Death Benefit?

Life insurance proceeds avoid probate, so payouts are faster than any assets that must go through the court system. If the insurance company needs to investigate the claim, a payout is typically received between 14 and 60 days after filing.

Can I Get Life Insurance With a Pre-Existing Condition?

Yes. Although some pre-existing conditions may be more challenging to insure, getting life insurance coverage isn’t impossible. The best way to find affordable coverage is to work with an independent broker who advocates on your behalf.

If you have a child approaching adulthood, make sure you complete these 7 vital tasks.

Get a Life Insurance Quote to Protect Your Family

We can help you buy term life insurance or permanent life insurance. Whether you want to purchase life insurance on yourself, your spouse, a parent, or your child or grandchild, a dedicated Quotacy agent is waiting to help you through the life insurance buying process.

Quotacy is an independent life insurance broker. This means we don’t work for any particular insurance company and can shop the market to get you the best possible price. Apply through Quotacy, and we’ll help your family get affordable life insurance coverage.

Get an instant term life insurance quote today—no contact information required.

Note: Life insurance quotes used in this article are accurate as of July 12, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments