When you think about the family provider, most people’s minds go to the parent that brings home the bacon. It’s obvious that this person needs to have life insurance. Term insurance is affordable and structured to provide income replacement if the loss of a provider happens unexpectedly. Without this provider, the family would struggle financially.

Salary.com estimates the average stay-at-home parent is worth over $200,000 annually. That’s a lot of money to make up for if they were no longer around. Life insurance for stay-at-home parents is just as important as it is for income providers.

An income is how one pays for a home, a car, bills, children’s school activities, food, and clothing. So, if a family has one parent working outside the home and one stay-at-home parent, they only need to have the breadwinning parent covered, right? Wrong.

Imagine all the daily duties a stay-at-home parent takes care of. If they were not working inside the home, you would need to pay someone for the following services or figure out a way to find time to do them yourself:

- Transport children to school and other places

- Cook meals

- Clean the house

- Grocery shop

- Do laundry

These are just a handful of the services an average stay-at-home parent provides each week. You could even add teacher, psychologist, and accountant to their job title.

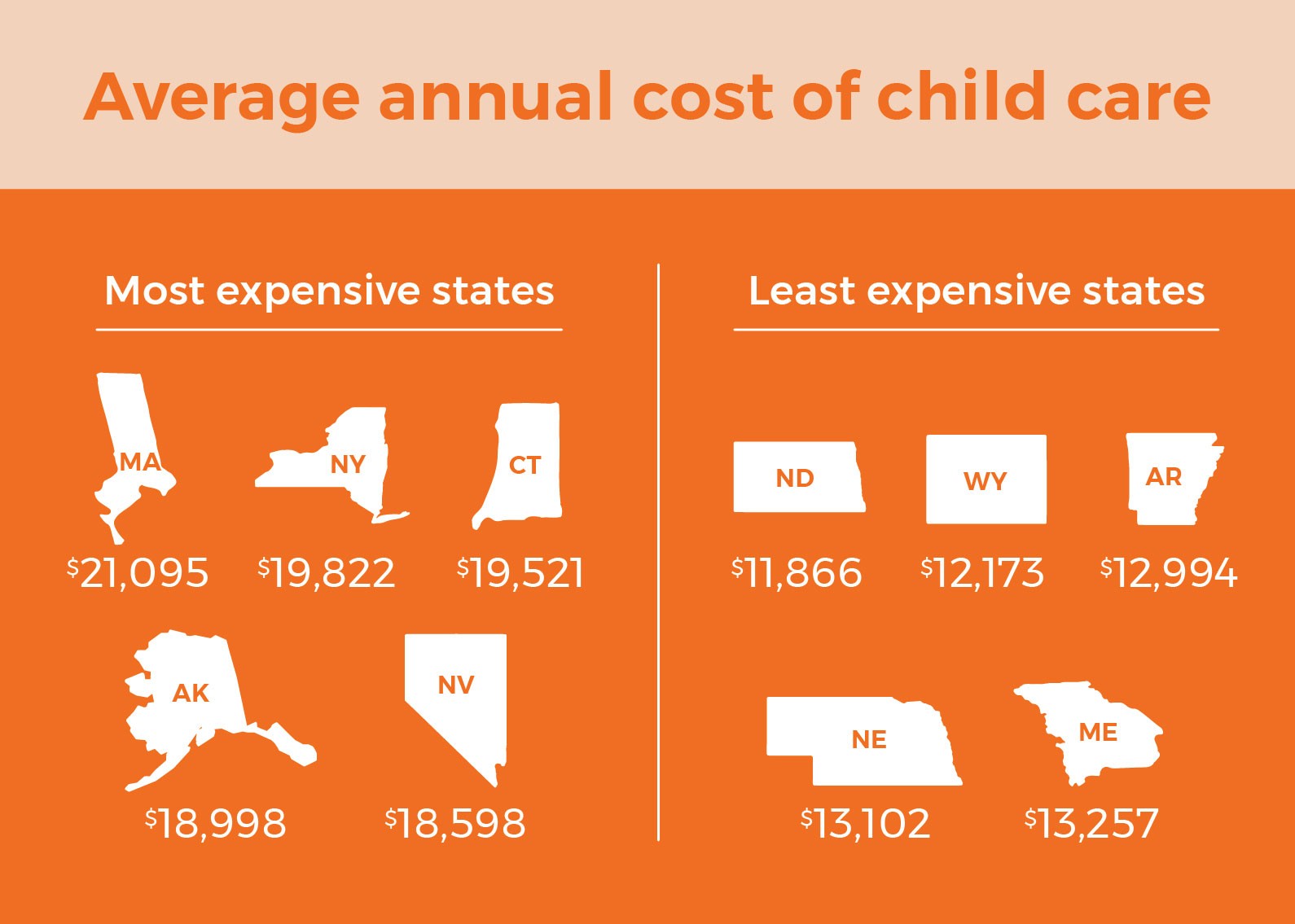

For families with children too young for school, it’s becoming more common for one parent to end up staying home indefinitely. The cost of daycare increases every year. For many families, it ends up making more sense for one parent to quit their job rather than pay for daycare services or a nanny.

*Numbers from The Street article Here’s the Cost of Child Care in Every State

Whether you work outside or inside the home, life insurance is essential for families.

See what you’d pay for life insurance

How Much Coverage Does a Stay-at-Home Parent Need?

It makes the most sense for a stay-at-home parent to have enough term life insurance coverage to last until all the children are at least 18. If you plan on paying for your children’s college education, the coverage should be a longer term.

When buying life insurance coverage on a stay-at-home parent you will need to consider the costs of replacing all the work they do at home. And think about how long you will need these duties taken care of. Are your kids still very young? Or are they relatively independent and able to babysit themselves at home? The younger your children are, the more years you’ll need help taking care of them, meaning the more life insurance coverage you should own on a stay-at-home parent.

» Calculate: Calculate Your Life Insurance Needs

Term life insurance is the perfect life insurance option for stay-at-home parents. Term life insurance is designed to last only a specific period of time—the term length. This term length is chosen by you. Term lengths vary from to 40 years, depending on your age. The younger your children are, the more time you will want life insurance protection.

Term life insurance is also customizable and can fit into most family budgets. The tables below show some estimates of term life insurance costs depending on your coverage amount and term lengths.

Term life insurance has fixed premiums. This means, using the example tables above, if our 30-year-old stay-at-home mom bought a 30-year $250,000 term life insurance policy, her monthly rate would remain $15.44 the entire term and will not increase at any time during the 30 years even if she develops a health condition.

Getting Life Insurance Coverage Approved for a Stay-at-Home Parent

Calculating the amount of term life insurance on a stay-at-home parent can be a little tricky with life insurance companies sometimes. Life insurance companies have rules on how much life insurance coverage an individual can own. Life insurance isn’t designed to increase wealth. It’s not an investment tool. Its main purpose is to replace lost income due to an unexpected death.

For example, if you make $30,000 per year, the life insurance company is going to question your application if you apply for a $10 million dollar insurance policy. The life insurance companies do not want insured clients to essentially be worth more dead than alive.

As a general rule of thumb, many insurance professionals advise you to have 10 to 20 times your current income to maintain your loved ones’ standard of living. Because stay-at-home parents do not generate income, on paper it’s difficult to determine how much coverage they can be approved for. Most life insurance companies would allow a stay-at-home parent to have coverage equal to that of the income earning spouse. If the earner makes a substantial amount of money and has a substantial amount of life insurance coverage, life insurance companies may cut the coverage for the stay-at-home parent in half.

Example: One carrier may follow the guidelines that state if the income-earning spouse has $3 million or less of life insurance coverage, they will approve the stay-at-home parent for the same amount. If applying for more than $3 million, the financial underwriters will consider approval on a case-by-case basis.

Sometimes in order for a stay-at-home parent to be approved for the coverage they applied for, information must be sent to the insurance company to explain why the client is hoping for that coverage amount. This is one example of why working with a life insurance broker that has years of experience is beneficial. Here at Quotacy we have an in-house underwriter that knows the ins-and-outs of the major life insurance companies. We know what information the insurance company requires.

Another benefit of working with a life insurance broker is our ability to shop your case around to the top-rated life insurance companies. While one life insurance company may deny a specific amount the stay-at-home parent applies for, another company may not have any issues with it. As a broker, we aren’t restricted to only sell products from one particular company. We’re your advocates in the life insurance marketplace.

» Explore: Average Monthly Life Insurance Costs in 2023

Applying for Life Insurance for a Stay-at-Home Parent

A stay-at-home parent can easily apply for his or her own life insurance policy right online. It takes just a few minutes to run term life insurance quotes and then submit your online application.

However, what people also often don’t realize is that you can apply for life insurance on your spouse. The working spouse can apply for and own a policy on their stay-at-home spouse.

A stay-at-home spouse can also apply for and own life insurance on the working spouse. Whichever method of ownership you and your spouse choose, both individuals will still need to electronically sign the application, complete a brief phone interview with a representative of the insurance company, and, if applicable, take a medical exam.

Stay-at-home parents are the unsung heroes of the household and need life insurance coverage just as much as the breadwinner.

Quotacy works with many of the best life insurance companies, and we will work closely with you to get all the facts so you get the best coverage possible for your individual situation. Whether you work in or outside the home, if you have anyone who depends on you, life insurance should be in your financial plan.

Note: Life insurance quotes used in this article are accurate as of July 21, 2023. These are only estimates and your life insurance costs may be higher or lower.

Very interesting post. Stay at home moms do provide a valuable service to the family and her contribution would be sorely missed. This is all the more reason for women to consider buying life insurance on themselves and why it is important to the family.