In most cases, life insurance payouts (or death benefits) are tax-free. However, there are situations in which some or all of these payouts can be taxed.

In addition, it’s vital to understand the relationship between your estate and life insurance taxation. In this guide, you’ll learn the situations when life insurance becomes taxable, how to navigate these scenarios, and the most effective strategies.

Table of Contents

- Are Life Insurance Proceeds Taxable?

- How to Avoid Taxes on Life Insurance

- Are Life Insurance Premiums Tax-Deductible?

Life Insurance and Taxes: Key Takeaways

- Life Insurance Taxation: Life insurance proceeds are typically tax-free for beneficiaries. However, policy ownership arrangements, selling or transferring ownership, and significant cash value accumulation can trigger taxation.

- Term Life Insurance: With few tax implications, term life insurance is a straightforward option, providing income replacement for beneficiaries upon the insured’s death. Taxes may come into play in situations involving gift taxes, income taxes on installments or life settlements, and potential estate taxes.

- Permanent Life Insurance: The cash value accumulation in permanent life insurance introduces additional tax considerations. Withdrawals, loans, surrendering the policy, and earning dividends on your policy can result in taxation.

- Avoiding Taxation: Proper planning and understanding of tax laws can help prevent taxation. Techniques like avoiding the Goodman Triangle, understanding the transfer-for-value rules, being aware of the 7-pay test, and keeping track of estate size can be helpful.

- Life Insurance Premiums: While generally not tax-deductible for individuals, there are exceptions for charity-owned life insurance and certain business expenses.

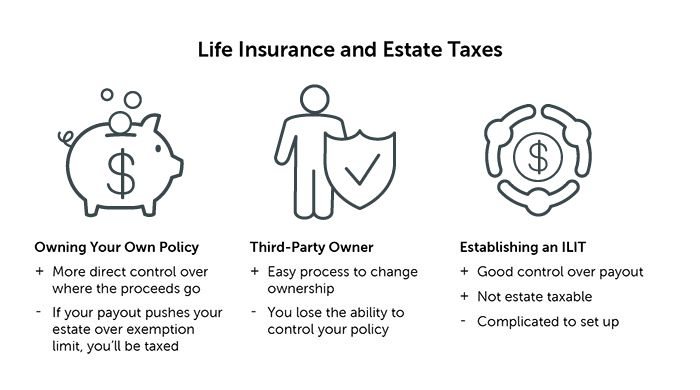

- Estate Planning: To protect heirs from excessive estate taxes, consider strategies like transferring the ownership of your life insurance policy, setting up irrevocable trusts, or gifting the policy to a beneficiary.

Learn more about the relationship between life insurance and estate planning.

Are Life Insurance Proceeds Taxable?

Because life insurance is seen as compensation for a beneficiary’s loss and not a source of income, federal law usually protects life insurance proceeds from taxation.

However, there are exceptions, which we’ll explore in a bit. First, let’s review the different taxes that could potentially be associated with life insurance:

- Income tax: Applies to all your earnings in a year

- Estate tax: Applies if your estate exceeds a certain threshold

- Inheritance tax: Applies in very few states

- Gift tax: May apply when you give a gift that exceeds a certain amount in a given year

- Generation-skipping tax: Applies to significant transfers of wealth made directly to grandchildren

Tax implications are mainly a concern for those who own large amounts of cash value life insurance, such as universal life or whole life insurance. However, term life insurance is not entirely exempt.

Term Life Insurance

Term life insurance is the most straightforward and affordable type of life insurance. It replaces a provider’s income if they pass away prematurely.

The tax-free death benefit proceeds offer financial support for the surviving beneficiaries when they need it most. The money helps them maintain their lifestyle, manage the immediate funeral costs, and meet their financial goals.

Term life insurance policies do not earn cash value, limiting taxation scenarios. Still, there are a few to be aware of:

- Gift taxes: If you own a life insurance policy on another person and name a third party as the beneficiary, death benefits can be considered a gift. If the payout exceeds your individual gift tax exclusion amounts, it may trigger a gift tax.

- Income taxes on installments: If the beneficiaries receive death benefit proceeds in installments, interest earnings may be subject to income tax.

- Income taxes on life settlements: If you decide to sell your term life insurance policy to a third party, any amount that exceeds the total premiums paid (your “cost basis”) may be taxed.

- Income taxes on transfers: Some death proceeds may be subject to income taxes due to transfer-of-value rules if the ownership changes.

- Estate taxes: If you own a policy when you pass away, proceeds are included in your estate’s value, which may trigger estate taxes.

These scenarios are avoidable, but we’ll delve into those details later.

Permanent Life Insurance

Unlike term policies, many permanent life insurance products accumulate cash value, introducing additional tax considerations on top of the scenarios that may affect term life insurance.

Cash value life insurance has tax implications in the following scenarios:

- Income tax on withdrawals: If you withdraw money from your cash value, any amount that exceeds the total premiums paid into the policy may be taxed

- Income tax on loans: The balance may be taxed if your policy lapses or is surrendered with an unpaid loan.

- Income tax on surrender: If you surrender the policy for more cash than the total premiums you paid, that amount is generally taxable.

- Income tax on earnings: If your policy earns dividends that are left to accumulate interest, the interest portion is generally taxable.

Learn more about the differences between term and whole life insurance.

See what you’d pay for life insurance

Scenarios When Life Insurance Is Taxed and How to Avoid Them

We briefly discussed the taxation of both term and permanent life insurance policies. Now, let’s delve deeper into these scenarios and how to avoid them.

The Goodman Triangle a.k.a. Unholy Trinity

A life insurance policy involves three roles: the owner, the insured, and the beneficiary. More often than not, one person fills two of those roles.

If there are three different people to fill each role, the IRS views the death benefit as a gift from the owner to the beneficiary.

The payout could be subject to gift taxes if it exceeds gift tax exclusions, which only apply if the owner has gifted more than $17,000 annually or $12.92 million in their lifetime.

This arrangement is often called the “unholy trinity” or “Goodman Triangle,” named after a court case that set a precedent for this rule.

How to Avoid This Tax

Avoiding the Goodman Triangle tax scenario requires careful planning in designating the policy owner, insured, and beneficiary.

- The easiest way to avoid this potential tax is to have the policy owner and beneficiary be the same person.

- Another option is to have the insured also be the policy owner, which means the value will be included in the insured’s estate for tax purposes.

- Creating an Irrevocable Life Insurance Trust (ILIT) to own the policy is another effective solution.

Transfer-for-Value

One of the key benefits of any kind of life insurance is the tax-free death benefit for beneficiaries. However, transfer-for-value rules could void this tax-free status.

If you’re considering selling your life insurance policy, be aware that the new owner might need to pay income taxes on the death benefit when it’s paid out.

According to the transfer-for-value rule, if a life insurance policy is sold, some of the death benefits could be taxable.

The taxable amount would be the death benefit payout minus the amount paid for the policy.

How to Avoid This Tax

There are exceptions to the transfer-for-value rule. If the policy owner transfers the ownership to one of the following, income tax won’t be applied:

- The insured person

- The insured’s spouse or partner

- A partnership in which the insured person is a partner

- A corporation in which the insured person is an officer or a shareholder

Additionally, establishing an Irrevocable Life Insurance Trust (ILIT) to hold ownership of the policy can effectively bypass the implications of the transfer-for-value rule.

Another helpful strategy involves policy exchanges. The IRS generally allows one life insurance policy to be exchanged for another without triggering the transfer-for-value rule, as per Section 1035 of the Internal Revenue Code.

Modified Endowment Contracts (MECs)

Single-premium life insurance policies gained popularity following a tax code overhaul in 1986. These policies worked much like whole life insurance but with one substantial upfront payment instead of several over time.

This format allowed policyholders to overfund their policy, thus enhancing the payout. Furthermore, borrowing against the policy’s value was possible, transforming these policies into somewhat of a tax-free private bank account.

To close this tax loophole, Congress introduced the “Modified Endowment Contract” or MEC classification through what is known as the 7-pay test.

Features points of the 7-pay test and MECs include:

- The 7-pay test limits contributions made to a policy within its first seven years.

- If contributions exceed this limit, the policy becomes an MEC.

- Any distribution from a MEC policy results in income taxation if there is a gain in the contract no matter how the distribution occurs; partial withdrawals or loans are treated the same way.

- Additionally, an extra tax penalty applies if loans are taken out against an MEC before the policyholder turns 59 ½.

How to Avoid This Tax

Avoiding turning your life insurance policy into a MEC primarily involves you keeping track of your life insurance premium payments.

- Familiarize yourself with the guidelines set by the 7-Pay test and avoid overpaying during those years.

- Consider spreading your premium payments out over a long period.

- Consult with a financial advisor who can guide you.

Most life insurance buyers don’t have to worry about this issue. It typically takes a substantial overpayment beyond what most policy owners could afford to push a policy into the territory of becoming a MEC.

Estate Size

Estate taxes are payable on property included in your estate at death if the gross value exceeds available deductions and credits. As of 2023, the established federal estate tax exemption is $12.9 million per individual and $25.84 million per married couple.

Life insurance is often one of the most valuable assets in an estate. Owning a policy at death could push you over this threshold. It’s not unusual for individuals to have life insurance policies worth millions of dollars.

Furthermore, your state could impose its own estate or inheritance taxes.

While neither you (the deceased) nor your beneficiaries (who receive the payout tax-free) will be directly affected by this potential tax, your estate’s heirs may feel the impact. During the estate settlement process, any outstanding taxes and debts are settled before anything else, including inheritance.

Scenarios when life insurance is included in your estate:

- When life insurance proceeds are payable to your estate.

- If you possessed an incident of ownership in the policy at the time of your death.

- If you transferred ownership of the policy within three years of your death.

An incident of ownership means you have some control over the policy (i.e. beneficiary changes or cash value access). Establishing an irrevocable trust as the owner voids those privileges. A revocable trust lets you maintain control, but the policy is included in your estate for taxation.

How to Avoid This Tax

Because the federal estate tax exemption amounts are so high, most families do not have to worry about this tax. But it’s still important to know how to avoid the situation.

To protect your heirs from excessive taxes, consider the following strategies to keep your life insurance out of your estate:

- Designate specific primary and contingent beneficiaries to avoid proceeds being defaulted to your estate.

- Transfer the ownership of your life insurance policy to a trustworthy family member or friend. Remember, this means surrendering all control to the new owner.

- Name your spouse your primary beneficiary. Proceeds payable to a spouse qualify for the federal estate tax marital deduction, and the total value is deducted from your gross estate.

- Set up an ILIT to own the policy.

- Gift the policy to a beneficiary.

Transferring Wealth to Younger Generations

The Generation-Skipping Transfer (GST) tax is a federal tax in the U.S. that applies to assets transferred to individuals who are more than one generation below the grantor, such as grandchildren or great-grandchildren. This tax is in addition to any potential gift or estate tax.

Like the gift and estate tax exemptions, GST tax exemptions are $12.9M per person or $25.84M for a married couple, and therefore, many families do not have to be concerned about this tax.

How to Avoid This Tax

Once again, trusts come into play to protect life insurance proceeds from taxation. A Generation-Skipping Trust (GST) allows for the transfer of assets to younger generations and avoids or lessens the impact of taxes.

Here’s how it works:

- The grantor, typically a grandparent, establishes a GST trust and names their grandchildren the beneficiaries.

- The grandparent purchases life insurance on themselves and names the trust the owner and beneficiary of the policy.

- The grandparent transfers money into the trust, and the trust then uses this money to pay the policy premiums. This transfer may be subject to gift tax, but they can use their annual gift tax exclusion or their lifetime gift tax exemption to minimize or eliminate this tax.

- Upon the grandparent’s death, their death benefit is paid out to the trust, which can then make distributions to the grandchildren.

This is a simplified example. To set up a GST, work with an experienced attorney.

Are Life Insurance Premiums Tax-Deductible?

Life insurance premiums are generally not tax-deductible for individuals since they are considered personal expenses. There is one exception:

- If you gift a life insurance policy to a charity and continue paying the premiums, those premiums can be treated as charitable donations and are tax deductible.

If you own a business, you can deduct life insurance premiums as a business expense in the following scenarios:

- If you own a business and pay for life insurance for your employees, those premiums may be deductible.

- As the employer, you may not be a beneficiary directly or indirectly.

- If you offer group term life insurance to your employees, premiums for the first $50,000 of coverage are usually deductible.

- Premiums for coverage tied to non-qualified employee benefit plans, like deferred compensation, could also be deductible.

The world of taxes can be complex, and this is a broad overview. Consult with a tax professional to fully understand your unique circumstances and ensure you comply with all tax laws.

Compare Life Insurance Quotes and Apply Today

They say that only two things in life are certain—death and taxes. Thankfully, when it comes to life insurance, you usually rely on the payout to be tax-free.

For most people buying life insurance, your beneficiaries won’t pay a dime in taxes on the death benefits. This is a key reason life insurance stands out as an effective means to provide financial protection for your loved ones.

If you’re looking to get life insurance, look no further. Get life insurance quotes instantly without giving away any contact information.

Compare policies and pricing from multiple top-rated insurance companies, and then when you’re ready to apply, the online application only takes a few minutes to complete.

Once your application is submitted, you will be assigned a dedicated Quotacy agent. This agent will be your advocate, guiding you throughout each step of the process.

Tax laws are complex and subject to change. This article is for educational purposes and not written by a financial advisor.

Awesome topic. Thank you for the information.