Life insurance plays a crucial role in protecting your loved ones. It’s not just another expense. It’s a vital investment that provides peace of mind and financial stability. From safeguarding your family’s well-being today to ensuring their future needs are met, life insurance offers a safety net for life’s uncertainties.

This article delves into how life insurance works, who it’s for, pros and cons, and costs to help you understand if life insurance is worth it for you.

Table of Contents

- Who Needs Life Insurance?

- What Does Life Insurance Cover?

- How Does Life Insurance Work?

- The Pros & Cons of Life Insurance

- How Much Is Life Insurance?

- Is Life Insurance Worth It for You?

- Calculate Your Life Insurance Cost

Who Needs Life Insurance?

Is anyone in your life dependent on your income? If so, it’s important to have life insurance. It protects your dependents’ financial future by helping replace your salary if you pass away unexpectedly.

Many people need life insurance for various reasons, including:

- Parents: Ensure financial security for their children.

- Partners: Provide a financial safety net, enabling them to manage bills and maintain their standard of living.

- Business Owners: Cover business debts, protect against loss of income, and support the continued operation after you pass.

- Individuals with Shared Debt: Prevent others from inheriting your debt.

- High Net Worth Individuals: Manage estate taxes, facilitate a smooth wealth transition to heirs, and preserve their legacy.

What Does Life Insurance Cover?

All life insurance policies have the same basic function: Pay a policy’s death benefit to its beneficiaries if the insured dies while coverage is active. Additional benefits depend on the type of policy you purchase.

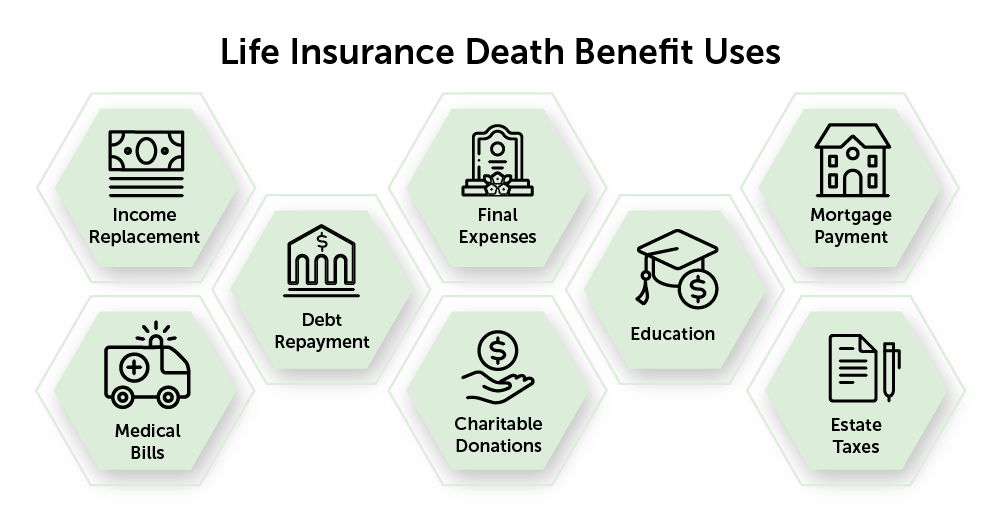

Although beneficiaries can use the death benefit however they wish, life insurance coverage is calculated to cover the insured’s:

- Income, so their loved ones can maintain their standard of living

- Outstanding debts, like a mortgage and/or student loans

- Final expenses, including funeral costs, burial/cremation expenses, and medical bills

- Estate taxes

- Education costs if you want to pay your kids’ college tuition

- Business needs, like succession planning, buy-sell agreements, and debts

- Desire to leave charitable contributions to meaningful causes

How Does Life Insurance Work?

Life insurance is a contract between you and the insurance company. In exchange for paying premiums on time, the insurance company promises to pay a death benefit if you die while the policy is inforce.

This is how life insurance works:

- Choose a Policy: You have a choice between a term policy, which provides coverage for a set period at a low cost, or permanent life insurance, which is more expensive but lasts your entire life.

- Select a Death Benefit: You decide the amount your beneficiaries will receive upon your death. It should account for their financial needs, including income replacement, debt repayment, and future expenses such as children’s education.

- Identify Beneficiaries: You designate one or more beneficiaries who will receive the death benefit. It’s also recommended to name contingent, or backup, beneficiaries.

- Pay Premiums: You make regular premium payments to keep the policy active. The premium amount depends on the death benefit, policy type, age, health status, lifestyle, and occupation.

- Policy Payout: If you die while the policy is in effect, the insurance company pays the death benefit to your designated beneficiaries. They can use these funds to cover funeral costs, repay debts, replace lost income, or fund future expenses.

- Policy Termination or Renewal: If a term policy expires while you’re still alive, you can usually renew it, convert it to a permanent policy, or let it terminate. If you stop paying premiums, the policy may lapse, meaning coverage ends.

Term Policies

Term life insurance is often the best option for families because it’s straightforward protection that can fit into most budgets.

- Duration: Coverage lasts a set period, typically 10-40 years. If you die during this term, the death benefit is paid to the beneficiaries.

- Premiums: Premiums are much lower than permanent life insurance, making it more affordable. Premiums are fixed and won’t increase for the entirety of the term.

- Death Benefit: If you die during the term, the insurance company pays the designated beneficiaries a tax-free death benefit.

- No Cash Value: Term life insurance doesn’t accumulate any cash value. It’s designed purely for death benefit protection.

Interested in term insurance, but unsure how long your coverage should last? Explore your options: How Long Should Term Life Insurance Last?

Permanent Policies

As its name suggests, permanent life insurance provides lifelong coverage and includes a cash value component that grows over time.

- Lifelong Coverage: As long as premiums are covered, permanent life insurance pays your beneficiaries a tax-free death benefit no matter when you die.

- Cash Value Component: A portion of the premiums you pay contributes to a cash value accumulating over the policy’s lifetime. This cash value grows on a tax-deferred basis and can be accessed during your lifetime via policy loans or withdrawals.

- Flexible or Fixed Premiums: Depending on your chosen policy, premiums might be fixed or flexible (allowing adjustments over time).

Unsure what type of coverage you need? Explore the differences between term and permanent life insurance to find your ideal solutions.

See what you’d pay for life insurance

Pros and Cons of Life Insurance

Like all financial products, owning life insurance comes with its own set of benefits and drawbacks.

Here are the pros and cons to consider when deciding whether to purchase life insurance:

Pros of Life Insurance

- Life insurance provides you peace of mind knowing your loved ones will be financially secure, no matter what.

- It can be kept out of probate, ensuring the death benefit goes only to beneficiaries rather than court fees.

- Your policy’s payout prevents loved ones from financial ruin due to debt inheritance or the inability to pay the mortgage without your income.

- Some forms of permanent life insurance offer a cash value component that grows over time and can serve as an additional form of savings or investment.

- During a challenging time for your family, they won’t have to worry about funeral expenses.

Cons of Life Insurance

- Life insurance can be expensive, particularly if you’re older or have health issues.

- It may not be necessary if you’re single, have no dependents, and have enough assets to cover your debts and funeral expenses.

- Permanent life insurance policies can be complex and difficult to understand.

- Accessing the cash value may reduce your death benefit, and fees or penalties could be associated with withdrawals or loans.

- If you can no longer afford the premiums, you may risk losing the policy and not receiving any money back.

How Much Is Life Insurance?

In a recent report by LIMRA, over half of Americans surveyed believe a 20-year $250,000 term policy for a healthy 30-year-old male would cost about $500 per year. In reality, it would cost under $200.

People assume life insurance is more expensive than it is because we don’t talk about it much.

The cost of a life insurance policy varies by individual.

The insurance company determines premiums based on the following:

- The insured’s age

- The insured’s level of risk (health and lifestyle)

- The type of policy applied for

- The coverage amount

- The length of coverage

When you apply, you permit the insurance company to review personal records, such as:

- Medical records

- Prescription drug records

- Motor vehicle records

- Financial records

- Criminal records

- Life insurance history

While they may not review all records in-depth, it’s an underwriter’s job to gather the essential information from these sources to determine whether to approve an applicant for coverage. Then they assign the applicant a particular risk class.

The most common risk classifications are:

- Preferred: Above average health and best pricing

- Standard: Average health and good pricing

- Substandard: Below average health and higher-than-average pricing

Substandard pricing is also known as table rating. Typical table ratings start at Table A, or Table 1, and run all the way to Table P, or Table 16. Each table rating is an extra 25% on top of the Standard price. In other words, Table A means the applicant pays 25% on top of the Standard rate, Table B equals 50% plus the standard rate, etc.

Term vs Permanent Costs

Term life insurance is more affordable than permanent. Permanent is more expensive because it lasts your entire life and offers additional features such as cash value accumulation and the potential to earn dividends.

The tables below show the difference in pricing between a 20-year term life insurance policy and a participating (dividend-earning) whole life insurance policy.

All other things being equal, women will pay less than men for life insurance due to their longer life expectancy on average.

Learn more about life insurance costs for different policy options and what you could expect to pay.

Is Life Insurance Worth It for You?

What happens if you die unexpectedly? Could your family afford to pay the bills, pay for your funeral, and maintain their standard of living?

If you have people who depend on you, life insurance is worth every penny. Term life insurance can be customized to fit most budgets.

Life insurance is meant to replace your income. For stay-at-home parents, life insurance can provide funds needed to find help for the surviving parent. Life insurance is a safety net.

The important thing to do is buy a policy that you can comfortably afford long-term. While you may love to leave behind $1,000,000 of life insurance if you die, it may not be the right policy for you.

Unsure how much life insurance coverage you need? Use our free life insurance calculator. It can point you in the right direction.

Compare Life Insurance Quotes From Top-Rated Carriers

Because life insurance is priced based on your individual factors, working with an independent broker and comparing quotes is beneficial. Not all life insurance companies underwrite the same way.

For example, an applicant with a history of depression may apply to a company and receive a Standard risk class. Another insurer given the same information may apply a different risk class, placing the applicant into either a higher or a lower rating category.

When you apply through Quotacy, you’re assigned a dedicated agent whose job is to find the carrier that will offer the best rating for you. As an independent broker, we have a fiduciary duty to you, our client, not the insurance companies.

Getting quotes is easy, too. You can instantly see term life insurance quotes from various insurance companies without providing contact information. Try it out for yourself: get term life insurance quotes.

After seeing estimated pricing, choose a policy you like and apply online in a few short minutes. After that, your agent goes to work for you.

Don’t postpone getting life insurance. You never know what tomorrow may bring.

Note: Life insurance quotes used in this article are accurate as of June 14, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments