If you’re in your 30s, it’s time to start thinking about securing your future and providing a financial safety net for your loved ones.

Whether you’re in a committed relationship, have children, or are navigating the financial responsibilities of home ownership, life insurance can offer invaluable protection. However, choosing a life insurance plan is not like buying groceries; it can be complex, and you may not know where to start.

In this article, we’ll walk you through different life insurance plans, key factors that influence pricing, and tips for securing the best rates.

- Why 30-Year-Olds Need Life Insurance

- Types of Life Insurance for Those in Their 30s

- Factors That Affect Policy Rates for 30-Year-Olds

- How to Determine the Amount of Coverage You Need

- Tips for Getting the Best Rates

Why 30-Year-Olds Need Life Insurance

Buying life insurance in your 30s is a smart decision. This decade is often marked by significant life events that make having a life insurance policy increasingly important.

Reasons why you may need life insurance in your 30s:

- Protecting Your Spouse or Partner’s Financial Future: Whether you’re married or in a committed relationship, life insurance can serve as a financial cushion for your significant other. It can help cover loss of income, debts, and other financial responsibilities that your partner might struggle with in your absence.

- Ensuring Your Children’s Well-Being: If you have kids or plan to start a family soon, life insurance is essential for ensuring their financial stability. It can cover educational expenses, healthcare, and even day-to-day expenses should something happen to you.

- Home Ownership Concerns: A mortgage is often the largest debt a person will incur in their lifetime. Life insurance can help ensure that your family can remain in their home by covering mortgage payments in case of your untimely passing.

- Debt Management: From student loans to credit card debts, most 30-somethings are still managing some level of debt. A life insurance policy can help clear these debts, easing the financial burden on your family.

- Supporting Elderly Parents: Many people in their 30s find themselves in the “sandwich generation,” caught between raising children and caring for aging parents. Life insurance can provide peace of mind, knowing that you can financially help your parents even if you’re no longer around.

Another often overlooked reason to get life insurance in your 30s is the low-cost advantage. Insurers offer better rates to those who are younger and in good health, making it an ideal time to lock in an affordable premium.

Consider the table below, which illustrates how term rates increase based on the age at which you apply. With many life insurance policies, the rate is locked in at the time of purchase.

For example, based on the rates displayed, a 35-year-old woman could secure a 20-year term policy with a $250,000 coverage amount for under $12 per month. Her rate stays the same for those 20 years even as she ages or if she develops a serious medical condition.

Explore more term life insurance rates by age and length of coverage.

See what you’d pay for life insurance

Types of Life Insurance for Those in Their 30s

There are two main categories of life insurance: term and permanent. Choosing between these depends on your financial goals, budget, and family needs, and you might even find that a combination of both suits you best.

Term Life Insurance

Term life insurance is the most straightforward type of life insurance. It’s also the most affordable, making it a popular choice for families and those on a budget.

- Duration: Term life insurance provides coverage for a fixed period, ranging from 10 to 40 years, depending on what you choose.

- Coverage Amount: You can select an amount ranging from $50,000 to several million dollars, based on your financial needs and obligations. This is the amount paid to your beneficiaries.

- Cost: The younger and healthier you are at the time of purchase, the more cost-effective the policy will be. Once you select a term, your rates are locked in for that duration, offering predictability and ease of planning.

If you pass away during the term, your beneficiaries receive the death benefit proceeds tax-free. However, if you outlive the term—which is what all families hope for—your coverage simply expires.

Most policies do give you the option to renew or convert the coverage if you decide you want to remain insured. Learn about how these options work: What Happens When Term Life Insurance Expires?

Permanent Life Insurance

Permanent life insurance refers to a category of life insurance policies designed to provide coverage for your entire life. This category includes specific types such as whole life and universal life insurance.

These permanent policies set themselves apart from term insurance with some unique features, but they are much more expensive.

- Duration: Permanent life insurance provides coverage for your entire life.

- Coverage Amount: Coverage amounts vary from $5,000 to several million dollars, based on your financial needs and obligations.

- Features: Permanent life insurance offers attractive features such as cash value accumulation, potential dividends (in the case of whole life insurance), and flexibility in premium payments (with universal life insurance).

- Cost: Permanent life insurance premiums are more affordable when you are younger and in good health. However, these rates can still be 10-20 times higher than term life insurance.

Get a more in-depth look at term, universal, and whole life insurance to help you determine which type is best for you.

Group Life Insurance

You might also work for a company that offers you group life insurance as part of your employee benefits package. The coverage amount is minimal, typically equal to one year’s salary, but premiums are often very inexpensive or free.

Take advantage and accept any free coverage your employer provides. This is a nice benefit, especially considering employers aren’t required to offer it. However, it’s best not to rely solely on this coverage if you have people relying on you.

Relying only on group life insurance has disadvantages:

- The life insurance amount may not be sufficient to cover mortgage payments, childcare, educational expenses, and other long-term financial responsibilities for your family.

- Your coverage is tied to your employment. If you change jobs, lose your job, or retire, you could lose your insurance coverage.

- While initially cost-effective, the rates for group policies increase as you age.

Factors that Affect Policy Rates for 30-Year-Olds

Several factors influence the cost of a life insurance policy, with age and health status being the most significant. Fortunately, if you’re in your 30s, you’re generally viewed as young by insurance companies, and it’s less likely that you’ve developed chronic health issues.

Though insurance companies may weigh these factors differently, they commonly consider the following when determining your premium:

- Age

- Gender

- Health

- Tobacco use

- Lifestyle habits, such as your alcohol and drug use

- Family health history

- Occupation and hobbies

- Driving history and criminal record

After evaluating your application to assess your level of risk, life insurance underwriters will assign you a rate class (also called a risk class).

The most common risk classifications fall into one of three groups: preferred, standard, and substandard.

- Preferred classes are reserved for the healthiest individuals and offer the best pricing.

- Standard risk classes are for people with average health and life expectancy.

- Substandard classes are for high-risk individuals.

- Tobacco users have their own standard and preferred classes.

The Standard risk class is typically the starting point in life insurance underwriting. It represents an average risk compared to others within the same age and gender group. If you are healthier than average, you may qualify for preferred classes. If you’re less healthy, you may be assigned a substandard risk class.

The risk class you’re assigned determines how much your policy will cost. The less risky you are to insure, the better your rate. Below is an example to illustrate how your risk class affects your price.

How to Determine Your Coverage Needs

One of the key steps in the buying journey is figuring out how much life insurance to buy. You want to avoid under-insuring yourself, as that could leave your family financially vulnerable if you pass away unexpectedly. On the other hand, if your premiums are too costly in the long run, you run the risk of letting your policy lapse, which also benefits no one.

If you’re choosing term life insurance, you can select a term length anywhere from 10 to 40 years, depending on your needs. When choosing your term, align it with the duration of your longest financial commitment, whether that’s your mortgage, your planned retirement age, or the time until your youngest child becomes financially independent.

Unsure which term length to choose? Review our guide: Life Insurance Term Length: How Long Should Your Coverage Last?

While buying coverage amounts like $250,000, $500,000, or even more might seem overwhelming, the premiums can be surprisingly affordable, especially if you’re in good health. If something happens to you, the goal for this policy is to cover funeral expenses, remaining debts, and help support your family’s standard of living.

If you’re considering permanent life insurance, it’s important to recognize that this is a long-term financial commitment. Relying solely on a permanent policy for all your insurance needs could become financially burdensome.

To save money in the long run and still ensure your needs are met, you may want to consider buying a little of both. You could get a large term life insurance policy to cover significant, time-sensitive expenses such as mortgage payments and the costs of raising children. Then, supplement this with a smaller permanent life insurance policy for ongoing, long-term needs like estate planning or leaving a financial legacy.

Learn more about buying more than one life insurance policy.

Laddering Life Insurance Policies

If permanent life insurance isn’t right for you and you think a term life insurance policy may not be enough coverage, consider laddering policies.

Laddering, or layering, term life insurance policies is when you buy more than one policy, each with varying coverage amounts and term lengths. You can do this either at different stages of your life or all at once, depending on your needs.

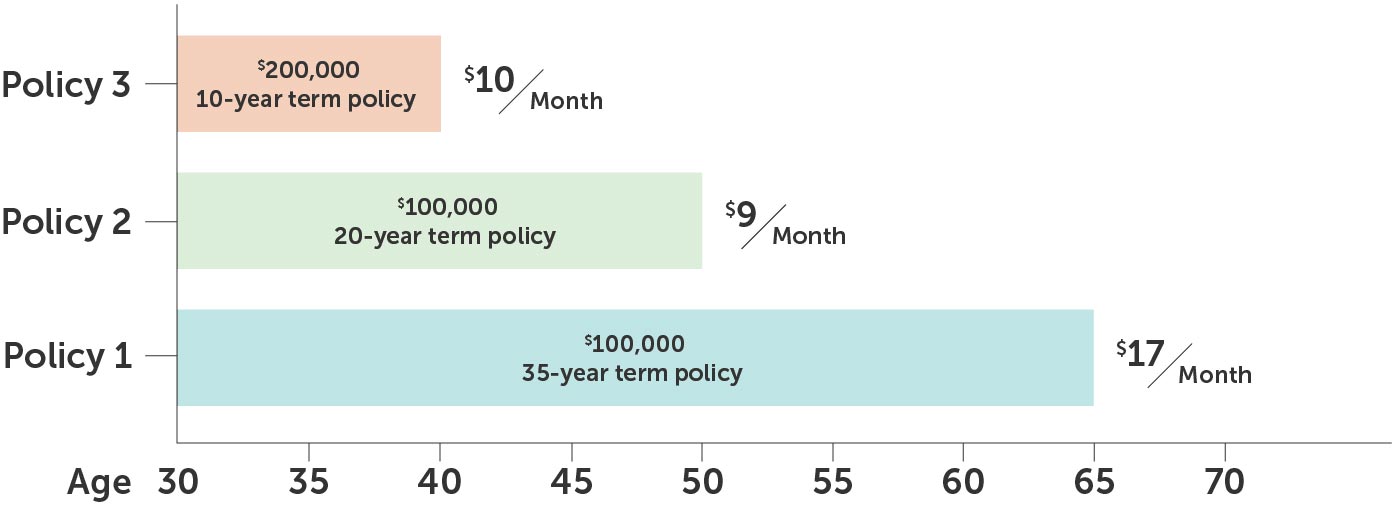

Example 1: Buying Multiple Policies at Once

Jim, age 30, and his wife Pam just bought a home. They also plan to start a family this year.

Jim decides to buy three term life insurance policies.

- Policy 1: A 35-year term with $100,000 coverage. This will financially protect Pam through their working years.

- Policy 2: A 20-year term with $100,000 coverage. This will help Pam pay the mortgage and start college funds for their kids if Jim dies unexpectedly.

- Policy 3: A 10-year term with $200,000 coverage. This, combined with the other two, ensures that Pam can maintain the family’s standard of living during their kids’ formative years.

As they pay off the mortgage and the kids grow up, their insurance needs decrease. This makes laddering a smart choice for them.

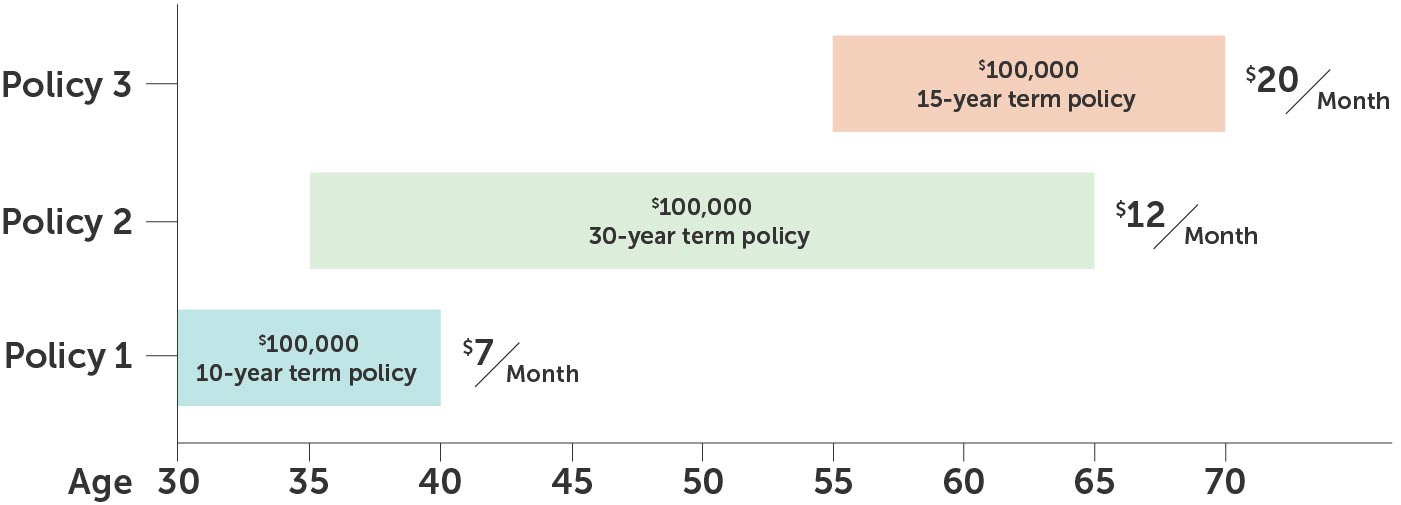

Example 2: Buying Policies Over Time

Blair, 30, and her husband Chuck are newlyweds on a tight budget. Still, Blair wants to make sure Chuck is protected if she dies suddenly.

- Policy 1: She starts with a 10-year, $100,000 policy. It’s modest but will cover funeral expenses and shared debt.

- Policy 2: At 35, they save up for a down payment and buy their first home, so Blair adds a 30-year, $100,000 policy. This helps Chuck pay the mortgage if she dies unexpectedly.

- Policy 3: At age 55, Blair buys a 15-year, $100,000 policy so Chuck won’t have to use his retirement savings to pay bills if she passes away prematurely.

By laddering policies like this, Blair can tailor her coverage to her changing needs over time.

Not sure how much term life insurance you need?

Tips for Getting the Best Rates

In your 30s, you’re balancing a lot. You’re paying off debt while saving for retirement. You’re learning what it takes to be a successful adult and provider. Fortunately, you can find ways to secure life insurance without breaking the bank. Follow these tips to get the best price.

- Work with an Independent Broker: Brokers like Quotacy work with multiple insurance companies, allowing you to find the best rates and policies for your unique situation.

- Consider Term Life: Term life insurance is typically more affordable than permanent and is well-suited for specific financial obligations, like a mortgage or raising kids.

- Buy Early: The younger you are, the lower your premiums.

- Consider Laddering: Buy multiple, smaller policies for different life stages to potentially save on premiums.

- Buy What You Can Afford: Always buy a policy that you can afford in the long term. Even a modest policy can provide invaluable peace of mind for your family’s future.

Get Quotes Today from Quotacy

Getting life insurance has never been easier. Start the process by getting free and instant term life insurance quotes.

Compare options and apply right online in just a few minutes. Once your application is submitted, a dedicated Quotacy agent will be assigned to you, working diligently to ensure you receive the best price possible and guiding you through every phase of the process.

Bonus: If you’re in your 30s, you may be eligible to skip the life insurance medical exam. This streamlines the buying process. In some cases, you can find out if you’re approved in 24 hours or sooner. Your agent will let you know if this option is available to you.

Unsure how much life insurance you need? Try out our online life insurance needs calculator.

Note: Life insurance quotes used in this article are accurate as of November 13, 2023. These are only estimates and your life insurance costs may be higher or lower.

Please recheck the data you cite from the CDC in your article. Your table reflects the total number of deaths in that age range, not deaths per 100,000. You are saying that there are 47,010 deaths per 100,000. That actual deaths per 100,000 in that age range is closer to 180.

Thanks for letting us know, JC! We ended up using a different table from the CDC altogether.