Permanent life insurance costs more than term life insurance because it’s designed to last your entire life and has cash value growth. Term life insurance is the best choice for most families, but many can still benefit from a permanent policy.

In this post, you’ll learn all about permanent life insurance: the different types, how they work, the costs, and, ultimately, is permanent life insurance worth it?

What Is Permanent Life Insurance?

Permanent life insurance is a type of policy that provides coverage for your entire life as long as you keep the policy inforce by paying premiums. When you die, the insurance company pays a death benefit to your beneficiaries.

Common characteristics of permanent policies include:

- A savings component, which you can access through policy loans or withdrawals.

- Rates are more expensive than term life insurance rates due to the lasting coverage and features.

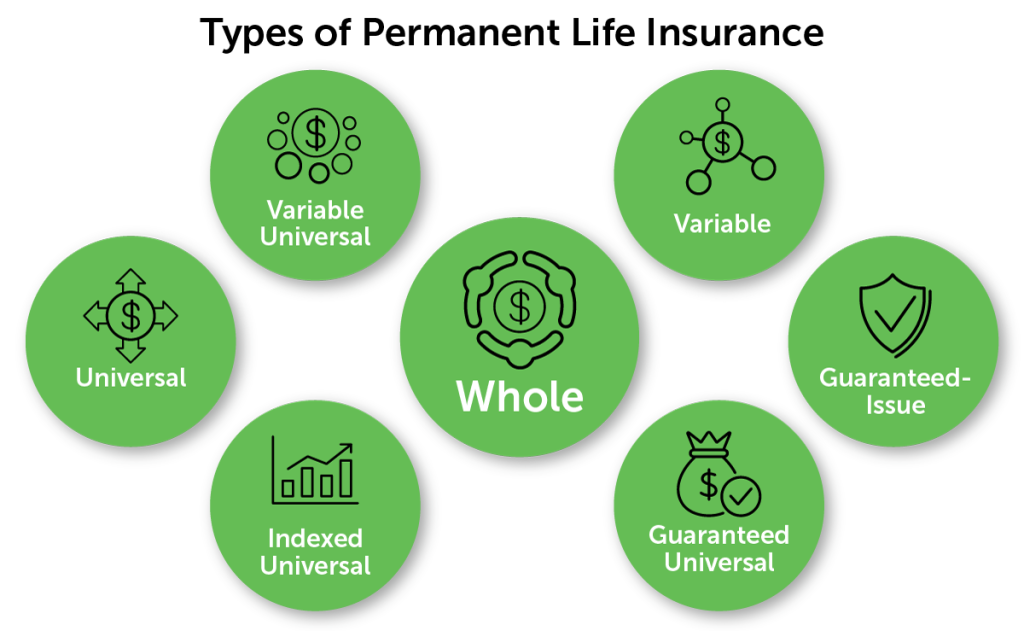

Types of Permanent Life Insurance

There are several types of permanent life insurance, including:

- Whole life (WL) insurance: This is the most common type of permanent life insurance. The premiums remain level for your entire life. The cash value component grows at a guaranteed rate over time and can be accessed via policy loans.

- Universal life (UL) insurance: This type of policy offers more flexibility than whole life insurance. You can adjust the premium payments and death benefit amount. The insurance company typically sets the interest rate on the cash value account, which can be fixed or variable.

- Indexed universal life (IUL) insurance: Indexed universal life insurance allows for flexibility in premium payments and death benefit amounts. The main difference is that the cash value component is tied to a specific market index, offering returns based on market performance.

- Guaranteed universal life (GUL) insurance: Guaranteed universal life insurance is the most basic permanent life insurance product. GUL provides lifetime coverage but has fewer bells and whistles than other permanent products. The premiums are lower than other permanent products (but still higher than term life insurance).

- Variable life insurance: This policy also includes a cash value component, but you have various investment options. Returns may be higher, but they’re subject to market fluctuation.

- Variable universal life (VUL) insurance: This policy incorporates UL’s flexibility and adjustment features with the policyowner-directed investment aspects of variable life insurance.

- Guaranteed-issue life insurance: Guaranteed-issue life insurance is a whole life insurance policy without medical requirements that offers instant coverage. Face amount options are limited, typically ranging from $5,000 to $50,000, and rates are high.

How Does Permanent Life Insurance Work?

At a basic level, as long as the policy owner pays the premiums, coverage remains in place for the insured individual’s lifetime. When the insured dies, the beneficiaries submit a claim to the insurance company and receive a death benefit check.

Permanent policies have other features besides lifelong coverage.

Permanent Life Insurance Cash Value

The savings component of a permanent life insurance policy is the cash value account. When you pay a premium, some is funneled into this account, where it earns interest and grows over time.

How the cash value accumulates varies by the type of permanent policy you own.

Whole Life Insurance

- The insurance company invests a portion of your premium in conservative assets, such as bonds, mortgages, and other fixed-income securities.

- The cash value grows tax-deferred at a guaranteed interest rate.

- The cash value tends to grow more slowly than universal and variable life insurance policies, but less risk is involved since it’s consistent, guaranteed growth.

Universal Life Insurance

Like whole life, the insurance company invests a portion of your premiums, generating returns that grow your cash value account. But universal policies do not offer a guaranteed interest rate and must be closely monitored.

- The cash value growth in a UL policy is tied to a specific interest rate, which is usually determined by the performance of the insurer’s investments.

- Some UL policies offer a guaranteed minimum interest rate, providing a floor so your account doesn’t lose money.

- Some UL policies, such as indexed universal life insurance, are tied to a market index, such as the S&P 500, and cash value growth is based on its performance.

- Some UL policies, such as variable universal life insurance, offer investment options similar to a mutual fund.

Variable Life Insurance

Unlike whole and universal life insurance, variable life insurance policies allow you to choose how your premiums are invested. In doing so, you take on all the risk when buying a variable policy. Variable policies offer no guarantees of either interest rate or minimum cash value.

- Variable policies offer a range of investment options that vary in terms of risk, return potential, and asset allocation.

- You can allocate cash value among the available sub-accounts, including stocks, bonds, and mutual funds, and change allocations as your needs and risk tolerance evolve.

Note regarding all cash value life insurance policies: although you can invest your premiums and interest compounds over time, life insurance is first and foremost financial protection for beneficiaries. It’s not an investment strategy. Consider other investment options to diversify your financial portfolio and meet your long-term goals.

Permanent Life Insurance Dividends

Whole life insurance policies are either participating or non-participating.

- Non-participating policies are usually offered by publicly-owned insurance companies. Any surplus earnings are distributed to stock shareholders.

- Participating policies are offered by mutual insurance policies, which are owned by the policy owners. Surplus earnings return to the policy owner in the form of dividends.

Because participating policies have the potential to provide future dividends, they generally have higher premiums than non-participating.

How Much Does It Cost?

Permanent life insurance is more expensive than term life insurance. The cost of your permanent life insurance policy will depend on several factors, including:

- The type of permanent policy you get

- The policy’s face amount

- Your individual factors

- Gender

- Age

- Health status

- Lifestyle factors

Below is an example of the cost of different life insurance policies that provide $250,000 in coverage for a 35-year-old man who qualifies for the best risk class (preferred plus).

| Policy | Monthly Quote | Features |

|---|---|---|

| 30-Year Term Policy | $20.82 |

|

| Participating WL Policy | $287.54 |

|

| Non-Participating WL Policy | $179.16 |

|

| GUL Policy | $159.59 |

|

| UL Policy | $268.19 |

|

All sales of variable life insurance policies require the insurance company to be registered as an investment company and all sales agents to be registered with the Securities and Exchange Commission (SEC). Quotacy does not offer variable life insurance products.

See what you’d pay for life insurance

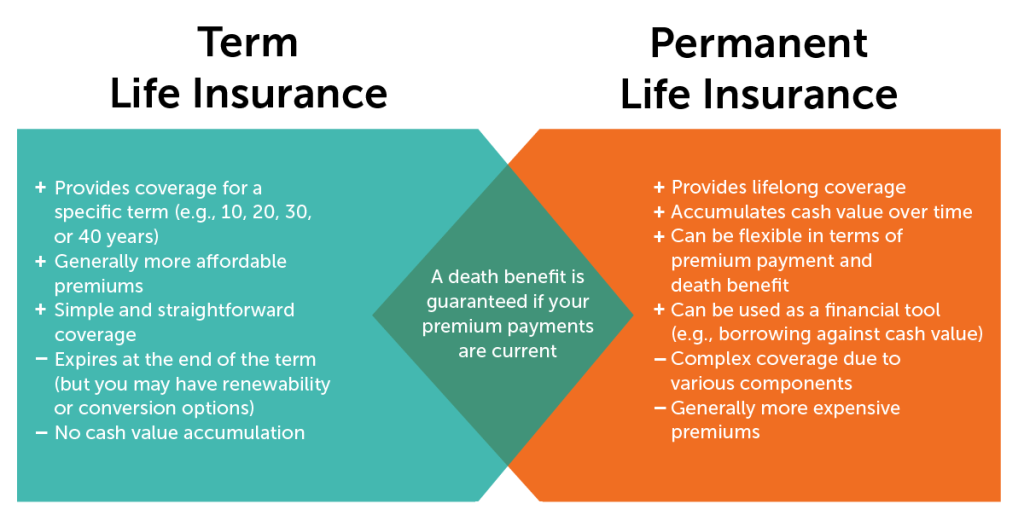

Permanent vs Term Life Insurance

Permanent life insurance offers lifelong coverage and cash value accumulation, but policies can be expensive. Term life insurance provides coverage for a specific term at more affordable rates.

Permanent Life Insurance:

- Provides lifelong coverage

- Accumulates cash value over time

- Generally more expensive premiums

- Flexible in terms of premium payment and death benefit

- Can be used as a financial tool (e.g., borrowing against cash value)

- Complex coverage due to various components

Term Life Insurance:

- Provides coverage for a specific term (e.g., 10, 20, 30, or 40 years)

- No cash value accumulation

- Generally more affordable premiums

- Simple and straightforward coverage

- Expires at the end of the term; may require a new policy or conversion to permanent insurance

Choosing between term and permanent life insurance can be a difficult decision. Learn the differences between term and permanent life insurance.

Permanent Life Insurance Pros and Cons

Creating a pros and cons list helps when making a tough decision. Life insurance is an essential purchase for you and your loved ones, so we understand why it may seem daunting.

Use the following permanent life insurance pros and cons list to help make decisions.

Pros of Permanent Life Insurance:

- Lifelong coverage: Provides protection for your entire life, as long as premiums are paid

- Cash value accumulation: Builds cash value over time, which can be used for various financial needs

- Flexible premiums: Allows adjustments to premium payments in some policy types (e.g., universal life)

- Investment options: Offers different investment choices for cash value growth (e.g., variable life)

- Tax advantages: Grows cash value on a tax-deferred basis and offers tax-free death benefits to beneficiaries

- Financial tool: Can be used for loans, withdrawals, or as collateral for other loans

- Guaranteed death benefit: Ensures a payout to beneficiaries, regardless of when you pass away

Cons of Permanent Life Insurance:

- Higher premiums: Generally more expensive than term life insurance due to lifelong coverage and cash value component

- Complexity: Various policy types, investment options, and fees make it more challenging to understand

- Fees and charges: Management fees, surrender charges, and other expenses can reduce the policy’s overall value

- Investment risks: Some policies (e.g., variable life) expose the cash value to market risks, which can result in losses

- Long-term commitment: Requires a long-term financial commitment, as surrendering the policy early can lead to substantial fees

- Not always necessary: Some individuals may not need lifelong coverage and could be better served by more affordable term life insurance

Do I Need Permanent Life Insurance?

Speaking with a life insurance broker or agent is always a good idea if you’re unsure what type of life insurance you need. Contact Quotacy and get unbiased advice. As an independent broker, we work for you, not the insurance company.

However, we also understand if you prefer to figure it out independently. Whether you need permanent life insurance depends on your financial situation, goals, and needs.

Consider these factors when deciding if permanent life insurance is right for you:

- Lifelong coverage: If you want to ensure your loved ones are protected financially for your entire life, permanent life insurance may be a suitable option.

- Estate planning: Permanent life insurance can play a role in estate planning by providing liquidity to cover estate taxes or ensuring the equal distribution of assets among heirs.

- Wealth accumulation: The cash value component of permanent life insurance can be a tax-advantaged investment vehicle, potentially growing your wealth over time.

- Business planning: Business owners can use permanent life insurance to fund buy-sell agreements, protect against losing a key employee, or provide employee benefits.

- Affordability: Consider whether you can afford the higher premiums of permanent life insurance compared to term life insurance. It is crucial to ensure that you can maintain payments throughout your life.

- Insurance needs: Evaluate whether your needs will change over time. For example, if you only need coverage for a specific period (e.g., while your children are young), term life insurance may be more appropriate.

- Financial goals: Assess your financial goals, retirement plans, and existing investment strategies to determine if permanent life insurance aligns with your overall financial plan.

Permanent Life Insurance FAQs

Permanent life insurance can be confusing. Here are some answers to additional questions about buying life insurance that you may have.

Is Permanent Life Insurance the Same as Whole Life?

Whole life is one policy option that belongs to a larger category of life insurance products called permanent life insurance.

The broader category includes all policies that provide lifelong coverage. Whole life insurance is a specific type of permanent life insurance with a fixed premium, a guaranteed death benefit, and a cash value component growing at a guaranteed rate.

Why Is Permanent Life Insurance a Bad Choice for Some People?

The most significant challenges posted by permanent life insurance policies include:

- Cost

- Difficult to manage

- Features are complex

Occasionally, people will buy a permanent life insurance policy under the advice of an agent who doesn’t thoroughly explain the policy owner’s responsibilities. Some individuals may have been better off buying term life insurance and investing the premium savings in other investment options.

Is Permanent Life Insurance a Good Investment?

Life insurance primarily serves as income protection for your beneficiaries. You should not use it as your primary means of investing.

If you max out traditional retirement plans, such as 401(k), Roth, and traditional IRAs, and have extra disposable income you want to invest, looking into a permanent life insurance policy may be a good option.

Learn more about your life insurance options and what you should consider before purchasing in our wise buyer’s guide.

Request a Permanent Life Insurance Quote Today

Getting a permanent life insurance quote isn’t as simple as getting term life insurance quotes.

Complete this short form, and a Quotacy agent will reach out to review your life insurance needs and provide personalized permanent life insurance quotes.

It’s essential to carefully assess your financial situation, insurance needs, and long-term goals before deciding on a life insurance policy. We can help.

Note: Life insurance quotes used in this article are accurate as of May 17, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments