A life insurance beneficiary is the person or entity designated to receive the proceeds of a life insurance policy upon the insured’s death.

Choosing the right beneficiary secures your loved ones’ financial safety and well-being after your passing. Understanding the rules and options helps keep your death benefit out of probate and ensures your beneficiaries get their full payout.

In this guide, we’ll explain everything you need to know about life insurance beneficiaries, including how they work and why staying informed on this topic is essential for both policyholders and potential beneficiaries.

- What Is a Life Insurance Beneficiary?

- How Does Being a Beneficiary Work?

- How to Designate a Beneficiary on Your Policy

- Why & When to Review Your Beneficiary

Are you a life insurance beneficiary? Learn about filing a life insurance claim.

What Is a Life Insurance Beneficiary?

A life insurance beneficiary is a person (or entity like a charity or business) who will receive the life insurance payout, called the death benefit, when you die.

- If you have a term life insurance policy, your beneficiary will receive the face amount of the policy if you die during the term.

- If you have permanent life insurance, your beneficiary will receive the face amount minus withdrawals or outstanding loan balances, if any, no matter when you die.

Who Can Be a Beneficiary?

Theoretically, you can name anyone you wish as a beneficiary. But when you first apply for the policy and designate a beneficiary, the insurance company will likely ask what your relationship is to that person or entity. The reason behind this question is to establish an insurable interest.

The insurance company wants to see that your beneficiary has a legitimate reason for your continued well-being. The insurance company doesn’t want you worth more dead than alive.

| Note: For life insurance policies, insurable interest only needs to exist when you buy the policy, not when the death benefit is paid. |

Common examples of who can be a life insurance beneficiary:

- Family members: Spouses/partners, adult children, parents, and siblings are common choices for life insurance beneficiaries.

- Trusts: One common estate planning tactic is to name a trust as your life insurance beneficiary. This protects assets from probate and ensures dependents are taken care of.

- Charities: Naming a charitable organization as a beneficiary is a great way to leave a lasting impact.

- Business partners: If you co-own a business and have life insurance on your partners, it’s typical in this scenario to name each other as beneficiaries. If tragedy strikes, you can rest easy knowing that business and financial obligations are covered.

There are some situations in which specific loved ones should not be named beneficiaries.

Minor Children

Minor children, usually those under 18, are legally unable to manage their own financial affairs. As a result, they cannot directly control the proceeds from a life insurance policy.

If you name your minor child as a beneficiary and they are still a minor when you die, the court may need to appoint a guardian to manage the funds on the child’s behalf. This process can be time-consuming and expensive, and the appointed guardian may be ill-suited for money management.

Dependents With Special Needs

Many individuals with special needs or disabilities receive government benefits, such as Supplemental Security Income (SSI) or Medicaid. These benefits often have income and asset limits. If you list them as beneficiaries on your policy, the policy is considered an asset and could push them beyond eligibility thresholds.

Ensure dependent loved ones will be cared for after you’re gone, even if they need long-term care.

How Does Being a Beneficiary Work?

There are three parties involved in a life insurance policy:

- Policy owner: Individual or entity who owns and controls the policy. They’re responsible for paying premiums and oversight — including beneficiary management.

- Insured: The policy covers this person’s life. Their health and lifestyle factors determine policy rates. If the insured passes away while the policy is active, the beneficiary receives the death benefit. They have no control over beneficiaries.

- Beneficiary: Person or entity the policy owner designates to receive the policy’s death benefit. Legally, they’re the only ones who can claim death benefits.

The policy owner and insured can be the same person. The policy owner and beneficiary can be the same person. The insured and beneficiary cannot be the same person.

How Many Beneficiaries Can You Have?

There aren’t many life insurance beneficiary rules. You can have as many beneficiaries as you’d like, but the proceed percentages must add up to 100%.

Example:

$500,000 Life Insurance Policy Beneficiaries:

- Spouse 50% ($250,000)

- Mother 20% ($100,000)

- Brother 15% ($75,000)

- Charity 15% ($75,000)

Does your life insurance plan call for more than one beneficiary? Naming multiple beneficiaries is a common practice you may want to consider.

Primary Beneficiary vs Contingent: How Are They Different?

Although not required, it’s always a good idea to name contingent beneficiaries in addition to primary beneficiaries.

What Is a Primary Beneficiary?

Primary beneficiaries are the people or entities first in line to receive the death benefit payout when the insured dies. You, as policy owner, can designate multiple primary beneficiaries.

What Is a Contingent Beneficiary?

Contingent beneficiaries, also known as secondary beneficiaries, are the people or entities who receive death benefit proceeds if the primary beneficiaries are unable or unwilling. You can name multiple contingent beneficiaries.

The reason it’s important to name contingent beneficiaries is to keep your life insurance policy out of your estate.

For example, let’s say you purchased life insurance on yourself and named your spouse the sole primary beneficiary.

If you and your spouse die in a car accident with no contingent beneficiary, the death benefit proceeds go to your estate.

What happens when proceeds go to your estate?

- Probate process: When life insurance proceeds go to your estate, they become part of the probate process. Probate can be time-consuming, expensive, and public. It may also incur legal fees that reduce beneficiaries’ benefits.

- Estate taxes: If you owe estate taxes and proceeds go to your estate, your beneficiaries get whatever is leftover. Death benefits left directly to beneficiaries are usually tax-free.

- Creditor claims: Creditors can access your estate to satisfy outstanding debts. Death benefits left directly to beneficiaries are usually protected.

- Lack of control: Distribution of funds is subject to your will. If you don’t have one, the state’s intestate succession laws manage the distribution for you, which may not align with your wishes.

- Potential family disputes: There’s an increased likelihood of dispute. Naming individual beneficiaries helps to avoid conflict by clearly defining who receives the death benefit.

Do Insurance Carriers Track Down Beneficiaries After the Insured Has Passed?

No, life insurance carriers typically do not track down beneficiaries. Insurers don’t automatically know when one of their customers has died.

Responsibility to notify the company of the insured’s death and begin the claims process falls on their beneficiary, estate executor, or family.

Some states recently implemented regulations requiring insurance companies to actively search for deceased policyholders. This ensures beneficiaries receive benefits that policy owners intended.

Ultimately, it’s the policy owner’s responsibility to inform beneficiaries of their role and responsibilities.

If a loved one recently passed and you’re unsure if they had coverage, take these steps to find out if they had life insurance.

See what you’d pay for life insurance

How to Designate a Beneficiary on Your Life Insurance Policy

For basic beneficiary designations, you’ll need the following information about them:

- Full legal name

- Birth date

- Relationship to you

- Tax ID number or SSN (not all carriers will ask for this)

If you only list one primary beneficiary, they’ll automatically receive 100% of the proceeds. If you list more than one, you must assign percentages to each (totaling 100%).

Designating for Multiple Beneficiaries with Survivorship

If you have multiple primary beneficiaries, we advise that you outline how to handle death proceeds if a primary beneficiary dies before or at the same time as you.

You have two distribution options:

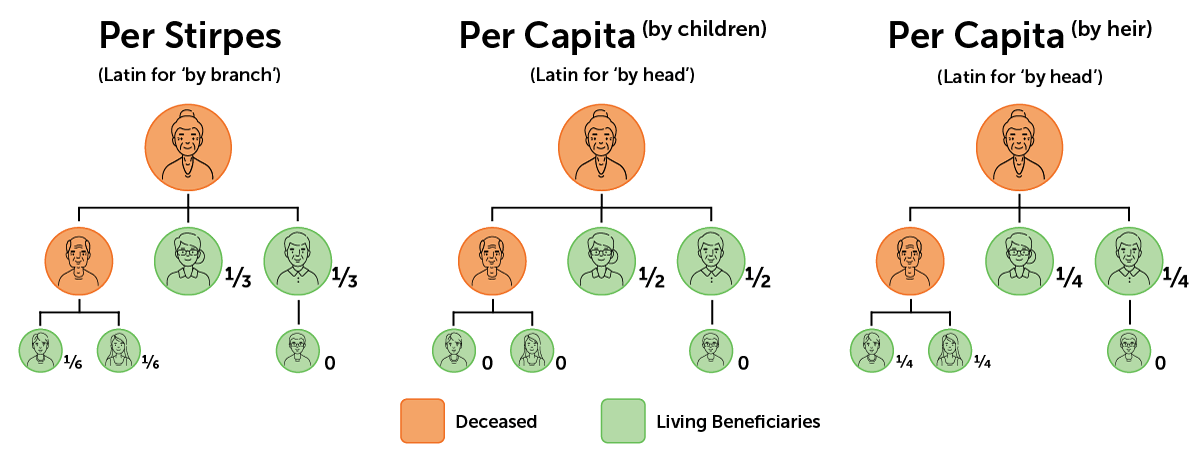

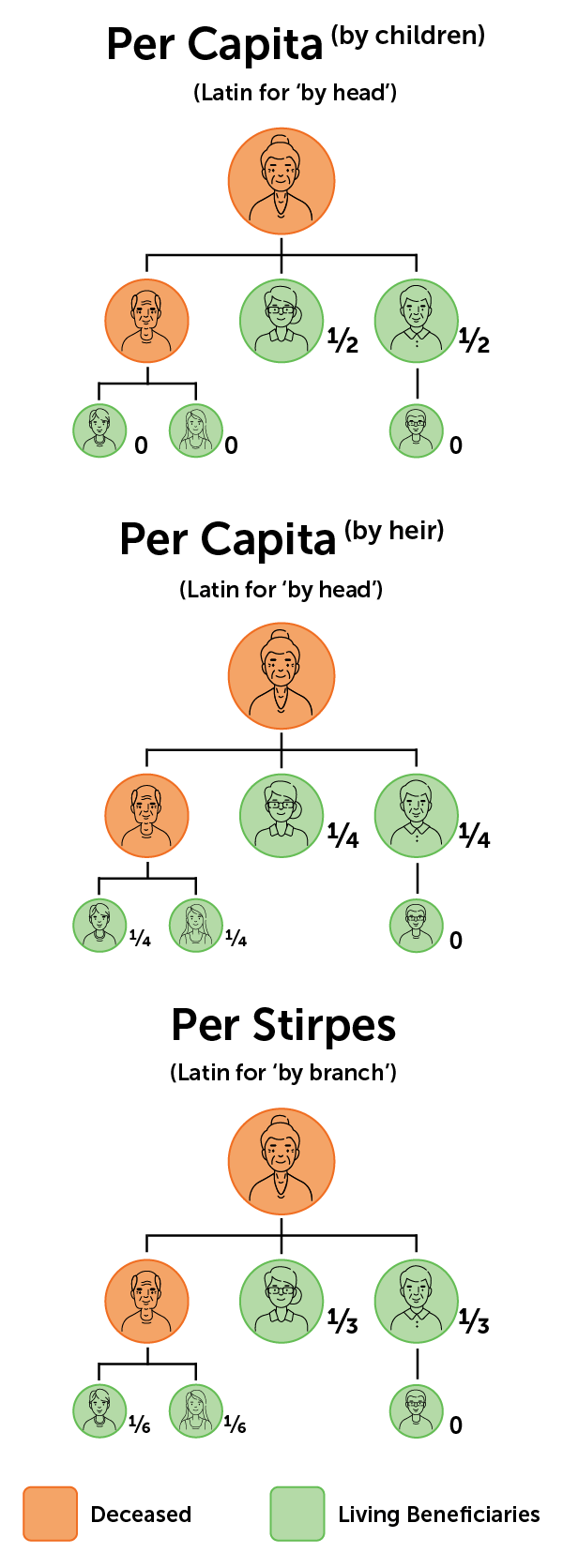

- Per stirpes: If a primary beneficiary dies, their share is passed onto their descendants.

- Per capita: If a primary beneficiary dies, their share is equally divided among the surviving beneficiaries.

However, using a trust may be a more efficient way to distribute life insurance proceeds if you have complex beneficiary needs, especially if beneficiaries are minor children.

Why & When to Review Your Beneficiaries

Life can change in ways that impact your policy. It’s smart to review your beneficiaries on an annual basis.

Review your beneficiaries if these life events occur:

- Engagement: Update your policy to include your fiancé as a beneficiary, even before marriage.

- Marriage: Update beneficiaries if you want your spouse to receive benefits.

- Divorce: Remove your ex-spouse to avoid them receiving the death benefit.

- Child reaches legal age: Update beneficiaries to include children once they reach the age of majority.

- New grandchild: You may wish to change distribution if some of your children have children.

- Will creation: Ensure life insurance designations align with your will.

- Trust creation: Name a trust as a beneficiary for minors, special needs, or those with financial issues.

- Moving to a new state: Review property laws to ensure your life insurance remains unaffected.

- Taking out a loan: Update beneficiaries to cover co-signed loans, protecting the co-signer from debt.

- Loss of spouse: Update policy after the loss of a spouse. This is also a reminder to name contingent beneficiaries.

- Involvement with a charity: Name a charity as a beneficiary to support their cause.

Aside from beneficiary review in the cases listed above, use our estate planning checklist to ensure your wishes are fulfilled and avoid potential legal or financial issues.

Who Can Change a Policy’s Beneficiary?

Only the policy owner can change a life insurance policy’s beneficiary. As the owner, you can update your beneficiaries anytime unless there are legal restrictions, such as:

- During a divorce, the court may restrict your access to finances, including life insurance policies, until it’s settled

- You cannot change an irrevocable beneficiary without their direct consent.

Some exceptional cases exist in which someone other than the policy owner can make beneficiary changes.

- If power of attorney (POA) states explicitly that the POA agent can make life insurance changes, they may do so on behalf of the policy owner.

- A court may order the policy owner to change the beneficiary. This can occur with divorce or child support obligations.

- If the policy owner appointed a guardian or conservator, this court-appointed person may have the authority to change the beneficiary.

Learn more about when to review your life insurance policy, including beneficiaries, and what to look for.

Visit Quotacy’s Blog for More Resources and Advice From Experts

Your life insurance policy means a lot to you and your beneficiaries. Be sure to carefully consider your beneficiaries and review your policy regularly.

Explore our blog to learn everything you need to know about life insurance. Still don’t have a life insurance policy? We can help.

Get anonymous term life insurance quotes instantly. When you’re ready to apply, the online application only takes a few minutes. Protect those you love most with life insurance.

0 Comments