Life insurance companies have a team of underwriters that evaluate applications to determine how much of a risk it would be to insure a particular individual. The underwriters use actuarial tables and guidelines to make these assessments. They then assign each applicant a risk class.

On average, about two-thirds of the individuals that apply for life insurance on Quotacy are issued as applied. What this means is that two-thirds of the time, our quoting tool is able to accurately predict what risk class and premium amount the life insurance carrier will end up offering you.

The other one-third accounts for those rare cases in which an individual has health and lifestyle traits that our quoting software couldn’t account for. Hopefully this blog post will help provide some insight into how underwriting certain health and lifestyle traits works.

Table of Contents

There are many factors that go into determining the cost of a life insurance policy. Medical conditions can play a big role. The type of medical issue you have, it’s severity, and treatment all will be evaluated by the life insurance company.

Thankfully, not all life insurance companies evaluate factors in the same way. Quotacy works with many different life insurance companies and will help you find the best life policy for your needs and budget.

The table below lists the basic risk classifications, starting with the best. If an individual carries certain health or lifestyle factors that do not allow them to fall into one of the typical risk classes, they will be table rated to make up for the extra risk the carrier is taking on for insuring them.

If an applicant is a tobacco user, depending on the product and how often they use, they may assign a tobacco risk class (Preferred Tobacco or Standard Tobacco) and these come with surcharge.

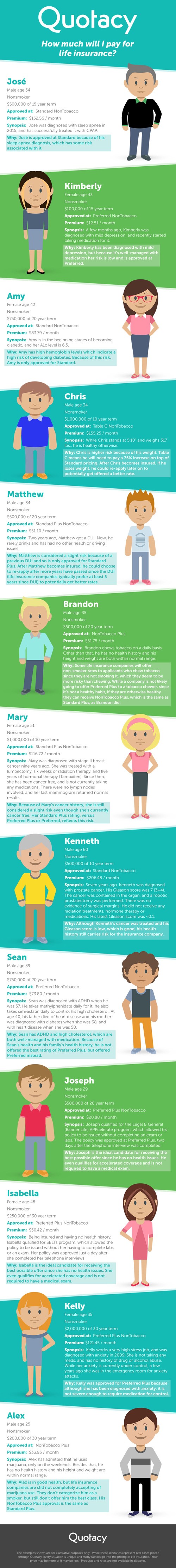

To help you have a better understanding on how medical conditions and lifestyle choices can affect what risk class a carrier assigns you to and how much you will pay for life insurance coverage, we have gathered some real-life examples. While the following examples are actual past client cases, names have been changed and these results are not conclusive of every situation.

No two applicants are the same and there are many factors that go in to life insurance underwriting. These are for illustrative purposes only.

See what you’d pay for life insurance

Case Study #1 – Sleep Apnea

José is a 54-year-old male and applies for a 15-year policy with $500,000 in coverage. He was diagnosed with sleep apnea one year ago and successfully treats it with a CPAP machine.

The life insurance carrier approved José at Standard Non-Tobacco with a monthly premium of $144.32.

The reason José was approved at Standard is because his sleep apnea carries a risk, even with it being well-controlled.

Case Study #2 – Depression

Kimberly is a 43-year-old female and applies for a 15-year policy with $100,000 in coverage. She was diagnosed with mild depression a few months ago and recently started taking medication to manage it.

The life insurance carrier approved Kimberly at Preferred Non-Tobacco with a monthly premium of $11.46.

The reason Kimberly was approved at Preferred is because her case is mild and well-managed with medication, so her risk is low.

Case Study #3 – High Hemoglobin Levels

Amy is a 42-year-old female and applied for a 20-year policy with $750,000 in coverage. Her medical exams results revealed that her A1c level is 6.5% while the normal range for the hemoglobin A1c test is between 4% and 5.6%

The life insurance carrier approves Amy at Standard Non-Tobacco with a monthly premium of $70.61.

The reason Amy is approved at Standard is because of her high hemoglobin levels. This indicates a high risk of developing diabetes.

Case Study #4 – Build

Chris is a 34-year-old male and applied for a 10-year policy with $1,000,000 in coverage. Chris is 5’10” and weighs 317 pounds – he is otherwise healthy.

The life insurance carrier approved Chris at Table C Non-Tobacco with a monthly premium of $77.33.

The reason Chris was approved at Table C is because his build puts him at a higher risk. Table C means he will need to pay a 75% increase on top of the Standard pricing. After Chris becomes insured, if he loses weight, he could re-apply later on to potentially get offered a better rate.

» Learn more: Height and Weight & Your Life Insurance Application

Case Study #5 – Driving Record

Matthew is a 34-year-old male and applied for a 20-year policy with $500,000 in coverage. Two years ago, Matthew got a DUI. Now he rarely drinks and has had no other health or driving issues.

The life insurance carrier approved Matthew at Standard Plus Non-Tobacco with a monthly premium of $33.15.

The reason Matthew was approved at Standard Plus is because he is considered a slight risk because of his DUI history. After Matthew becomes insured, he could choose to re-apply after more years have passed since the DUI. Life insurance companies typically prefer at least five years to have passed to consider preferred rates.

Case Study #6 – Chewing Tobacco

Brandon is a 35-year-old male and applied for a 20-year policy with $500,000 in coverage. Brandon chews tobacco on a daily basis. Other than that, he has no poor health history and his height and weight is within normal range.

The life insurance carrier approved Brandon at Standard Plus Non-Tobacco with a monthly premium of $34.00.

The reason Brandon was approved at Standard Plus is because chewing tobacco is not a healthy habit; however, some life insurance companies would have offered tobacco rates to Brandon because of this, which would have made his premiums higher. This life insurance carrier views chewing tobacco as an unhealthy habit, but does not deem it as risky as smoking cigarettes.

» Learn more: Life Insurance for Tobacco, Nicotine, and Marijuana Users

Case Study #7 – Breast Cancer

Mary is a 51-year-old female and applied for a 10-year policy with $1,000,000 in coverage. Mary was diagnosed with stage II breast cancer nine years ago. She was treated with a lumpectomy, six weeks of radiation therapy, and five years of hormonal therapy. Since then she has been cancer free and is not currently taking any medications. There were no lymph nodes involved and her last mammogram returned normal results.

The life insurance carrier approved Mary at Standard Plus Non-Tobacco with a monthly premium of $106.19.

The reason Mary was approved at Standard Plus is because of her cancer history. Although in remission, she is considered a slight risk.

Case Study #8 – Prostate Cancer

Kenneth is a 60-year-old male and applied for a 10-year policy with $500,000 in coverage. Kenneth was diagnosed with prostate cancer seven years ago. His Gleason score was 7 (3+4). The cancer was contained in the organ and a robotic prostatectomy was performed. The surgical margins were clean. He did not receive any radiation treatments, hormone therapy, or medications. His latest Gleason score was <0.1.

The life insurance carrier approved Kenneth at Standard Non-Tobacco with a monthly premium of $191.35.

The reason Kenneth was approved at Standard is because of his health history. His Gleason score, although low now, reflected aggressive cancer growth and this history carries a risk for the carrier.

Case Study #9 – Health and Family History

Sean is a 39-year-old male and applied for a 20-year policy with $750,000 in coverage. Sean was diagnosed with ADHD when he was 37 and takes medication for it daily. He takes a second medication to control his high cholesterol. His father died at age 40 of heart disease and his mother was diagnosed with diabetes when she was 38 and heart disease when she was 50.

The life insurance carrier approved Sean at Preferred Non-Tobacco with a monthly premium of $45.60.

The reason Sean was approved at Preferred is because of the combination of his own health history and that of his family. While his current conditions are well-managed, there is risk of him developing additional health issues.

Case Study #10 – Healthy Male

Joseph is a 29-year-old male and applied for a 20-year policy with $500,000 in coverage. Joseph is healthy with no history of medical issues.

Joseph qualified for Symetra’s SwiftTerm program. They approved his application at Preferred Plus two days after his phone interview and did not require a medical exam. His monthly premium payments are $18.70.

» Learn more: What Is No Medical Exam Life Insurance? Accelerated Underwriting?

Case Study #11 – Healthy Female

Isabella is a 48-year-old female and applied for a 30-year policy with $250,000 in coverage. Isabella is healthy with no history of medical issues.

Isabella qualified for SBLI’s accelerated program. They approved her application at Preferred Plus one day after her phone interview and did not require a medical exam. Her monthly premium payments are $43.72.

Case Study #12 – Anxiety

Kelly is a 35-year-old female and applied for a 30-year policy with $2,000,000 in coverage. Kelly has a high-stress job and was diagnosed with anxiety six years ago. She is not taking any medication nor does she have a history of drug or alcohol abuse. A few years ago she was in the emergency room for anxiety attacks. Her anxiety is currently under control.

The life insurance carrier approved Kelly at Preferred Plus with a monthly premium of $94.03.

The reason Kelly was approved at Preferred Plus is because although she has been diagnosed with anxiety, it is not severe enough to require medication for control.

Case Study #13 – Marijuana

Alex is a 25-year-old male and applied for a 30-year policy with $200,000 in coverage. Alex uses marijuana on weekends. He has no negative health history and is of healthy build.

The life insurance carrier approved Alex at Standard Plus with a monthly premium of $23.29.

The reason Alex was approved at Standard Plus is because life insurance companies are still wary of recreational marijuana use. Some life insurance companies would have given Alex a tobacco rate, which would have made his premiums more expensive.

» Calculate: Life insurance needs calculator

Diagnosed with a medical issue not featured in one of these examples? You can still apply. Quotacy will shop your case and work hard to get you coverage. Get a free, instant term life insurance quote today.

Note: Life insurance quotes used in this article are accurate as of September 20, 2022. These are only estimates and your life insurance costs may be higher or lower.

0 Comments