What is accelerated underwriting? Before we get into what accelerated underwriting is, let’s first quickly go over what underwriting, in general, is.

Underwriting is the process in which the life insurance company evaluates an applicant and determines how risky they would be to take on as a client. The applicant’s overall mortality risk is the primary focus. Essentially, what’s the probability this person is dying sooner rather than later?

Life insurance underwriters gather data on the applicant, evaluate it, and then classify them within a certain risk group which will decide the applicant’s premiums.

Until recent years, traditional underwriting was the process all insurers used. This requires collection of extensive medical information on a client, including a medical exam (height and weight measurements, blood pressure and pulse readings, and blood and urine samples). From the time a client submits an application to underwriting to final approval, the traditional process can take up to a few months.

Due to advancing technology and data analytics, many insurance companies are turning to accelerated underwriting.

What is accelerated underwriting?

With the accelerated underwriting process, insurers lean heavily on third-party consumer data including credit reports, motor vehicle reports, the prescription drug database, criminal records, and the Medical Information Bureau. Then predictive analytics tools are used to help the insurance company classify the applicant’s risk.

Accelerated underwriting is used by many insurance companies up to 50% of the time. For applicants with multiple health concerns or severe conditions, the traditional underwriting process will be required.

Is accelerated underwriting good for the applicant?

Accelerated underwriting is a great process for applicants in average or excellent health and with good financial history. An application going through accelerated underwriting instead of traditional can speed up how quickly that applicant is approved and insured. Sometimes the approval is instant. An applicant also gets to skip the medical exam.

See what you’d pay for life insurance

How does accelerated underwriting work?

There are different paths of accelerated underwriting depending on the insurance company applied to.

There are instant coverage paths, automated underwriting paths, and simplified underwriting paths.

Instant Coverage Underwriting

For companies that offer instant coverage, you will know immediately after you apply if you’re accepted and your coverage begins as soon as you submit your first payment.

You need to meet strict criteria in order to be accepted. If you are not accepted, there’s a good chance you can still qualify for life insurance via a company that uses a different underwriting process.

Automated Underwriting

Many insurance companies offer both automated and traditional underwriting in order to accommodate as many applicants as possible.

With automated underwriting, insurance companies use the information you provide on your application to run a health “background check” on you. Through data analysis and predictive analytics, if you’re deemed low risk, you aren’t required to get a medical exam. You’re then approved and insured much faster compared to traditional underwriting.

You won’t know if you qualify for the automated underwriting path until after you apply. If you end up not being accepted for automated underwriting, your application will automatically go through traditional underwriting.

Simplified Underwriting

Simplified underwriting has fewer eligibility criteria requirements. The application is very short and only asks a few health questions. Typically, only serious medical conditions can disqualify you, such as diabetes, heart disease, stroke, cancer, alcohol or drug abuse, mental illness, and HIV.

Simplified issue life insurance has coverage limitations. The coverage length and amount options are often less than what you could get through traditional or accelerated underwriting. For example, traditional underwriting coverage maximums are in the tens of millions. Accelerated underwriting often maxes out at $3,000,000. Simplified underwriting’s maximum is $500,000, and, more commonly, capped at $100,000 to $250,000.

Because companies require less information from applicants, it’s more difficult for them to classify their risk. People who apply for simplified underwriting are, therefore, assumed to have some minor health impairments, so premiums will be higher.

If you’re in good health, avoid simplified underwriting products to get the best coverage for your dollar.

Applying for Life Insurance

Quotacy works with many different life insurance companies.

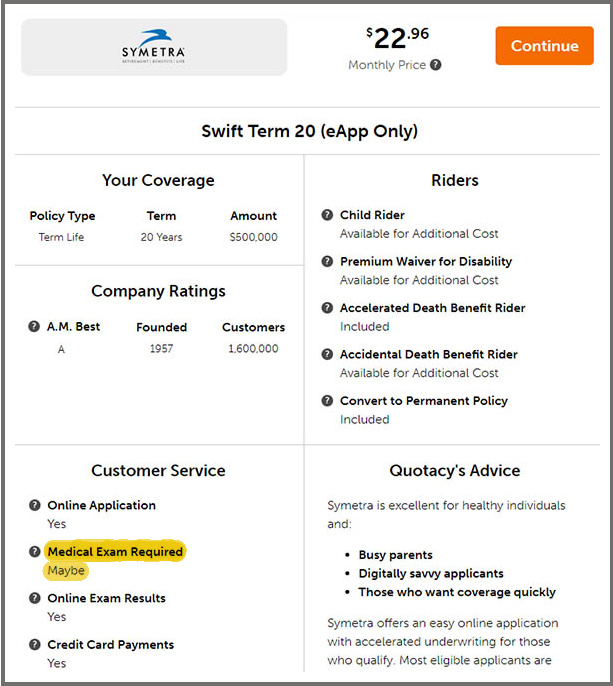

Most of the insurance companies we work with have an accelerated underwriting process. To check if the insurance company you want to choose offers this, hit the “Ratings & Info” tab. If it states “Maybe” under Medical Exam Required, this means this company has an accelerated underwriting process and you may be eligible to skip the medical exam.

After you apply and the insurance company evaluates your application, your Quotacy agent will let you know if you qualify for the accelerated underwriting process. If not, your application will go through the traditional underwriting process and you will need to get a medical exam. The medical exam is completely free and the examiner comes to your home or office, wherever is more convenient for you.

You don’t need to worry about figuring out your next steps or when to take them. Your Quotacy agent will keep you updated as your application moves through the life insurance buying process.

Ready to start?

The first step is to get a quote. And you can do it yourself!

We do not require contact information just to see price estimates. Enter basic information about yourself, such as your zip code, birthdate, height and weight, and smoking status to see term life insurance quotes instantly.

We don’t need your contact information until you decide to apply. After that, we will never sell it. Only Quotacy, the insurance company, and third-party medical examiner will have your contact information.

Start the process. Get a term life insurance quote now.

Have questions? Unsure what type of life insurance to buy, or not sure how much? Contact us directly or pop on over to our Life Insurance Buyers Guide.

Note: Life insurance quotes used in this article accurate as of October 28, 2021. These are only estimates and your life insurance costs may be higher or lower.

0 Comments