Pre-Existing Conditions

The life insurance industry views sleep apnea as a risk and your costs may be affected by it, but Quotacy agents are experts at working with clients diagnosed with sleep apnea. Here’s what you need to know.

Pre-Existing Conditions

In this post we discuss how lupus may affect your life insurance rates and what you can expect when applying.

Pre-Existing Conditions

Even if you chew tobacco, you can still get life insurance and may even be able to get great non-smoker rates.

Pre-Existing Conditions

While pregnancy is not a barrier to purchasing life insurance, it can still limit your options. This article will help clarify how pregnancy can affect buying life insurance.

Pre-Existing Conditions

This Halloween, we don’t want to scare you away with a high price because of your medical issues, so we dug up our new friend, Frankie, to help us explain the insurance costs of a few common issues and diseases.

Pre-Existing Conditions

Whether you are a daily cigar smoker or an occasional one, smoking cigars can have a direct effect on the cost of life insurance.

Pre-Existing Conditions

In this post, we discuss how colorectal cancer may affect your life insurance rates and what you can expect when applying.

Pre-Existing Conditions

In this post, we discuss how ulcerative colitis may affect your life insurance rates and what you can expect when applying.

Pre-Existing Conditions

In this post, we discuss how high blood pressure (hypertension) may affect your life insurance rates and what you can expect when applying.

Pre-Existing Conditions

Whether you use tobacco, nicotine, or marijuana products, chances are you can still get life insurance coverage.

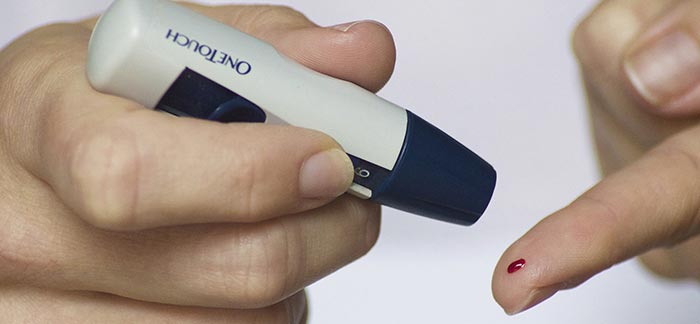

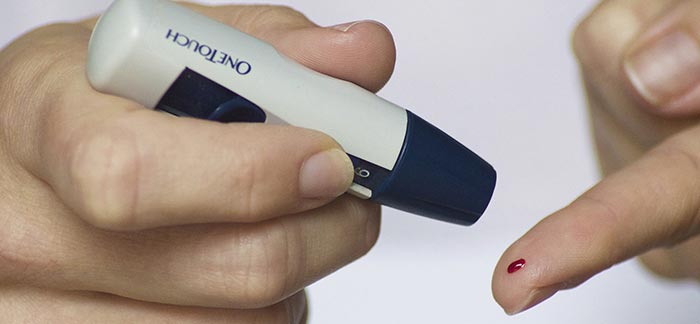

Pre-Existing Conditions

Being diabetic does not mean you can’t be approved for life insurance. In this post, we explain how diabetes can affect your life insurance rates.

Pre-Existing Conditions

ADHD affects individuals quite differently and the condition’s severity varies. Here we talk about how ADHD affects buying life insurance.

Pre-Existing Conditions

A depression diagnosis isn’t an automatic decline for life insurance. Learn how life insurance and depression works.

Pre-Existing Conditions

Having a pre-existing medical condition does not automatically prevent you from buying life insurance. Read on to find out how Quotacy can help you.

Pre-Existing Conditions

You can still get life insurance even if you smoke a pipe, and you may be able to qualify for great non-smoker rates.