While purchasing life insurance can pose additional challenges for individuals with diabetes, it’s not impossible. The likelihood of your approval varies depending on various health and financial factors, how well you manage your health, and whether you have type 1 or type 2 diabetes.

We understand the importance of protecting your family from a financial struggle in the event of an unexpected death. As a life insurance broker, we have long-standing relationships with and in-depth knowledge about the nation’s top carriers.

Table of Contents

- How Do I Get Life Insurance With Diabetes?

- Underwriting Diabetes: Type 1 vs Type 2

- Policy Options for People with Diabetes

- Life Insurance Rates for People With Diabetes

- Tips to Reduce Risk & Boost Approval Odds

Visit our blog for more expert life insurance tips and advice.

How Do I Get Life Insurance With Diabetes?

We want to set realistic expectations upfront. People with diabetes can get life insurance but likely won’t qualify for the cheapest rates.

Getting life insurance quotes online is easy, but the pricing you see is likely too good to be true. Online quoting tools are excellent estimators for people who don’t have chronic medical conditions, but diabetes is evaluated on a case-by-case basis.

For applicants with pre-existing conditions, such as diabetes, working with an independent broker is your best bet at finding coverage.

As a broker, we can access policies from many different life insurance companies. The more options you have, the easier it is to find affordable life insurance coverage. In addition, brokers have a fiduciary duty to you, the client, not the insurance companies.

Underwriting Diabetes: Type 1 vs Type 2

All life insurance companies have their own rules, known as underwriting guidelines, to evaluate applicants to determine the risk of insuring them. The riskier the individual, the higher their rate.

Underwriters evaluate each diabetes case individually, considering factors such as the age at which the disease started, the type of treatment received, how well the condition is managed, and any related complications.

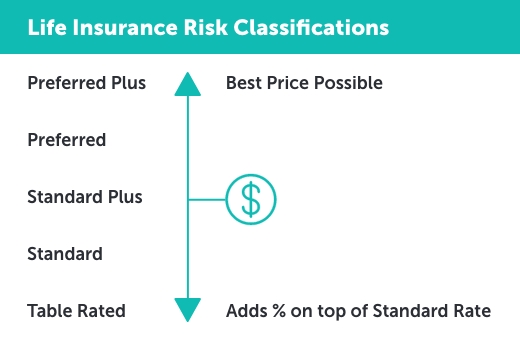

After the underwriter reviews your application, they assign you a risk class. Risk classes determine the final price of your policy (if you’re approved).

The most common risk classifications are:

- Preferred: Above average health and best pricing

- Standard: Average health and reasonable pricing

- Substandard: Below-average health and higher-than-average pricing

Let’s explore how companies underwrite Type 1 and Type 2 diabetes.

Type 1 Diabetes

Type 1 diabetes is an autoimmune condition people consider the more severe type of diabetes. Sometimes called juvenile-onset or insulin-dependent diabetes mellitus (IDDM), Type 1 diabetes has a peak age at the onset of 12 years old. It’s unusual to begin after age 40.

Underwriters focus on the following:

- Age at onset

- Years since diagnosis

- Control of diabetes (primarily based on HbA1c levels)

- Presence of any complications

- Presence of any additional medical conditions

Underwriters often perceive Type 1 diabetes as riskier than Type 2 for the following reasons:

- Onset age: Type 1 often begins in childhood or adolescence, which means prolonged exposure to potential complications from the disease.

- Management: Type 1 requires daily insulin injections or an insulin pump. Any inconsistency or mistakes in management can lead to severe health issues.

- Disease characteristics: Type 1 is an autoimmune disease where the body’s immune system attacks the insulin-producing cells in the pancreas. This means the body cannot produce insulin to regulate blood sugar.

- Risk of complications: Individuals with Type 1 diabetes have a higher risk of developing complications such as heart disease, kidney damage, nerve damage, and eye problems, among others.

- Lifestyle changes: While lifestyle changes can significantly affect the progression and control of Type 2 diabetes, Type 1 is less influenced by such changes and is more dependent on regular insulin administration.

Type 2 Diabetes

Type 2 diabetes, also called adult-onset or noninsulin-dependent diabetes mellitus (NIDDM), occurs when the body does not produce enough insulin or resists it.

Type 2 usually develops after 30, but its incidence is increasing in children and adolescents, especially those who are obese. It’s usually not diagnosed until health complications have occurred.

Underwriters focus on:

- Age at diagnosis and duration of diabetes

- Control of diabetes (primarily based on HbA1c levels)

- Treatment compliance

- Presence of any complications

- Presence of any additional medical conditions, such as neuropathy or hypertension

Underwriters often perceive Type 2 diabetes as less risky than Type 1 for the following reasons:

- Late-onset and lifestyle: Type 2 diabetes often develops later in life. Because lifestyle factors such as obesity, poor diet, and lack of exercise are known to trigger this condition, you can manage or even reverse it with lifestyle changes and medication.

- Management: Type 2 is typically easier to manage because it doesn’t necessarily require insulin. Many control their blood sugar levels with oral medication, diet, and exercise alone.

- Insulin production: In Type 2 diabetes, the body still produces insulin, but it either doesn’t make enough or the body doesn’t use it efficiently. While this isn’t ideal, it’s generally considered less risky than Type 1.

For both Type 1 and Type 2 diabetes, underwriting can be a complex process. The underwriters assign credits and debits to each applicant to determine the overall risk classification.

You can earn debits for:

- Age of onset

- Type of diabetes

- Complications

- Poor management

You can earn credits for effectively managing your condition.

Gestational Diabetes

Gestational diabetes is underwritten differently than Type 1 or 2 because it’s usually temporary. Some women develop gestational diabetes during pregnancy. In many cases, a woman’s blood glucose levels will revert to normal following childbirth. However, insurers do take caution when underwriting because gestational diabetes can increase a woman’s likelihood of developing Type 2 diabetes later on in life.

What to know about life insurance and gestational diabetes:

- Most insurers won’t approve life insurance coverage for a woman who is currently pregnant and diagnosed with gestational diabetes.

- If you’re pregnant with a history of gestational diabetes, most companies will postpone offering coverage until six weeks post-delivery.

- If you’re pregnant and don’t currently have gestational diabetes but have in the past, many companies will postpone coverage.

- If the condition is entirely resolved, it won’t impact your life insurance risk class.

Policy Options for People with Diabetes

The types of policies you qualify for will depend on:

- Your risk factors (financial & criminal histories, age, etc.)

- The company you apply to

- How your condition is managed

If your diabetes is well-managed, you may qualify for traditional life insurance policies, such as term or whole life insurance.

If you’re declined, guaranteed issue life insurance may be an option for you.

Term Life Insurance

Term life insurance is temporary coverage that lasts 10-40 years. Because it’s not permanent coverage, it’s the most affordable option.

Things to know about term life insurance for diabetics:

- Term insurance can be customized to fit into many budgets.

- Term insurance pays a tax-free death benefit if death occurs during the chosen timeframe.

- If your health worsens over time, most term policies allow you to convert your coverage into permanent life insurance.

Whole Life Insurance

Whole life insurance is permanent coverage that accumulates cash value and has the potential to earn dividends. Because of these features, it’s often the most expensive life insurance option.

Things to know about whole life insurance for diabetics:

- Because of increased health risks, people with diabetes will likely pay high premiums for whole life insurance.

- Whole life policies build cash value over time, which can be borrowed against if needed.

- If you purchase participating whole life, your policy may earn dividends which you can take as cash, use to pay premiums, or increase your death benefit and cash value.

- Whole life pays out a tax-free death benefit no matter when you die as long as the policy is active.

Guaranteed Issue Life Insurance

If you don’t qualify for traditional life insurance, such as term, whole, or universal, guaranteed issue life insurance may be an option for you. It’s generally available to people between 50 and 80 without having to answer any health-related questions or undergo a medical examination.

Things to know about guaranteed issue life insurance for people with diabetes:

- Guaranteed issue policies offer guaranteed acceptance, but the premiums are significantly higher due to the increased risk assumed by the insurance companies.

- These policies typically have a two-year waiting period. If you die within this timeframe, the policy will only pay a partial death benefit or refund the premiums you paid instead of the total death benefit.

- The death benefits with guaranteed issue policies are lower than traditional life insurance policies. They’re meant to cover end-of-life expenses rather than replace your income.

Which type of life insurance is best for you? Learn the pros and cons of term and whole life to help you decide.

See what you’d pay for life insurance

Life Insurance Rates for People with Diabetes

The cost of life insurance for individuals with diabetes varies from one provider to the next.

Each company evaluates risk based on its own criteria to determine your rate class, which dictates your costs.

One company might approve you at a Standard rate, while another might only offer a Substandard rating.

At Quotacy, we work with over 25 of the nation’s top-rated life insurance companies and are familiar with their distinct practices. We use our expertise to understand your situation and match you with the company most likely to offer you the best rate.

We like to be transparent, so it’s important to know that most applicants with diabetes will be “table rated.” Insurers use the table rating system to set the premiums for high-risk applicants.

Typical table ratings start at Table A, or Table 1, and run to Table P, or Table 16.

Each table rating is an extra 25% on top of the Standard price. In other words, Table A means the applicant pays 25% on top of the Standard rate. Table B equals 50% plus the standard rate, etc.

Type 1 Costs

The cost of life insurance can vary drastically across insurance companies due to how they underwrite certain risk factors. Working with a broker who can compare prices across different insurers on your behalf is essential.

Real-Life Example: Life Insurance for a Type 1 Diabetic

Jane Doe is 30 years old, a non-smoker, and was diagnosed with Type 1 diabetes when she was four.

- She visits her doctor every six months.

- She monitors her own blood sugar and needs insulin to control it – 70 units.

- Her most recent HbA1c level (glycated hemoglobin) was 7.4.

- She has not experienced chest pain or coronary artery disease, protein in the urine, neuropathy, retinopathy, abnormal ECG, overweight, elevated lipids, kidney disease, blackout spells, or hypertension.

- She does not have any other major health problems.

She applies for a $250,000 20-year policy and tells her agent that she would prefer a term policy but will consider a permanent one.

This table shows responses from a few insurance companies after her agent completed an underwriting study.

- Insurance Company A offers Jane Table H non-tobacco. If the Standard premium cost is $24/month, Jane would pay $72/month (24 + 200%).

- Insurance Company B offers Jane Table 10 non-tobacco. Jane would pay $84/month (24 + 250%).

- Insurance Company C offers Jane Table 8 non-tobacco for a permanent policy. They decline term coverage. Because permanent costs about 10 times more than comparable term coverage, Jane would pay $720/month.

- Insurance Company D decides to decline Jane’s application altogether. They won’t take the risk.

Type 2 Costs

Just like the costs can differ for those with Type 1 diabetes, the same applies to individuals with a history of Type 2 or current diagnosis.

Real-Life Example: Life Insurance for a Type 2 Diabetic

John Doe is 54, male, non-smoker, and was diagnosed with Type 2 diabetes when he was 49.

- He visits his doctor every 6 months, and his diabetes is controlled by daily medication.

- He monitors his own blood sugar, and the most recent reading was 116.

- His most recent HbA1c level was 6.2.

- He has other health issues: elevated lipids (controlled by medication) and a history of kidney stones.

He applies for a $500,000 20-year term policy.

- Insurance Company A offers John Standard to Standard Plus (pending full review of his medical records.) Considering John’s age, his Standard to Standard Plus premiums would fall around $135 – $150 monthly.

- Insurance Company B offers John a standard non-tobacco rating pending proof that he hasn’t had recent health issues.

- Insurance Company C offers John Table 2. His estimated Standard monthly cost would be $150. To account for Table 2, add $150 + 50%. His monthly premium total would be $225.

- Insurance Company D offers John Table C. Again, the Standard monthly cost would be $150. To account for Table 3, add $150 + 75%. His monthly premium would be $263.

Note: In the tables above, we use the term “Tentative Offer” because during these underwriting studies, life insurance companies provide us with an idea of what they can offer our client. The company conducts an overview of the client’s information to give a conditional offer. However, a complete review of the application and all records is still necessary before confirming any premium costs and rating classifications.

If you can prove your condition is well-managed, the chances of approval are much higher.

If you have other health issues besides diabetes, approval will be more challenging.

However, the more information you provide to contextualize your situation, the better.

When you apply for life insurance through Quotacy, your agent is your advocate. Being honest and upfront ensures they match you with the best carrier and policy for your unique situation.

Tips to Reduce Risk & Boost Approval Odds

If you have diabetes, effective management of your condition and overall health directly impacts your risk level, ultimately deciding whether you get coverage.

Here are some tips to consider to improve your approval odds:

- Consistent management: Show that you’re actively controlling your diabetes by strictly following your prescribed medications, frequently checking your blood sugar, and regularly visiting your doctor. Maintaining a healthy diet and a regular exercise regime can also aid in controlling blood sugar levels.

- Control-related health factors: Monitor and manage related health problems such as high cholesterol, hypertension, obesity, and heart disease to lower your risk and increase the chances of approval.

- Avoid smoking: Smoking can makes health issues worse, especially for diabetics. Quitting will significantly improve your approval odds. Plus, tobacco users pay higher premiums than those who don’t, even when diabetes isn’t a factor.

- Work with a broker: Brokers have relationships with multiple carriers and operate as life insurance matchmakers. They find the best company to fit your personal criteria and advocate for you throughout the process and beyond.

- Perform annual reviews: Once you have life insurance, review your policy regularly with your agent. If your condition improves or you make significant lifestyle changes, you may qualify for better rates.

Unsure how much life insurance coverage you need? Try our free life insurance calculator.

Compare Quotes for Life Insurance With Diabetes

Typically, quoting tools require contact information to show results.

At Quotacy, we believe shopping for life insurance should be hassle-free, so we provide estimates without asking for contact information.

Our quoting tool doesn’t account for all health-related details, like blood glucose levels; it’s a cost estimate. But it does factor in height, weight, tobacco use, blood pressure, cholesterol levels, and family health history.

If you have diabetes, the final cost may be more than what’s shown by the tool. As a broker, it’s our duty to find you the best rate possible.

After getting a quote, completing the online application only takes a few minutes. After it’s submitted, you’re assigned a dedicated agent. Be upfront and honest with your agent regarding all health and lifestyle factors. They don’t work on commission, which means their only goal is to find you affordable coverage to help you protect your family.

At Quotacy, we have a long history of helping clients, including those with diabetes, obtain life insurance. We closely work with in-house underwriters who are experts in examining each individual’s health history and determining the most suitable life insurance company for your unique situation.

If you are ready to buy life insurance coverage, get a term life insurance quote now, and start the process.

Note: Life insurance quotes used in this article are accurate as of June 28, 2023. These are only estimates and your life insurance costs may be higher or lower.

Diabetes is more of an inconvenience than anything. It’s annoying and I wish it would go away but the type I have (type 1) is permanent and cannot be treated by diet and exercise. Even though it’s an inconvenience it doesn’t really stop me from doing anything I just have to check my blood sugar and press a few buttons on my pump and I’m on my way but still I really wish I could sit down with a tub of icing and eat it all in one sitting or dance for three hours straight without stopping to check my blood sugar.

If you suffer from Diabetes insurers will want to know exactly how you control your condition, and you will probably be asked to undergo a medical before you will be offered cover. You will also need to provide comprehensive details of any treatment through your GP or specialist consultant.

Although insurers will be prepared to offer cover to diabetics, not all of them will, as some consider the risks of a claim to be too great.

However, your chances of being accepted for cover will be higher if there is plenty of evidence that your condition is being well managed.

This will usually involve sending insurers your medical reports and they may even request blood sugar readings. If they aren’t happy that you’ve sent enough evidence, they may reject your application for life insurance.

Once you’ve had an application refused, you’re likely to find it much harder to get a policy elsewhere, as you will have to declare you’ve already been turned down for cover, so make sure you choose which insurer you’re going to apply to very carefully.