Thinking of people as a whole, some are healthier than others. Within each age group, the probability of death is greater for some than others.

Long story short, your risk of dying is not based on age alone. It’s based on the larger context of your lifestyle and habits.

Life insurance companies base coverage costs on individual risk factors. How exactly do these risk factors affect life insurance premiums? The more that apply to your lifestyle, the higher your cost will be.

It doesn’t make sense to allow someone with a greater probability of death to pay the same as someone who likely won’t die for another handful of decades.

Factors Affecting Risk

In order for an insurance company to determine what risk class an applicant is, they rely on evaluating factors that may impact an applicant’s longevity.

These risk factors include:

- Age

- Build

- Physical condition

- Tobacco use

- Personal history

- Family history

- Occupation

- Residence

- Sex

- Aviation activities

- Avocations (hobbies)

The cost of life insurance is determined by your level of risk, based on actuarial guidelines. Life insurance actuaries calculate how different risk factors affect a person’s mortality. The riskier you are to insure, the higher your life insurance premiums will be.

Your age, gender, medical history, occupation, and even your hobbies can carry a certain level of risk. When you apply for life insurance, these factors are evaluated and your risk class is determined. Not every life insurance company evaluates particular risk factors in the same way. Some are more lenient than others, depending on the company’s history with a particular risk.

When you apply for life insurance through Quotacy, your agent will review your application to make sure you’re matched with the best insurance company for your situation.

Age

Your age is the primary determinant in evaluating the likelihood of death and impacts your life insurance process:

- Upon application, you’re categorized into an appropriate age group, and your other risk factors are assessed in comparison to the average risks in your age bracket.

Life insurance companies have set age limits for coverage eligibility:

- These age limits vary from company to company, with the maximum age ranging from as low as 60 to as high as 80.

- If your age exceeds the company’s maximum limit, they will consider you uninsurable.

- Similarly, if you’re below the minimum age, typically 18 or 20, you will need to wait until you reach the eligible age.

Life insurance needs change depending on your age, which impacts your potential rates. Learn when to buy life insurance to get your best rate and coverage.

Build

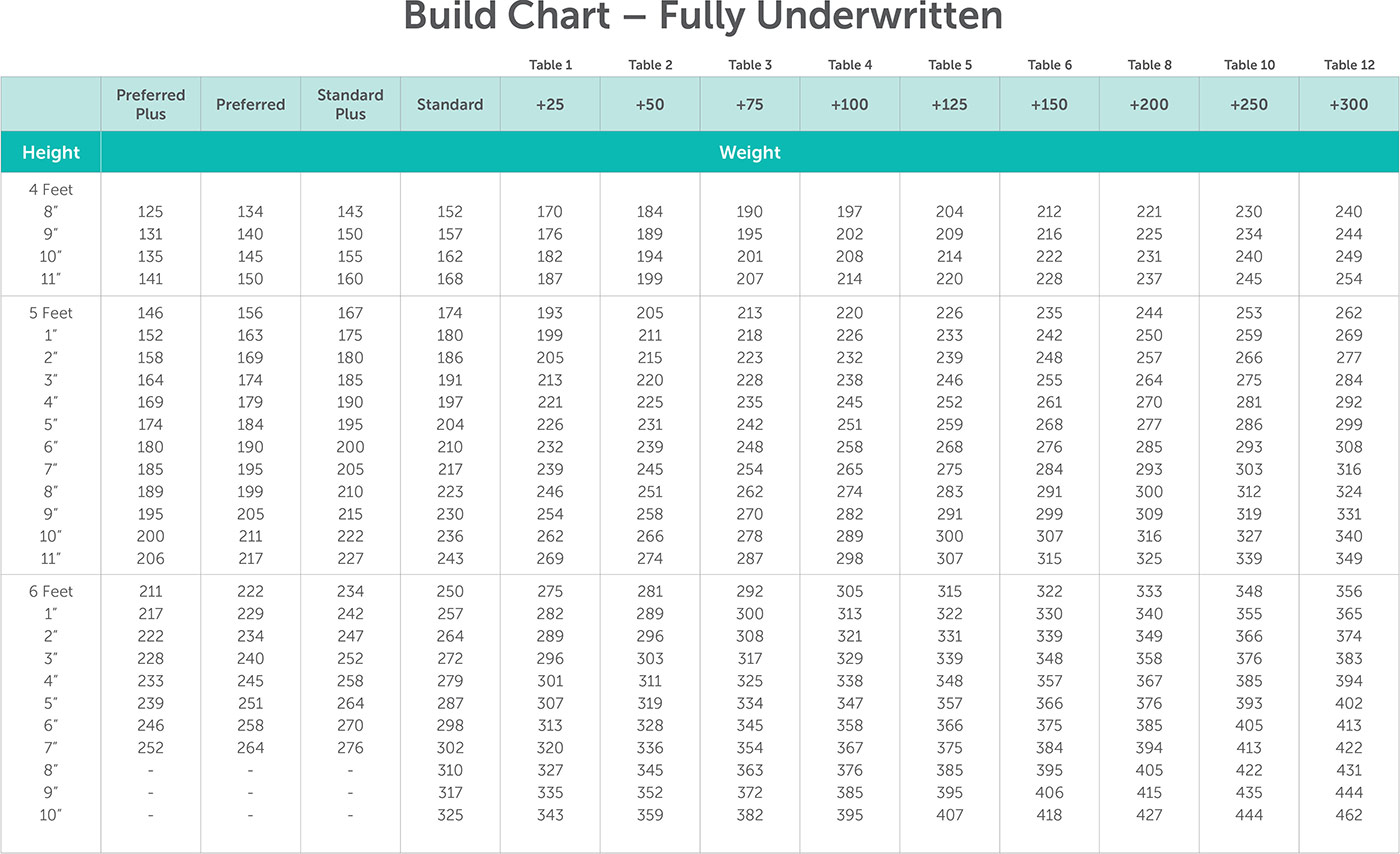

Your build—the relationship between your height and weight—is one of the more basic determinants for probability of death. Build charts may vary slightly across life insurance companies, but the table below is one example.

If you are within an average height/weight range, then your build is a neutral factor. However, if your height/weight is beyond the average, you may end up in a substandard risk class.

Physical Condition

Life insurance companies assess potential policyholders based on physical and mental health factors that may impact life expectancy. They accomplish this through:

- The application process, which includes specific health-related questions.

- Ordering medical records when necessary.

- Requiring a medical examination in most cases.

The medical examination primarily aims to identify:

- Any malfunctioning of vital organs, detected through a blood test and urinalysis.

However, companies typically deny coverage if you:

- Are scheduled for diagnostic testing or surgery.

- Are currently undergoing treatment for any health condition.

- Have not fully recovered from an illness.

Tobacco Use

It’s not a secret that smoking is bad for your health. If you smoke cigarettes, you’re going to be classified in a Tobacco risk class and you’re going to pay more for life insurance.

Insurance companies view the following tobacco-related items differently:

- Pipe smoking

- Chewing tobacco

- Electronic cigarettes

- Cigars

- Smoking cessation products (e.g. Nicorette gum)

- Marijuana

Some life insurance companies may qualify you for a non-tobacco risk class, other assign a tobacco risk class—the more companies you have access to, the better your chances for a lower premium. It’s one of the many reasons to work with an independent agency (like Quotacy) versus a captive agency who only works with one life insurance company.

Personal History

Life insurance applications often inquire about various aspects of your personal and health history:

- Past habits and environments:

- Substance use, including both legal and illicit drugs, as well as alcohol, are scrutinized. Specific concerns include:

- Past substance abuse that may have caused lasting bodily harm.

- Current use of hard drugs, which will result in automatic disqualification.

- Marijuana use, the acceptance of which varies among companies.

- Alcohol consumption, where moderate use is acceptable but heavy use poses a significant mortality risk due to potential health damage.

- Living and working conditions, especially recent exposure to hazardous environments that could have affected health.

- Substance use, including both legal and illicit drugs, as well as alcohol, are scrutinized. Specific concerns include:

- Current insurance status:

- Existence of any active life insurance policy, which influences the amount of additional coverage you can secure.

- Any previous life insurance application rejections, as the reasons might still be relevant.

Family History

Because certain medical conditions are hereditary, family history plays a role in life insurance as well. When you apply for life insurance, you are asked about the ages and health status of your parents and siblings. If any are deceased, the age they died and their cause of death will also be asked.

When determining an applicant’s risk class, a very good family history will be a credit and a very poor family history may be a few points against your overall evaluation.

Occupation

Certain jobs carry a higher risk, leading to potentially shorter life expectancies and greater life insurance premiums. These jobs can be categorized based on:

- Accident-prone roles such as construction workers.

- Unhealthy work environments such as miners.

Life insurance companies provide occupational manuals detailing:

- Occupations that may negatively affect lifespan.

- The potential for higher premiums for these occupations.

However, if you transition from a high-risk job to a less hazardous one, you have the right to:

- Request reconsideration from your life insurance company.

- Potentially move to a better risk class, resulting in lower premiums depending on the situation.

Residence

Mortality rates vary throughout the world. If you are contemplating foreign travel or residence, the life insurance company will want to know when, where, and for how long.

They also want to know if you have recently traveled to or lived in a foreign country.

A particular country’s climate, living standards, sanitary conditions, medical care, political stability, and terrorist risk can all have an effect on your mortality.

You can learn more about how life insurance companies evaluate applicants who are non-U.S. citizens.

Sex

Statistically speaking, women live longer than men. According to the Centers for Disease Control and Prevention (CDC), the life expectancy for women is 5.8 years higher than men.

There are many reasons for this; some of the main ones being that women, overall, are more health conscious and more willing to see a doctor when needed.

Women also are less prone to risky behavior compared to men.

Life insurance is all about life expectancy so women pay lower premiums.

Aviation Activities

Historically, aviation was seen as a high-risk activity by life insurance companies, leading to:

- Exorbitantly high premiums for policyholders

- An aviation exclusion clause, denying beneficiaries the death benefit in the event of a plane crash

However, due to technological advancements and increased safety measures, air travel has become less risky, and insurance companies have adapted:

- There are no longer any restrictions for passengers or crew members of commercial airliners.

Yet, closer scrutiny is applied to:

- Private pilots, assessed based on:

- Age

- Experience

- Training

- Frequency of flights

- Military aircraft crew members, evaluated by:

- Age

- Type of duty

Avocation

Like occupations, certain hobbies are considered hazardous. The most common of these are:

- Racing

- Sky diving

- Scuba diving

- Mountain climbing.

If you apply for life insurance and are somewhat of a daredevil, you may have a flat extra added onto your premium. A flat extra is an additional fee you pay that cushions the risk the life insurance company takes by insuring you. These flat extras typically range from $3-10 per every $1000 of coverage.

Similar to occupations, if you are paying more for your policy because of a specific risky hobby, but then stop doing said hobby, you can ask the life insurance company for a reconsideration.

Learn more about your life insurance options and their average monthly costs.

Buy Life Insurance Through Quotacy to Get Your Best Price

As you have read, life insurance companies are very thorough. Not all life insurance companies evaluate, i.e. underwrite, risk factors in the same manner however. The life insurance industry is very competitive and in order to stand out, different life insurance companies focus on different health or lifestyle niches.

Quotacy works with many of the best rated national life insurance companies and we’re ready to help you find the best life insurance policy. Start the by comparing free term life insurance quotes today—no personal contact information required.

0 Comments