It’s Halloween here at Quotacy and buying life insurance is less scary when you’re informed. Today, we’re talking about how life insurance can be impacted by health conditions.

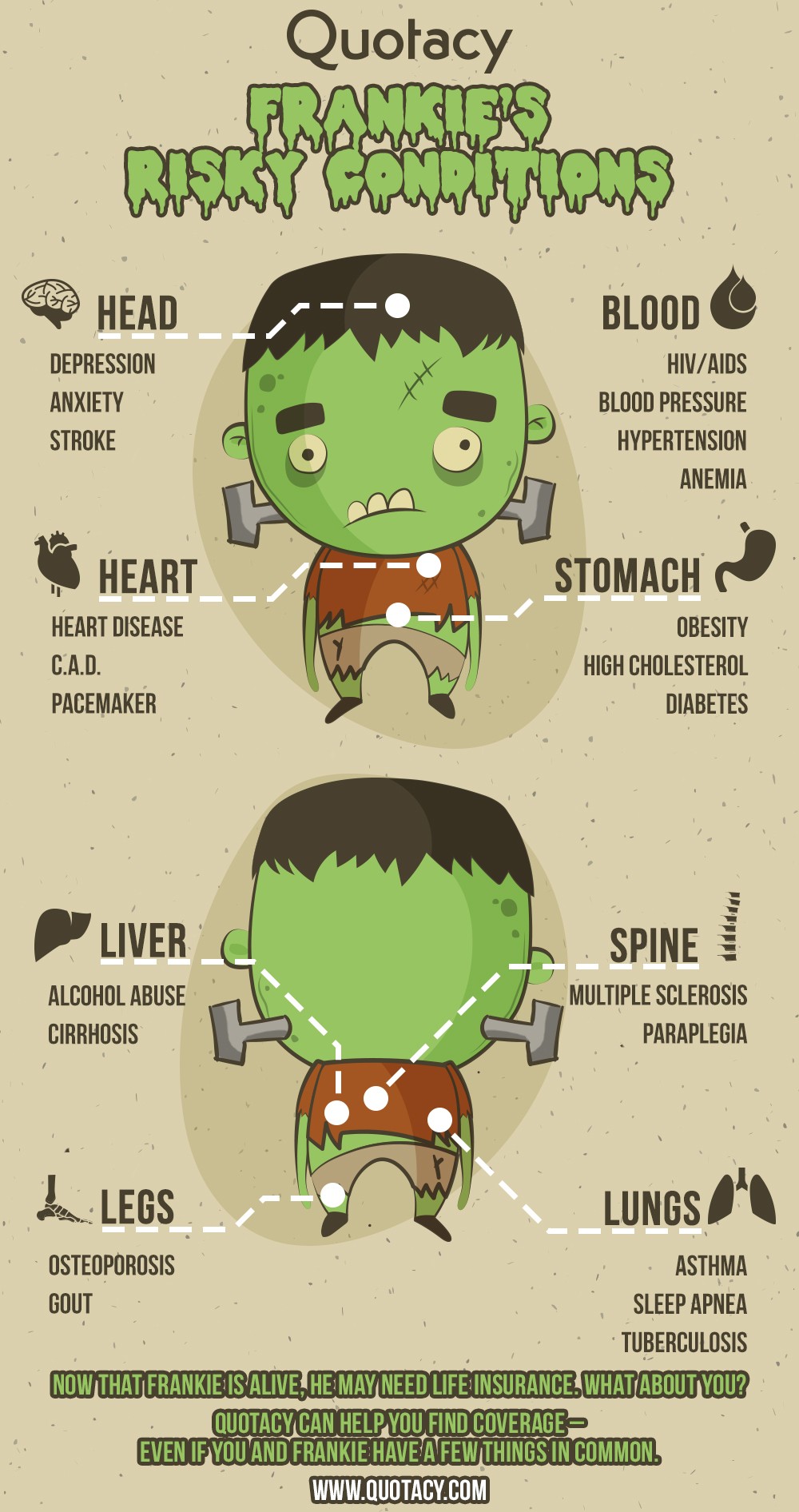

To do so, we dug up some risky health issues and gave them all to our new friend, Frankie (see graphic below). And before you ask, no, he’s not related to Victor and his monster, although he hears that quite often.

With everything that he’s got going on, it’s doubtful that Frankie would be approved for coverage. Luckily, if you’ve only got one or two of these risky health issues, it’s still definitely possible to be approved for life insurance, especially through Quotacy. We’ll make sure to shop around for you to find the best possible price.

Let’s review some of Frankie’s conditions to determine how life insurance underwriters may take them into consideration.

See what you’d pay for life insurance

Issues That Affect the Head

- Depression: Affecting both behavior and physical well-being, depression can impact your insurance rates. Mild cases that are well-managed may still qualify for best-class rates.

- Anxiety: Similar to depression, the impact of anxiety on your life can affect your rates. Minor and well-controlled anxiety can see approvals for preferred rates.

- Stroke: A serious medical condition, a stroke can limit your insurance options to standard or table rates.

Issues That Affect the Heart

- Heart Disease: A broad term that covers numerous conditions. Your specific medical situation may heavily influence your rates.

- Coronary Artery Disease (C.A.D.): A condition that underwriters examine closely due to its potential for serious health issues.

- Pacemaker: Thanks to technological advances, having a pacemaker is less of a penalty on your insurance application than before.

Issues That Affect the Lungs

- Asthma: Severity determines the rates, and well-managed asthma often receives reasonable offers.

- Sleep Apnea: Common but impactful, this condition affects your breathing while you sleep.

- Tuberculosis: While active TB is a no-go, being cured and healthy could mean standard rates.

Issues That Affect the Stomach

- Obesity: Your Body Mass Index (BMI) plays a part in underwriting decisions.

- High Cholesterol: Aim to keep levels below 240 mg/dl for more favorable rates.

- Diabetes: Several factors come into play when evaluating diabetes.

Issues That Affect the Blood

- HIV and AIDS: Recent medical advances have opened doors for coverage, though restrictions apply.

- Blood Pressure and Hypertension: High levels can restrict your options.

- Anemia: The severity and management of your condition affect your rates.

Issues That Affect the Liver

- Alcohol Abuse: A risky condition that underwriters assess carefully.

- Cirrhosis: Severe cases are typically declined.

Issues That Affect the Spine

- Multiple Sclerosis: A complex condition with many underwriting factors.

- Paraplegia and Quadriplegia: Paralysis conditions that generally result in substandard rates.

Issues That Affect the Legs

- Osteoporosis: Bone density and past fractures play a role in rating.

- Gout: Severity and frequency of attacks are evaluated.

If you’re starting your life insurance journey with a medical condition that has an impact on your life, you can almost certainly still find insurance – but you probably won’t end up getting best-class rates.

Here at Quotacy, we’re always upfront and honest about our price estimates. The more details you provide upfront about any pre-existing conditions you have, the more accurate your quote will be. This also makes it easier for your agent to search for the best final rate on your behalf.

If you’d like to explore your options for coverage, get a term life insurance quote online. You can get quotes instantly without even giving up any contact information.

When you’re ready to apply, the online process only takes a few minutes. On the application, we’ll ask about any medical conditions. This allows your Quotacy agent to shop around for you to find the coverage that best matches your needs. Who knows, the prices might shock you (in a good way!)

0 Comments