A life insurance policy is essential a financial safety net for families. After the death of a provider, the death benefit payout can be a tremendous help for anything from funeral expenses to unpaid debts.

The life insurance claims process is likely unfamiliar to many who go through it, but it’s pretty simple. All you need to do it gather some documents, notify the insurer, wait, and receive the payout.

We’ll guide you through the finer details of how to file a life insurance claim and how policy payouts work.

Table of Contents

- When to File a Life Insurance Claim

- How to File a Life Insurance Claim

- Why Would a Claim Be Rejected?

- Life Insurance Claims FAQs

As the owner of a life insurance policy, there are several responsibilities to be aware of.

When to File a Life Insurance Claim

Life insurance companies don’t automatically know when an insured individual dies. To collect the life insurance death benefit payout, beneficiaries must file a claim.

There’s no time frame in which you’re required to make a claim, but it’s often best to file as soon as possible after the death to alleviate financial stress.

If life insurance policy death benefits are not claimed after a few years, the insurer turns the funds over to the state government. Even then, beneficiaries can still file a claim for the money through the state’s unclaimed property program.

How to File a Life Insurance Claim

There are a few steps to follow when filing a life insurance claim after the death of a loved one.

Step 1: Gather Documents

The insurance company will require a few documents to start the death claims process. Sending them all at once helps speed things along.

Documents required for a life insurance claim:

- Certified Death Certificate: Get certified copies of the death certificate from the funeral director. Life insurance companies won’t take photocopies.

- Claim Form: Many insurance companies have a claim form on their website that you can submit electronically or print off and return via mail. If not, call the company and ask what is required to file a claim.

- Policy Document: Some insurance companies prefer a copy of the original insurance policy, and some may just need the policy number. Either way, it’s helpful if you have the policy on hand when filing.

Step 2: Contact the Insurance Company

Once you have gathered the documents, call the insurance company or your agent and notify them of the death. They’ll explain the rest of the claims process to you and can update their files.

Step 3: Wait for Claim to Be Processed

Once you submit the claim, insurance companies will begin their investigation.

- They’ll review your claim and ensure they don’t need more information.

- They’ll confirm the policy was inforce at the time of death.

- They’ll confirm you’re an actual beneficiary. You may need to provide proof of identification.

- If the insured died within two years of buying the policy, the insurance company has the right to investigate the original application to ensure fraud was not committed.

Life insurance companies typically have up to 30 days to review a claim, but most complete the process within a week or two. They are motivated to pay claims quickly due to interest charges that accumulate as they hang onto the proceeds.

The process may take quite a bit longer if the policy is still within the two-year contestability period.

Step 4: Receive Payout

Life insurance death benefits are paid out as a lump sum or in installments. Beneficiaries can choose how to receive the claim payment on the insurance company’s claim form.

- Lump Sum: As it sounds, this is when the insurance company pays the beneficiary their entire payout amount at once tax-free. This is the default option if nothing is specified.

- Installments: With this option, you can decide to keep the death benefit with the insurance company and allow them to invest it and get paid in installments. While the death benefit isn’t subject to income taxes, earnings are. Depending on the insurance company, beneficiaries may have different installment payout options, including:

-

- Specific income: The insurance company pays out both principal and interest on a predetermined schedule.

- Interest income: The insurance company invests the death benefit amount and pays out the interest. The death benefit remains untouched and can be paid to a secondary beneficiary upon the death of the first beneficiary.

- Life income: With this option, the insurance company will calculate a fixed guaranteed amount of monthly payment based on the death benefit amount, gender, and age for the life of the beneficiary.

Most beneficiaries choose to accept the lump sum. They can use the funds immediately and decide how to invest them.

See what you’d pay for life insurance

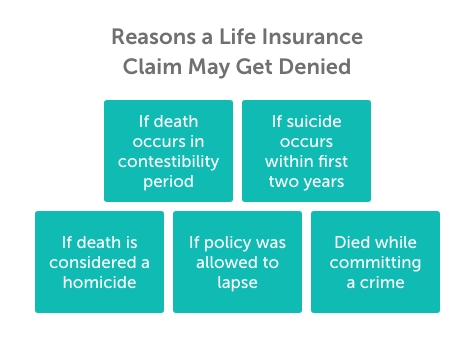

Why Would a Claim Be Rejected?

Life insurance companies rarely reject death claims, but in certain situations, they have to.

The death benefit isn’t paid out when a claim is denied, but the premium payments are returned.

Reasons a claim may get denied:

- Contestability: If the insured dies within the policy’s contestability period, the insurer can deny claims due to fraud or false application information.

- Suicide: If the insured dies by suicide in the first two years, the death benefit will not be paid.

- Homicide: If the insured’s death is under investigation, the insurance company will not pay any claims until the beneficiary is cleared of any wrongdoing.

- Policy Lapse: If the policy’s premiums have not been paid and the grace period has passed, the policy lapses. A lapsed policy is invalid.

- Died While Committing a Crime: If the insured person dies while participating in illegal activities, the insurance company may deny the claim depending on the circumstances.

How to Claim Life Insurance FAQs

Claiming life insurance death benefits is unfamiliar territory for most. The following list covers additional questions you may have.

- Can you collect life insurance without a death certificate?

No. Life insurance companies require proof of death when filing a claim. Even if there is a situation in which the insured person is missing and presumed dead, a court will issue an official death certificate. - Who is the claimant on a life insurance policy?

The claimant is the beneficiary listed on the life insurance policy. - What if there are multiple beneficiaries?

Each person needs to submit their own claim to receive benefits. Some insurance companies require all paperwork to be submitted before payments begin, while others will process claims separately. - How long do you have to claim life insurance after the insured person dies?

There is no time limit for when a beneficiary must file a claim. - How soon after a death can you file a claim?

You can file as soon as you like. - How long does it take to get a life insurance policy payout?

Life insurance proceeds avoid probate, so payouts are faster than any assets that must go through the court system. If the insurance company needs to investigate the claim, a payout is received between 14 and 60 days after filing. - Are there partial life insurance payouts?

- If the policy owner borrows against their cash value and doesn’t pay it back, the insurance company will take what is owed (balance plus interest) from the death benefit before paying out proceeds to the beneficiaries.

- If the policy owner withdraws from the cash value, this amount is deducted from the death benefit payout.

- If the policy owner used living benefits due to terminal or chronic illness, the death benefit is reduced by the amount used.

Unsure if your deceased loved one had life insurance? Learn how to find out if someone has a policy.

Explore Quotacy’s Blog for Expert Life Insurance Advice

You buy a life insurance policy because you want to protect your beneficiaries. When you purchase life insurance, it’s important to review your policy at least once a year and inform your beneficiaries of their status. They need to file a claim to receive the death benefit proceeds when you die.

Life insurance isn’t a cheerful topic, and we get that. But make sure your beneficiaries know you have life insurance to protect them financially.

Get more of your questions answered on our life insurance FAQs page, or visit our blog to learn more.

Situation: a life insurance policy is taken out and the beneficiary is “Nancy Greene” but at the time of the policy holder’s death this person’s name was still her maiden name “Nancy Parker” would the person still receive the payment? Also, if not, would the payment go to a secondary beneficiary?

When Nancy submits a claim for the payout, if there are any issues regarding her last name with the insurance company, she would simply need to establish the connection between Nancy Parker and Nancy Greene, i.e., a marriage certificate. This is not a situation in which the payout would skip Nancy and go to the secondary.

Hi if there are 2 people named as owners of the policy and the insured person dies

And ther is no beneficiary named does the money go to the estate or the co owner ?

Hi Steve, it depends on the policy. Is this a joint life insurance policy? If it’s a first-to-die policy, the death benefit is paid to the surviving owner. If it’s a second-to-die, then no death benefit is paid upon the first death.

My dad passed away and both his beneficiary are dead and I am his only kid,he never remarried and I feel like I am being played.

Lacy, I am sorry to hear of your loss. If there are no living beneficiaries, the proceeds will be paid to his estate where they will be distributed according to the laws of your state.

This is very helpful xss thank you. Iam searching for an insurance company that carries both life insurance, auto and home.

The information you provided was very helpful, however I still need to understand. I bought a life insurance policy , one for me, and one for my husband. They are $10,000. Policies. I bought them in May of 2017. I bought them so my kids do not have that cost on them to bury us. Now that the policy is 4 years old, and my husband or myself should pass, will the policy pay the full $10,000 ? Question 2, can I at this time add more coverage to our policies, and do you know the approximate amount I would have to pay, say if I wanted to increase it to a $20,000 policy ? I would appreciate your help

Hi Debbie, I need to know more information. What type of life insurance do you own? What insurance company? I recommend you call us (844) 786-8229 and an advisor can conduct a policy review with you.

How interesting that you say there are a few different ways to choose to receive a death benefit. My grandfather is getting older and we are helping him with life insurance. I will find a good life insurance coverage service in his area.

If you buy Life Insurance for someone who is an alcoholic and he passes, will it pay out a month after the death of the person? Or would this be a pre existing medical condition and not pay?

Hi Lisa,

Pre-existing conditions come into play when you’re applying for life insurance not when the policy is already active. If this person has life insurance and later becomes an alcoholic, the insurance company will still pay out the death benefit.

But if this person was already an alcoholic when he applied for life insurance, but lied about his alcohol use on his application and then he dies, the insurance company can contest the death benefit claim. Insurance companies typically have two years to investigate an applicant and any death benefit claims.

If you do not have life insurance on this person yet, it will be difficult to find an insurance company willing to offer life insurance coverage on him. His heavy alcohol use would show up in the lab results of his life insurance medical exam. If he’s been an alcoholic for quite some time, it is likely this fact is stated in his doctor records as well, which insurance companies order during the underwriting process.

My Mother in law died and she had a Life Insurance policy through John Hancock. There are 4 beneficiaries and JH says everyone needs to file the claim before they will pay out. One of the beneficiaries is being disagreeable and won’t file the paper work. What can we do?

Jennifer,

I am sorry to hear of the passing of your mother-in-law and that you’re dealing with a disagreeable beneficiary. You and the other two beneficiaries should send in a letter to John Hancock along with the death claim forms. In the letter, note that the 4th beneficiary is alive but at this time has refused to complete their paperwork. Eventually John Hancock will have to pay out to you three regardless of what the fourth beneficiary does.

So what happens if the person who set up the policy passes away after only 3 months of payments? Do the beneficiaries get any pay out or the premiums back??

Hi Holly,

A traditional life insurance policy pays out no matter when you die as long as the policy is active. To answer your question, let’s just say John Smith purchases a $500,000 20-year term life insurance policy and dies three months later. His beneficiaries will still receive $500,000 even though John only paid three month’s worth of payments.

Is it common for a life insurance company to not disclose the amount of the policy payout to the beneficiary while awaiting for claim submission and processing because currently we are going threw this whole ordeal my Grandfather and Grandmother both passed my father is the payee he spoke with insurance company and they said all needed forms have been submitted and approved legit we are only waiting for the claims department to cut the check but we have no idea of the amount the check is for because whoever my father spoke with last said that they dont even know the amount i find that to be very odd i would greatly appreciate some feedback on this thank you

Hi John, is your father just the payee or is he also the beneficiary? If he is just the payee, the insurance company won’t provide information to him. In our experience though, if he is the primary beneficiary or owner then there shouldn’t be any reason why the insurer can’t give out the information. Perhaps there is more than one primary beneficiary and the insurance company had not yet divided the total amounts.