Being a small business owner is rewarding, but it’s not easy. You work extremely hard to ensure your business stays successful. A buy-sell agreement is an essential part of your business succession planning.

A buy-sell agreement is a legal contract that states what happens to your share of the business if you die or leave. This guide will teach you how buy/sell agreements work and why they’re needed.

Table of Contents

- What Is a Buy-Sell Agreement?

- How Does a Buy-Sell Agreement Work?

- Why Is a Buy-Sell Needed?

- Creating a Buy-Sell Agreement with Life Insurance

Explore the various ways small business owners can use life insurance to protect what they’ve worked so hard to build.

What Is a Buy-Sell Agreement?

A buy-sell agreement is a legally binding, written contract detailing how an owner must sell their share of the business in certain situations. The sale price is prearranged and documented in the agreement.

There are three parties involved in a buy-sell:

- The business owner

- The person or entity who agrees to buy the owner’s interest

- The business owner’s heirs

If you own a business, you’re helping support not only yourself and your family but business partners and employees. Without a plan in place, what happens if you die unexpectedly or become disabled and can no longer work?

If you’re the sole owner, your business ceases to operate. If you’re in a partnership, your share of the business goes to your heirs, who may not be interested or may not be the best fit to take over.

A buy-sell agreement ensures the business can continue, and your loved ones are taken care of without resorting to costly lawsuits or probate court.

Types of Buy-Sell Agreements

The type of buy-sell agreement you set up will depend on the type of business and who’s involved (e.g., sole proprietorship, partnership, or corporation), and your goals.

There are three types of buy-sell agreements:

- One-way buy-sell agreement: This is used for sole proprietorships. In a one-way buy-sell, the sole owner commits to sell, and the purchaser commits to buying the business interest if a specific event occurs (e.g., death, disability, retirement). The purchaser is often one of the business’s key employees or a family member.

- Cross-purchase buy-sell agreement: This is most often used for partnerships. In a cross-purchase buy-sell, all owners commit to purchasing the business interest of another owner if a specific event occurs. This type of buy-sell works well for businesses with two to three owners who are all relatively close in age.

- Entity-purchase buy-sell agreement (also known as a stock redemption agreement): This is a logical option for multiple owners or owners with varying ages. In an entity-purchase buy-sell, the business entity buys the owner’s interest should a specific event occur.

Life insurance is often used as collateral for an SBA loan. Learn more about SBA loans for life insurance.

How Does a Buy-Sell Agreement Work?

While each agreement is different, the general concept is as follows:

- The business owner and prospective business interest buyer agree on terms. These terms include the events that trigger the buy-sell, how it will be funded, and how much the interest will cost.

- If the event occurs, the buyer purchases the owner’s interest for the predetermined price. If the event is death, the buyer purchases the interest from the deceased owner’s estate.

Events that should be addressed in a buy-sell include:

- Death

- Disability

- Divorce

- Retirement

- Personal bankruptcy

- Involuntary termination or disqualification (such as losing one’s license to practice)

Why Is a Buy-Sell Agreement Needed?

A buy-sell agreement protects a business and those relying on it for their standard of living. It provides peace of mind for what may happen if a business owner suddenly leaves or retires.

Benefits of a Buy-Sell Agreement for a Business:

- Increases the ability of a business to prosper after major life events

- Preserves ownership control

- Provides continuity of management

- Avoids legal battles and contestation

- Establishes a fair and reasonable price for the business

Benefits of a Buy-Sell Agreement for Owners and Employees:

- Gives assurance to a valued key employee or family member that their loyalty and dedication are recognized and that their role in the business will continue

- Cash value, if applicable, can be accessed for business uses

- Cash is available for estate liquidity or other family needs

- The departing owner and heirs are relieved of business responsibilities

- Helps fix the value of the deceased’s interest for federal estate tax purposes

How to Create a Buy-Sell Agreement with Life Insurance

A buy-sell agreement lays out the plans for purchasing business owner interests. An essential part of the buy/sell is deciding how to fund the purchase. Options include taking out a bank loan, using cash, and agreeing to installment payments. But the most popular way to fund a buy-sell is with life insurance.

See what you’d pay for life insurance

How life insurance is used in a cross-purchase plan:

- Each business owner purchases a life insurance policy on each of the other owners.

- The individual business owner is the owner, payor, and beneficiary of the life insurance policy on the other business owner(s).

- If an owner dies, the surviving owner(s) receives the policy death benefit payout and uses the amount to purchase the deceased owner’s share of the business.

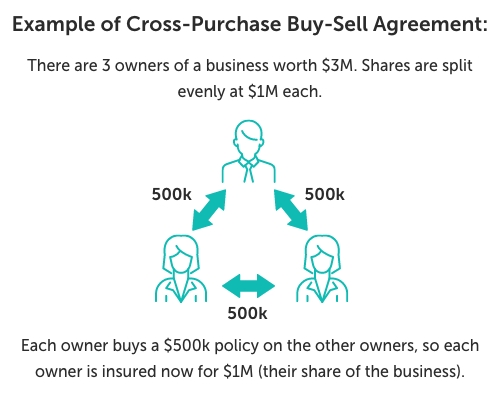

Example of Cross-Purchase Buy-Sell Agreement:

There are three co-owners of a business worth $3,000,000. The shares are split evenly, at $1,000,000 per person.

Every co-owner must purchase two separate $500,000 life insurance policies; one for each of their co-owners.

Each individual is now insured for $1,000,000, their share of the business.

If an owner dies, the surviving owners each receive a death benefit of $500,000. They purchase the deceased owner’s share of the business from the estate for $1,000,000 total. The surviving owners now each own a share valued at $1,500,000.

How life insurance is used in an entity-purchase plan:

- Each owner enters into an agreement with the business to sell their respective shares and agrees to the life insurance coverage.

- The business is the owner, payor, and beneficiary of the life insurance policy on the business owner(s).

- If an owner dies, the business purchases that owner’s interest using the death benefit payout. The remaining business owners’ interests then increase.

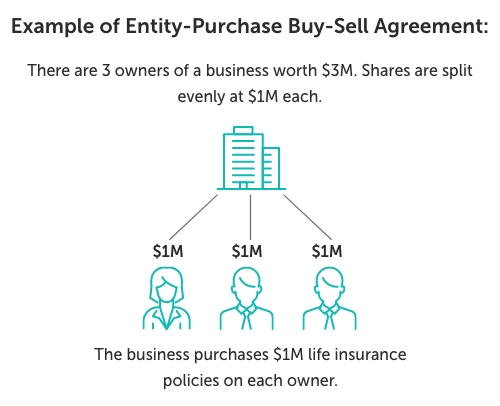

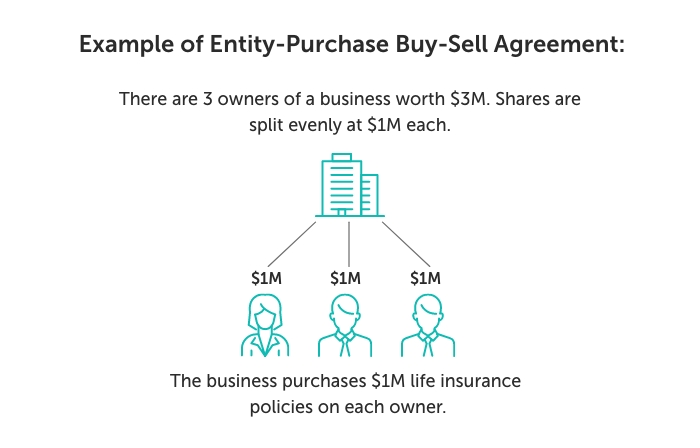

Example of Entity-Purchase Buy-Sell Agreement:

There are three co-owners of a business worth $3,000,000. The shares are split evenly at $1,000,000 per person.

The business purchases $1,000,000 life insurance policies on each of them.

If a business owner dies, the business receives a death benefit of $1,000,000. The business purchases the deceased’s share from his or her estate using the death benefit payout. These shares are then redistributed to the two surviving business owners increasing their individual shares to $1,500,000.

What Type of Life Insurance Should Be Used?

Both term and permanent life insurance can be used for a buy-and-sell agreement.

Term life insurance may be more appropriate if:

- The buy-sell agreement is expected to end by age 65 or 70 (retirement age).

- Lower premiums are needed due to limited cash flow.

Permanent life insurance may be more appropriate if:

- The buy-sell requires funds for disability or retirement scenarios.

- Insurance is needed as a source of liquidity or collateral for the business.

- The owners/partners are young, and the buy-sell agreement is estimated to be in place for a long time.

The cost of a life insurance policy is specific to the individual. If the parties in the agreement have a wide range of ages and health profiles, an entity-purchase agreement is better than a cross-purchase. For example, it wouldn’t be fair for a healthy 35-year-old co-owner to pay policy premiums on a 55-year-old co-owner with high cholesterol.

Another case where entity purchase would be better than cross-purchase is if more than 2-3 owners are involved.

Example:

Let’s say a company has six co-owners.

With a cross-purchase plan, a total of 30 life insurance policies would need to be purchased because each owner needs to own a policy on the other owners. As you can imagine, this gets quite complex and a lot to manage.

An entity-purchase plan would be better in this situation. The company would be the owner of six life insurance policies, one on each of the owners.

Benefits of Using Life Insurance to Fund a Buy-Sell:

- Life insurance creates a lump sum of cash to fund the buy-sell agreement at death.

- Life insurance proceeds are usually paid quickly after your death, ensuring that the buy-sell transaction can be settled quickly.

- Life insurance proceeds are usually income tax free.

- If sufficient cash values have built up, the funds can be accessed to purchase an owner’s interest following retirement or disability.

- If sufficient cash values have built up, and the buy-sell agreement is no longer needed, funds can be accessed to supplement retirement income.

Buy-sell agreements are extremely important so it’s advisable to hire an experienced attorney to draft these contracts to make sure everything is structured properly.

Disability insurance is also often used in buy-sell agreements. Learn how disability insurance protects business owners.

Get Life Insurance to Fund Your Buy-Sell Agreement

One aspect of business ownership is planning what happens if or when you leave the business. If your business’ strategic plan doesn’t yet include succession planning, start as soon as possible.

Life insurance can help with many small business needs. If you need life insurance, it’s simple to start the process right online.

Start by getting a term life insurance quote today. Window shop in peace without giving up any contact information and know that your information will never be sold.

If permanent life insurance is more in line with your needs, we can provide personalized quotes for you. Simply complete our short questionnaire and an agent will follow up with you.

0 Comments