Life insurance is a financial safety net for your family, but it won’t do you or your loved ones any good if you can’t afford it.

Truthfully, most people overestimate the cost of life insurance. In a survey by LIMRA, millennials, on average, guessed that a $250,000 term policy for a 30-year-old cost $1,000 per year, when in reality, it’s just around $160 annually.

Term life insurance is the best option for families because it’s very customizable and affordable. Whatever your budget, Quotacy can help you get life insurance coverage so you can protect your family.

How to Fit Life Insurance Into Your Budget

There are two primary types of life insurance: term life insurance and permanent life insurance.

Term life insurance is the most affordable. If you have a tight budget, a term policy is the way to go.

Term life insurance provides coverage for a specific period of time. It’s designed to end when you’re nearing retirement and have fewer financial responsibilities, such as dependent children.

Jim and Julie, both 35 years old, have two children aged 4 and 5. They each purchase a 30-year $500,000 term life insurance policy. This policy provides financial protection over the next 30 years as Jim and Julie raise their children, save for retirement, and pay down their mortgage.

If either Jim or Julie passes away before age 65, the $500,000 death benefit is paid out to ensure the family doesn’t face financial difficulties. Once the 30-year term ends, the coverage terminates.

As a safeguard, most term life insurance policies include a conversion and renewal option. Should you still need coverage but become uninsurable, these options keep you insured for a price.

See what you’d pay for life insurance

Choosing Your Life Insurance Coverage

One of the most significant benefits of life insurance is that the death benefit is paid to beneficiaries tax-free. Think about the disappointment you feel when you get a bonus check at work, only to see nearly half of it vanish due to taxes. Fortunately, this isn’t the case with life insurance payouts in the majority of situations.

With this in mind, you can have confidence that the coverage amount you select is the amount your loved ones will receive if you were to pass away while the policy is active. And because there is a range of coverage amount and term length options available, term life insurance premiums are relatively easy to fit into a budget.

Term coverage choices range from $50,000 up to $25,000,000 or more, and term lengths vary from 10 years to 40 years. These options may differ based on your age and financial need.

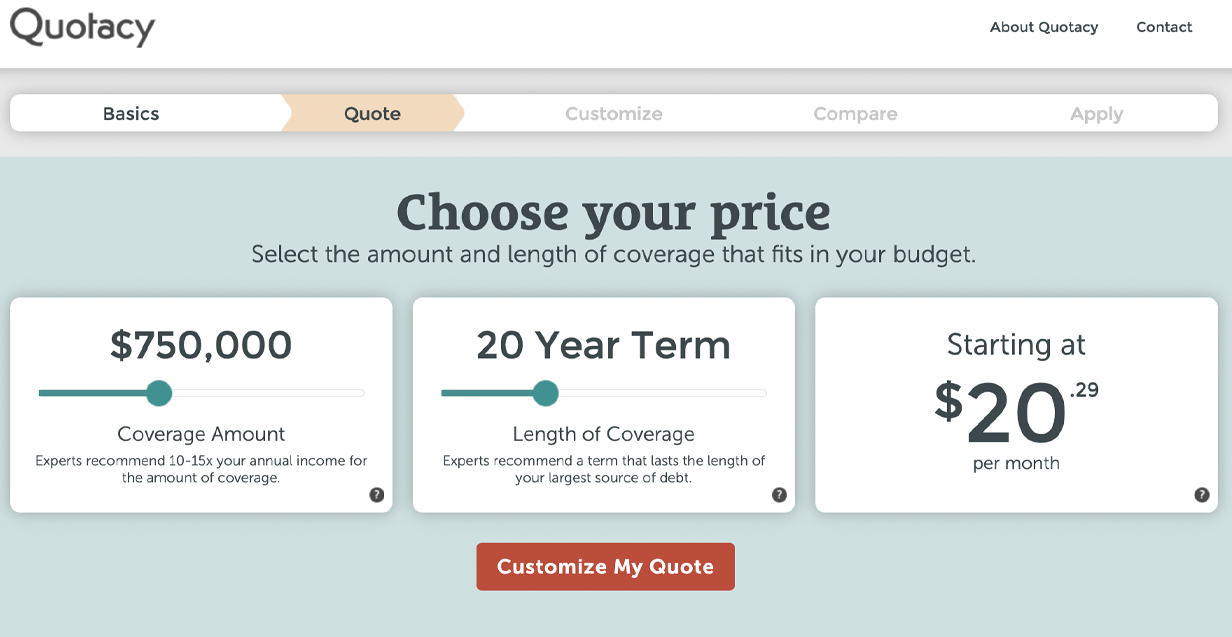

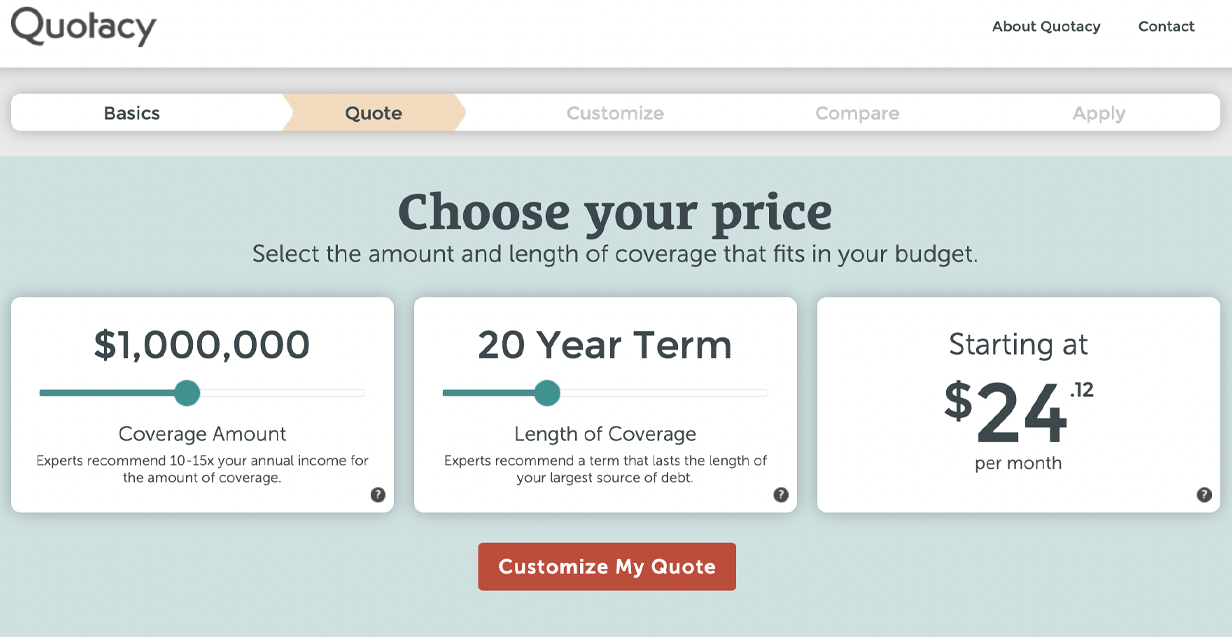

Typically, the more coverage you want, the more the policy will cost. But sometimes the premium difference is minimal compared to the change in coverage amount. Consider the screenshots below.

These screenshots show term insurance quotes for a healthy 30-year-old female. The monthly premium difference between a $750,000 term life insurance policy and a $1,000,000 term life insurance policy is less than $5 per month.

In other words, for just a few dollars more each month, you can secure $250,000 more coverage for your loved ones. If you have a mortgage and multiple children, that extra $250,000 could be extremely beneficial in case of an unexpected loss.

Let’s pretend you’re that 30-year-old mother. What in your daily life could you cut back on to fit $25 into your monthly budget to be able to afford a $1,000,000 life insurance policy to protect your children?

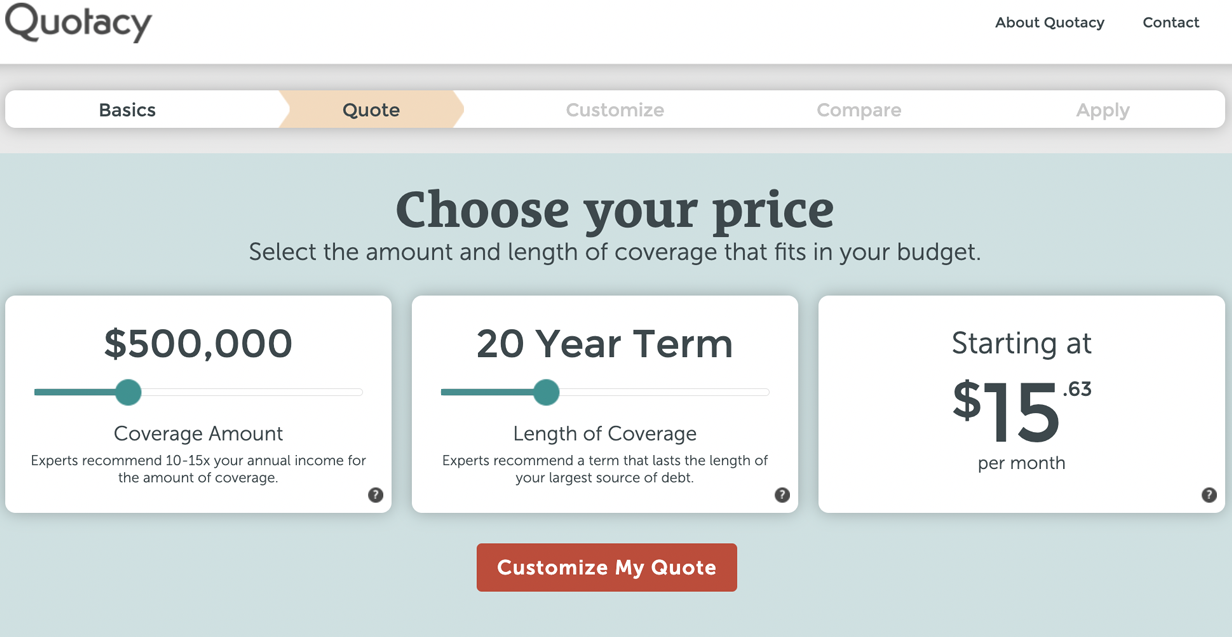

Or maybe you have a strict budget and can only afford to spend $15 per month for coverage. By adjusting the coverage amount to $500,000 using the sliders on our term life insurance quoting tool, you can lower your estimated life insurance premium to about $15. $500,000 is still a substantial coverage amount.

Even if you can only comfortably afford a $100,000 term life insurance policy, some life insurance is better than none at all.

Not sure how much term life insurance you need?

Autopay Your Life Insurance Premium

Even though life insurance companies typically offer a 30-day grace period, don’t risk your policy terminating. Once your life insurance policy is inforce, set up automatic payments from your checking account to ensure you don’t forget to pay your life insurance premium.

All the term life insurance policies we offer have level premiums. This means your payment will never change.

For example, if you lock in $20 per month, it will never increase for your entire term, regardless of your age or any potential health developments.

Whether you decide to pay monthly or annually, it will always be the same. It makes autopay and budgeting very simple.

What Will My Life Insurance Premium Cost?

Your life insurance premium will be mainly determined by your gender, age, health, and the terms you choose. If you aren’t sure how much life insurance you need, our life insurance needs calculator can help you decide.

The best way to ensure your life insurance premiums fit into your budget is to work with a broker. A broker has the ability to shop the market and compare costs across many different companies and their products.

Quotacy works with over 25 of the nation’s top insurance companies. When you run a quote on our website, you’ll be given many company options to choose from.

If you don’t have a preference about which life insurance company to go with, we usually just recommend that you go with whichever one is cheapest.

Explore policy pricing based on various factors: Average Monthly Life Insurance Costs

An online quoting tool can’t calculate for every single type of scenario. There’s a chance that an insurance company may find something in your application (a health or lifestyle factor, for example) that causes them to offer you a less-than-perfect risk class.

However, after you apply, your Quotacy agent will review your application before submitting it to the insurance company. They’ll make sure you’re matched with the life insurance company that will give you the best final rate possible.

If your final offer comes back at a price you’re not comfortable with, your Quotacy agent will help find an option that works best for you and your family.

What are you waiting for? Get your free life insurance quote today.

Note: Life insurance quotes used in this article are accurate as of December 4, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments