Do you pay life insurance monthly or annually? Both options are available, but if you can afford the annual lump sum, you’ll save about 3-5%.

The premium itself doesn’t change. Instead, the discount comes from reduced administrative fees. Processing one large payment per year is more efficient than processing twelve smaller ones.

Explore different life insurance policy options and their average monthly costs.

Your Life Insurance Premium Payment Options

Typically, life insurance buyers choose between two forms of payment: monthly payments or annual payments. There are pros and cons of each.

Choosing Monthly Payments

+ Financially easier to manage because they are smaller payments

– EFT setup often required i.e. auto pay through your savings or checking account

– Administrative fees included

Choosing Annual Payments

+ Only having to pay once per year is convenient

+ Costs less overall because there are no monthly administrative fees

– May not be feasible for all budgets

When you’re running term life insurance quotes and deciding whether you want to pay monthly or annually, keep in mind it’s not as simple as dividing or multiplying by 12 when comparing the two. This is because of the extra administrative fees added onto the monthly option.

In order to be as transparent as possible, we do include the monthly fees in our quoting tool. This way there aren’t surprises at the end of your buying process.

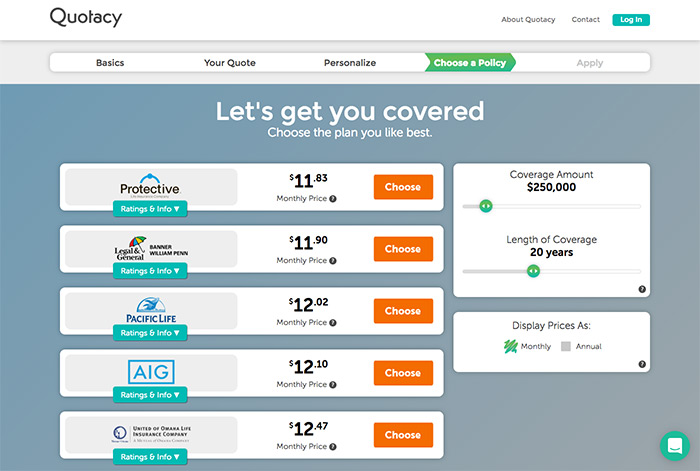

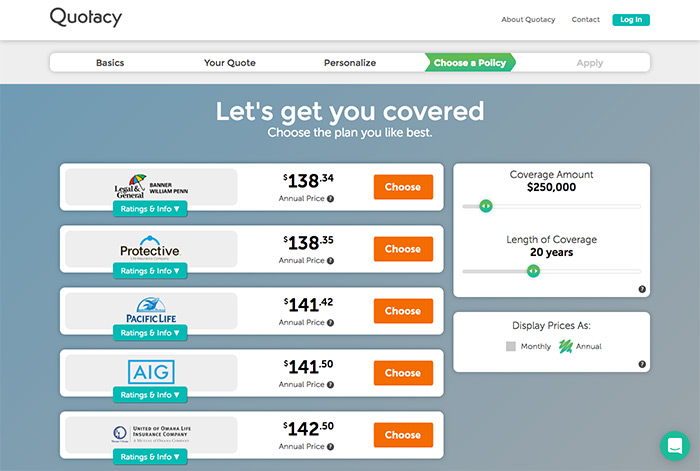

As you can see in the screenshots below, simply taking the monthly quote and multiplying it by 12 does not equal the annual price. Using the Protective quote as an example, multiplying $11.83 by 12 is $141.96. But the actual annual premium is less than that at $138.35. It’s less because the annual option has fewer fees.

How Do I Pay for My Life Insurance Premiums?

Paying with Paper Checks

If you prefer to send in a paper check for every life insurance premium, you need to choose to pay annually. If you rather have a monthly payment schedule, most companies will require you to set up EFT payments.

Why?

It’s much easier to forget to pay your premiums if you need to send in a paper check every month. It’s more work for insurance companies to keep track of all of their customers’ paper checks coming in so frequently. And when customers forget to pay, the insurance company as a courtesy sends out payment reminders.

More policies would lapse more often requiring grace periods and reinstatement processes to occur much more often. All of these things cost time and money—which would mean forcing customers to pay more.

To keep costs lower, companies require the automatic EFT payments for those who choose to pay monthly.

Paying with Electronic Funds Transfer (EFT)

EFT payments automatically withdraw premium payments directly from your checking or savings account each month. You can choose this option if you pay annually, but it’s required if you pay monthly. It’s an easy way to make sure your premium gets paid on time so your policy doesn’t lapse.

Paying with Money Orders or Cashier’s Checks

Paying your life insurance premiums with money orders or cashier’s checks is generally not permissible because the insurance companies want to make sure you have a U.S. bank account.

Paying with Credit Cards

There are a few insurance companies that allow you to pay your initial premium payment on a credit card, but the majority of companies don’t allow it on your future payments. Most companies don’t allow credit card payments whatsoever.

Why?

There are quite a few reasons why life insurance companies don’t allow credit card payments:

- Typical merchant fees charged for credit card transactions are 3-4% and can be higher for cards that have to be keyed in (versus swiped)—which would be all premium credit card payments.

- Credit card payments would add an additional step to the posting process. The processing staff would have to post the payment and then key in the credit card numbers. These steps are extra time and money, not to mention there is extra opportunity for errors.

- Credit cards expire whereas savings and checking accounts do not. Life insurance companies would be reaching out to their customers frequently needing updated card information to ensure policies don’t lapse. Again, these steps would require extra time and money.

Life insurance companies are handling millions of policies at any given time. In order to keep up with the tasks required to process and monitor credit card payments, they would need to hire additional staff. This would trickle down and force applicants to pay more. Overall, it saves consumers money if the life insurance companies do not allow credit cards for premiums payments.

See what you’d pay for life insurance

How Much Money Would I Save by Paying Annually?

Life insurance companies have to do less administrative work if a client pays annually, so they provide annual payers a discount. Depending on the insurance company, this discount is usually about 3-5%.

Example:

A healthy 30-year-old man buys a Mutual of Omaha $500,000 20-year term life insurance policy and pays $23.87 per month. Multiplied by 12, this means he pays $286.44 each year for his coverage.

Had he chosen to pay his premiums annually, it would cost $277.50 per year. A savings of $8.94 each year.

While those yearly savings don’t seem like much, they do add up over time. Also, the higher your premiums, the more you would save. Consider an older individual buying a larger amount of life insurance.

Example:

A healthy 50-year-old man buys a Mutual of Omaha $2,000,000 20-year term life insurance policy and pays $347.66 per month. Multiplied by 12, this means he pays $4,171.92 each year for his coverage.

Had he chosen to pay his premiums annually, it would cost $4,042.50. A savings of $129.42 each year.

What If I Die Right After Paying My Premium?

You may be wondering what happens if you decide to pay your term policy’s life insurance premiums annually, but die at the beginning of your term year. For example, what if you pay your annual premium of $500 in March and die in April?

Many states require life insurance companies to return the “unearned” premiums. And even if a state does not require this, many life insurance companies still do so as a courtesy. So, not only would the insurance company be writing a check for the death benefit total, they would also write a separate check refunding the premiums that would have covered May through the following February. (At least for term life insurance policies, some permanent policies have different rules.)

Where Do My Life Insurance Premiums Go?

Insurance companies mainly use the money you pay in three ways:

- Premiums go toward paying for day-to-day operations.

- Premiums go toward death benefit claims the company pays to beneficiaries of other policies.

- Premiums are invested by the insurance companies to maximize profits.

If you’re curious about the financial strength of the life insurance companies Quotacy works with, check out our life insurance company review page. We only work with top rated companies so you can buy with confidence.

» Compare: Term life insurance quotes

Applying for Term Life Insurance on Quotacy

When you run a term life insurance quote on Quotacy.com, the quotes are shown as monthly payments until you get to the Choose a Policy page. Here is where you can opt to display the quotes as Annual instead.

Once you decide on a policy, whichever premium mode (monthly or annually) is displayed is what your application will be set up as; however, you can ask your agent to change this during the buying process if you decide to switch to a different option. You can also opt to pay quarterly or bi-annually, but these options are chosen less frequently.

Buying life insurance is an important purchase for you and your loved ones. We’re here to help make the process as easy as possible and keep you updated every step of the way.

» Learn more: Are Term Life Insurance Rates Worth It?

Note: Life insurance quotes used in this article are accurate as of March 3, 2023. These are only estimates and your life insurance costs may be higher or lower.

Great Article