People abuse substances such as drugs, alcohol, and tobacco for varied and complicated reasons.

According to research from the National Survey on Drug Use and Health, in 2019, over 60% of Americans aged 12 or older used a substance (i.e. tobacco, alcohol, or illicit drug) in the past month. That’s an estimated 165.4 million people in the U.S.

Not all of these individuals are guilty of abusing their substance of choice. However, an estimated 21.6 million people needed substance use treatment in 2019.

Substance abuse can have disastrous affects on the individual and his or her family. In addition, these abuses impact society. In 2019, substance abuse cost the U.S. more than $740 billion annually in expenses related to crime, lost work productivity, and health care.

This leads us to our topic today. With a history of substance abuse, can I get life insurance?

Can I buy life insurance if I’m a recovering addict?

Quotacy agents have helped former drug addicts get life insurance. If you’re a recovering addict, getting approved for life insurance depends on a few factors. Your best chances of getting coverage is to apply through a broker, like Quotacy. Brokers are not tied to one life insurance company and are able to shop the market.

When you apply online at Quotacy, you can choose which life insurance company you want to apply with. Your Quotacy agent will review your application and work hard to get you approved. Not all life insurance companies view a history of drug addiction the same. If the company you initially picked won’t offer you reasonable coverage, we’ll keep shopping and give you options.

Start the process by getting a free term life insurance quote or keep reading for more in-depth information about life insurance and substance abuse.

» Compare: Term life insurance quotes

If I have a history of substance abuse, can I buy life insurance?

Anyone currently abusing a substance will be declined for life insurance coverage. But life insurance companies may consider applicants with a history of abuse, as long as applicant had discontinued use for, typically, a minimum of two years.

Each life insurance company has their own unique underwriting guide they follow when evaluating applications. This guide also states how they underwrite applicants with a history of substance abuse.

After evaluating an application, they give a classification to the applicant. This classification can be a “standard” risk class or a table rating. There are different standard risk classes depending if you use tobacco or not as well. A table rating typically means that your pricing for life insurance will be the Standard price plus 25% for every step down the table you are.

| Risk Classes | |

|---|---|

| For Non-Tobacco Users | For Tobacco Users |

| Preferred Plus | Preferred Tobacco |

| Preferred | |

| Standard Plus | Standard Tobacco |

| Standard | |

When underwriting a history of drug abuse, underwriters will focus on:

- Severity and frequency of the abuse

- Type of drug abused

- Severity of associated complications

- Evidence of dependence and/or withdrawal

- Legal problems related to abuse (such as DUIs)

- Abuse of multiple drugs (including alcohol)

- Number of relapses

- Current participation in a group such as Narcotics Anonymous.

It pays to work with an agency that has contracts with multiple life insurance carriers, because while one company may deny or table an applicant, another company may offer standard ratings to that same applicant.

This is especially common when it comes to marijuana use. For example, some companies would classify recreational marijuana use as “tobacco use” and would only offer tobacco ratings to the applicant, while another company may offer preferred non-tobacco rates as long as the use is minimal.

See what you’d pay for life insurance

What classifies as substance abuse?

While the definition of substance abuse has nuances that can vary depending on who is defining it, life insurance underwriters acknowledge the Psychiatric Text Diagnostic and Statistical Manual of Mental Disorder’s definition. Substance abuse is a maladaptive pattern of substance use leading to clinically significant impairment or distress, as manifested by one (or more) of the following, occurring within a 12-month period:

- Recurrent use resulting in a failure to fulfill major role obligations at work, school, or home.

- Recurrent use in situations in which it is physically hazardous.

- Recurrent legal problems due to drug use.

- Continued use despite social or interpersonal problems caused or exacerbated by the effects of the substance.

Substance abuse also causes increased mortality risk; therefore, life insurance companies do not take a history of substance abuse lightly. Mortality risks among substance abusers include:

- Deaths from natural causes such as the poisonous effects of substances and from infections (hepatitis/HIV/endocarditis) from injectables.

- Accidental deaths from overdose and trauma (motor vehicle accidents, falls, etc.).

- Violent deaths from suicide and homicide.

Other points that increase the risk associated with substance abuse:

- Multiple or polydrug use/abuse, especially involving illicit street drugs.

- Substance abuse in the presence of a known psychiatric impairment.

- Substance abuse in the presence of known interaction with the legal system, such as adverse driving record or other arrest record.

- Substance abuse in the presence of social (occupation, marital, familial) or behavioral problems.

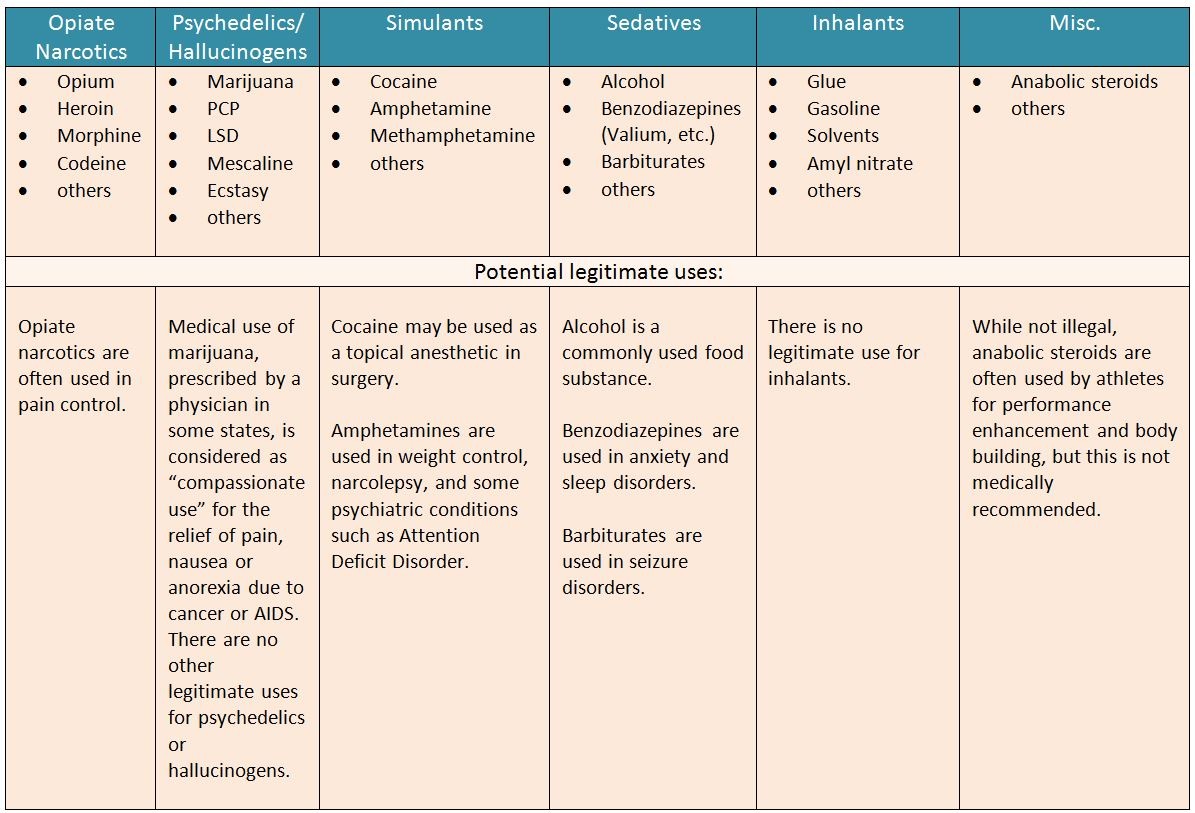

There are drugs that have legitimate uses in addition to their abuse potential. Underwriters take how the drug is being used into consideration when evaluating an application. Below is a table of common drugs (divided by classes) and their possible legitimate uses.

» Learn more: Life Insurance and the Opioid Crisis

A benefit to working with Quotacy is that we work with multiple A-rated life insurance companies. We have the ability to shop cases around to different companies to try our best to get an applicant approved.

Our in-house underwriter has worked in many carrier home offices, knows how to navigate each individual’s health and lifestyle history, and knows which life insurance company would be the best option for your individual case. If you are ready to buy life insurance coverage, get a term life insurance quote now and let’s start the process.

Quotacy, being a brokerage firm for finding life insurance for individuals with a history of substance abuse and other disabilities, I assume that there is a fee involved for your services. If so, what is this fee? Also, I am on Social Security Disability and work part time when I can find work. I am looking for between 15,000 and 20,000 dollars affordable term life insurance, fixed rate for 30 years.

Hi Christopher, we are a broker for anyone who needs life insurance and there is no extra fee to use Quotacy. However, the smallest coverage amount our carriers offer for term life insurance is $50,000. Feel free to get free online quotes using our tool https://www.quotacy.com/life-insurance-quotes/ and you can apply right online if you find a policy you’re interested in.

1. Does occasional episodic periodic use of Percoset for pain, say an annual prescription of 120 tablets (that less than half of which may not be consumed) constitute a medical reason or insurance reason to expect a premature death, shortened life expectancy or most importantly my own personal longevity?

2. Is there medical evidence of this limited occasional usage shortening longevity? If so, can you please forward it?

3. Is there evidence that this mentioned usage does NOT shorten life expectancy, and if so, can you please forward it?

Thank you kindly. Your efforts are greatly appreciated!

Anthony,

We (Quotacy) do not perform any studies or collect data regarding how factors affect mortality. We leave that up to actuaries and underwriters at the insurance companies. So, I apologize, but I do not have any medical evidence to pass along to you.

However, in regards to your Percocet question, the life insurance companies’ main concerns will be the potential for addiction to the pain medication and the chronic pain possibly leading to depression. Minimal use of pain medication would likely exclude an applicant from getting Preferred risk classes (best of the best), but wouldn’t necessarily place an applicant in the substandard risk classes. Everyone’s situation is unique and insurance companies would consider an individual’s overall risk factors.