Many employer benefits packages offer voluntary life insurance to supplement any coverage you already have. It’s optional and separate from basic group life insurance.

If you’re eligible for your own term life insurance policy, the voluntary option isn’t worth it.

Still, there are are cases where you should buy voluntary life insurance through your employer, and this guide will help you figure it out.

Table of Contents

- What Is Voluntary Life Insurance?

- How Does Voluntary Life Insurance Work?

- Is Voluntary Life Insurance Worth It?

- Voluntary Life Insurance vs Personal Term Life Insurance

- Should I Get Voluntary Life Insurance?

Is group life insurance supplemented with voluntary life insurance a good deal for you? Compare a term life quotes from the nation’s top carriers Quotacy today to find out.

What Is Voluntary Life Insurance?

Many employers offer their employees optional life insurance plans. Voluntary life insurance can supplement your group policy.

Because it’s available to all employees regardless of health, you will pay group rates for voluntary coverage. Group rates are only reasonable if you have a pre-existing condition or other risk factors that make private life insurance more expensive.

In addition, voluntary coverage offers limited benefits, so it isn’t the best option for everyone.

Voluntary Life Insurance vs Basic Group Life Insurance: Are They Different?

While both are types of life insurance offered through your employer, basic group life insurance and voluntary life plans have many differences.

Group vs. Voluntary Life Insurance:

- Group life insurance coverage is typically an amount equal to your annual salary.

- Voluntary life insurance is optional buy-up coverage. You can buy 3-5 times your salary without providing proof of insurability and up to 8 times if you’re in good health.

- Your employer pays for group life insurance premiums.

- Voluntary life insurance premiums are group rates that you’re responsible for.

- Both group and voluntary life coverage end if you leave your job.

How Does Voluntary Life Insurance Work?

Many companies offer employees two voluntary life insurance options:

- Guaranteed issue: No medical questions. Coverage amounts are typically 3-5 times your salary (unless that exceeds the set limit).

- Simplified issue: You need to provide evidence of insurability and answer a short medical questionnaire. Coverage amounts are typically 8-10 times your salary (unless that exceeds the set limit.

Employees can buy voluntary life insurance coverage during the open enrollment period.

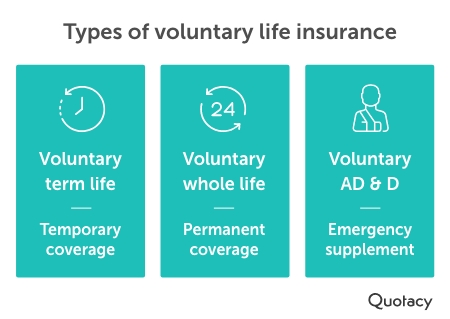

Types of Voluntary Life Insurance

Employers offer buy-up voluntary coverage, which is usually voluntary term life insurance. Voluntary whole life insurance is less common.

Voluntary Term Life

Voluntary term life insurance is basic financial protection for your beneficiaries. Term life insurance is not designed to last a lifetime, only a specific period. Your beneficiaries receive a death benefit check if you die during the term.

Every year during open enrollment, you need to re-enroll in the coverage. Voluntary term life insurance premiums are based on group rates by age per $1,000 of coverage. If you move into a new age group, your rates will increase from the prior year.

Voluntary Whole Life

Some employers will offer permanent life insurance. These policies are designed to last your entire lifetime. Some even accumulate cash value.

Permanent voluntary life insurance policies will be much more expensive than term life insurance. But because of the permanent nature of voluntary whole life and universal life insurance, you’re likely able to keep the policy if you change jobs.

Voluntary Accidental Death and Dismemberment Insurance (AD&D)

Many employers provide a small amount of accidental death and dismemberment insurance along with your basic group life insurance. But employees often have the option to buy additional voluntary AD&D insurance as well.

AD&D insurance has two components:

- It pays a benefit if you survive an accident and wind up with serious injuries

- It pays your beneficiaries additional benefits on top of your group life insurance benefits if you die from an accident

Accidental death and dismemberment insurance is cheap since it only pays out in severe injury or accidental death cases. AD&D insurance should supplement traditional life insurance. It shouldn’t be your sole insurance plan.

See what you’d pay for life insurance

Is Voluntary Life Insurance Worth It?

If you are denied a personal life insurance policy outside of work, voluntary life insurance is worth it to protect your family.

Disadvantages of Choosing Employee Voluntary Life Insurance

The main disadvantage of voluntary life insurance is that you don’t own it and, therefore, don’t completely control your coverage.

Other disadvantages:

- Group rates: If you’re in excellent health, you’ll pay too much for voluntary life insurance. In addition, these rates aren’t fixed, so they increase as you age.

- Limited coverage amounts: If you have young children, a mortgage, and debt, the coverage available through voluntary life insurance plans may not be adequate.

- Portability issues: If you leave your job, your coverage doesn’t automatically follow you. If your policy is portable, you must apply and likely pay higher rates.

Advantages of Choosing Employee Voluntary Life Insurance

The main advantage of voluntary life insurance is that you can get coverage without providing evidence of insurability.

Other advantages:

- Guaranteed coverage: If you’re a smoker or have significant health issues, you can get limited coverage at a better price than what you’d pay for a personal life insurance policy.

- Premiums deducted from paycheck: You don’t need to worry about accidentally missing a payment. Your employer can deduct premiums straight from your paycheck.

- Spouse and dependents: Many plans offer the option to purchase life insurance for your spouse, domestic partner, and children at group rates.

Use our wise buyers’ guide to ensure you get the best life insurance policy at the best price.

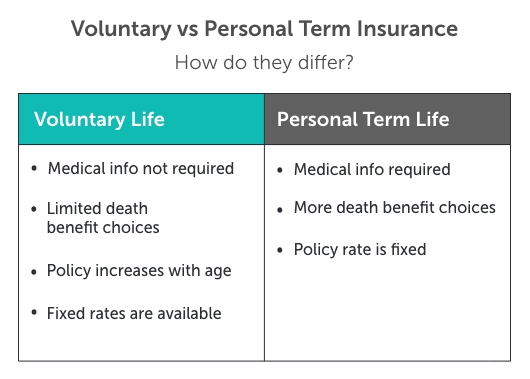

Voluntary Life Insurance vs Personal Term Life Insurance Plan

A personal term life insurance policy is one you own outright and is entirely separate from your employer. As the policy owner, you’re in charge and determine how long your coverage lasts. This is the opposite of voluntary.

Voluntary life insurance is not a guaranteed benefit. Employers aren’t required to offer it. And even if they do, employers can change benefits at any time.

They can also terminate your coverage if you become ill or injured and can no longer work. Contracts typically say employees must be actively employed to participate in these benefits.

Let’s review the other differences between voluntary and personal term life insurance.

Providing Medical Information

Through voluntary life insurance, you can often buy up to 3-5 times your annual salary without needing to provide any medical information. You need to be underwritten to buy your own term life insurance policy.

Underwritten means the insurance company will evaluate your current and past health history and lifestyle to determine your insurability. Your rates are based on your age and their findings. In many cases, you need to partake in a quick medical exam so they have your most recent data.

Death Benefit Choices

With a personal term life insurance policy, you have a wide range of coverage choices from as little as $50,000 to tens of millions. The death benefit you choose should fit your family’s financial needs and goals.

For most families, basic group life insurance isn’t enough. The cost of voluntary life insurance may not be worth it, depending on your age and health.

Policy Costs

Term life insurance is straightforward coverage with a fixed rate for the entire term. You choose how long you want your coverage to last, with options ranging from 10-40 years. The price you pay for your term policy will not change.

Compare the costs of a personal term life insurance policy with a voluntary policy using the example table below. The rates are for a 30-year-old, healthy male.

| Age | Monthly Cost of a $500K Voluntary Life Insurance Policy | Monthly Cost of a 30-Year $500K Term Life Insurance Policy |

|---|---|---|

| 30-34 | $27 | $29.54 |

| 35-39 | $30.50 | $29.54 |

| 40-44 | $34.00 | $29.54 |

| 45-49 | $51.00 | $29.54 |

| 50-54 | $78.00 | $29.54 |

| 55-59 | $146.00 | $29.54 |

| Total cost after 30 years | $21,990.00 | $10,634.40 |

Should I Get Voluntary Life Insurance?

We recommend applying for life insurance through an independent broker before buying voluntary coverage. It’s better peace of mind not to rely on your employee voluntary life insurance.

If you already have voluntary coverage, you might consider applying for a personal term life insurance policy before open enrollment comes around. You may find that you can save money with a term policy through a broker. Then you can simply not re-enroll in your voluntary coverage.

If you were denied a personal term life insurance policy, buy enough voluntary life insurance to cover your needs.

Assessing your coverage needs isn’t always straightforward. Use our guide to evaluate your situation and understand how much life insurance you should get.

What to Look for in a Voluntary Life Insurance Plan

Here are the things to review when going through your voluntary life insurance plan paperwork:

- Term or Permanent: Is the coverage term or permanent? If permanent, how does it work if you leave the company?

- Portability: Is the plan portable if you change jobs? When is the deadline to apply for portable coverage? Are there health limitations?

- Conversion: Does the plan have conversion privileges in case you aren’t eligible for portable coverage? What type of life insurance does it convert to?

- Spouse and Dependent Coverage: Can you purchase life insurance for your spouse or children?

Contact Quotacy’s team of experts for trustworthy support at any point in your life insurance journey. Our team works on salary, not commission, so we’ve always got your best interest in mind.

Discover Your Needs with Quotacy’s Term Life Calculator

Free group life insurance is a great benefit. It’s always wise to accept any employer-paid group life insurance.

Your basic group life insurance is likely not enough to cover your needs. Everyday items like food and clothes, mortgage and car payments, children’s after-school programs, health insurance, pet-related costs, student loans, electric bills, etc. Would your family be able to cover all these expenses if you died unexpectedly and your income was gone?

If you’re unsure if your group or voluntary life insurance is enough, try our free life insurance needs calculator. You can find out how much life insurance you need to protect your family by answering a few questions.

Note: Life insurance quotes used in this article are accurate as of October 25, 2022. These are only estimates and your life insurance costs may be higher or lower.

0 Comments