Term life insurance policies are only designed to last a certain length of time. Once that period ends, so does the coverage. Conveniently, many carriers include an option to convert a term policy to permanent, often a whole life policy.

Converting term life to whole life is an excellent benefit and an easy process if you need to take advantage of it. In this guide, you’ll learn why a term conversion option is important and how the process works.

Table of Contents

- What Does Converting Term to Whole Life Mean?

- Why Convert Term to Whole Life Insurance

- How Does Term Conversion Work?

- Pros and Cons of Converting

- Converting a Group Plan to Permanent Life Insurance

- Alternatives to Life Insurance Policy Conversion

- Term Conversion FAQs

Have you assessed your coverage needs? Knowing how much life insurance you should have is essential to ensure your loved ones are adequately cared for if you suddenly pass away.

What Does Converting Term to Whole Life Mean?

A term policy provides coverage for a specific term. Commonly, 10, 20, 30, or 40 years. When the term is over, your policy expires, and coverage ends.

When the final policy year ends, coverage expires, and your insurance terminates.

However, most term life insurance includes a conversion option.

This option (also called a term conversion rider) allows you to transform your current term policy into a whole life insurance policy. Then, your coverage becomes permanent and lasts your entire life.

Converting term to whole life also means you don’t need to go through the underwriting process again. Instead, you get to keep your original risk class assignment.

Term Life Insurance vs Whole Life Insurance

Life insurance policies fall under one of two broad categories: term and permanent.

Term life insurance is temporary and affordable. It’s meant to provide financial protection for your loved ones when you need it most.

Whole life insurance is a type of permanent coverage. All policies in this category last until a lifetime.

What makes whole life unique?

- It has a cash value account that accumulates at a guaranteed interest rate

- You can choose a participating policy and earn dividends

- Because of the added benefits, it’s far more expensive than term

Take a deeper dive into the differences between term and whole life insurance to understand how they work.

Can All Term Policies Be Converted Into Whole Policies?

No. Not all life insurance companies offer conversion options on their term policies, but many do.

Depending on your carrier, whole life insurance may not be an option even if your policy is convertible. Some companies offer universal policy conversions instead. Whether you convert to whole or universal life insurance, the conversion process is generally the same.

Why Convert Term to Whole Life Insurance

Life brings many changes, which means your financial goals will likely change as well.

A convertible term policy provides the flexibility life requires. Take advantage of inexpensive term rates with the knowledge that you can convert to a permanent policy later in life if needed.

Terminal illness makes you uninsurable for new traditional life insurance coverage. If you have a convertible term policy, you don’t need to go through medical underwriting again. Even if you were diagnosed with stage 4 cancer, you could convert to a permanent policy ensuring your family will receive a death benefit no matter when you die.

A serious medical diagnosis isn’t the only reason to convert a policy.

Reasons to Convert a Term Policy

- Declining health – If you’re diagnosed with a serious medical condition, converting to whole life can protect your family’s finances if you die prematurely.

- Legal trouble – DUIs, misdemeanors, etc., can make you uninsurable for traditional life insurance. If you need more coverage but are also in some hot water legally, you can still convert your term policy.

- Budget changes – Maybe you originally wanted a permanent policy but could only afford term. If you make more money now and still want lifelong coverage, you could convert.

- Build cash value – A portion of permanent premiums goes into a cash value account that accumulates interest. You can access low-interest loans against this amount during your lifetime to use however you wish. The sooner you convert, the sooner your cash value will grow.

- Protect lifelong dependents – After buying term life insurance, you may become responsible for an aging loved one. Or you may have a child with special needs who will need lifelong care. Converting to a permanent policy can ensure any dependents will be financially secure when you die.

See what you’d pay for life insurance

How Does Term Conversion Work?

Converting your term policy into a permanent policy is quite simple.

- Step 1: Check that your conversion option has not expired.

- Step 2: Contact the insurance company to determine what permanent life insurance products are available for conversion.

- Step 3: Choose how much of your term coverage you want to convert.

- Step 4: Complete the conversion application form and submit it to the carrier.

What Is a Term Conversion Expiry Date?

Every carrier lists a term conversion period in the policy. This is the time frame you’re given to convert.

Some term conversion periods don’t expire until the term policy expires. Some policies state that the term conversion option is only available within the first 5 or 10 years. Look at the fine print in your policy or ask your agent.

What Is a Partial Term Conversion?

Term life insurance is purchased to cover big-ticket things like your mortgage and the costs of raising children. Buying term life insurance with a large face amount (e.g., $500,000 or $1,000,000) is common since these financial obligations are substantial but temporary.

Most people don’t need extensive permanent policies unless they have a high net worth and will owe a large estate tax bill. So, partial term conversions are more common than full term conversions.

A partial term conversion is when you only convert a portion of your term policy.

If you choose a partial conversion, you’re left with two separate policies:

- The remainder of your term policy and your new permanent policy

- The premium on the remaining term policy will drop since the face amount has decreased.

How Much Does it Cost to Convert?

A term conversion rider is included for free on most term policies. There is also no fee to convert. Nonetheless, permanent life insurance policies are much more expensive than term.

When you convert, you get the added benefits of permanent life insurance, but with that also comes paying higher permanent life insurance premiums. Thankfully, your health won’t impact the cost of your new permanent policy, but your age does.

Example:

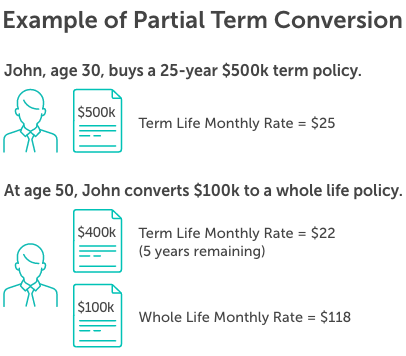

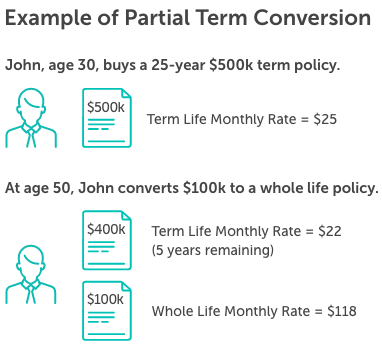

A healthy 30-year-old male purchased a $500,000 25-year term life insurance policy for $25 per month.

At age 50, he decides to convert $100,000 to a whole life insurance policy. The cost of his new whole life policy is $118 per month.

His current term policy has five years left of the 25-year term, and the face amount drops to $400,000, which lowers his monthly premium from $25 to $22.

He now owns two life insurance policies. A $400,000 term life insurance policy with five years of coverage left and a $100,000 whole life insurance policy.

For the next five years, his total cost of life insurance is $140 per month. When the term policy expires, his monthly premium is reduced to $118.

Pros and Cons of Converting Term Life to Whole Life

A conversion option is an excellent benefit to fall back on should you need it. Remember, it isn’t always the best decision. Consider the pros and cons of a term life insurance conversion.

Pros:

- No underwriting

- No medical exam

- Keep your original risk class

- Lifelong coverage

- Accumulate cash value

- Full vs. partial conversion

- Guaranteed death benefit payout to beneficiaries

Cons:

- Converting means higher premiums

- Age is still a factor in converted policy premiums

- Limited policy options

- Must convert during conversion period

- Healthy individuals may consider taking advantage of a competitive insurance marketplace and apply for a new policy instead of converting

Converting a Group Plan to Permanent Life Insurance

When you get group life insurance coverage through your job, you may be able to convert it to an individual whole life insurance policy if you leave that employer or are terminated. These new rates will be age-based and higher than group rates.

Depending on your age and health, getting a new life insurance policy may be a better option than converting a group plan. Still, converting is a good idea if you’re uninsurable for traditional life insurance or can only qualify for substandard rates.

Portability vs Conversion

Many group life insurance policies offer both portable and convertible options. Porting means taking the group coverage with you. The group coverage is typically term life insurance.

The differences between a portable policy and a convertible policy are summarized below.

| Portable Policy | Convertible Policy | |

|---|---|---|

| What type of policy do you get? | Term life insurance | Whole life insurance |

| What is the cost? | Premiums start low, but increase in five-year increments. | Higher premiums than term. Because they are fixed, they’ll never increase. |

| How long does the coverage last? | Up to a specified age (e.g. 75) | Entire lifetime |

| Do you need to answer any medical questions or get an exam? | Evidence of insurability is often required | No |

| Will my coverage change? | Coverage amounts often decrease when you reach a specific age (e.g., 65) | No |

Alternatives to Life Insurance Policy Conversion

A term life insurance policy doesn’t provide coverage forever. If you want more life insurance coverage, there are alternatives to converting.

Buy a New Policy

Depending on your age and health, if your term policy is set to expire soon, you may be able to buy a new term life insurance policy for a better price than converting or renewing your existing policy.

To buy a new term life insurance policy, you’ll have to go through the underwriting process again, but chances are you’ll save a lot of money with this option compared to converting.

Ladder Policies

You may need term life insurance for different financial obligations. To save money, you can choose to buy multiple life insurance policies with different expiration dates. Using this strategy, called laddering, you get the coverage you need at the lowest price.

and have each expire at different times.

Renew Your Term Policy

Most term life insurance policies let you renew your coverage when the term ends. Like the conversion option, you do not need to prove you’re insurable to do so.

Renewing a term policy yearly is not recommended. Each year premiums will get higher and higher.

If an individual is diagnosed with a terminal illness and their term policy will expire soon, renewable term life insurance can save their loved ones’ lives.

Renewing may be better than converting if your life expectancy has significantly decreased and you only have a year or two left to live.

If you’re interested in buying a new life insurance policy, use our term life needs calculator to determine how much coverage you need.

Term Conversion FAQs

Converting a term policy can be a bit confusing. Here are some answers to additional questions you may have about term conversions.

Do Conversion Options Vary Between Life Insurance Carriers?

Yes, conversion options differ between life insurance carriers.

- Not all life insurance companies offer a conversion option on their term policies.

- The permanent products you can convert to can vary between carriers. Some carriers have multiple permanent options to choose from, some have limited conversion products to choose from.

- The window of time you have to convert varies between carriers. Some carriers allow policy owners to convert any time before the level term policy is set to expire. Some carriers limit the conversion window to a certain number of years, e.g. the first 10 years following the date of policy activation. Some carriers base the conversion window on the insured’s age, e.g. conversion available prior to 65th birthday.

How Long Does the Conversion Process Take?

If your request is in Good Order (application is complete and all information needed is submitted), a conversion typically takes a week or less.

What Happens to My Riders on My Term Policy if I Convert?

Some life insurance riders can be transferred to the new policy without evidence of insurability, such as accelerated death benefit riders, waiver of premium riders, and child riders. These rules can differ between carriers, however.

Some products you convert to have new riders you can opt to purchase, for example, long-term care riders are not available on term products but are on some permanent products.

Can the Owner of the New Permanent Policy Be a Different Person?

Some life insurance companies do allow you to change ownership when you convert. Depending on the carrier, the conversion application may include a Change of Ownership section to complete, or you may need to complete a separate form. Your agent or broker can help you gather the correct forms.

Get Dependable Life Insurance Advice in Quotacy’s Blog

Getting life insurance may be one of the most impactful choices you ever make. We expect you to have questions. At Quotacy, we believe everyone deserves access to accurate and trustworthy life insurance resources. Get unbiased answers from our expert-written and expert-reviewed life insurance blog.

As an independent life insurance broker, we work with over 25 of the nation’s top insurance companies. We can help you find life insurance coverage that fits your needs and budget. Compare term life insurance quotes without giving away any personal contact information and apply today.

Note: Life insurance quotes used in this article are accurate as of February 15, 2023. These are only estimates and your life insurance costs may be higher or lower.

Hi thank you for the excellent article.

I have a convertible life policy and pay about 500 dollars per month for 3m cover.

I intend to convert at the age of 70. I was assigned the best health class. I have 5 daughters.

Can you run a calculation please how much my premium will be?

I was thinking if the total premia paid until 100 years old is less than the cover amount then it is worth converting.

If i cannot afford the premium at 70, I might ask my 5 daughters to share and pay for it as they know they will get it likely all back and more.

Hi Peggy Sue, I am not sure what type of policy you plan to convert to nor do I know how much of your $3M term policy you plan to convert, so I am not able to quote how much your converted policy would cost. Contact your agent or insurance company directly and ask them to run a quote for you. If you purchased your term policy through Quotacy, you can call us at (844) 786-8229.

Thank you. I convert the full 3M usd.

It’s just term life with a convertible option that runs to I am 70.

I am

Worried that the premia will be sky high. In the examples below you only conveniently gave numbers when someone converts at 40 I want a dummy illustration for when the conversion happens at 70. I took this 3 m policu out when i was 35.

Hi Peggy Sue, I don’t know what conversion products are available to you. However, I can give you some quote examples to give you an idea of the cost of permanent life insurance if a 70-year-old female were to buy at the best health class.

– A $3,000,000 participating whole life policy with fixed payments until age 100 runs approximately $16,732 per month for a healthy 70 y/o woman.

– A $3,000,000 indexed universal life insurance policy has initial planned premiums running approximately $10,331 per month for a healthy 70 y/o woman.

– A $3,000,000 guaranteed universal life insurance policy with fixed payments runs approximately $8,280 per month for a healthy 70 y/o woman.

These are strictly estimates for a random 70 y/o woman with a Preferred Plus risk class, they are not guaranteed rates. Permanent policies are quite complex and there are various factors to each of the quoted policies. Your converted policy rates may be higher or lower. To get exact quotes, contact the insurance company that wrote your policy. Good luck!

Can I convert a term policy bought prior to the 7702 changes to whole and get the old 7702 whole policy? My company says this only works for original age and not attained age conversion.

Hi James, all carriers are now required to issue new policies, including conversions, based on the new 7702 regulations.

Is the term insurer obligated to notify the policy holder when the conversion date is approaching?

Hi Jon, an insurer may notify you when you’re eligible to convert and when the expiration date is approaching, but they are not obligated to do so. Many insurers do this as a courtesy to their customers.

If you convert your expiring term life to a universal life at age 57, for the amount of 500,000, up until the age of 90, what would the monthly premiums increase to. If it is based on age and no exam is needed. How is the monthly premium determined. Would you have a monthly ballpark amount for the amount above? I know the monthly premium never goes up unless you miss a payment.

Thanks,

Ellen

Hi Ellen,

The monthly premium when you convert is based on what risk class you were originally given, your age, how much coverage you’re converting (full or partial amount), and the product you’re converting to.

When it comes to universal life insurance there are many factors involved. Is it a Guaranteed UL? Indexed UL? Variable UL? Is there a no lapse guarantee? Is it a short pay scenario? Unfortunately, I can’t give you a simple estimate. However, I asked one of our product specialists to run some quotes to give you an idea of price. He averaged together some quotes for a GUL, guaranteed for life, and an IUL, endowing at age 95, and premiums will run you about $550-600 per month for a $500,000 conversion at age 57 at the best health risk class (Preferred Plus).

How does an insurance company benefit from allowing the conversion of a term policy to a whole life plan? What’s in it for them?

Hi Scott, only about 1% of term policy owners (or even less than that) actually convert their policies into a permanent policy. The conversion option is typically only taken advantage of by individuals who suddenly find themselves with a much shorter life expectancy and want to keep insurance coverage in place for loved ones. That being said, the insurance company doesn’t benefit too much from a conversion because more likely than not they are going to be paying out a large death benefit check. While the premiums jump significantly when converting from term to whole, if you aren’t going to be living too many more years then it’s worth it to leave your family the guaranteed death benefit that comes with that permanent policy. Doing right by their customers is essentially what insurance companies get out of offering a conversion option.

Hi Natasha,

When it comes to selling your term policy may I convert it myself or does a licensed agent or agency have to do this for me?

Hi Andy, if you want to convert your term policy into a permanent policy you just need to reach out to your agent. There is a conversion form they can fill out with you. If you bought directly from an insurance company reaching out to their policy service team would be the best place to start.

Great article, very easy to read and understand, simply explained.

Thanks!

Can I just cash out my policy instead of converting it?

Hi Tanya,

Term life insurance policies do not accumulate a cash value like whole life policies do. Therefore, there would be nothing to “cash out.” If you opt to not convert your term policy, your coverage will simply end at the end of the term.

If you purchased a return of premium term policy, then you would get back all the premiums you paid at the end of the term. This is different than a “normal” term policy and does cost more. Thanks for your question!

Can you ask for a 1035 exchange so the cost basis from the term policy transfers over to the new universal life policy?

Term Conversion

Kathy, great question! The simple answer to your question is YES. When structuring a universal life contract to grow cash for distribution at some point in the future a bigger basis means that you can withdraw more money before taking out loans on the contract. It is a very good idea to 1035 the term into universal life if the purpose of the permanent life insurance is for cash value accumulation and distribution. If the purpose of the permanent life insurance policy is for death benefit only, then a 1035 typically will have no benefit.

I like a free term life insurance qoute

Hi Kenneth,

You can get a free term life insurance quote by click this link: Term Quote Tool. It’ll take you to the quoting tool on our website and it is super easy to use.