As you exchange vows and start this exciting new chapter, securing your shared future is the ultimate act of love.

Term life insurance might not be as thrilling as honeymoon planning, but it’s an essential building block for lifelong peace of mind. Here’s what you need to know.

A Golden Opportunity: Why Term Life Insurance Is a Must for Newlyweds

Getting term life insurance early in your marriage can prepare you for a worry-free future. But with so many insurance companies and products to choose from, finding the perfect fit can be daunting.

Don’t worry! Our simple tool lets you compare life insurance quotes online within minutes. But first, let’s break down the essentials of term life insurance.

First Things First: Getting a Policy

- Inclusivity: All married couples, regardless of gender identification, can get term life insurance.

- Early Bird Benefits: Younger couples benefit from lower premiums. Lock these rates early and save money in the long run. Consider the rate table below. A 30-year-old husband can purchase a policy that provides $500,000 in coverage that lasts 30 years for only $29.33 per month.

- Flexible Options: With term insurance, you can customize your coverage to your unique needs. And most policies allow you to switch to a permanent plan later on without undergoing underwriting again.

The Purpose of a Policy: Your Beneficiaries

Life insurance is a great tool to protect your loved ones financially. It provides a tax-free death benefit that your beneficiary can use however they wish.

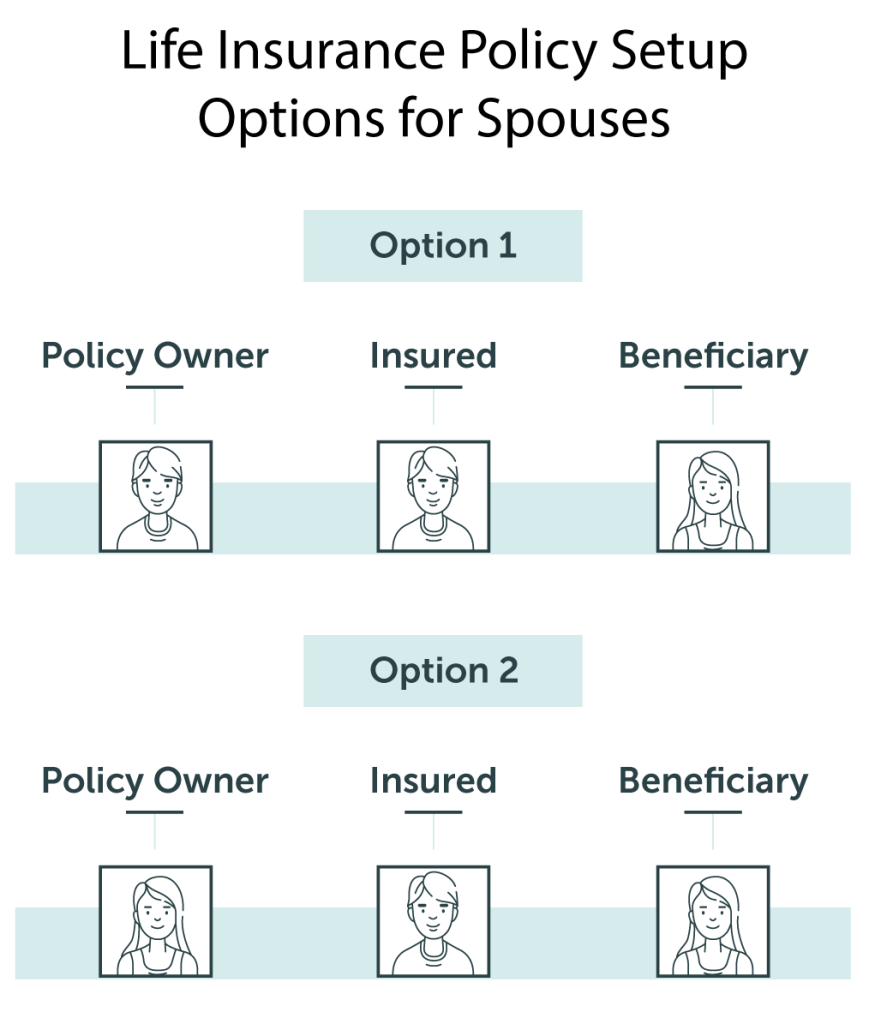

While you can name anyone you’d like as your beneficiary, choosing one of these two setups is most common for newlyweds:

- You as the owner and insured, and your spouse is the beneficiary.

- Your spouse is the owner and beneficiary of a policy that insures you.

Tailored for You: The Best Options for Newlyweds

Term and whole life insurance are the most common types of policies. Term is the most popular for newlyweds because of its affordability and simplicity.

However, it’s important to make an informed choice. Take a closer look at term and whole life to judge for yourself which option suits your needs better.

Term Life Policies

Why it’s Great: Term life insurance is cost-effective and allows you to choose the length of coverage. It’s especially suitable if you want protection during critical years, like raising children or paying off a mortgage. Rates are fixed and don’t increase as you age.

Flexibility: You can select terms ranging from 10 to 40 years and pick the coverage amount that matches your family’s financial needs. Optional riders can also provide additional customization.

Strategy Tip: Consider laddering policies – having multiple term life policies with different lengths and coverage amounts. As your responsibilities decrease (e.g., children leaving home), so does your coverage.

Interested in term insurance but unsure how long your coverage should last? Explore your options.

Whole Life Policies

Why it’s Great: Whole life insurance provides lifelong coverage and includes a savings component where cash value can build up. This is useful if you want to leave a legacy or have a source of funds you can access during your lifetime. Rates are fixed and don’t increase as you age.

Guaranteed Benefits: Premiums are higher than term life, but the coverage lasts a lifetime, and the policy accrues cash value.

Strategy Tip: If you need lifelong coverage, many buy a modestly-sized whole life policy that supplements a more comprehensive term policy. This combination is more cost-effective than relying solely on a whole life policy to meet your insurance needs.

Unsure if you need term or permanent life insurance? Learn about the pros and cons of each: Do I Need Term or Whole Life?

Roadmap to Coverage: How Much Do You Need?

Life insurance is not one-size-fits-all. Here are quick tips to determine the right amount of coverage:

- Assess Financial Goals: What’s coming down the road? Will you have children? Plan to support aging parents? Keeping these things in mind will help you understand the coverage you need.

- List Current & Projected Debts: Grab a calculator and start tallying up your debts – think mortgages, loans, and credit card bills. Don’t forget to add stuff on the horizon, like sending the kids to college.

- Expect the Unexpected: Many families struggle to find funds to pay for unexpected end-of-life expenses, like medical bills and a funeral. Include these costs in your coverage.

Use our free term life insurance needs calculator to effortlessly assess how much coverage will safeguard your family’s dreams.

The Final Vow: A Promise to Secure Your Loved Ones

Your marriage is the beginning of a lifetime of shared dreams and aspirations. Term life insurance is the shield that protects these dreams. So, take the vow to secure your loved ones and embrace the joys of married life with complete confidence.

Ready to take the leap? Start comparing quotes now. You’re not required to provide contact information to see pricing; there’s no obligation to buy after applying.

Let Quotacy Help You Find Your Best Policy

When you apply for life insurance, the insurance company is going to take a look at your risk factors. These factors can include both your medical and lifestyle history.

Health conditions, like diabetes or anxiety, can impact your life insurance costs. As can habits and hobbies, like alcohol consumption and participating in risky activities like skydiving.

Not all insurance companies will look at these factors in the same light. This variation in assessment means your prices can vary depending on the insurer you apply to.

With so many different insurance companies to choose from, how do you know which will give you the best deal? This is when Quotacy comes in.

As an independent broker, we have access to many different insurance companies, but don’t work for them. We work for you.

When you apply through Quotacy, you’re assigned a dedicated agent whose job is to find you the best coverage for your unique circumstances.

- Use marijuana? We have a carrier for that.

- Diagnosed with depression? We have a carrier for that.

- Got a DUI in your past? We have a carrier for that.

- Have your private pilot’s license? We have a carrier for that.

Once we review your application, we’ll shop around to all our 25+ life insurance companies and make sure you’re paired with the best one for you. Consider us your life insurance matchmaker.

Note: Life insurance quotes used in this article are accurate as of July 6, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments