If you’re bundling multiple services from the same company, you’re likely saving a few dollars each month. Bundling internet and cable is extremely popular, as is bundling home and auto insurance.

But what about life insurance?

If you get term life insurance quotes from your home or auto insurance company, are you going to be getting the best rate? Unfortunately, most likely not.

Bundling your life insurance with your other insurance policies may be the only time bundling could cost you money.

What about the multi-policy discount?

It’s true. If you have homeowner’s insurance with Insurance Company XYZ and they say you can save money also buying life insurance from them, you will save money on your homeowner’s insurance. But they legally cannot discount your life insurance premiums.

The life insurance industry is highly regulated. If you get term life insurance quotes from Company XYZ directly through them, these quotes will be the same even if your local agent or a broker runs them for you instead—whether you have another product or service through XYZ or not.

When it comes to life insurance, there are no Groupons or BOGO deals.

Knowing this, you may be wondering: Well, even if my life insurance premium isn’t cheaper, I’ll still save money bundling since my other insurance policy’s rate will decrease with the multi-policy discount.

You may save money in the short term. However, while your term life insurance rates are fixed (meaning they won’t change) your home and auto rates are not.

Insurance companies want you to bundle with them. It’s why they offer multi-policy discounts. If your home or auto insurance policy rates go up, customers tend to stay loyal and don’t want to put time and effort into shopping around for new insurance companies.

Going with your home or auto insurance company for your term life insurance policy, without shopping around first, may cost you money in the long run.

» Calculate: Life insurance needs calculator

Why would I save money on my term life insurance quotes if I didn’t bundle?

The life insurance industry is highly competitive. These companies often adjust their rates and risk classes to keep up with societal changes and in order to reach a larger group of customers. The key to staying solvent as a life insurance company is to spread out risk. Companies want to insure a wide variety of individuals and keeping rates competitive is one strategy in doing so.

If you automatically go with your home or auto insurance company for your term life insurance policy, you’re missing out on a potentially less expensive rate elsewhere. A term life insurance policy can last up to 35 years. And, again, these premiums are fixed so you’d be paying the more expensive premium until your term expires, or you pass away.

The best way to save money on a term life insurance policy is to shop around. Not all life insurance companies evaluate applicants in the same way. There is likely an insurance company out there who will give you better term life insurance quotes than your home or auto company.

We understand that shopping around for a term life insurance policy doesn’t seem like much fun and it sounds time-consuming. This is when a life insurance broker is beneficial.

Quotacy is a life insurance broker. When you apply for life insurance through us, we do the hard behind-the-scenes work for you.

» Learn more: Quotacy Shops Your Case—What Does This Mean?

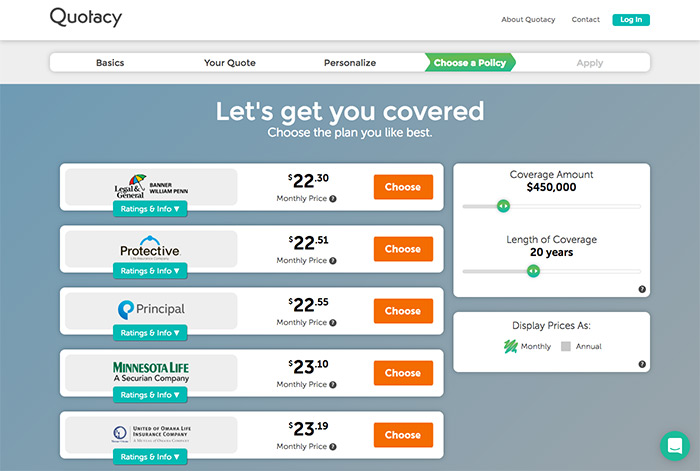

When you run a term life insurance quote and get to the part of the process that requires you to choose a term life insurance policy to apply for, we typically recommend you go with the least expensive one to start.

Your Quotacy agent will then review your application to make sure the company you chose will treat you the most favorably. If not, this is when we shop around for you.

Your agent starts what is called an underwriting study. They send out an anonymous summary of your application to insurance companies we work with to ask what risk class they would approve you as.

This takes about 3-5 business days. Once we receive all the results back from the companies, we will provide you with your best pricing options.

All the insurance companies we work with are top-rated for the best term life insurance. Which means they are financially strong with great industry ratings.

But what if I already bought my term life insurance policy from my home or auto company?

We have clients come to us often looking to replace their current policy. Unlike your cable company, you are not locked in your term life insurance policy. There is no penalty fee to cancel. But be aware that you also don’t get a refund.

Another important thing to note is that if you decide to get a new term life insurance policy, your current age and health will be evaluated for the new policy. If you’re much older or a serious medical condition has creeped in since you purchased your original policy, you may be better off sticking with your current insurance company.

However, it’s free to apply for a new term life insurance policy. You can get a good estimate of what you may pay by running term life insurance quotes. Don’t worry, it’s anonymous to do so on Quotacy. If you like what you see, we can process your application and find out what your premiums would be for a new policy. If you find out that you cannot get a better rate elsewhere, you can walk away and stick with your current policy.

See what you’d pay for life insurance

What if I bundle myself and my spouse together on the same term life insurance policy?

Once again life insurance separates itself from home or auto insurance with this idea. One homeowner’s insurance policy can protect both you and your spouse—same with auto insurance. However, none of the top-rated life insurance companies we work with offer joint term life insurance policies. They are rarely sold in today’s market.

Joint term life insurance is also referred to as first-to-die life insurance. If you and your spouse are insured on a first-to-die policy, if one of you died, the surviving spouse is paid the death benefit and the policy terminates. The surviving spouse is now without life insurance coverage.

In addition to the survivor being without coverage, the premiums for first-to-die life insurance are not based on your individual health risk. If one of you is quite healthy and the other not-so-much, the policy premiums aren’t going to be in favor of the healthier person. Because there isn’t much demand for these policies, the need for insurance companies to keep these rates competitive doesn’t really exist. Ergo, a first-to-die term life insurance policy won’t end up being much cheaper than two individual term life insurance policies anyway.

How do I buy term life insurance policies for myself and my spouse?

Spouses can buy life insurance on each other. Or you can choose to buy life insurance on yourself and name your spouse the beneficiary.

Whether you each decide to own your own policies, buy on each other, or have one of you own both policies, we do recommend that when filling out your applications that you use two different email addresses so communication doesn’t get confusing. Even if the policyowner of both policies is the same person, the agent will need to communicate with the applicant directly.

Examples of Policy Ownership

| Policy One | Policy Two |

| Policyowner: Wife | Policyowner: Husband |

| Insured: Wife | Insured: Husband |

| Beneficiary: Husband | Beneficiary: Wife |

| Policy One | Policy Two |

| Policyowner: Husband | Policyowner: Husband |

| Insured: Wife | Insured: Husband |

| Beneficiary: Husband | Beneficiary: Wife |

| Policy One | Policy Two |

| Policyowner: Husband | Policyowner: Wife |

| Insured: Wife | Insured: Husband |

| Beneficiary: Husband | Beneficiary: Wife |

Your Quotacy agent will keep you and your spouse updated every step of the way as your policies move through the buying process. Your agent works for you, not the insurance companies. If you ever have any questions or concerns, reach out at any time.

» Compare: Term life insurance quotes

Hi, I read your article, and this information it’s very impressive and useful for me. Keep it up

Thank you so much:)