Can you cancel life insurance? If you own the policy in question, you can cancel yours at any time.

Common reasons why people cancel their policies include:

- They simply no longer need it

- They are replacing it with a new life insurance policy.

The type of life insurance policy you’re canceling, either term or permanent, will determine how you cancel it and what happens.

» Calculate: Life insurance needs calculator

How to Cancel a Term Life Insurance Policy

Canceling a term life insurance policy is relatively straightforward. There are no fees to cancel a term life insurance policy and you have two options:

- You can choose to stop making payments: The insurance company will typically send several notices, making it clear that your policy will lapse soon. If you change your mind, there is a 30-day grace period in which you can pay the premium and keep your policy active.

- You can call the insurer to cancel: If you make annual, quarterly, or bi-annual payments instead of monthly payments, this is the ideal method; you can request a refund of the unused premium. Some insurers require a written request. They may ask you to write a letter or complete a surrender form.

Note: If you set-up automated payments be sure to take the appropriate steps to stop these. Most insurance companies allow you to set up ACH payments, also called electronic fund transfers (EFT), so you don’t need to worry about forgetting to make a premium payment. With this method, the insurance company withdraws premium payments directly from your checking account. In this case, you will need to contact the insurance company directly to end the payments. Sometimes the bank needs to contacted as well.

Canceling a Permanent Life Insurance Policy

Most types of permanent life insurance, like whole life insurance or universal life insurance, build up cash value within the policy.

If you, the policyowner, cancel this type of coverage, a set of laws called nonforfeiture values, allow you to claim a fair share of that cash value. Because of this, you shouldn’t stop paying premiums and let the policy lapse; you’ll lose out on money that belongs to you.

Permanent policies are quite complex, so there are some important pieces of information to be aware of first.

Surrender Fees/Charges

Life insurance companies make money by investing policy premiums wisely. These investments are long-term, so owners who cancel after a short period are charged surrender fees to make up for the loss.

The most important things to know about surrender fees are:

- They’re determined how long the policy has been active

- They typically begin at 100% of the value for the first year then decline until they’re gone.

- Once the fee has disappeared, you can surrender the policy for free

These surrender charges are explained in your policy.

» Learn more: Can I Sell My Life Insurance Policy?

Income Tax

If you cancel (surrender) your permanent life insurance policy for the cash value and get more back than you put in, those profits are taxed as ordinary income. If you received any cash benefits like dividends, loans, or withdrawals, those are factored into your net gains.

Here is a simple formula to break it down:

[policy surrender value + cash benefit value] – your total premium payments = Taxable $$$

You aren’t taxed for losing money, so if the formula gives you a negative number, you’re in the clear.

See what you’d pay for life insurance

Canceling a Life Insurance Policy Because You No Longer Need It

As a policyowner, it’s your right to terminate your life insurance policy at any time. Keep in mind that premiums will increase as you age and health issues arise.

If you may need life insurance later on, it’s best to keep your current policy active. If you cancel coverage and reapply several years later, you’ll pay a lot more than you do now. Not to mention you’ll have to take another medical exam.

Canceling a Life Insurance Policy Because You Can’t Afford It

Some carriers allow you to change the coverage amount at certain times. If you need to cancel your policy because you’re struggling to pay the premiums, here’s what you should do:

- Call the insurance company

- Ask them if it’s possible to decrease the face amount

- If it’s possible, they will tell you what your new premium would be.

Even if you can’t afford as much coverage as you want, having a little life insurance is better than none if your family ends up needing it.

Canceling a Life Insurance Policy Because You’re Buying a New One

There are many reasons you may want to replace your life insurance policy with a new one. You may want to take advantage of your good health, or your insurance needs may have changed. Whatever the reason, don’t cancel your current policy until your new one is inforce (active).

» Compare: Term life insurance quotes

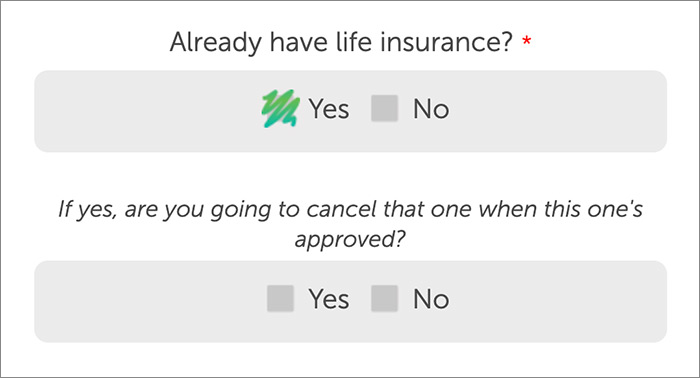

When you apply for a new policy, on the application you will be asked if you currently have any active life insurance in your name and if you are planning on replacing this policy with your new policy. The image below shows what Quotacy’s online application asks.

Knowing that you can own more than one policy at a time, if you still want to cancel your current one, call the insurance company and tell them you want to terminate the policy. But, again, we recommend that you don’t cancel the policy until your new one is 100% inforce and you’ve reviewed it.

The final task on your to-do list if you cancel a life insurance policy is to inform your beneficiaries. It would be awful if you were to die and then your family discovered you no longer had life insurance.

To avoid confusion, you may want to destroy or return the canceled policy documents.

Canceling life insurance policies and replacing life insurance policies are common. Contact Quotacy if you want a new life insurance policy but don’t know what to do about your current one and get a term life insurance quote in seconds without giving away any contact information.

If you purchased your life insurance policy through Quotacy, you can contact us and we can help. Otherwise, you can always simply contact the insurance company directly and they can terminate the policy.

I want my money back

Mustapha, I’m not sure what GCB refers to. Did you purchase your policy through Quotacy? I can’t find your name in our system.

Hi Karabo, contact the insurance company noted on your life insurance policy. They can help.

Please how can I terminate my funeal policy

Vicky, call your insurance company. They can assist you in terminating your policy.

Hello, if you purchased through Quotacy you can contact us directly. Otherwise, you need to contact IFA Clientele.

I don’t need the money just terminate my policies, that’s all I need

Novlet, you need to reach out to your policy’s insurance company directly. Since you did not purchase a policy through us, unfortunately, we cannot help you.

I have no paper work of my life insurance from ALG how do I find out w what my policy terms

Debra, call your insurance company’s customer service department and they can look up your policy using your personal information such as date of birth and SSN. Call them directly, do not leave this information on a public comment board.

Hello, please contact 1Life directly and they can help you terminate you coverage.