Wills and trusts are both estate planning tools. They’re incredibly valuable when planning how to distribute your property and assets when you die.

To utilize them best, you need to know the differences between a will and a trust. In this guide, you’ll learn how wills and trusts work, their differences, and if you should have both.

What Is a Will?

A will doesn’t have to be complex. It can actually be very basic. Still, it’s the most critical estate planning document. It allows you to leave instructions on distributing your assets after your death and includes guardianship decisions for your minor children.

Table of Contents

- What Is a Will?

- What Is a Trust?

- Differences Between a Trust and a Will

- Will or Trust: Which Is Better?

- How Life Insurance Works with Wills and Trusts

It’s never too early to get your end-of-life affairs in order. Learn the seven essential tasks you need to complete to be prepared.

Having a will is essential. If you die without one, your estate management and care of your minor children will be determined by your state’s intestacy laws. Decisions may take months or years in probate court, and costs accumulate throughout this process.

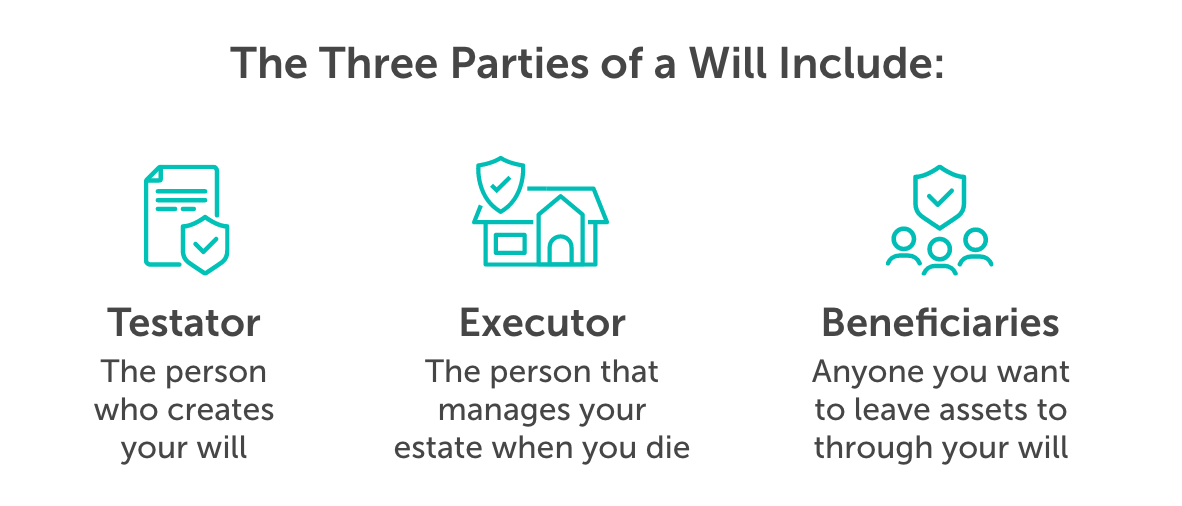

Parties in a Will:

- A testator (the person who creates the will).

- An executor (the person you choose to manage your estate when you die).

- Beneficiaries (anyone you want to leave assets to through your will).

Types of Wills:

- Simple Will: A simple will is the most common type. They name an executor, outline how you want your assets to be distributed, how debts should be paid, and who is to care for your minor children. Care for any surviving pets can also be addressed in a simple will.

- Testamentary Will: A testamentary will places your assets into a trust when you die. A trustee then manages the assets within the trust on behalf of your beneficiaries via the instructions left in the will. It’s helpful if you want to specify how and when beneficiaries can use funds left to them.

- Joint Will: A joint will is when two separate people create nearly identical wills and name each other sole beneficiaries. The will states that when the first person dies, their entire estate goes to the survivor. Once one of the individuals dies, the will cannot be changed.

- Living Will: A living will is very different from other wills. A living will states your medical care and end-of-life preferences should you become unable to decide for yourself.

You create a will while you’re alive, but they don’t take effect until you pass away.

What Is a Trust?

A trust dictates your asset distribution wishes. A trust is more complex than a will. But there are advantages to a trust, such as privacy and the ability to set specific terms.

Unlike a will, some trusts can go into effect once it’s signed.

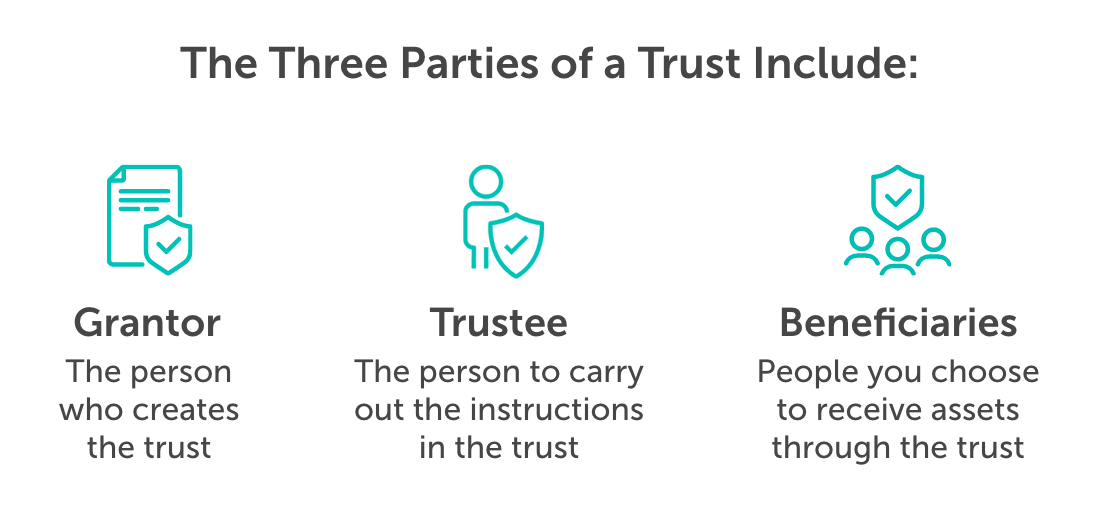

Parties in a Trust:

- A grantor (the person who creates the trust).

- The trustee (the person you name to carry out the instructions in the trust).

- Beneficiaries (the people you choose to receive assets through the trust).

Categories of Trusts:

- Living Trust: A living trust is created during the grantor’s lifetime. Once created, the grantor decides what assets should be in it and then transfers the title of those assets to the trust. The grantor can benefit from the trust while alive. When the grantor dies, the trustee takes over management.

- Testamentary Trust: A testamentary trust is created based on the instructions in a person’s will. It doesn’t go into effect until the grantor’s death. A disadvantage is that the assets have to first go through probate.

- Revocable Trust: A revocable trust means the grantor can alter or terminate the trust during their lifetime.

- Irrevocable Trust: An irrevocable trust cannot be changed once it’s established. The benefit is that all assets transferred to an irrevocable trust are no longer considered part of the grantor’s estate, which helps minimize taxes.

- Funded Trust: A trust is considered funded if the grantor transfers assets into it during their lifetime.

- Unfunded Trust: An unfunded trust is simply an agreement with no assets yet transferred into the trust. It becomes funded when the individual dies, and property is transferred through a will. A disadvantage is that the assets have to first go through probate.

Trusts can fit into one or more of the previous categories. For example, a living trust can be revocable and fully funded.

See what you’d pay for life insurance

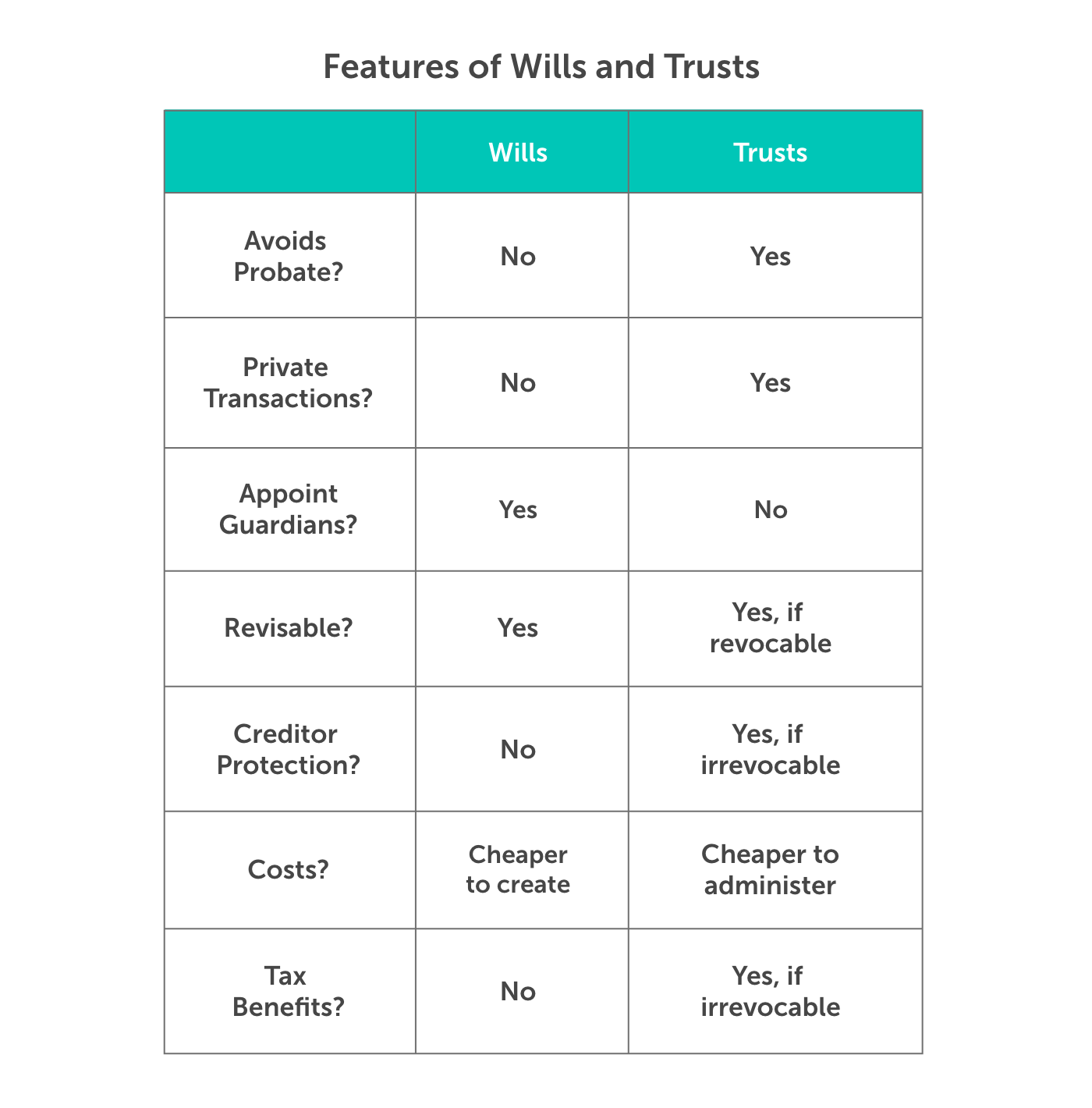

What Is the Difference Between a Trust and a Will?

Wills and trusts are both important documents for estate planning. They are different but complementary. Here’s how they differ.

Probate

A will goes through probate. Trusts do not.

Probate is a court process that validates wills when a person dies and approves the named executor so they can begin to distribute your property and assets according to your wishes. Probate court can take months to finalize, and your estate will need to pay legal fees associated with it.

Privacy

A will goes through probate, which becomes part of the public record. Trusts remain private because they bypass probate.

Creditor Protection

Assets transferred into an irrevocable trust are protected from the grantor’s creditors. This is because the trust is now the owner and the grantor no longer has any rights to it.

Creditors can seek to access assets named in wills and revocable trusts.

Revisions

You can change your will as many times as you want while living. You can also change the terms in revocable trusts while living.

Irrevocable trusts cannot be revised.

Guardian Appointments

A will is critical if you have minor children because you can name who you wish to be their guardian if you die before they are independent. Trusts are not used to appoint guardians.

Tax Benefits

There are no tax benefits through a will.

There are estate tax benefits through irrevocable trusts. When you transfer assets and property into an irrevocable trust, you relinquish ownership. Therefore, the value is removed from your taxable estate. Irrevocable trusts can also be used for gift and income tax advantages, so it’s advisable to work with an estate planning attorney when creating a trust.

Costs

Wills are relatively inexpensive to create. You can often make a simple will online for cheap. If you want a lawyer’s help, it may cost $200-500. In addition, when the testator dies, probate can cost hundreds or thousands of dollars in legal fees. The larger the estate, the higher the cost.

Trusts typically require a lawyer to establish due to their complexities. You can expect to pay $1,000-3,000. DIY trusts are cheaper, but having a lawyer at least review them is wise. Upon the grantor’s death, the distribution of trust assets is less expensive than a will because it avoids probate.

Will or Trust: Which Is Better for Me?

Wills and trusts are both beneficial, and neither is better than the other. Whether you need one or both depends on your financial and family needs.

Many think wills and trusts are only necessary for wealthy people. This isn’t the case.

Everyone has an estate. Whether you have an estate valued under $100,000 or over $10,000,000, wills and trusts can make things easier for your surviving loved ones when you die.

A will may be all you need if you have a simple estate. A will can take care of guardianship for minor children, name a caretaker for your pets, state who you wish to receive what, and instruct how you want any debt handled.

A trust is better if you have complicated family circumstances to handle. There are many different types of trusts, such as a special needs trusts, spendthrift trusts, and life insurance trusts. Each is beneficial for a particular situation.

If you have a complex estate, a trust may be necessary. A trust can manage multiple properties and businesses, reduce estate taxes, and leave specific asset distribution instructions, such as limiting when and how much money your children can access.

Trust vs Will

- Want to leave money and property to specific individuals? Use a will.

- Want to name guardians for your minor children? Use a will.

- Have special needs children you need to plan for? Use a trust.

- Have multiple properties? Use a trust.

- Do you want to limit how your beneficiaries use the money and property you leave to them? Use a trust.

- Want to lower your estate taxes? Use a trust.

Many people would benefit from having both a will and a trust since they can accomplish different things.

How Life Insurance Works with Wills and Trusts

Life insurance, wills, and trusts are all vital to estate planning.

- Life insurance pays a death benefit when you die to the beneficiaries you name on the policy. This payout comes from the insurance company.

- Wills leave assets to beneficiaries you name in the will. You own the assets listed in your will.

- Trusts leave assets to beneficiaries named in the trust. Assets from a will can be transferred into a trust upon your death. Life insurance death benefits can also be paid to a trust.

Life insurance is often used in conjunction with a trust. You can create an irrevocable life insurance trust (ILIT) to protect assets and get tax benefits.

With an ILIT, you name the trust, owner, and life insurance policy beneficiary. It can own either term or permanent life insurance. An ILIT can reduce your taxable estate, provide liquidity to beneficiaries to pay taxes and other expenses or debts, avoid gift taxes, protect government benefits for loved ones receiving aid, and help with legacy planning.

Learn more about the role life insurance plays in estate planning and beyond.

Wills, trusts, and life insurance policies should be reviewed throughout your life to ensure they align with your needs and wishes. Life brings many changes, which may call for beneficiary changes.

Because of the tax implications with trusts, hiring an estate planning attorney is advisable. Wills are more simple, and many people are comfortable creating one themselves.

Get Life Insurance for Estate Planning Today & Protect Your Loved Ones Tomorrow

Fill out a short questionnaire to request a whole life insurance quote, or compare term life insurance quotes in seconds with our easy-to-use tool.

0 Comments