A $250,000 policy is a commonly purchased amount of life insurance. It’s often enough to pay off a mortgage, typically the largest family debt, yet still very affordable. How much is a $250,000 life insurance policy going to cost and is it right for you? To help you answer that question, we are going to take a closer look at some scenarios and example pricing for different age groups, genders, and term lengths.

Table of Contents

- Can Anyone Get a $250,000 Life Insurance Policy?

- When Does $250,000 of Coverage Make Sense?

- How Much Is a $250,000 Life Insurance Policy?

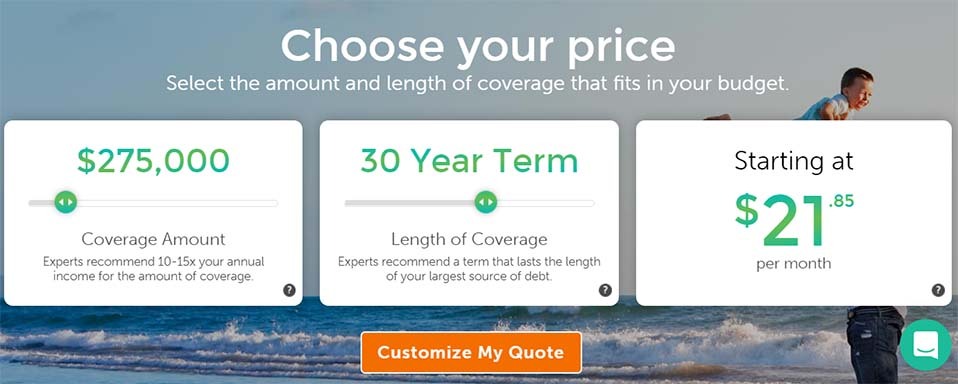

Get an instant quote for $250,000 of term coverage instantly using our free quoting tool below. No need to give away any contact information in order to see real-time pricing estimates.

Can Anyone Get a $250,000 Life Insurance Policy?

Life insurance is meant to replace wealth, not increase it, so, when you apply for coverage, carriers require financial justification for the amount. Most people people can justify $250,000 worth of life insurance.

Be mindful of your insurability limit if you already have coverage but need more. This term refers to the total amount of insurance an individual can hold at one time.

If you are not employed and have no income, then you may not qualify for $250,000. This scenario does not apply to stay-at-home parents, however.

When Does $250,000 of Coverage Make Sense?

A $250,000 term life insurance policy makes sense in many scenarios. The premiums are affordable, and this death benefit cover many expenses left by a provider dying unexpectedly, like a mortgage.

According to a recent study, the average mortgage debt per U.S. household is $236,443. If you pass away and your family can no longer afford to maintain payments, they’ll have to find another place to live.

Ensuring your family can keep their home, even if you pass away is a priceless gift.

When buying a term life insurance policy, be sure to choose a term length that is at least as long as the mortgage loan.

It’s important to note that the difference between the costs of a $250,000 term life insurance policy and a $275,000 or $300,000 policy is typically only a few cents or dollars per month.

One of the great things about buying life insurance through Quotacy is that our quoting tool is easy to use and you can see pricing instantly without giving up any contact information. Use the sliders to change the coverage amount and term length to see how it directly impacts the monthly cost.

You may easily be able to afford to buy a $300,000 term life insurance policy when you originally were only looking for $250,000. What else could your family pay for with an extra $50,000? Funeral costs, medical bills, children’s education funds? Your loved ones can use the life insurance funds however they wish.

How Much Is a $250,000 Life Insurance Policy?

The cost of a life insurance policy is determined by a number of factors such as gender, age, health status, and the policy coverage and term length you choose. A $250,000 term life insurance policy is one of the most affordable options. I’ll illustrate the cost of a $250,000 policy across various ages and risk classes. Term length options vary from 10 to 40 years, but I’ll show the most common to keep things simple.

If something happens to you, term life insurance will financially protect the loved ones you leave behind. You can take pride in knowing you’re shielding them from financial harm should you die unexpectedly.

A $250,000 life insurance policy is budget-friendly, but may not be the right amount for you. Our life insurance needs calculator can help you determine the right about of coverage you need.

If you prefer to talk with an advisor to determine how much life insurance you need, contact us directly here at Quotacy. Our agents are happy to go over your needs, but won’t push you into buying coverage you don’t need.

Note: Life insurance quotes used in this article are accurate as of June 23, 2023. These are only estimates and your life insurance costs may be higher or lower.

0 Comments