A 40-year term life insurance policy is a great opportunity for individuals who want affordable financial protection for their families well into their retirement years.

In This Article

How does 40-year term life insurance work?

Can I get a 40-year term life insurance policy?

Can I get 40-year term life insurance with no medical exam?

Should I get 40-year term life insurance?

How much does a 40-year term life insurance policy cost?

See what you’d pay for life insurance

How does 40-year term life insurance work?

When you buy a 40-year term life insurance policy, you lock in your rate for those 40 years. Even if you develop a medical issue, your rate won’t change the entire term.

For example, a 35-year-old healthy non-smoking male can buy a $250,000 40-year term life insurance policy for under $38 per month. He will have this coverage for the next 40 years until he’s 65 years old.

If he dies prior to age 65, his beneficiaries receive a death benefit check of $250,000. If he is still alive at the end of the term, the coverage simply ends.

Can I get a 40-year term life insurance policy?

A 40-year term is not available for everyone.

- If you are a non-smoker, the 40-year term option is available to people aged 45 and younger.

- If you use tobacco, the 40-year term option is available to people aged 40 and younger.

We currently offer a 40-year term through Protective Life Insurance. They are one of the few carriers that offer a 40-year term. So, if you’re working with a captive agent, like State Farm, Allstate, and Farmers, you won’t have a 40-year term option. Work with an independent life insurance broker so you get the most options and best price.

» Compare: Get your 40-year term quote

Can I get 40-year term life insurance without a medical exam?

It’s possible to get a no-exam 40-year term life insurance policy. Many life insurance companies offer accelerated underwriting programs for eligible applicants.

Accelerated underwriting means that the process goes faster than traditional underwriting and you aren’t required to get a medical exam.

Not everyone will qualify for the accelerated underwriting path. There are health qualifications, such as having blood pressure readings of 140/90 or less and cholesterol levels of 120-300.

After you apply, your agent will let you know if you qualify for the no-exam accelerated underwriting process.

Should I get 40-year term life insurance?

Americans are living longer and working longer in order to meet financial needs. In today’s economy, many Americans carry debt into their retirement years.

Permanent life insurance can provide coverage for your entire life, but it’s very expensive. A 40-year term life insurance policy is a great compromise. It’s much more affordable than permanent insurance and because it lasts quite a while, you can provide financial protection for your loved ones well into your 60s and 70s.

Until now, if you had long-term life insurance needs you had essentially two options:

- Buy a permanent life insurance policy to make sure you have coverage your entire life.

- Buy a 10-30 year term policy and then later on buy another term policy, if you’re still insurable, or convert your term policy.

Each option has its pros and cons.

With option 1, you have coverage your entire life, access to cash values, and possibly dividends, but you’re paying substantially high premiums each month.

With option 2, you have affordable coverage but if you need to buy another policy later on, the term life insurance may not be so affordable any more if you’re facing new health issues—not to mention you have aged. And converting a policy will increase your premiums exponentially.

Enter the 40-year term life insurance policy.

A 40-year term option may not be permanent, but for the budget-conscious buyer, it can make a huge difference to both you and your family.

» Calculate: Life insurance needs calculator

How much does a 40-year term life insurance policy cost?

The longer your term length, the higher your premiums—but these monthly costs are much more affordable than permanent life insurance. And peace of mind to you and your loved ones is priceless.

The table below illustrates some examples of how much a 40-year term life insurance policy may cost you.

40-Year Term Life Insurance Rates for $250,000 of Coverage

Monthly Cost by Age for Healthy, Non-Smokers

| Age | Male | Female |

|---|---|---|

| 25 | $24.75 | $20.15 |

| 30 | $29.41 | $22.16 |

| 35 | $37.64 | $28.71 |

| 40 | $60.64 | $48.17 |

| 45 | $95.91 | $76.57 |

According to the CDC, the average life expectancy in the United States is just over 76 years. A 40-year term policy evens the odds a bit.

Term life insurance is designed to protect against the what-ifs in life. Having term coverage protects your family from financial devastation if you were to die unexpectedly during your prime earning years. However, a 40-year term policy can even protect your loved ones into your retirement years.

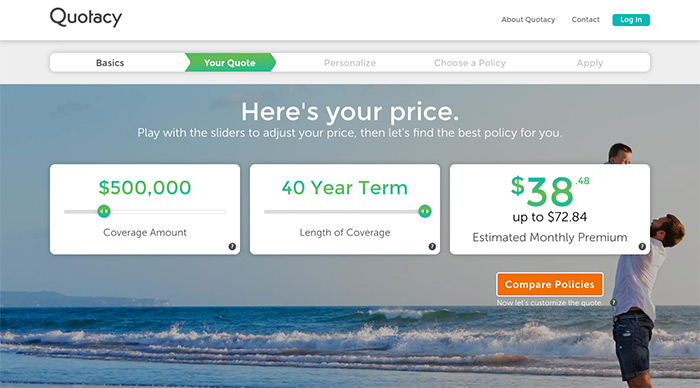

If you’re age 45 and younger, easily find out how much a 40-year term policy may cost you. Simply run a quote and slide the arrow up to 40 years.

If you’re older than 45, there are 35-year term policies available until age 50. And, don’t worry, the 10-30 year terms haven’t gone anywhere. Many life insurance companies offer policies ranging from 10-30 years and your Quotacy agent can help you find a policy that works with your budget.

As an independent broker, Quotacy has access to products from multiple top-rated life insurance companies. Because we work for you and not any particular insurance company, we are dedicated to helping you find the best policy for your family’s needs.

Note: Life insurance quotes used in this article are accurate as of March 3, 2023. These are only estimates and your life insurance costs may be higher or lower.

Very informative article. The video is also a great addition as well.