Thyroid conditions can impact buying life insurance. However, many people with a thyroid condition still apply for life insurance and are accepted for coverage.

Buying Life Insurance with a Thyroid Condition

If you have a thyroid condition, your best chances of getting affordable life insurance is to apply through a broker. Brokers are not tied to one life insurance company and are able to shop the market.

We want you to get approved and will work hard to help you get coverage. Start the process by getting a free term life insurance quote or keep reading for more in-depth information about life insurance and thyroid conditions.

See what you’d pay for life insurance

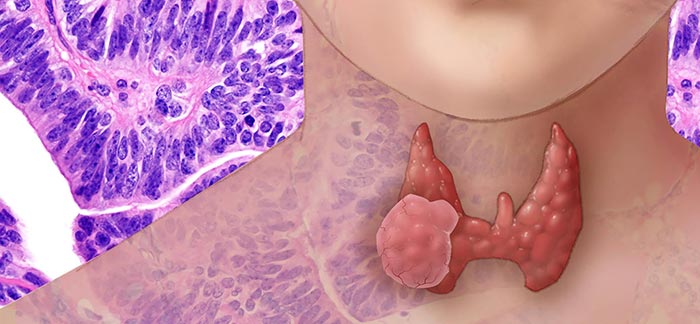

Thyroid Nodules and Life Insurance

Here are some facts from Endocrineweb.com about thyroid nodules and thyroid conditions:

- Thyroid nodules are three times more common in women than men.

- One in 40 young men has a thyroid nodule.

- More than 95% of all thyroid nodules are benign (non-cancerous growths).

- Most people will develop a thyroid nodule by the time they are 50 years old.

- The incidence of thyroid nodules increases with age.

When evaluating thyroid nodules, life insurance underwriters will look into an applicant’s family and medical history. It is very possible for an applicant to receive favorable underwriting outcomes even if there is a history of nodules. Some factors that can bring about positive life insurance offers include:

- No personal or family history of cancer

- Regular doctor follow-ups

- Nodule size is stable

If you have a history of thyroid nodules, you can still apply for life insurance. Your Quotacy agent will work hard to find a term life insurance policy that fits your situation to help you financially protect your loved ones.

Thyroid Cancer and Life Insurance

Thyroid cancer is the most common malignancy of the endocrine system.

The types of thyroid cancer are papillary, papillary-follicular, follicular, medullary, and anaplastic. The long-term prognosis varies with the cell type and the stage.

When life insurance underwriters are evaluating an applicant with a history of thyroid cancer, they will consider the following factors:

- Type of thyroid cancer

- Pathology

- Age of applicant

- Type of treatment and dates performed

- Any remission and for how long

- Any recurrence

- Any complications from treatment

Each life insurance company underwrites medical conditions a little differently. Matching with the right life insurance company is essential for getting approved for coverage.

Below is an example of one life insurance company’s thyroid cancer underwriting guidelines:

- A preferred offering may be available after 10 years from treatment.

- Standard can be considered for lowest grade papillary tumor after 3 years from treatment.

- Standard can be considered for low to moderate papillary tumor 5-6 years following treatment.

- History of anaplastic tumor is declined.

The above example is how one insurance company underwrites thyroid cancer. This is not standard across all insurance companies. Some would be more lenient, some would be more strict.

As an independent life insurance broker, we have contracts with multiple top-rated life insurance companies. If you have a history of thyroid cancer, your Quotacy agent will be able to recommend which carrier will be most favorable to your individual situation. Start the process by getting a term life insurance quote now.

Your personal contact information is not required to see estimated premium pricing. Because of this you are able to window-shop in a private setting. Give us a try. We want to help you get life insurance and make the process as easy as possible.

My hyperthyroidism/Graves disease is being managed with medication. I do have heart palpitations but my Dr. says there are no issues with my heart. I have been seen by a cardiologist and have had numerous tests done. I was recently denied life insurance because the company said “heart palpitations are an abnormality”. But, women who are in menopause can experience them as well. Why cant I get coverage?

Hi Karin, have you worked with a broker that has access with many different companies? I recommend you apply through a broker. A broker can shop your case around to see if there is an insurer willing to offer you coverage. We’ve worked with many clients who have been denied elsewhere because of pre-existing conditions and we’ve been able to find them coverage.

I have Hypothyroidism and I would like to get life insurance

Hi Marir, if your hypothyroidism is being treated and well-controlled, you shouldn’t have a problem getting approved for life insurance. I recommend you apply through our online portal and then your Quotacy agent will review your application and help ensure you get the best life insurance rate possible.