Life insurance products fall into one of two categories: term life insurance or permanent life insurance. Some permanent life insurance policies have a savings component that earns interest. These policies are known as cash value life insurance.

Life insurance policies with cash value are more expensive than those without this feature. In this article, you’ll learn how the cash value in life insurance works and whether these policies are worth the cost.

Table of Contents

- The Basics of Cash Value Life Insurance

- How Does Cash Value Life Insurance Work?

- How to Use Cash Value Life Insurance

- Is Cash Value Life Insurance a Good Investment?

- Do You Need Cash Value Life Insurance?

Looking for ways to use life insurance while you’re still alive? Understand your options and learn which is best for you.

The Basics of Cash Value Life Insurance

Permanent life insurance lasts your entire life. If your permanent policy has a cash value feature, some of your premiums go towards the insurance coverage while the insurance company invests the rest.

This invested amount grows over time and accumulates tax-deferred interest, allowing the cash value to increase gradually.

As a policy owner, you can access the cash value anytime. With that said, it does take a few years for the account to accumulate enough worthwhile funds. There are a few ways to access this money, such as a policy loan or a withdrawal.

- Cash value life insurance is a type of life insurance policy that offers both a death benefit and a savings component.

- Unlike term life insurance, which only provides a death benefit for a specific period, cash value life insurance covers your entire life.

- The premiums for cash value policies are higher than term because of their extra features and guaranteed death benefit payout.

- A portion of each premium payment goes towards insurance coverage, while the rest is invested in a savings account or investment portfolio.

- The policy’s cash value can be accessed through loans or withdrawals or used to pay premiums.

- The policy’s cash value component can grow tax-deferred, meaning that you don’t have to pay taxes on the investment earnings until you withdraw them.

- There are different cash value policies, including whole, universal, and variable life insurance. Each has unique features and benefits.

Cash value life insurance can be more complex than term life insurance, and it’s essential to fully understand the terms and fees associated with the policy before purchasing one.

How Does Cash Value Life Insurance Work?

Life insurance policies require premium payments to remain active. Your payments are divided into three portions:

- Pay for the protection (your beneficiary’s death benefit)

- Pay for the insurer’s administrative expenses

- Contribute to the cash value account

The insurance company invests the money in the cash value account and slowly accumulates based on its interest rate. The interest earned depends on the policy terms.

The following permanent policies accrue cash value in slightly different ways:

- Whole life insurance has a fixed interest rate. The cash value grows slowly but steadily.

- Universal life insurance has a guaranteed floor interest rate and fluctuating interest crediting rate based on current economic conditions.

- Indexed universal life insurance offers a hybrid interest rate structure that combines a fixed interest rate with a potential return based on the performance of a market index, such as the S&P 500.

- Variable universal life insurance allows the policyholder to dabble in various investment options, including stocks, bonds, and mutual funds. The policy’s cash value will fluctuate based on the performance of the underlying investments.

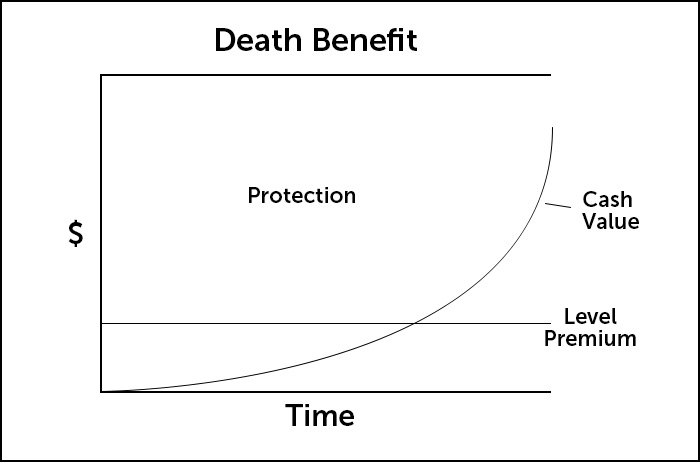

As you continue to pay premiums on the policy and earn more interest, the cash value grows over the years. The cash value may take several years to build up to a significant amount. The image below provides an example of how the cash value grows in a whole life insurance policy.

If you don’t spend your cash value while alive, it will not be added to your death benefit.

Instead, the insurance company keeps it.

If you take out a loan against the cash value and have not paid it back, the balance plus interest will be deducted from your beneficiary’s death benefit payout.

The primary purpose of life insurance is to provide a death benefit to your beneficiaries when you die, and the cash value is a secondary feature of certain types of life insurance policies.

See what you’d pay for life insurance

How to Use Cash Value Life Insurance

Depending on the terms of your policy, there are a few different ways to access your cash value.

Take Out a Policy Loan

You can take out loans against your policy’s cash value. You can think of it as borrowing from yourself.

- You can typically access up to 90% of your policy’s cash value.

- Policy loans are tax-free.

- Policy loans accrue interest like any other personal loan, but the interest rate is typically lower than credit card rates or loans from third-party lenders.

- Policy loans are anonymous and not reported to IRS or credit bureaus.

Taking out a loan decreases your cash value account, slowing its growth because compounding interest has less to build from. You can pay back the loan (or just the interest) during your lifetime, but it’s not required.

If the outstanding balance and accumulating interest exceeds the policy’s total cash value, the policy will terminate. If you die before you repay the loan, your insurer takes whatever is left from the death benefit.

Make a Withdrawal

You may be able to make a tax-free withdrawal from your permanent life insurance policy if you have a universal life insurance policy.

- Withdrawals are permanent deductions from your cash value account.

- If your withdrawal exceeds the amount you’ve paid so far into the cash value portion of your policy, it’ll be taxed as income.

Withdrawals are permanently subtracted from the policy’s value. You can’t pay it back, unlike policy loans. This means there is now less cash value left to earn dividends, accumulate, and borrow against.

A withdrawal also reduces the death benefit paid to your beneficiaries when you pass away.

Surrender Your Policy

Surrendering means canceling your policy and coverage. When you surrender life insurance, your equity is the amount you’ve paid into the cash value portion of your account plus accrued interest.

- If you have any loans or unpaid premiums on the policy, the insurance company subtracts these amounts from the surrender value.

- You may need to pay surrender fees if you haven’t owned the policy for long.

- If the amount you receive upon surrendering your policy exceeds the total premiums paid, the excess amount may be subject to income tax.

Strongly consider your life insurance needs before surrendering your policy. Once you cancel it, you cannot get the policy back.

Use Cash Value to Pay Premiums

Depending on the terms of your policy, you can use the cash value to pay your premiums. But remember that depleting the funds in the cash value account can cause your policy to lapse, ending your life insurance coverage altogether.

Is Cash Value Life Insurance a Good Investment?

While cash value life insurance can provide some living benefits, such as the ability to borrow against the cash value or use it to pay premiums, it’s not considered a good investment strategy or a primary means of saving for the future.

There are several reasons for this:

- Lower returns compared to other investment options, such as mutual funds, stocks, or real estate

- Higher fees than other investment options, which reduces the overall return on investment

- Insurance costs further reduce the amount of money available for investment

For these reasons, financial advisors generally recommend that individuals prioritize other investment strategies, such as contributing to a retirement account, before considering cash value life insurance as a way to save for the future.

However, cash value life insurance may be a viable option for individuals who want both insurance coverage and additional benefits, such as the ability to borrow against the cash value or use it to pay premiums.

Do You Need Cash Value Life Insurance?

Most people don’t need permanent life insurance. Term life insurance is much more affordable and can provide the right amount of protection for families. However, there are cases in which a permanent policy can help achieve your goals.

- If you have a large estate, the life insurance benefit can provide the liquidity needed to pay off estate taxes.

- If you have disposable income and have already maxed out other tax-deferred accounts, it can provide additional tax advantages and accessible funds.

- If you have a lifelong dependent who will need care even after you’re gone, it can provide long-term protection.

Not sure what kind of life insurance you need? Explore the pros, cons, and differences between term and whole life insurance.

If you already have term life insurance and are considering whether you need permanent coverage, prioritize your retirement savings first. This means maximizing your 401(k) and IRA contributions before exploring other financial options.

Once you’ve built a solid foundation for your retirement savings, consider expanding your financial profile with the help of a life insurance broker who can provide guidance on permanent life insurance options that align with your long-term goals.

Contact a Quotacy Agent for a Cash Value Insurance Life Quote

While term life insurance is the most common policy we help our clients buy, we also offer permanent life insurance products, such as whole life, guaranteed universal life, universal life, indexed universal life, and guaranteed-issue life insurance.

Remember, these policies are more expensive than term life insurance policies because they last your entire life and have additional features, such as cash value accumulation.

If you’re interested in cash value life insurance, it is vital to fully understand the terms and fees associated with the policy before purchasing one. If you need help determining what type of life insurance you need, contact us today, and an agent can go through a needs analysis with you.

If you’re ready to get quotes, you can get instant term quotes now. For permanent life insurance, fill out this short questionnaire for a personalized quote.

With a traditional whole life policy that reaches maturity at age 100, if the insured dies at age 101 will they receive the full face value of the policy or only the cash value account?

Hello Chris! They would receive the surrender value of the policy.

My dad took out a life insurance policy on me & my mom told me that I could cash out on it. But my dad has been gone (dead) for 3 years. How can I cash out on it?

Are you the owner of the policy or is your mom? If your mom is the owner, she has the option to surrender the policy and give you the money, or she could transfer ownership to you. Then you would be able to decide what to do with it, including potentially surrendering it for its cash value.

Both of these options may carry tax implications. But without knowing the details of your specific policy, it’s hard to provide accurate advice. I strongly recommend you and your mom contact both a financial advisor and the insurance company to fully understand your options and any potential consequences.

A great article provided. The aim of life insurance is to provide financial protection to surviving dependents after the death of an insured. It is essential for applicants to analyze their financial situation and determine the standard of living needed for their surviving dependents.