Life insurance is important if you’re a caregiver. If you died, how would your loved one be cared for?

As your loved one’s caregiver, you’re irreplaceable.

Whether your loved one is your special needs child, an elderly relative, or a parent needing round-the-clock care, you’re there for them everyday—making them feel loved, taking care of the little things, and making their days as bright as you can.

You’re their protector, provider, and friend.

If your loved one outlives you, you want to ensure that they are still cared for in the same way.

To do that, you’ll need to make sure that there are enough funds available to support your loved one, taking over your financial or care responsibilities.

Life Insurance Can Protect the Financial Future of Your Loved One

Buying a term life insurance policy would provide your loved ones with a death benefit (paid to your named beneficiary upon your passing), which would help cover the costs that you normally covered, such as:

- Utility bills

- Healthcare costs

- Mortgage or rental payments for your loved ones

- Day-to-day expenses

- Property taxes

- The search for a new caregiver

- The costs of a potential move to an assisted living facility

- An emergency funds

- Legal fees associated with the management of your estate and/or your loved one’s guardianship

- Maintenance of insurance premiums

You’re dedicated to providing for your loved ones and making sure that they receive the best care possible. And, with the best term life insurance policy, that devotion won’t end if you pass away.

» Compare: Term life insurance quotes for caregivers

Using Life Insurance to Plan Ahead

There are two things to think about when you begin to look at term life options.

The first is how much coverage you will need to provide for your loved ones if you die unexpectedly. Finding the right amount of coverage—including any optional riders—means that there won’t be any extra burdens on your loved ones (such as funeral and burial expenses) as they mourn their loss.

The second is knowing how they will be cared for if you die unexpectedly.

Perhaps you have a sibling or a partner who may be able to step in. You need to factor in the time that they will spend caring for your family member.

It’s important to get enough coverage to supplement their potential loss of income and provide some compensation for their time (even if they’re not asking to be formally paid).

Additionally, it is possible that at some point your relative will no longer be able to care for your loved one, or that you don’t know of anyone who is willing or prepared to take on the role. If this happens, then your death benefit will allow a smooth transition to an assisted living facility or allow for the hiring of a full-time home health worker.

Term life insurance is the most affordable type of life insurance coverage. It’s customizable by term length and face amount, making it a good fit for most budgets. Term length options vary from 10-40 years.

Your age and health affect the cost of your term life insurance, but once you buy the policy, your rates won’t increase the entire term. This is one reason why buying a term life insurance policy as soon as you have the need is ideal.

As an example of how age and health affect the cost of a term life insurance policy, take a look at the table below.

Preferred Plus, Preferred, Standard Plus, and Standard are different risk classes that are assigned to applicants. If you’re healthy and don’t pose much risk for the insurance company to insure, you can qualify for Preferred Plus and Preferred. Those who are higher risk for insurance companies to insure will have higher premiums.

| Quotes for a 20-Year $500,000 Term Life Insurance Policy for a Non-Smoking Female | ||||

|---|---|---|---|---|

| Age | Preferred Plus | Preferred | Standard Plus | Standard |

| 30 | $15.16 | $19.41 | $26.69 | $29.52 |

| 35 | $17.51 | $22.15 | $29.49 | $32.67 |

| 40 | $24.11 | $30.02 | $39.69 | $43.71 |

| 45 | $36.46 | $42.83 | $58.22 | $66.71 |

| 50 | $55.44 | $65.36 | $84.15 | $98.59 |

| 55 | $84.12 | $96.93 | $124.69 | $149.63 |

| 60 | $142.23 | $161.44 | $221.41 | $260.69 |

Your term life insurance policy will provide a circle of protection around your loved ones and their future caregivers.

In addition to just getting the best term life insurance policy for yourself, there are also a few ways to provide a bit more security.

See what you’d pay for life insurance

Life Insurance Riders Provide Additional Protection

Many life insurance policies offer options called riders, which can be added on to your existing policy or be purchased separately (depending on the rider type). These are important options to consider as a caregiver.

Here are five riders to consider:

Disability Income Rider

The disability income rider allows you to have your premium payments waived and grants you a supplementary income—usually based on the value of your policy—if you become disabled.

Insurance companies usually have limits on how much can be paid each month and for how long you can receive it.

Long-Term Care Rider

A long-term care rider offers a lump-sum benefit to help with costs if you develop severe cognitive impairment or are unable to perform two or more activities of daily living (ADL).

This money, which is deducted from your policy’s death benefit, can cover full-time home care or pay for your nursing home fees. The most that you can receive from this type of rider is a percentage of the face value of your policy.

Note: Long-term care riders are only available on permanent life insurance policies, not term life insurance policies.

Critical Illness Rider

A critical illness rider offers a lump-sum benefit to cover healthcare and other costs if you have a critical illness (such as cancer, kidney failure, end-stage lung disease, or other life-threatening condition). This payment is deducted from your death benefit.

Accelerated Death Benefit Rider

The accelerated death benefit rider pays out a portion of the death benefit if you are terminally ill. This rider is usually included with term life insurance policies at no cost. Benefit payouts are usually capped at $250,000 to $500,000.

Child Rider

If you have a child with a disability or special needs, look into adding a child rider onto your policy.

A child rider is the easiest way to obtain life insurance coverage for your child. While a death benefit is one aspect of what a child rider can offer, another benefit is that purchasing a child rider guarantees your children’s future insurability.

Not all life insurance companies will approve coverage on a child with a disability or special needs. But some life insurance companies won’t ask for medical information when applying for a child rider.

If you want to get a child rider for your child, be sure to tell your Quotacy agent upfront if your child has a disability or special needs. Your agent will make sure you apply to a company that offers a child rider with no medical information.

Regardless of the rider that you might be leaning towards, you’ll need a simple way to select the right term life policy to go along with it.

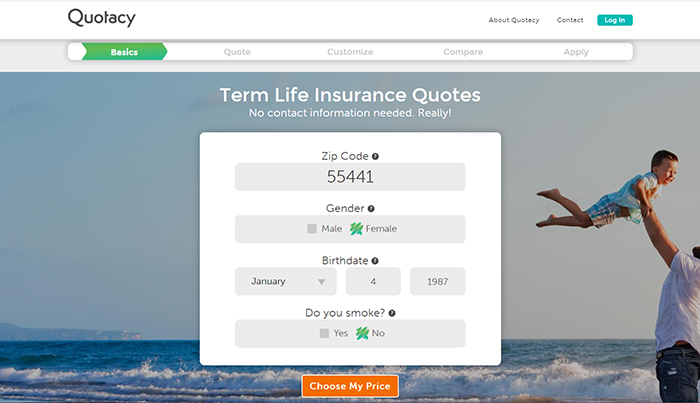

Your next step is to use our free quotes tool.

Applying for Life Insurance as a Caregiver

You’ll be able to compare term life insurance policies from the best life insurance companies side-by-side, select a policy, and apply in under five minutes. Before choosing a life insurance company to apply to, you’ll be shown the riders available for that specific company.

Once you’ve applied, our insurance agents will look at your application and advocate for you to make sure that you’ve got the best rate for the coverage that you need.

If your loved one is expected to outlive you, then you may want to consider permanent life insurance instead of term life insurance. Term life insurance is protection against the what-ifs. Permanent life insurance pays out a death benefit no matter when you die, as long as the premiums are paid.

The problem with permanent life insurance is that it’s much more expensive than term life insurance. Not all families can afford permanent life insurance. Learn more about your permanent life insurance options here.

If your loved one has special needs or a disability and will need care for his or her entire life and are expected to outlive you, we recommend you work with a financial planner. Long-term financial planning in this scenario can be tricky to ensure your loved one doesn’t lose any government benefits.

Naming Beneficiaries on Your Policy

If you’re caring for someone who receives, or is expected to receive, means-tested government benefits such as Supplemental Security Income or Medicaid, it’s important not to name this person directly as a beneficiary of your policy.

“Means-tested” means that having any assets worth more than $2,000 would disqualify your loved one from receiving these benefits.

You can name the person who has agreed to be the guardian for your child, should you die, as beneficiary. But the best option is to create a trust and name the trust beneficiary.

As a caregiver, you have extra responsibilities that you have to think about in addition to your personal obligations. Let us help you find the best life insurance for your family’s needs. In just a few minutes, you can make your loved one’s future more secure.

» Compare: Term life insurance quotes for caregivers

Great