An accelerated death benefit (ADB) is an option on most life insurance policies that enables you, as policy owner, to receive an advance of your policy’s death benefit if you’re diagnosed with a terminal illness. You can use these funds however you wish.

The accelerated death benefit option is also often called a living benefit rider. This rider is free and is typically automatically included on your policy. In this guide, you’ll learn how this rider works and how it impacts your policy.

Table of Contents

- What Is an Accelerated Death Benefit Rider?

- How Does an Accelerated Death Benefit Work?

- Accelerated Death Benefit Examples

- Is an Accelerated Death Benefit Worth It?

- Accelerated Death Benefit FAQs

What type of life insurance do you need? If you aren’t confident, learn about the differences between term and permanent insurance and which is best for you.

What Is an Accelerated Death Benefit Rider?

Life insurance policies have a policy owner, insured, and beneficiary.

- The policy owner and insured are often the same person, but not always.

- The policy owner and beneficiary can also be the same person.

When the insured dies, the beneficiaries receive the death benefit from the insurance company.

With an accelerated death benefit rider, if the insured is diagnosed with a terminal illness, the policy owner can request a portion of the death benefit, thereby accelerating the death benefit.

As a broker, we partner with many top-rated life insurance companies. The accelerated death benefit rider is free on all life insurance policies we offer, both term and permanent products. However, the rider is unavailable in some states.

How Does an Accelerated Death Benefit Rider Work?

First, you must meet the qualifying conditions to access the accelerated benefits.

The requirements include:

- The insured must have a terminal illness.

- The insured must have a life expectancy of 6, 12, or 24 months or less (this can vary by the insurance company and state you live in).

- Typically, the policy must have been inforce for at least two years.

Getting accelerated death benefits is a simple process:

- Obtain a written statement from your doctor stating your prognosis.

- Contact your insurance company or agent to obtain the short benefit request form.

- Complete and submit the form to the insurer.

- The insurer will send you a payout after approval.

Things to know about accelerated death benefit riders:

- The rider is free, but there is typically an administrative charge when the benefit is accelerated. This fee varies by the insurer but ranges from $100-300.

- Some insurers charge interest on your requested amount instead of a fee and deduct the total balance from your death benefit before paying your beneficiaries.

- The amount you can accelerate varies by insurer. Some limit up to 50% of the death benefit, while others allow you to accelerate the entire death benefit amount.

- Most insurers pay out the accelerated amount as a lump sum. Some give the option to receive the benefit as monthly payments.

- Some insurers only allow you to request a death benefit acceleration once under the specific rider.

How acceleration affects your policy:

- The amount you accelerate will be subtracted from your beneficiary’s death benefit.

- If you have a permanent policy with cash value, the accelerated benefit amount will limit access.

- If you have a cash value policy with an outstanding loan, a portion of the accelerated benefit may be used to repay the loan.

What Is the Purpose of This Rider?

Accelerated death benefits allow policy owners access to money if their life expectancy is drastically reduced.

This feature was introduced in the 80s when the AIDS epidemic was at its peak in the United States. During that time, many individuals with terminal illnesses needed financial assistance to cover the costs of their medical care and resorted to selling their policies.

Life insurance companies recognized that policy owners facing terminal illnesses needed financial support, and the first ADB riders were created. These riders’ primary purpose was to provide terminally ill policy owners an option to alleviate financial burdens and improve their quality of life.

Today, you can use your accelerated benefits however you want. You don’t need to use the money strictly for medical care, even though that is a common choice.

Some common ways people use their ADB include:

- Paying off medical bills

- Covering expenses associated with palliative or hospice care

- Trying experimental treatments your health insurance won’t cover

- Taking your family on a memorable vacation

- Completing your bucket list

- Prepaying for funeral expenses

Other Types of Accelerated Benefits

Accelerated death benefits are known as “living benefits” since you can use portions of your policy’s death benefit while still alive. A terminal illness accelerated death benefit rider is the most common living benefits rider attached to a life insurance policy.

Still, there are other similar living benefits riders to be aware of.

- Critical Illness Rider: This rider lets you accelerate death benefits if diagnosed with a critical illness. Eligible illnesses vary by company but generally include cancer, heart attack, stroke, kidney failure, vital organ transplant, and paralysis.

- Chronic Illness Rider: This rider lets you accelerate death benefits if you can no longer perform 2 out of 6 activities of daily living (ADLs). Your doctor will need to diagnose your condition as permanent to qualify.

- Long-Term Care Rider: This rider lets you accelerate death benefits if you cannot perform 2 out of 6 activities of daily living (ADLs) for at least 90 days.

Learn about other ways you can use your life insurance policy while alive.

See what you’d pay for life insurance

Accelerated Death Benefit Examples

Riders with living benefits can be very beneficial to individuals during difficult times. These hypothetical examples help illustrate real-life situations where people might use life insurance with accelerated death benefits.

Example 1:

John, a 55-year-old father of two, was diagnosed with stage IV pancreatic cancer. His prognosis is poor, and his doctors have estimated he has less than 12 months to live.

John has a life insurance policy with a $500,000 death benefit and an accelerated death benefit rider. He decides to access 50% of his death benefit ($250,000) through the ADB rider to cover his medical expenses, including costly treatments not covered by his health insurance.

When John dies, his wife, the policy’s beneficiary, will receive the remaining funds. She can use this money to pay off the family home, ensuring the family can continue to live there without worrying about mortgage payments.

Example 2:

Sarah, a 68-year-old retiree, was diagnosed with early-onset Alzheimer’s disease. As her condition progresses, she cannot perform several activities of daily living (ADLs) without assistance.

Sarah has a life insurance policy with a $300,000 death benefit and a chronic illness ADB rider.

She decides to access 30% of her death benefit ($90,000) through the ADB rider to cover the costs of a professional caregiver who assists her with daily tasks and provides companionship.

The funds also help modify her home to accommodate her changing needs, such as installing safety rails and a walk-in bathtub.

Example 3:

David, a 45-year-old executive, suffers a major heart attack and requires bypass surgery and extensive recovery.

He has a life insurance policy with a $1,000,000 death benefit and a critical illness ADB rider.

Due to the severity of his condition and the long recovery period, David decides to access 20% of his death benefit ($200,000) through the ADB rider.

He uses the funds to pay for his medical expenses, including rehabilitation and therapy not fully covered by his health insurance. Additionally, David uses the remaining amount to supplement his lost income during his recovery and cover his family’s living expenses.

Is an Accelerated Death Benefit Worth It?

An accelerated death benefit rider is absolutely worth it. These riders are free on most life insurance policies, and you’re only charged a fee or interest if you decide to use it.

The proceeds you receive through this option can be life-changing. Maybe the experimental treatment you can pay for extends your life. Perhaps you make everlasting memories on one final family vacation.

It’s important to remember that the amount you accelerate is deducted from what’s left to your beneficiaries.

Ultimately, if you had one year or less to live, wouldn’t you be glad to know that you can immediately receive a portion of your policy’s death benefit to spend in any way you wish?

Accelerated Death Benefit FAQs

Have more questions about life insurance accelerated death benefit riders? These Q&As may help.

How Much Does This Rider Pay Out?

The payout from an Accelerated Death Benefit (ADB) rider depends on several factors, including the specific terms of the rider and your life insurance policy’s death benefit amount.

With an ADB rider, you can access up to a certain percentage of your policy’s death benefit, typically ranging from 25% to 100%, up to a maximum specified limit, depending on the insurance company.

What Does the Payout Process Look Like?

- Submit your claim and provide documentation that supports your request.

- The insurance company will review the claim and verify your eligibility.

Once the claim is approved, the insurance company may offer various payout options, such as a lump sum, regular monthly payments, or a combination.

You choose which best suits your financial needs. After selecting the payout option, you’ll receive the accelerated death benefit according to the desired payment schedule.

Can This Rider Impact My Policy’s Death Benefit?

If you use the rider and accelerate your benefits, this rider impacts your policy’s death benefit—the amount you use while alive is deducted from what your beneficiaries ultimately receive.

Are Accelerated Death Benefits Taxable?

In general, accelerated death benefits are not taxable if you’re terminally or chronically ill, as defined by the Internal Revenue Service (IRS). However, there are exceptions where the benefits could be taxable:

- If the benefits exceed the cost of qualified long-term care services: When the benefits are used to pay for qualified long-term care services, only the amount that exceeds the actual cost of these services may be considered taxable income.

- If the policy is transferred to another individual: If you transfer ownership of the policy to another individual (e.g., by selling or gifting the policy), the accelerated death benefits may become taxable to the recipient.

- If the benefits are received from a modified endowment contract (MEC): Accelerated death benefits received from a modified endowment contract may be taxable.

Please note that tax laws and regulations can change, and your specific situation may have unique factors that affect taxability. It’s recommended that you consult with a tax professional for advice tailored to your circumstances.

Did you know that an accelerated death benefit isn’t your only policy rider option? There are a host of other potential add-ons that may benefit you. Learn about the other riders that exist.

Get a Life Insurance Quote and See Your Rider Options

Life insurance serves as a crucial financial safety net for your family. It provides peace of mind for them and you. Get a free term life insurance quote instantly—no contact information is required to see pricing.

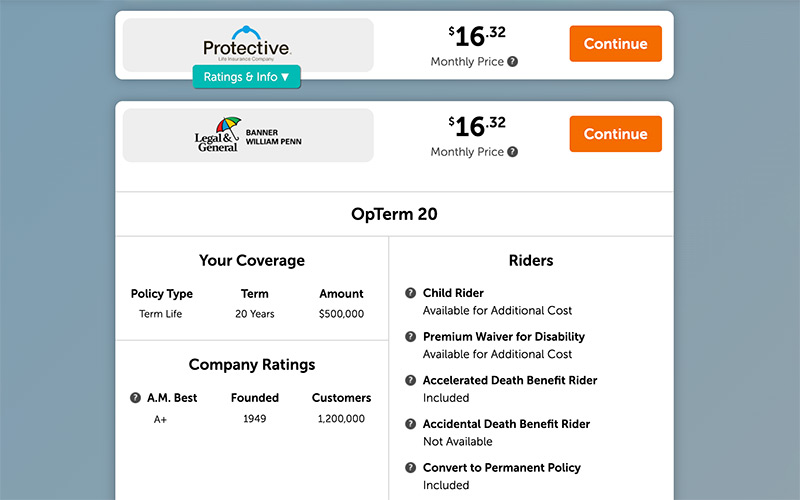

When you apply for life insurance on Quotacy, you’ll be shown what policies you qualify for.

You’ll also see which riders are available under each policy. Just hit the drop-down “Ratings and Info” tab.

Quotacy is an independent life insurance broker, and we offer products from many different insurance companies. All the companies we work with are A-rated or better, so you can be confident when choosing an insurer.

Interested in learning more about all the carriers we work with? Explore here: Carriers we work with.

0 Comments