End-of-life planning isn’t a fun task, but it’s necessary. Without plans in place, your death will add undue stress and anxiety to the grief your loved ones are already trying to manage.

Understanding how to prepare for death is not only for your peace of mind but for your family’s. In this guide, we share how you plan for death, including the documents you need for end-of-life planning and the preparations you should make.

Table of Contents

- Last Will and Testament

- Durable Power of Attorney

- Living Will

- Durable Healthcare Power of Attorney

- Estate Settlement

- Life Insurance

- Funeral Arrangements

Learn more about life insurance and the role it plays in estate planning.

Preparing for Death: It’s Never Too Soon

We’re going to die. We just don’t know when. We also don’t know how we’re going to die. Will it be due to old age? Will it be a sudden accident?

You see it on the Go Fund Me website constantly. Families are desperate for help because their loved one died unexpectedly without end-of-life plans.

No one wants to think about dying, but your loved ones pay the price if you don’t.

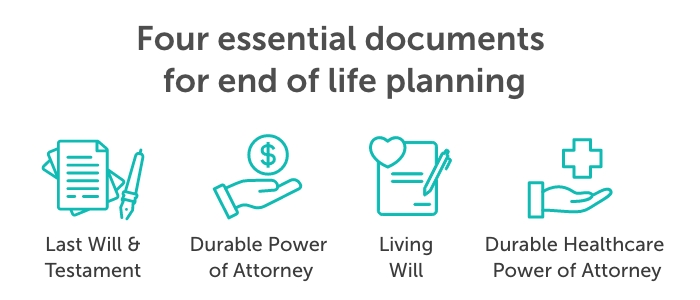

4 Essential Documents for End-of-Life Planning

Burial or cremation? Funeral or celebration of life?

If you’re in a coma, do you want to be kept alive at all costs? Do you wish to donate your organs?

Don’t force your family to make these tough decisions for you. Make end-of-life arrangements and answer these critical questions before it’s too late.

Last Will and Testament

In a will, you make three critical decisions:

- Who inherits your property

- Name guardians for your children (the most important part of a will if your children are minors)

- Document your funeral wishes

A court process called probate occurs when you die to validate the will and ensure the stated instructions make legal sense.

In a will, you also have the option to designate an executor. An executor carries out the instructions you leave in your will. If you do not choose an executor, the probate court will name a representative to carry out the instructions. An executor/representative does not receive their power until you, the will’s creator, die.

A will cannot direct everything you own. If you own something jointly with rights of survivorship, the joint owner will take over ownership. For example, if you and your spouse jointly own a vehicle (both of your names on the title), you can’t leave the car to your brother in your will. The car must pass on to your spouse when you die.

Other situations that override a will:

- Beneficiaries named on:

-

- retirement accounts (e.g., IRA)

- bank accounts (typically referred to as payable on death designations, not beneficiaries)

- life insurance policies

- annuities

- living trusts

- Community-property

Having a detailed will makes life much easier for your family. It assures that there’s no confusion about asset and property allocation after your death, and there’s no guesswork as to how you wish to be laid to rest.

Learn more about wills and how they work.

Durable Power of Attorney

A durable power of attorney (POA) document allows you to appoint a person, known as an attorney-in-fact or agent, to manage your financial and personal affairs if you cannot. Unlike a simple power of attorney, a durable power of attorney remains valid even if you become incapacitated, e.g., comatose or dementia.

Not having a durable power of attorney can add undue stress on loved ones who are already emotionally exhausted. Not to mention, it’s not uncommon for animosity between family members to creep in during these stressful situations.

It’s important to note that your durable power of attorney does terminate when you die. Your estate executor and durable POA agent are two different roles. Even if you name an executor in your will, this doesn’t mean you have designated a durable POA agent. You can have the same person do both roles, but you must create a will and a durable power of attorney.

Living Will

A “living will,” “healthcare directive,” and “advance directive” all refer to the legal document that states your wishes for end-of-life medical care if you are incapacitated and unable to express these things yourself.

Without this document, family members and doctors are left to guess what you would prefer regarding treatment. They may end up in bitter disputes, occasionally making it to a courtroom.

The following are important things to address in a living will:

- Do you want all pain relief options available, even if they may have the side effect of unintentionally hastening your death?

- Which life-sustaining options do you want? Which don’t you want? How long do you want these to continue if your condition doesn’t improve?

- Would you want artificial life support removed if you are found to be irreversibly brain dead?

- Do you want to donate your organs and tissues?

- Would you like your body to be cremated, buried, or donated to science?

A living will must meet state requirements regarding notarization or witnesses to be valid. A living will can be revoked at any time as long as you are mentally capable.

Living wills are often used in conjunction with your healthcare power of attorney. A living will is specifically for end-of-life medical treatment, while the healthcare POA encompasses all other types of medical treatment.

Durable Healthcare Power of Attorney

A healthcare power of attorney, also called a medical power of appointment, is a document that appoints a person the authority to make medical decisions for you if you cannot.

Unlike a living will, a healthcare power of attorney is not limited to you being terminally ill or permanently unconscious. Even if you’re temporarily unable to make your own medical decisions, a healthcare proxy can speak on your behalf.

If you don’t have a living will or haven’t made any statements in your healthcare power of attorney about your desires, it will be up to the person you designate as a proxy to determine what you want in a particular medical situation.

Durable Healthcare Power of Attorney vs Durable Power of Attorney

Although they have similar names, your healthcare power of attorney and durable power of attorney are two separate documents.

- Naming an agent in one does not make them the agent in the other.

- You can have the same agent for healthcare and financial matters, but you must create both documents.

- The healthcare agent and POA agent should see eye-to-eye. They will likely work with each other to carry out their duties.

Use our estate planning checklist to ensure your end-of-life arrangements are in order.

See what you’d pay for life insurance

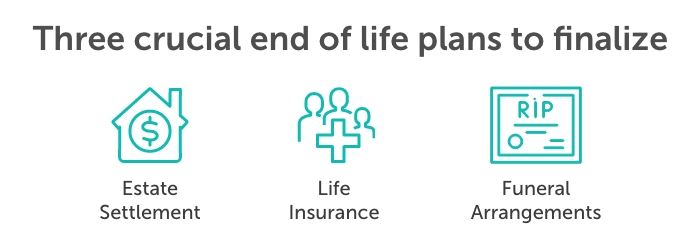

3 Crucial End-of-Life Plans to Finalize

Part of preparing for death is planning ahead for your family’s finances. Can they easily pay for your funeral? Will there be estate taxes? Can they continue their standard of living, or will they be thrown into financial turmoil?

Estate Settlement

Even if you aren’t worth millions of dollars, you still have an estate. An estate plan isn’t just for the rich or elderly.

The executor of your estate will be in charge of estate settlement. They’re responsible for collecting money owed to your estate, paying outstanding debts, and distributing the money left in the estate.

In addition to paying off credit card debt, auto loans, and personal loans, payments of debts owed will include any federal and state income, estate, and inheritance taxes. An estate has to be quite large to get hit with a federal estate tax, but even modest estates can get hit with a state estate tax.

The money to settle the estate comes from your assets. If you don’t have enough liquid funds, property will be sold to pay off these debts. This means your heirs inherit less.

One way to ensure your heirs inherit your assets is to get life insurance.

Life Insurance

Life insurance is included in your taxable estate, but it’s not taxed when paid out to your beneficiaries. Your heirs can use the policy’s death benefit to pay off your debt and estate taxes rather than sell sentimental assets to make those payments.

Term Life Insurance

Most families only need term life insurance. Term life insurance pays a death benefit if you die while the policy is inforce—term length options range from 10 to 40 years.

Term life insurance protects against the what-ifs in life. “What if I die suddenly in a car crash?” “What if I’m diagnosed with cancer?”

With term life insurance, your family receives a death benefit if you die too soon. The death benefit can be used to pay for end-of-life expenses and the everyday things your paychecks once covered.

Permanent Life Insurance

If you have a large estate or loved ones who will be financially dependent on you their entire life, then you’ll benefit from permanent life insurance. Permanent life insurance, whole life insurance being one of the most common, is designed to last your entire life. This policy will provide a death benefit when you die, not if you die.

Due to the tax benefits, permanent life insurance is often used for high-net-worth estate planning. It’s also a popular way to pay estate taxes and provide liquid inheritance to beneficiaries.

Because of the high premiums on permanent life insurance, the majority of families would benefit most from buying term life insurance while putting money towards emergency savings and retirement funds.

Unsure which type of life insurance is best for your situation? Learn more in our term versus whole life guide.

Funeral Arrangements

Some people have precise wishes regarding how they want to be laid to rest. Others don’t care much at all. Even if you’re the latter, consider documenting your preferred funeral arrangements so your loved ones don’t have to stress over it.

It’s recommended to state your wishes in both your will and living will. Tell the chosen executor of your estate or another trusted person about where your final wishes are documented.

Burial vs. Cremation Considerations

The first step in end-of-life preparation is choosing whether you’d rather be buried or cremated. The costs are significantly different between the two.

- Average Burial Cost: $7,000 – $12,000.

- Average Cremation Cost: $1,000 – $3,000. Cremation is far cheaper because no gravesite fees, caskets, cemetery fees, or headstones are involved.

If you choose to donate your body to science, this is often less expensive overall because the organization receiving your body pays for many expenses.

Funeral Considerations

Funerals can be held whether you’re buried, cremated, or donated. Funerals typically have four parts:

- Visitation

- Funeral

- Committal

- Reception

If there are specific things you want to be done at your funeral, tell your family. For example, people will often say they want a certain song to play or would prefer a charity donation instead of flowers.

Prepare for your death financially so your loved ones aren’t struggling to find money for a funeral. Here are some of the costs to consider*:

- Non-declinable funeral service fee: $2,300 (covers the cost of planning, permit, death certificate paperwork, and administration fees)

- Additional service fees: $1,400 (things like transporting the body to the funeral home and preparing the body)

- Facility use: $515

- Hearse: $350

- Casket: $2,500 – $10,000

- Vault: $1,572 (not always required)

*Dollar amounts are based on a study by the National Funeral Directors Association.

In addition to a funeral, people often gather together for a reception, memorial service, or celebration of life. This may include additional costs such as a venue, food, beverages, and music.

Find Life Insurance to Cover End-of-Life Plans

End-of-life planning relieves your family of a huge burden. As your loved ones are grieving your death, the last thing you want for them are financial struggles and arguments over your final wishes.

Preparing for End-of-Life Checklist:

- Last Will and Testament

- Durable Power of Attorney

- Living Will

- Healthcare Power of Attorney

- Funeral/Burial Arrangements

- Life Insurance

If you don’t already have life insurance, take time now and think about whether your family would be financially impacted if you suddenly died. You should have enough life insurance to replace your income and cover end-of-life expenses.

As an independent broker, Quotacy is your advocate in the life insurance buying process. Try our easy-to-use quoting tool to compare policies and apply for coverage today.

It makes sense that living wills are made to help family members and doctors understand what kind of treatment you would like to receive. My uncle is interested in becoming a construction worker in order to save money to afford his son’s education, but he wants to make sure that he is taken care of if he becomes paralyzed after an accident. Maybe he should find a professional that can help him write a living will.