Term life insurance is temporary life insurance coverage. It’s meant to protect a family during their most vulnerable financial time. This is typically when the family includes minor children and has a mortgage. The term policy is there to replace a breadwinner’s income should the worst happen.

Theoretically, once the term expires, so does their need for coverage because the children are grown and the mortgage loan is nearly paid off, if not completely paid off.

While term life insurance is overall an affordable product, the longer the term length of the policy, the higher the premium will be. The premiums are higher because the older you are, the closer to death you become, so the odds of the insurance company paying out a death benefit increase. They factor this risk into the premiums.

You can see in the example table below, the pricing difference as the term length increases.

| Quotes for $500,000 Term Life Insurance Policy for Healthy Male Aged 30 | |||||

|---|---|---|---|---|---|

| Term Length: | 10 Year Term | 15 Year Term | 20 Year Term | 25 Year Term | 30 Year Term |

| Monthly Premium: | $14 | $16 | $21 | $30 | $35 |

Premiums Increase When You Apply for a New Term Policy

If you find yourself wanting more coverage after your term ends, you’ll find that the premiums have increased dramatically.

Using the example from above, if this applicant purchased a 20-year term policy and then decided at the end of his term that he wanted to purchase another policy, it’s going to be much more costly because he is now 50 years old. The life insurance company knows that the odds of having to pay the death benefit at some point have increased greatly.

| Quotes for $500,000 Term Life Insurance Policy for Healthy Male Aged 50 | |||||

|---|---|---|---|---|---|

| Term Length: | 10 Year Term | 15 Year Term | 20 Year Term | 25 Year Term | 30 Year Term |

| Monthly Premium: | $47 | $65 | $85 | $133 | $144 |

As you can see, adding twenty years in age to the applicant changes the monthly premiums by a decent amount. And this isn’t even taking into consideration that the applicant may have developed a health condition at some point within those twenty years.

This leads to another reason why premiums increase at the end of a policy: your health.

As you age, it’s not unusual to develop some sort of health issue, whether that’s high blood pressure, osteoporosis, or something much more serious such as cancer. The less you are from perfect health, the higher your life insurance premiums are likely to be because, again, the higher the risk for the insurance company.

One way to get out of having to deal with higher premiums based on health is to purchase a term life policy that includes a term conversion option.

See what you’d pay for life insurance

Premiums Increase When You Convert to a Permanent Policy

Term conversion riders are nice to have just in case you do decide you need life-long coverage.

A term conversion allows you to convert your term policy into a permanent policy regardless of your health. Your age still comes into play, but if you develop a health issue along the way, the life insurance company does not take it into consideration.

When you convert to a permanent life policy, your premiums will increase because of your new age and because permanent policies are more expensive than term policies in general since they are designed to last forever. They typically also accumulate cash value you can access while you’re still living.

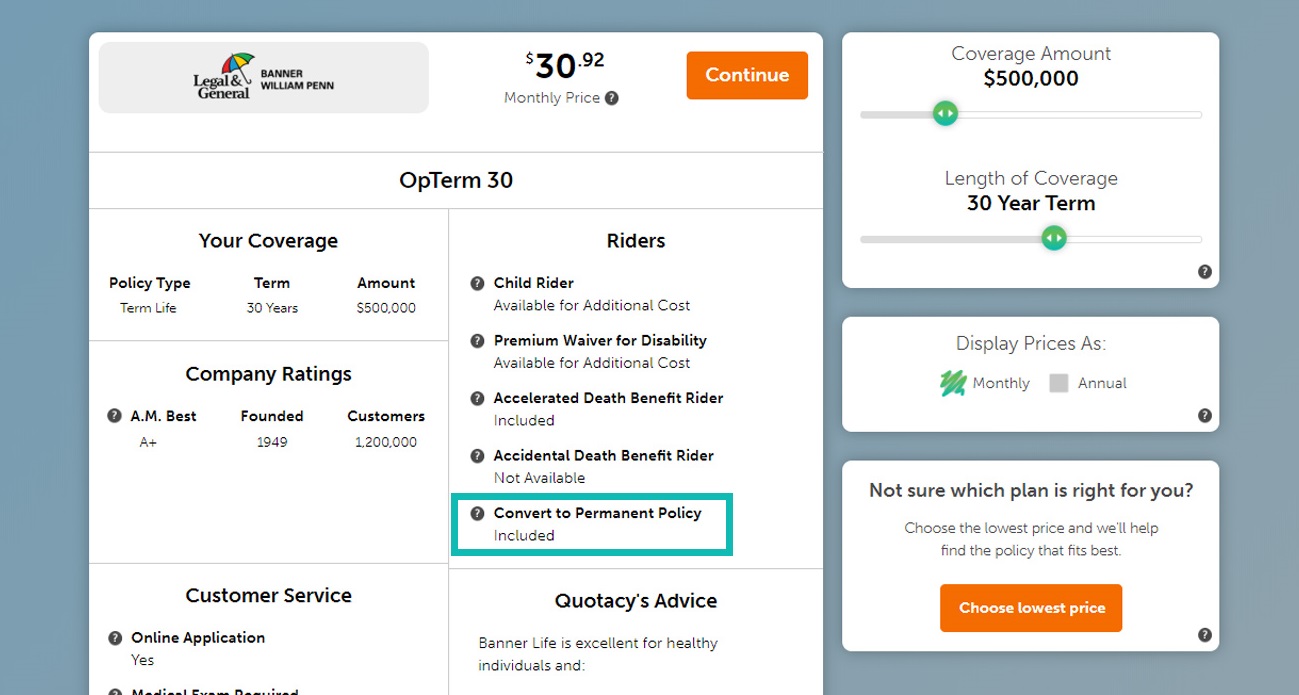

Most term life policies include a conversion option, but it’s always best not to assume. If it’s something you’re interested in, be sure to ask your agent if the policy you want to purchase has one. When you purchase a term life insurance policy on Quotacy, we let you know before you choose which policies include a free conversion option.

Be sure to take note of when your term policy’s conversion expiration date is. Some carriers only allow conversions within the first few years while others will allow it at any point during the term.

If you decide to convert, allow plenty of time to send in the paperwork for processing. The processing must also be completed before the expiration date. Most carriers do not have conversion grace periods.

The best way to avoid paying increased premiums is to buy the right amount of life insurance the first time. According to LIMRA, an estimated 29 million insured adults believe they need more life insurance coverage.

To help you determine how much coverage your family needs, check out our life insurance needs calculator. In a few simple steps, you can get a much better understanding of how much term life insurance coverage you need to protect your family.

Premiums Increase When You Renew Your Term Policy

Unfortunately, you’re not a mind reader and can’t always predict what will happen to you down the road. You may exercise regularly and eat salads every day, yet you could still get diagnosed with an unexpected critical disease, such as cancer.

If you have a short time left to live, you may decide you need to keep being covered, even if you have already passed the term conversion period. Many carriers allow policyowners to renew their policies at the end of the term, but for a price.

Life insurance companies realize the only reason someone would choose to renew their term policy (versus applying for a new one or converting to a permanent policy) is because the individual is desperate. And if you’re desperate to make sure you have life insurance, it’s likely you know you don’t have much time left.

For example, let’s say our 30-year-old male from the above examples is now 49 years old and was just diagnosed with a terminal illness. His doctor gives him a maximum of two years left to live.

The expiration date to convert his term policy has passed and he only has one year remaining on his term policy. He wants to make sure his family receives a death benefit to pay for his funeral, medical expenses, and have the funds to finish paying for his children’s college tuition.

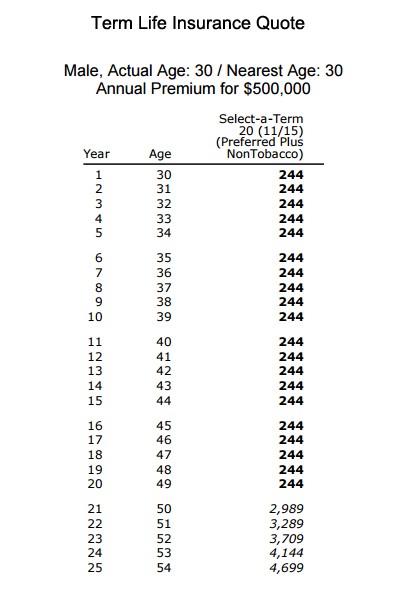

He decides to renew his policy. The chart below shows what his annual premiums have been, and what they will increase to after he renews his 20-year term policy.

As you can see, at year 21 his annual premium goes from $244 (about $21 per month) to $2989 (about $250 per month). Each year he renews, the premiums increase.

Policyowners who choose to go this route believe that it’s worth it since they know they don’t have much time left to live. They’re willing to pay absurdly high prices to make sure their beneficiaries receive the death benefit, which in this example would be $500,000.

While this thankfully isn’t a commonplace scenario, you can’t plan for all the what ifs in life no matter how hard you try, so it’s good to know you have options.

Note: Life insurance quotes used in this article accurate as of June 18, 2021. These are only estimates and your life insurance costs may be higher or lower.

I am 70. My premiums on my term life are going to be unaffordable in a few yeas. I’ve been paying on it for 20 years. Am I screwed

Richard, at the end of your current policy’s term, simply renewing the policy will increase your premiums drastically, you are correct. Renewing a term policy makes sense if the insured has a terminal illness, but, other than that, different options should be looked into if you want to continue life insurance coverage. How many years are left until your term policy ends? If you will be under age 80, you can look into final expense life insurance. Talk with your life insurance agent to see if you will still need life insurance coverage. Not everyone in their retirement years do. If you no longer have dependents relying on you financially and don’t have debt that you’ll be leaving behind, you may be able to rely on leaving your current assets to your heirs. You can always contact us here at Quotacy directly to discuss further life insurance coverage as well.