According to OrganDonor.gov, each day in the United States, about 80 people receive an organ transplant. There are currently over 116,000 people on the national transplant waiting list.

Organ transplantation is often a life-saving surgery. If you or someone you love has had a transplant surgery, it definitely makes you think about your own mortality and the importance of life insurance.

» Learn more: What to Know About Being an Organ Donor

Table of Contents

If you have had an organ or tissue transplant, buying life insurance can be more of a challenge. There are many factors associated with a transplant surgery that will affect whether or not you can be approved for life insurance and what price you will pay.

Your unique situation will be evaluated by the life insurance company on an individual case-by-case basis. This blog post will give you an idea of how organ and tissue transplants can affect life insurance outcomes, but everyone’s situation is different.

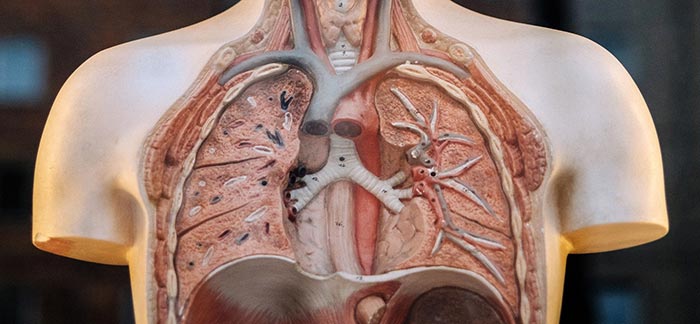

Mortality Risk of Organ and Tissue Transplantation

There are several different types of transplant surgeries with very different implications. Mortality risk varies not only by the type of organ or tissue transplanted, but also the reason why the transplant is needed. For example, someone who required a kidney transplant due to trauma will have a better life expectancy over someone who required the transplant due to chronic kidney disease.

Some organs can be donated via a living donor or a deceased donor. However, how the organ was donated can have an effect on mortality risk. Living organs tend to give better survival rates than cadaver organs and a living organ from someone related to you will have the highest success rate.

Types of Transplants and How They Affect Buying Life Insurance

Bone Marrow Transplant

Unlike other major organ transplant procedures, bone marrow transplantation involves infusion of bone marrow cells into the circulation of the recipient, rather than surgical replacement of an organ.

Bone marrow transplants are used to treat diseases such as leukemias, lymphomas, aplastic anemia, immune deficiency disorders, and some solid tumor cancers. The disease you were diagnosed with will have an effect on how you’re underwritten for life insurance.

In most cases, applicants with a history of bone marrow transplantation will be Table Rated. This means that while you may be approved for coverage, because the risk to insure you is greater than an insurance carrier’s typical standards, you’ll have to pay extra.

Learn more about table ratings here: What Are Table Ratings? What Do They Mean?

Corneal Transplant

Corneas are the most common transplant worldwide with over 40,000 surgeries performed each year in the U.S. Corneal transplantation is relatively safe and comes with a high success rate – over 90 percent.

When it comes to applying for life insurance with a history of corneal transplantation, the reason why you needed the surgery and the outcome are the two main determinants. Not only is it possible for applicants to be approved for standard rates, but a Preferred rating may be possible for individuals who have had no complications and are otherwise healthy.

Heart Transplant

A heart transplant is only performed after medical treatment or, in the case of ischemic heart disease, coronary artery bypass surgery have failed. Although a heart transplant can save your life, it comes with many risks.

Because of the extremely high risks involved with a heart transplant, the majority of all applicants who have had this operation will be declined for life insurance coverage.

See what you’d pay for life insurance

Liver Transplant

According to the Mayo Clinic, liver transplant is usually reserved as a treatment option for people who have significant complications due to end-stage chronic liver disease. As with a heart transplant, a liver transplant also requires you to take immunosuppressants for the rest of your life.

Livers can be obtained from living or deceased donors. In living donors, up to 65% of the liver is removed for transplant. The human liver regenerates and returns to its normal size shortly after surgical removal of part of the organ. For applicants who donated a liver, as long as liver function returned to normal and you are otherwise healthy, you should not have any issues getting life insurance coverage.

For the majority of applicants who have had a liver transplant, most life insurance companies will decline you for life insurance coverage. Some companies may consider a table rated offering on an individual basis if applicant has excellent quality of life and it has been at least ten years since the operation.

Lung Transplant

A lung transplant is reserved for people who have tried other medications or treatments, but their conditions haven’t sufficiently improved. Depending on your medical condition, a lung transplant may involve replacing one of your lungs or both of them. Like both liver and heart transplants, the biggest risks of a lung transplant are organ rejection and complications from the immunosuppressant medications.

Unfortunately, because of the high risks associated with a lung transplant, the majority of all applicants who have had this operation will be declined for life insurance coverage.

Renal (Kidney) Transplant

Kidney transplantation has become the most common and most successful of the major organ transplantation operations. The body can function perfectly well with one kidney, which is why living donors are not unusual with kidney transplants.

As with other major organ transplants, there is risk of rejection and chance of complications from immunosuppressants. However, failure rate with kidney transplants is much lower when compared to lung and heart.

Kidneys from live donors as opposed to cadavers produce a better outcome, and ideally the kidney would come from a close relative. The one year survival rate of the recipients of renal transplants from living donors is 97% and 94% from cadaver donors.

Life insurance coverage is attainable for those who have had a kidney transplant. Table ratings are likely. Depending on your age and whether or not the kidney was from a living person or a cadaver, a flat extra may also be added on. A flat extra is an additional fee to help cushion the risk an insurer takes. All applicants are closely evaluated on a case-by-case basis.

Pancreas Transplant

A pancreas transplant is most often done for individuals with Type 1 diabetes with end-stage renal disease.

There are three types of pancreas transplantation:

- Simultaneous pancreas kidney transplantation (SPK)

- Most common type of pancreas transplant

- Both kidney and pancreas are transplanted at the same time

- Pancreas after kidney transplantation (PAK)

- Pancreas is transplanted a short time (typically within months) after a kidney transplant

- Pancreas transplant alone (PTA)

- This treatment is reserved for those people with diabetes that have early or no kidney disease

According to the Mayo Clinic, pancreas rejection rates tend to be slightly higher among PTA recipients. SPK transplants have the best survival rate, but wait time for patients is longer since you’re waiting for two organs versus just one.

In addition to organ rejection and immunosuppressant complications, pancreas transplant risks also include:

- Blood clots or bleeding

- Urinary complications, including leaking or urinary tract infections

- Pancreatitis

Unfortunately, for the majority of applicants who have had a pancreas transplant, most life insurance companies will decline you for life insurance coverage. However, individual applicants are evaluated on a case-by-case basis and if enough years have passed since the transplant and applicant has shown no signs of complications, there are life insurance companies that will consider offering coverage.

Buying Life Insurance with a Transplantation History

The best advice we can give in regards to applying for life insurance with a transplant history is to work with an independent life insurance broker. Independent brokers have contracts with multiple life insurance companies. Not all life insurance companies view certain risks in the same light, so your chances of getting coverage are higher if you have access to multiple companies.

Quotacy is an independent life insurance broker. We work with multiple A-rated life insurance companies and can help you get life insurance. Our insurance experts and in-house underwriter know the ins and outs of the insurance companies and will work hard to find you coverage to financially protect your loved ones. Start the process by getting a free term life insurance quote today.

My term life is about to break me the monthly cost . Start off very reasonable now just out Of control. For twentyfold five years now untitle to much to screw me of all premiums I have maxed over the years bad business should be sued good in my opinion Fromm all transplant people together.

Earl, I am sorry to hear about your life insurance pricing troubles. Term life insurance has fixed premiums, so they should not be increasing. If you renewed your coverage, then you’re paying renewable premiums and these do increase. But that’s a different premium structure than what one would pay for the set term duration of a term policy.