The traditional American nuclear family, married dad and mom, and their children, has become less prevalent. Becoming more common are blended families.

Every family is unique, but a blended family has its own particular brand of considerations that need to be kept in mind when doing your estate and financial planning. You may need to plan for your current spouse, the children from your current relationship, the children from your previous relationship, and your spouse’s children from their previous relationship.

First Things First: Your Last Will and Testament

If you were previously married and created a will years ago, it may need some serious updating. It probably states that all your assets are to pass to your now ex-spouse. In some states, divorce automatically removes the spouse as executor and beneficiary and, similarly, a new marriage sometimes revokes (cancels) an existing will. But do not make this assumption. Save your family from potential turmoil by just taking the time to update the will.

In a blended family, a simple will is likely not going to cut it. A traditional simple will leaves everything to your spouse, and then upon his or her death everything is evenly split between all your children, including your children from your previous relationship, your step-children, and any children you have with your surviving spouse. But there is nothing in a simple will that prevents your spouse from changing what happens to your assets after he or she dies. Your children from your previous relationships may be disinherited in one fell swoop.

A Trust May Be Better

In a traditional will, you name guardians for your children and who gets what assets. However, with blended families, creating a trust may be best for distributing assets because you can leave very detailed instructions.

A living trust allows you to transfer assets into it and still utilize the assets and make changes to the trust while you’re alive. These assets also avoid the time-consuming and expensive probate process. In a living trust, you can name guardians for your children just like in a will. If you have a trust, you may think you don’t need a will. But something called a pour-over will is still a good idea to cover all the assets that you did not specifically transfer into a trust.

Pour-over Wills

A pour-over will essentially is a catch-all safety device. It simply states that any property you did not include in a trust will automatically transfer to your living trust upon your death. While these assets still go through probate for validation, the pour-over will protects your assets from being distributed according state law, which probably won’t line up with your wishes, and instead will be distributed according to the terms of your trust.

Living Wills

A living will (also known as an advance medical directive) is a statement of your wishes for the kind of life-sustaining medical intervention you want, or don’t want, in the event that you become terminally ill and unable to communicate. In a blended family, there will likely be many differing opinions regarding these types of situations. To avoid family feuding during an already stressful time, make your decisions known in advance.

Financial Planning for Blended Families

What are your financial planning needs? Ask yourself the following questions.

- What income do you want to replace? How long do you want to replace that income?

- Do you want to provide for your children from a previous marriage? Do you want them to inherit a business or other asset? Is there any required support obligations from a divorce decree?

- Are you, or is your spouse, a stay-at-home parent that may not have actual income they need to replace, but provide child care that would need to be paid for should something happen? What would the cost of care equal? How long would they need to provide that care? (Typically, if you’re a family with young children, you will have a higher need than a family who has teenagers.)

- Many times people buy life insurance to take care of debt. Do you have debt you want to cover? If so, what are the debts? A mortgage? Student loans?

- Do you have other expenses, including but not limited to, charitable contributions and emergency funds?

- Do you have future goals, for example, wanting to provide for college expenses? How much do you plan to contribute?

- Funerals can be expensive. What are your final wishes? How much will your desired funeral and burial plans cost? In addition, there may be administration costs, such as probate, that include legal and court fees.

- What assets do you currently have to cover these needs? Do you have group term insurance through your employer? Assets your family can liquidate?

Life insurance can play an essential role in estate planning for many blended family scenarios.

See what you’d pay for life insurance

Life Insurance for Blended Families

A life insurance policy insures a person and upon their death, the insurance company pays a death benefit to the beneficiary or beneficiaries.

In general, the death benefit from a life insurance policy is commonly used to:

- Fund your family’s income needs,

- Supplement your survivor’s retirement needs,

- Satisfy debt obligations,

- Establish an education fund,

- Pay estate taxes and administrative fees.

In your blended family, life insurance can be used in many ways. It can provide a sum of money that can be used to offset income your family loses upon your death.

In addition, life insurance can provide the means to satisfy any on-going child support obligations, both by giving your surviving spouse the means to provide for your children and by fulfilling any court-ordered child support payments.

Life insurance can also be used to equalize estates. If the beneficiaries of your life insurance policy are children from a previous marriage, the death benefit could be used to equalize an estate while all the other assets could pass to your current spouse.

Sometimes, especially when a family business is involved, the business could be passed to your children and the life insurance beneficiary could be your spouse (so as to account for the loss of the business). Or the business could be passed to your spouse and the life insurance proceeds could be used by your children to buy out the business from your spouse.

In any scenario, the ultimate goal is for the life insurance to provide the adequate liquidity based on your wishes.

The Different Types of Life Insurance

There are different types of life insurance that can meet different needs.

Term Life Insurance: A Basic and Affordable Type of Temporary Life Insurance

Term life insurance is the most basic and affordable type of life insurance. It’s designed to provide coverage during a specific period of time, called a term. Depending on your age, term options range from 5 to 40 years.

Term life insurance is ideal for individuals who need temporary insurance protection. By temporary, this can refer to the time in which you and your partner are raising children. Or the time during which you and your partner are paying off a house. Or the time in which you have a lot of debt you’re slowly paying off that you don’t want your loved ones to become responsible for if you were to die unexpectedly.

» Compare: Term life insurance quotes

For most people, term life insurance is all you need. For some, permanent life insurance may be the better option.

Whole Life Insurance: The Most Common and Kind-of-Expensive Type of Permanent Life Insurance

Whole life insurance is the most well-known type of permanent life insurance. As long as the policy is kept inforce, it will provide coverage until the day you die. This means your beneficiaries are guaranteed a death benefit payout, unlike with term life insurance since it only pays out if you die within the term period.

Whole life insurance can be a good addition to your financial portfolio if you are already maxing out retirement accounts and are looking for a way to build tax-free wealth. If you’re in this category, the whole life insurance policy may also be beneficial for estate planning by providing liquidity to pay taxes upon your death.

It can also be beneficial if you have children with special needs or a disability that will require lifelong care. This is a permanent need for financial protection, not temporary.

Universal Life Insurance: A Flexible and Somewhat-Affordable Type of Permanent Life Insurance

Universal life (UL) insurance is another common type of permanent life insurance. It trades some of the value growth benefits of a whole life insurance policy in exchange for more flexible payment plans and a lower price.

If you need permanent life insurance coverage, but don’t care as much about potential large cash value accumulation, then universal life insurance is something to consider. A more affordable universal life insurance option is guaranteed universal life (GUL) insurance.

Guaranteed universal life insurance is a permanent life insurance product that focuses on providing a death benefit, not growing cash value. The premiums for a guaranteed universal life insurance policy are some of the most affordable permanent life insurance premiums on the market. If permanent financial protection is best for your family situation, but you have a tight budget, consider guaranteed universal life insurance.

How to Use Life Insurance to Benefit Your Blended Family

In the event of your death, life insurance provides cash to your family to help pay for anything that your income was originally providing support to. Whether you need term life insurance, permanent life insurance, or a mixture of both depends on your personal situation.

If your blended family includes a wide age range of children, laddering term policies may be the best option. By laddering term policies you can cover different financial needs of varying amounts and timeframes.

Chris Benson married Jenny when he was 25. Together they had two children. At age 28, Chris purchased a $250,000 30-year term life insurance policy.

When he is 30 years old, he and Jenny get a divorce. Complying with a divorce agreement, Chris names Jenny an irrevocable beneficiary of the $250,000 term life insurance policy. This means Chris cannot change beneficiaries without Jenny’s consent. This policy will ensure Jenny receives financial support, replacing child support, for their children if Chris were to die before age 58.

When Chris is 45, he remarries a woman named Lisa who has a five-year-old son of her own. Chris and Lisa end up also having a daughter together.

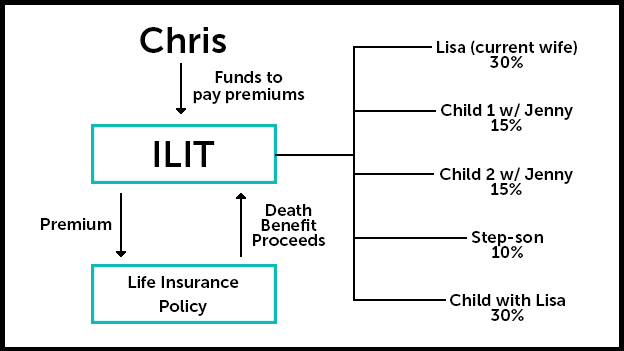

At age 50, with the help of an estate attorney, Chris creates an irrevocable life insurance trust (ILIT). This trust is the owner and beneficiary of a second life insurance policy Chris purchases, a 30-year term life insurance policy with a face amount of $750,000.

In the trust, Chris leaves specific instructions regarding distribution of the trust assets. He states that when he dies, 30% of the assets are to go to his wife, Lisa. He also states that two children from his previous marriage are to receive 15% each upon his death. He adds that 10% of the assets are to be given to his step-son once he turns 25. And the remaining 30% is to be put into a savings account for he and Lisa’s daughter to access once she turns 25.

Irrevocable life insurance trusts can hold additional future life insurance policies and, if desired, can also be funded with investment accounts. With Jenny’s consent, Chris would also have the option to transfer ownership of his $250,000 term life insurance policy to the trust, ensuring that the amount is not included in his taxable estate (as long as he doesn’t die within three years of the transfer, according to tax laws).

Unlike the living trust mentioned earlier in this article, an ILIT is irrevocable meaning that you cannot use the assets you place in the trust while you are alive nor can you make changes to it once it’s created. Having more than one trust is allowed and can be beneficial for different estate planning goals, but work with an attorney knowledgeable in trusts to ensure they’re set up in your best financial interests.

No matter your unique family situation, Quotacy can help you get the life insurance policies to cover your needs. Start the process by getting a term life insurance quote, no contact information needed until you’re ready to send in the online application. Better yet, after we receive your application, if you have a health or lifestyle risk factor that may affect your life insurance pricing, your dedicated Quotacy agent will comparison shop behind-the-scenes to ensure you’re getting the best price.

0 Comments