There are several forms of blindness and deafness. Millions of Americans are considered visually or hearing impaired. Individuals can be born impaired or it may develop as a result of an accident or medical condition.

A deaf or blind individual can obtain affordable life insurance. If your disability doesn’t affect your life expectancy, it might not increase your premium at all. If the impairment is caused by a pre-existing condition, the life insurance company underwrites the condition not the state of blindness or deafness.

Underwriting is an evaluation of a client’s health and medical history, occupation, hobbies, lifestyle, characteristics, and financial status that may affect life expectancy.

Buying Life Insurance with a Visual Impairment

Information life insurance underwriters will use to accurately assess blindness:

- What is the underlying cause (congenital, due to disease or injury)?

- What is the degree of visual impairment, particularly of visual acuity and visual fields?

- Is the blindness bilateral or unilateral?

Occupational factors they will assess:

- Does the nature of the applicant’s job demand good visual acuity?

- Does the visual impairment increase any hazards relating to the job?

- What is the prognosis of the visual disturbance?

If the person applying for life insurance was born blind or hearing impaired, or it was developed as a result of an injury over one year ago, typically, the impairment itself will not affect life insurance rates. If the impairment was diagnosed less than a year ago, insurance companies will often postpone until after a full year as passed. If the impairment is the result of a medical condition, the medical condition will be evaluated and likely will affect life insurance rates.

See what you’d pay for life insurance

Buying Life Insurance with a Hearing Impairment

Information life insurance underwriters will use to accurately assess blindness:

- What is the underlying cause?

- What is the degree of hearing impairment?

- Are there any other complications, particularly depression or other psychiatric disorder (i.e. auditory hallucinations), related to the impairment?

- Is the applicant socially isolated?

- Is there a history of accidents?

Occupational factors they will assess:

- What is the job history of the applicant with hearing loss?

- Does the nature of the job demand good hearing?

- Is the job likely to cause additional strain on the ears?

- Does the hearing disorder increase any hazards relating to the job?

- Has the applicant adequately adjusted to any limitations caused by the condition including use of a hearing aid where appropriate?

Being blind or hearing impaired is underwritten very similarly to a visual impairment. If the person applying for life insurance was born with hearing loss or it was developed as a result of an injury over one year ago, typically, the impairment itself will not affect life insurance rates. If the impairment was diagnosed less than a year ago, insurance companies will often postpone until after a full year as passed. If the impairment is the result of a medical condition, the medical condition will be evaluated and likely will affect life insurance rates.

When we say underwriters “typically” do this or that or “on average” something occurs, we’re being broad on purpose. Every individual is unique and life insurance is underwritten on a case-by-case basis. And not only this, life insurance companies don’t even underwrite uniformly across the board.

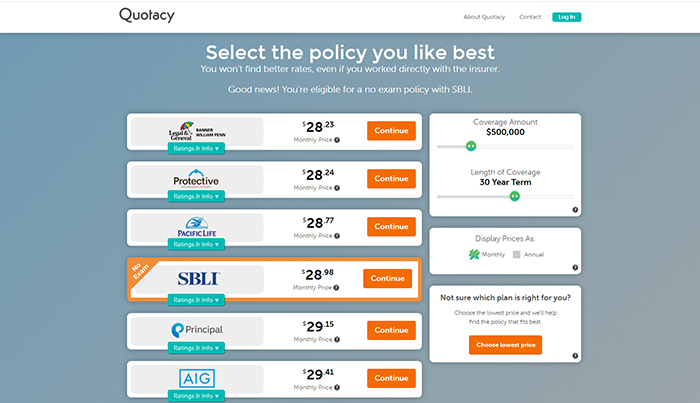

Getting quotes from multiple life insurance companies is the best way to make sure you get an affordable policy and one that is right for your particular situation. If you’re thinking this sounds time-consuming, you’re right, which is why Quotacy does all this for you behind the scenes.

After you submit your online application, a Quotacy agent will review it to determine we are not missing any information that would slow down the process. We also make sure the company you chose to apply to fits your case best.

As an example, if you note in your application that you suffer from a visual impairment as a result of diabetes and have applied to a company we know won’t offer the best price because of that, we will suggest a carrier that is typically more lenient with diabetes. It’s important to note you can still apply with your original carrier; it’s completely your choice. We just want to make sure you know your options.

Applying for Life Insurance with a Sight or Hearing Impairment

The process of buying life insurance has come a long way. You no longer need to sit down face-to-face with an agent and fill out a bunch of paper by hand. And while some carriers do want to do an interview over the phone with applicants, there are options for applicants with hearing impairments to complete this interview online instead.

If you need help applying for life insurance, Quotacy agents are available over the phone or via e-mail or text, whichever method is best for you.

Start the process now by getting term life insurance quotes instantly online. Quotacy doesn’t require any contact information to view term life insurance quotes. Shop in peace without worrying about getting inundated by calls from people trying to sell to you.

When you’re ready to apply, the online application takes less than ten minutes to complete. Your dedicated Quotacy agent will keep you updated every step of the way as your application moves through the buying process and will be here for your policy service needs down the road.

0 Comments