When you buy a term life insurance policy, you keep it active by paying a set premium. This premium is determined before you officially accept the coverage and start paying for it. For a term life insurance policy, this premium is fixed and won’t change the entirety of the term.

The premium is determined by your specific risk factors and also includes certain fees, but are there any hidden life insurance fees and charges? Not when you run term life insurance quotes on Quotacy, these fees are all built in. Nothing hidden here.

Your final premium may be different than your initial quote, but this isn’t because of added on fees. You may have risk factors that the insurance company requires higher premiums to cover, such as medical issues or risky lifestyle behavior.

Some people may judge certain fees as “hidden” because they aren’t marketed, but as with most products and services there are fees defined in the fine print. Today we’ll get the types of life insurance fees out in the open for transparency’s sake.

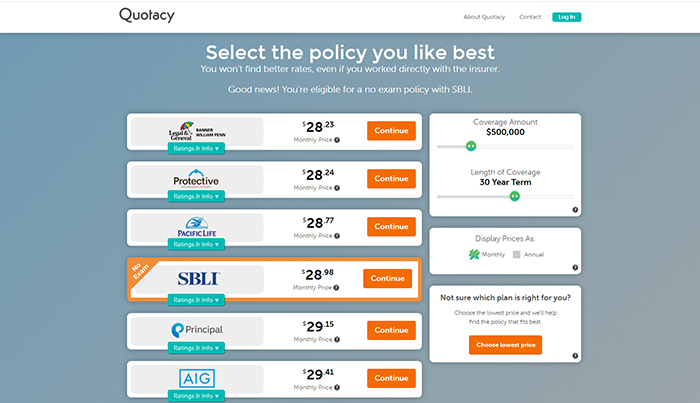

See what you’d pay for life insurance

Common Life Insurance Fees

Cost of Insurance

This is the actual cost of having life insurance protection. It’s determined by your age, gender, health, and death benefit amount. It’s the base cost of your policy.

Premium Loads/Sales Charges

These charges compensate the insurance company for sales expenses and state and local taxes.

Administration Fees

These fees are used to pay the costs of maintaining the policy, including accounting and recordkeeping. These fees are higher if you choose to pay your premiums monthly versus annually since administrative tasks occur more frequently.

Surrender Charge

Surrender charges are only applicable to permanent life insurance policies that have a cash value feature. This charge is deducted from your cash value if you surrender (terminate) your policy during your surrender charge period.

This surrender charge is determined by how long the policy has been active. It typically begins at 100% of the value for the first year and steadily declines until it disappears altogether after 10 or 20 years. After this period of time, you can surrender the policy with no fee.

As mentioned earlier, when you buy a term life insurance policy online through Quotacy, the fees are already included in the quote. If you buy a permanent life insurance policy, the surrender charge is simply taken from the cash value if you terminate the policy prematurely.

You may be wondering: what about commission fees?

For many life insurance agents, their main income source is the commissions from the life insurance policies they sell. They receive a certain percentage of the first year’s policy premium, and sometimes ongoing commissions each year the policy is inforce, which tend to be far smaller percentages.

Having this knowledge, people looking to buy life insurance may be hesitant that agents will try to upsell them so they get a larger commission. Life insurance agents are held to high ethics standards, but we still understand your concerns.

Your dedicated Quotacy agents receive a salary. They do not work on commission. Knowing this, we hope you can feel confident choosing Quotacy to buy life insurance.

Your Quotacy agent advocates for you. When you apply for life insurance online through Quotacy, your agent will shop your case across our top-rated life insurance companies to ensure you’re getting the best possible price even if you have a significant risk factor.

John takes a prescribed antidepressant and applies to a life insurance company that is likely to underwrite John as Standard. Before submitting John’s application, his Quotacy agent reaches out to other insurance companies to find out if any of them treat this antidepressant more favorably. One of the insurance companies state they would consider Preferred, saving John money on his life insurance premium. John can choose to change companies if he wishes. His Quotacy agent will take care of the necessary paperwork.

Rest assured that your Quotacy agent will go to bat for you. Overall, the life insurance industry needs to make a profit, but these companies do truly want to help individuals protect their loved ones. “Hidden fees” don’t exist.

If you’re looking to buy life insurance to protect your family’s financial future, there’s no time like the present. Your Quotacy agent will walk you through every step and keep you routinely updated so you know where you are in the process. Start by getting a free and anonymous term life insurance quote today.

0 Comments