They say money can’t buy happiness, but having your finances under control sure does help! Money (or lack of) can create stress and stress definitely doesn’t make one happier, so we’re going to discuss how you can make the most of what you have and how you can plan appropriately for the future.

When it comes to achieving financial well-being, and making the best of your finances, there are four key aspects to keep in mind:

- Personal cash flow – We’ll look at ways to maximize what you earn, set spending priorities and minimize monthly expenses so you can meet your savings goals.

- Protecting what’s important – Your ability to earn a paycheck is one of your family’s most precious assets and we’ll discuss ways to prepare for whatever life brings.

- Savings and growth – We’ll take a look at ways to put the money you’re able to set aside for the future to work for you to accomplish your short- and long-term goals.

- Retirement readiness – As retirement draws near, the strategy you used to build your savings will need to shift. We’ll discuss this transition period.

Consider Changing Up Your Budget

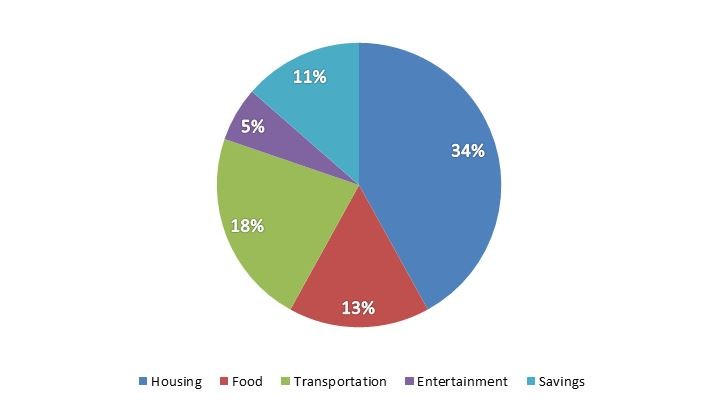

According to the U.S. Bureau of Labor Statistics, the typical household has the following budget:

Each wedge represents how much of their income is dedicated to a specific item. With this budget, the average household only has 19% of their income left for an emergency fund and any other extra spending.

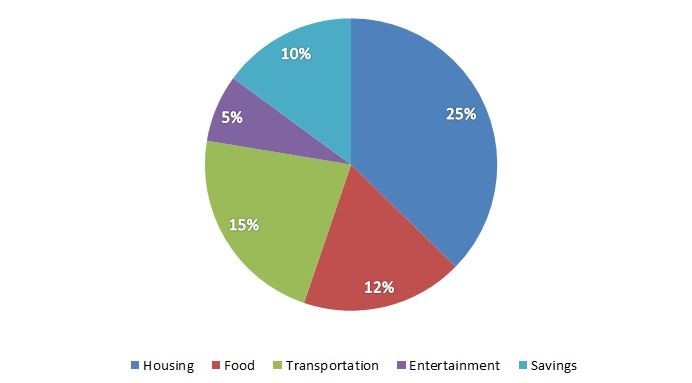

There is no one ideal budget since everyone’s priorities are different, however some financial planners recommend the following budget instead to make the best of your finances:

With this budget, a household would have 33% of their income remaining. Instead of focusing on having “leftover” money to put towards savings, though, a fundamental first step to financial well-being is actually considering to save first, and then spend.

It takes some discipline and planning to make “save first, then spend” habits, but here are some ideas that can help you get started:

- You could establish a fixed amount or percentage of your income to set aside each month;

- You could use automatic payroll deductions so the saving happens without you needing to do anything;

- You could commit to putting “new” money from raises, promotions, or bonuses towards savings.

Making these changes may be difficult at first given all the other demands on your income, but if you can develop these saving habits, you will be making your future more secure.

Be a Smart Consumer

Another way to make the best of your finances is to make the most of the money you have by being a smart consumer. We all know it’s not realistic to just say that you’re going to stop buying things. Life happens. You need a new suit for work or the brakes go out in the car. Be mindful when spending.

Here are some ideas on ways to be a smart consumer to make the best of your finances:

- Do your research and look for sales on necessary, large purchases and use coupons for smaller purchases.

- Dine out less.

- To cut down on impulse purchases, give yourself a 48-hour cooling off period. After that, go ahead if you still feel like you need it.

- Review your phone and TV bills. Eliminate unused services and features.

- Buying a new car? Consider a slightly used model.

- Reduce holiday spending by setting up a budget for gifts. Put the difference from sale items into savings.

- Consider opportunities to make extra cash. Working a little occasional overtime, taking on a second, part-time job, or putting a talent you have to work could earn you some extra savings money. Whether you’re driving for Uber or tutoring in your favorite subject, there are many part-time work opportunities.

See what you’d pay for life insurance

Be Careful in How You Use Credit and Take on Debt

Most of us have to take on debt at some point, but not all debt is created equal.

Let’s take a look at the different types of debt:

- credit cards and other revolving credit

- auto loans

- home loans

The key is to maintain a level of debt that is manageable and to use debt for the right types of purchases.

Some cautionary signs to make the best of your finances that you may need to reexamine your debt include:

- Making only minimum payments on credit cards

- Having balances on multiple cards

- Using payday loans

Including mortgage, your debts should be 36% or less of your monthly take-home income. If your non-mortgage payments are more than 10% of your take-home income and your total debt payments exceed 36% of that income, you probably have more debt than you can manage.

A good approach to minimizing your credit card debt is to charge only what you can pay for at the end of each month. But what if you’ve already accumulated a lot of debt? To be honest, it’s going to take time. To get your arms around the debt you have, start by taking an inventory of the cards, balances, interest rates, fees, and any other terms and conditions, e.g. minimum purchases.

If you have multiple credit card balances:

- Pay as much as you comfortably can each month, but focus on your highest interest rate card while continuing minimum payments on the others. Once the first is paid off, divert those payments to the second highest rate card and so on.

- Another option is to put all payments beyond the minimums on the lowest balance card until it’s paid off, then go to the next one with the lowest balance and so on.

- Consolidating credit card balances onto one low-rate card can be an option, but be sure and read the fine print to avoid transfer fees, introductory rates that expire, minimum monthly charges, etc.

- Refinancing a mortgage at a lower rate can be an option for some depending on the difference in rates, time left on the mortgage, and costs associated with refinancing, and you might be able to tap into your home’s equity to eliminate your highest-interest-rate debts.

Also, don’t forget about your credit score. Monitor your credit score at least annually. One resource is www.annualcreditreport.com. Each of the three major credit agencies (Equifax, Experian, and TransUnion) offers a free report once a year, so you can spread those out and get a report every four months.

Protect What’s Important

Your income is vital to your standard of living and that of your loved ones’. There are two financial products specifically made to protect and replace your income: disability insurance and life insurance.

Disability Insurance

Losing your ability to earn an income is a bigger risk than you might have considered:

- 1-in-4 20-year-olds will become disabled before retiring, according to the Social Security Administration.

- The average disability lasts 2.5 years, per a survey conducted by Gen Re.

- 50% of Americans would be in financial trouble in one month or less following a disability, according to the Life and Health Foundation for Education.

That’s where disability insurance comes in. It pays a monthly benefit if you’re too hurt or sick to work.

Life Insurance

We firmly believe in the benefits life insurance provides families. If a family provider dies, nothing can replace them, but the death benefit provided by a life insurance policy can ensure surviving loved ones have a financial safety net.

The benefits of life insurance:

- Pay for final expenses

- Pay off debt

- Replace income

- Leave a legacy

- Plan your estate

Life insurance falls into two major types – term and permanent. Term is insurance that’s there in the event you’re unexpectedly gone too soon. Permanent insurance is there for you as long as you live and allows you to leave a legacy when you’re gone.

Now, the amount and type of life insurance you need depends on your situation and your objectives. Unsure about how much life insurance protection your loved ones need? Play around with our Life Insurance Calculator which can help you determine how much coverage you should buy.

Make Goals for a Secure Retirement

We all work to earn an income so we can enjoy life. Once in your golden years, you shouldn’t have to work unless you want to.

Consider these objectives for a secure retirement:

- Guarantee your money won’t run out.

- Ensure that your savings won’t lose its buying power to inflation.

- As you get older and have less time to make up for any losses, reduce your exposure to risk.

- Continue to build your nest egg while it is big enough to earn more interest than you’re spending each year.

Retirement income sources include:

- Social security – For those of you close to retirement, SS should certainly be there for you.

- Defined benefit plans – While not as common as they used to be, some employers offer a defined benefit plan (previously called pensions) that provides a monthly payment to you in retirement based upon your salary and years of service.

- Part-time work – You might be planning to work part-time, but be aware this can impact a person’s eligibility for Social Security.

- Qualified savings plans – A tax-advantaged savings plan, through your employer or in an individual account, e.g. 401ks, IRAs, can create lasting income.

- Personal savings

Many assume that collecting Social Security benefits is pretty straightforward: you retire and start collecting a check. However, there are actually a number of strategies of how and when you file, particularly for married couples, that can help maximize the benefits you receive:

- Many elect before full retirement age, underestimating their life expectancy, resulting in significantly lower benefits. You can receive an 8 percent “raise” for every year you’re able to wait.

- Often, higher-earning spouses elect benefits early, exposing the surviving spouse to a longevity risk. Waiting can improve your retirement income while you’re alive and for a surviving spouse.

- You can receive benefits on an ex-spouse’s earning record if they’re unmarried, 62 or older, your marriage lasted more than 10 years and your ex-spouse is eligible to receive Social Security (even if they haven’t filed for benefits).

- Before electing Social Security benefits, it’s wise to consult with an expert to see what strategies are available. It can make a big difference.

Unsure if you’re on a good financial path? Consult a financial advisor. A quality advisor will listen to your goals, look at your current finances, and recommend how to make the best of your finances. Utilizing free money management tools such as Mint.com is another great way to start.

Not sure where to start in shopping for life insurance? Well, you’re already on the right track! Visit our Learning Center for helpful articles all about life insurance basics and must-knows.

0 Comments