Guaranteed universal life (GUL) insurance provides lifetime coverage at more affordable pricing than a whole life insurance policy.

GUL insurance is not to be confused with similar sounding products such as UL (universal life) or IUL (indexed universal life) insurance.

UL insurance offers lifelong coverage, flexible premiums, and cash value growth that is dependent on the insurer’s market performance. IUL insurance is similar to UL, except that the cash value’s growth is tied to the performance of an index, such as the S&P 500. Both UL and IUL policies are far more complex than guaranteed universal life (GUL) insurance.

GUL insurance may be ideal for individuals who want a guaranteed death benefit, but don’t need the fancy extras other permanent products offer, such as cash value accumulation or dividends.

Pros and Cons of Guaranteed Universal Life Insurance

GUL Insurance Pros

- Cost of insurance won’t change even as you age

- Your death benefit amount is guaranteed and not tied to an investment

- More affordable than other permanent products

- Option to adjust your death benefit if your needs change

- Potential for return of premium if you decide to cancel your policy

GUL Insurance Cons

- Potential for cash value accumulation is low to non-existent

- More expensive than term life insurance

Affordable Lifelong Coverage

GUL insurance is an affordable way to buy permanent insurance protection. As long as you pay your planned premiums to keep your policy active, your beneficiaries will receive the guaranteed death benefit when you die.

If your needs change as time goes on, you also have the option of decreasing your death benefit without having to buy a new, separate policy. This can be helpful if your budget changes and you need to lower your premiums, or if your financial responsibilities decrease and you no longer need as much coverage.

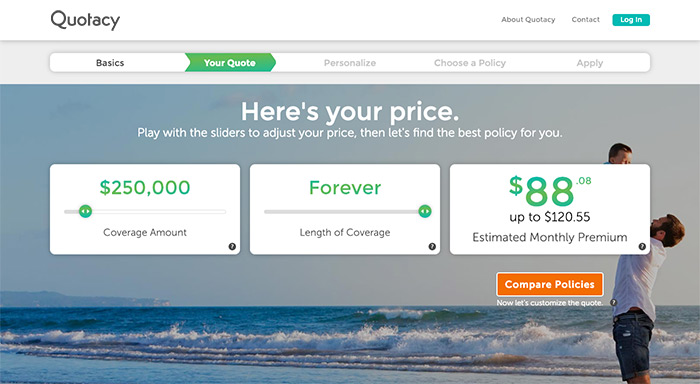

Want to see what you would pay for Guaranteed Universal Life Insurance?

Click the “Get Started” button below, enter basic info (zip, gender, birthdate), and follow these simple steps.

Pick your coverage amount

Choose “Forever” for length

Customize & compare quotes

Return of Premium Potential

Some guaranteed universal life insurance policies offer a return of premium option. So, if your needs change you can cancel your GUL policy during select policy intervals and receive paid premiums back.

The specifications of this feature varies depending on the policy. The insurance companies typically only allow policyowners to cancel the policy in return for a refund during certain years. The percentage of the premiums you’ve paid that you get back can also vary.

For example, one of the companies we work with allows you to surrender your GUL policy and get a refund during two specific time periods. You can cancel at the end of year 20 and receive 50% back or at the end of year 25 for 100% back.

Cash Value in GUL Insurance

If you’re looking for a life insurance policy that has the potential to accumulate significant cash value, a GUL policy isn’t it. While a feature of guaranteed universal life insurance often includes a cash value component, it should not be considered a benefit because growth is typically minimal.

If you’re more conservative with risk, and building cash value within a life insurance policy isn’t a priority to you, guaranteed universal life insurance is a good option.

With other more expensive permanent policies, the cash value can eventually accumulate to significant amounts. Policyowners can access this cash through policy loans and withdrawals.

GUL insurance, however, is designed to be a lower cost policy option with a focus on the lifetime guaranteed death benefit, not cash value. The cash value in a GUL policy is likely not going to generate enough to make taking out a loan worth it. When you take a loan out against a GUL policy, it can eliminate your death benefit guarantees.

The Cost of Guaranteed Universal Life Insurance

GUL insurance is more affordable than whole life insurance, but more expensive than term life insurance. In the table below, we compare the monthly costs for $250,000 in coverage. Rates are for a male applicant in excellent health who does not smoke.

GUL Insurance vs Term Life Insurance vs Whole Life Insurance Rates

| GUL Policy | Age 30 | Age 40 | Age 50 |

|---|---|---|---|

| $250,000 | $140.37 | $180.81 | $280.62 |

| 20-Year Term Policy | Age 30 | Age 40 | Age 50 |

| $250,000 | $12.49 | $17.33 | $38.75 |

| Whole Life Policy | Age 30 | Age 40 | Age 50 |

| $250,000 | $258.63 | $374.10 | $567.39 |

As with other traditional life insurance products, you will be fully underwritten when you apply for guaranteed universal life insurance. By fully underwritten, we mean your age, gender, smoking status, family history, and health and lifestyle factors will all be evaluated to determine your risk class—in addition to having a medical exam done.

Your risk class is what determines the price you pay for life insurance. Essentially, the riskier you are for the insurance company to insure, the higher your premiums are.

How much guaranteed coverage you want to purchase also affects the cost of a GUL policy. Again, your GUL coverage can last your entire life so whatever coverage amount you choose is the guaranteed death benefit amount your beneficiary will receive when you die.

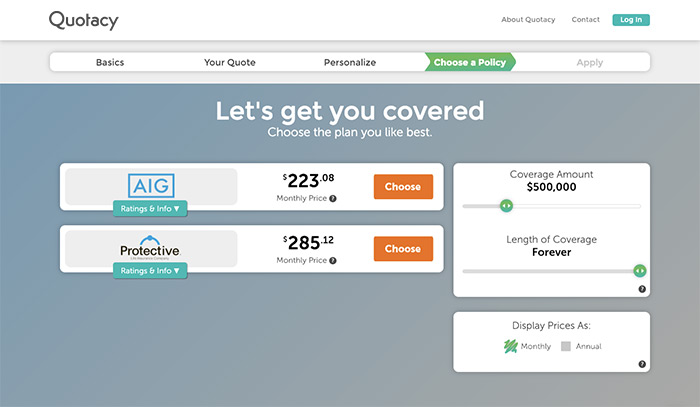

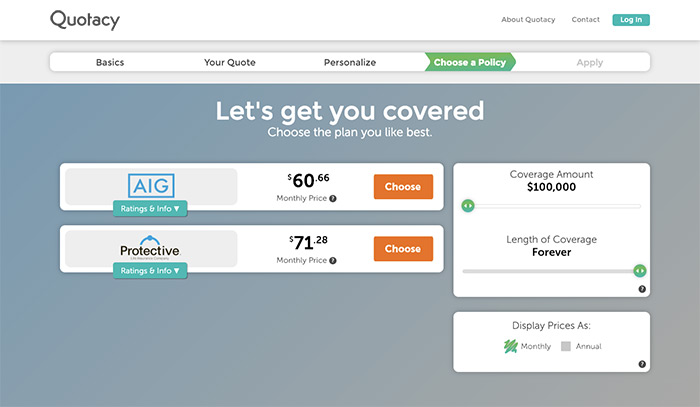

I ran a couple quotes for a healthy non-smoking 40-year-old woman. As you can see in the screenshots below, the cost of a GUL with $500,000 of guaranteed death benefit is much more expensive than a GUL with $100,000.

Laddering Life Insurance Policies: A Different Strategy

For individuals who want whole life insurance over term life insurance, it’s often because they want to leave behind some money no matter when they die. With term insurance, the coverage only lasts a specified period of time (often 10, 20, 30, or even 40 years) and if you don’t die within that time, your beneficiaries don’t receive a payout.

Term life insurance is a great product for families. It’s affordable and provides protection for your loved ones during their most financially-vulnerable years, the years when you’re paying a mortgage, saving for retirement, and raising children.

However, if you want life insurance to last until you die, not if you die, term life insurance isn’t going to cut it.

One option is to ladder different types of life insurance policies.

» Compare: Guaranteed universal life insurance quotes

Purchase a term life insurance policy with enough coverage to replace approximately 10 times your income and pay off all the big ticket items if you died unexpectedly, for example, the mortgage and your children’s college tuition. Then, in addition, buy a small guaranteed universal life insurance policy to provide funds for your funeral, end-of-life expenses, and a small inheritance.

Let’s look at an example.

He’s healthy and plans on living for a long time, but should the unexpected happen, he wants to ensure his wife and their children can remain in their home and that their children can attend college without financial struggle.

He hopes to live a long, happy life and die peacefully in his bed at an old age. If this happens, he still wants to leave behind supplemental income for his wife and some money for his children.

John can accomplish his goals by purchasing both a term life insurance policy and a guaranteed universal life insurance policy.

He purchases a $750,000 30-year term life insurance policy for $55 per month and also buys a $150,000 guaranteed universal life insurance policy for $100 per month.

If John dies before he turns age 65, his family receives $900,000 in total death benefit proceeds. If he lives past age 65, his family will receive $150,000 no matter what age he dies.

Who Should Consider Guaranteed Universal Life Insurance?

Honestly, most families only need term life insurance. But GUL insurance is a great option for those who would like lifelong protection but their budget doesn’t allow for a whole life insurance policy.

If you:

- Have a special needs dependent

- Own a small business

- Have debt that is expected to last until or into retirement

- Need estate tax protection

- Want to leave an inheritance

- Are older and your term policy ended but you still want coverage

then look into guaranteed universal life insurance.

Since GUL insurance is less complex than whole life insurance, you can run quotes yourself instantly on Quotacy.com.

Easily compare the costs of term life insurance and GUL insurance with our quoting tool. Simply go to our quoting tool, insert your basic information, and on the second page, move the Length of Coverage slider all the way to the right to “Forever”. Compare prices anonymously and then apply online in just minutes.

Note: Life insurance quotes used in this article are accurate as of September 9, 2022. These are only estimates and your life insurance costs may be higher or lower.

Do you have to have a physical and all that for guareented universal life insurance?

Hi Robin, Yes. Guaranteed universal life insurance has traditional underwriting. It’s not a simplified- or guaranteed-issue product. The medical exam is really not too bad though. The examiner will come to your home or office, wherever is most convenient. And there’s no cost to you for the exam.