Calculate the cost for this amount of coverage

It takes just a few minutes, any you won’t have to provide any personal information.

Get quotes from all the major carriers

Quotacy works with the largest, most reputable insurance companies to provide the best range of options to meet your needs.

Calculating how much life insurance you need

Life insurance needs are based on your needs and financial circumstances. It’s a balance between your current budget, and what your loved ones need to maintain their lifestyle.

Why the calculator needs these numbers

Your annual income

The main point of life insurance is to replace your income if you die so your family doesn’t financially suffer. Your family’s standard of living is provided by your paycheck. If that paycheck were to suddenly disappear, what happens to your family?

The rule of thumb is for providers to buy enough life insurance to cover ten times their income. But life insurance is not one-size-fits-all. Ten times your income may not be enough or it may simply be unaffordable for families on a budget. Multiplying your income by ten is a good starting point, however, and you can adjust as necessary from there.

For stay-at-home parents that don’t provide a paycheck, think of all the services you provide for your family. How much would it cost to replace these? Your spouse would either need to find time to do it all or hire help like a nanny and a housekeeper.

The annual cost to replace a stay-at-home parent’s contribution to a family averages $145,000 across the United States. This shows that parents who work inside the home need life insurance just as much as parents who work outside the home.

Your debt (good and bad)

Do you have debt that may fall onto your family’s shoulders if you died before it was paid off? Your mortgage is the most important type of debt to consider when buying life insurance. If you died tomorrow, you’d want your family to be able to afford to stay in their home. Selling a home under duress on top of the emotional turmoil of losing a spouse and parent would be devastating.

Do you have student loans that a loved one would become responsible for? If you live in a community-property state, your spouse may become responsible for the balance. If your loans were co-signed, the co-signer would become responsible. Student loan debt can be substantial. Consider this amount when buying life insurance.

Other types of debt to consider when buying life insurance include: car loans, credit card balances, personal loans, and home equity loans. Read more about how debt is passed on after death in this blog: What Happens to My Debt When I Die?

College contributions

If you plan on helping your kids out with college tuition, consider this cost when buying life insurance. You can use the estimates below and then multiply the numbers by how many children you have.

These are the average yearly tuition and fees costs for the 2018-2019 school year according to the College Board:

- Public two-year in-district = $3,660 (with room and board = $12,320)

- Public four-year in-state = $10,230 (with room and board = $21,370)

- Public four-year out-of-state = $26,290 (with room and board = $37,430)

- Private nonprofit four-year = $35,830 (with room and board = $48,510)

Your savings

The amount you have in your savings, investment, and retirement accounts (such as your 401(k) and IRA) can be subtracted from your life insurance needs total. Your loved ones will be able to access these funds when you die. How long it takes for them to gain access will depend on how you set up these accounts. Also, whether you die before or after retirement age will affect your beneficiary’s options in regards to retirement funds and Social Security benefits.

Assuming you name your spouse as the beneficiary on your retirement accounts, he or she will be able to gain control of these funds fairly quick when you die. If your bank accounts are jointly-owned, the co-owner will be given sole ownership and can access the funds. If your bank accounts are in your name only, then the account may have to go through probate to determine who gets access to it (likely your spouse if you’re married).

If you don’t want to add a second owner to your bank accounts but also want them to skip the probate process, you can name someone as the payable-on-death beneficiary. This is a simple form you fill out and submit to your bank. Another option would be to set up a living trust and put your bank account in it. For accounts you use frequently, it may be more convenient to choose the first option and leave the account in your name versus making deposits and withdrawals in the trust’s name.

Existing life insurance

If you have life insurance coverage through your employer, you can subtract this coverage amount. If you already own an individual life insurance policy and plan on keeping it (versus replacing it with the one you’re currently considering) you can also subtract this amount.

Burial

The cost of a funeral varies drastically. The average cost of a basic funeral and burial in the U.S. is $10,000. The average cost of a basic funeral and cremation is $4,000. However, these averages do not include an obituary, cemetery plot, headstone, flowers, or the memorial service. A memorial service can include a multitude of costs such as catering.

Many often leave their funeral wishes in their wills, but also write them down and store the document somewhere your family can access quickly. Wills need to be filed with the probate court. If you own a lot of property and assets at death, the probate process can take a long time. Funeral decisions likely will be made long before the process is complete.

Figuring out the right term for you

The length of your term life insurance policy depends on the unique needs of your personal situation. Term life insurance can last anywhere from 5 to 40 years, depending on your age.

Term life insurance is meant to financially protect your beneficiaries from your untimely death. The death benefit replaces a set amount of the income you provided so your family can take care of your end-of-life expenses and keep paying the bills.

For the typical family, the length of the term life insurance policy will ideally last until your largest source of debt is paid off or until your loved ones are financially independent.

When different terms might make sense for you

The “right amount” of life insurance is different for everybody. Life insurance is not a one-size-fits-all product. The amount you need depends on your finances, financial goals, and family situation.

10-Year Term

- If your children will enter college in a few years and you want to protect them from having to take on student loan debt if you pass away.

- If you are a few years from retirement and you want to provide security for your partner’s retirement years.

30-Year Term

- If you don’t yet have children but plan to.

- If you plan to pay off a newer mortgage should you pass away.

- If you want to leave funds to pay for your young grandchildren’s college education.

20-Year Term

- If you are a young family and you wish to safeguard your children’s financial future until they become independent.

- If you want to protect your family’s estate from long-term business debt that you personally guaranteed.

40-Year Term

- If you’re young and want coverage to last until you’re in your retirement years.

- If you’ve been thinking about permanent life insurance but it’s out of your budget.

- If you have debt that may take some time to pay off and don’t want to leave any behind to your family.

Maybe you need more than one life insurance policy

There’s no rule that says you’re only allowed to own one life insurance policy. For some people, owning more than one life insurance policy to cover a variety of needs is best. This strategy is called laddering.

Laddering life insurance policies can mean buying more than one policy at a time with varying term lengths and coverage amounts, or it can mean owning more than one policy and purchasing them at different intervals. The laddering strategy is ideal if you have different financial obligations you want to cover but don’t want to pay expensive premiums for one large term life insurance policy.

How to ladder life insurance

Buying multiple policies all at once

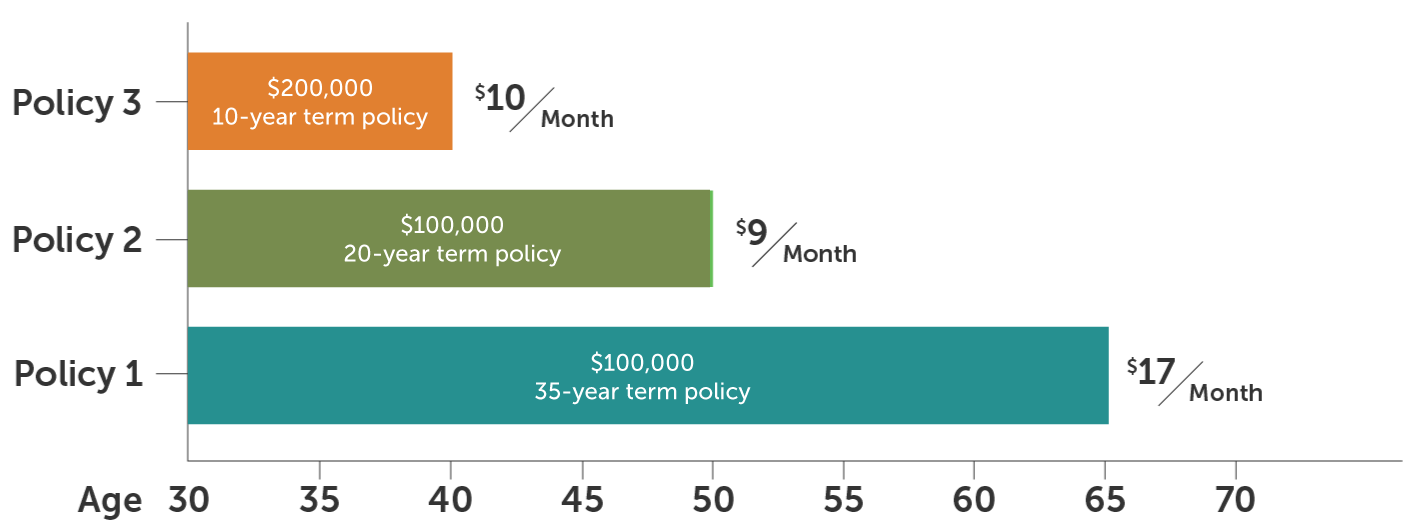

The graphic above shows an example of a healthy 30-year-old male buying three life insurance policies with varying term and coverage amounts at the same time.

During the first ten years, this policyowner has $400,000 in life insurance coverage to provide financial protection for his family during his children’s most formative years. After ten years is over, Policy #3 drops off and he has $200,000 in life insurance coverage to make sure the family home could be paid for if he died unexpectedly. After another ten years goes by, his children are grown and the mortgage balance is considerably less. Policy #2 then drops off and he’s left with $100,000 in coverage until age 65 to protect his spouse’s retirement plans.

This ladder life insurance strategy is more affordable over the total span of 35 years versus purchasing one 35-year term policy with $400,000 in coverage. And this is because when the individual policies end, the policyowner no longer has to pay those premiums.

Buying multiple policies in intervals

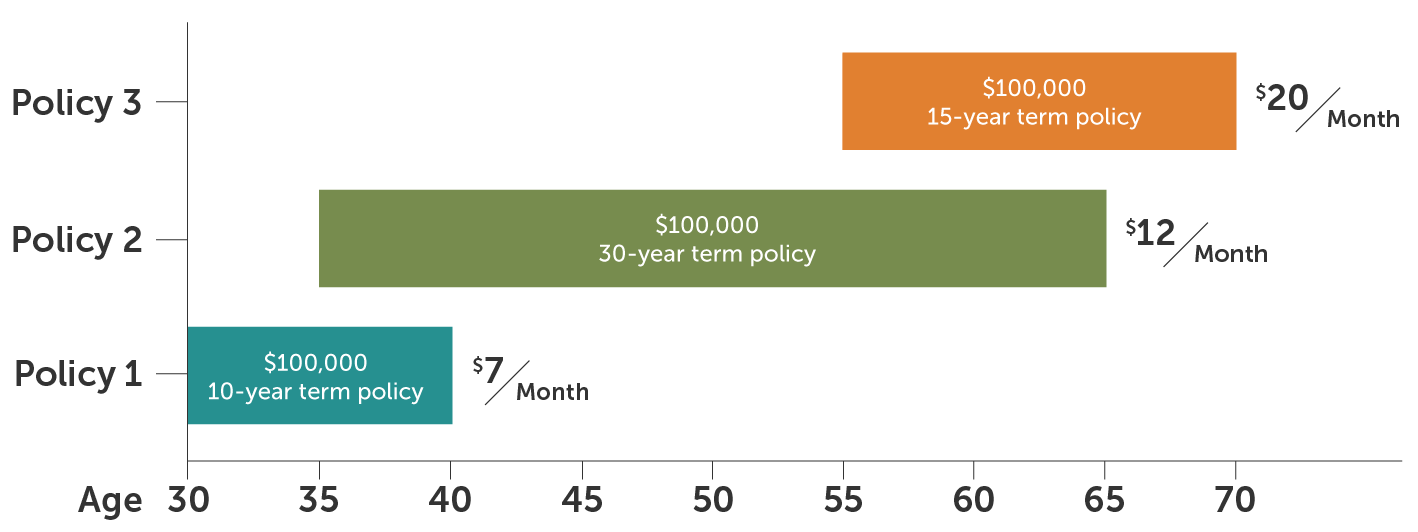

The graphic above shows an example of buying three life insurance policies with varying term and coverage amounts at different intervals. The policyowner is a healthy 30-year-old woman at the start of her first life insurance policy purchase.

This ladder life insurance strategy is ideal for someone who wants life insurance to protect their loved ones, but can’t afford much at first. A little bit of life insurance is better than none. As you grow into your peak earning years, you can purchase more term life insurance as you need it.

Learn more about life insurance

You’ll find answers to most all your questions right here. And if you want to learn more, simply contact us to speak with an experienced advisor.

Are there different kinds of life insurance?

There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance is coverage designed to last a specific period of time – typically from 10 to 40 years. Whole life insurance provides life-long coverage. There are some situations when whole life is more beneficial than term, but most families only need term life insurance.

How long do I need term life insurance?

The length of your term life insurance coverage should be based on the unique needs of your family as well as your long-term financial goals. You can choose a term length between 10 and 40 years. However, options may vary depending on your age. To learn more about which term length is appropriate for you, keep reading.

Who needs life insurance?

If you have anyone that depends on your income now, life insurance is incredibly important for protecting their financial future and way of life. There are a number of situations and types of people that need life insurance to protect those who would be negatively impacted from the loss of income.