Now as an adult you most likely realized that your education has been vital in getting you to where you are today. As a kid, you only knew it was getting in the way of playing with your Legos and Barbies. Well, it’s back to school time and whether this is your child’s first year of school or they are a pro at this point, it’s important to work with them outside of the classroom as well. Let’s discuss children and money.

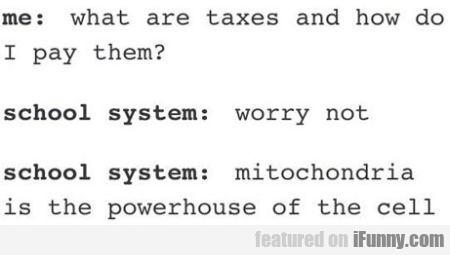

This humorous photo circulating the Internet pokes fun at what you learn in school.

On some level, this photo speaks truth. You leave high school and suddenly are thrown into the real world and can only remember that Fe is the chemical element symbol for Iron. Taxes might be a near mystery to a graduate, yet they will have to deal with them sooner rather than later.

Getting your child interested in learning about and understanding money at a young age can help tremendously when they get older. Preschool isn’t too soon to start with the basics.

Here are some ideas, based on age, of ways to teach your children about money:

Ages 2-3

- Start by first teaching them to identify each coin, explain that just because a penny is bigger than a dime, doesn’t mean it’s worth more.

- Play pretend shopping. Have them use the coins to “buy” household items such as cereal. This starts introducing the basics of commerce.

Ages 4-5

- Have them be in charge of coupon-clipping (with safety scissors.) Then go to the store and ask them to find the items you have coupons for. Explain to them that the coupons save money.

- Have them sort through their toys and ask them to pick some to donate. Explain to them that toys cost money and not all children are able to afford new toys, so it’s kind to share.

Ages 6-8

- If you choose to give an allowance for chores, take your child to open a savings account. Encourage them to put some of their allowance (and birthday money) in the account. Explain to them that banks reward savers by adding to their money with interest.

- Start having them use their own money to buy things they want, i.e. that new Nerf gun. They will learn how quickly money can disappear and the difference between needs and wants.

- Cement the idea of needs versus wants by explaining how putting needs before wants can have a negative chain reaction. For example, if both the furnace and TV break at the same time and you buy a new TV instead of fixing the furnace, it will get too cold during winter. Once the furnace is fixed, then a new TV can be considered.

Ages 9-12

- Teach them the importance of comparison shopping. Show them the price differences between generic and brand-name items and explain why one costs more than the other.

- Plan a garage sale and have them make a list of items in the house to sell. Put them in charge of organizing and pricing.

- Help them plan and host a lemonade stand. Go the the grocery store and buy what is needed. Have them track how much the ingredients cost. Talk through how much the lemonade should be sold for and how much they need to sell to break even and how much to make a profit.

» Calculate: Life insurance needs calculator

These ideas are just a few ways to help instill the value of a dollar in your young child’s mind. Teaching your child about money when they are little will lay that foundation and pique their interest.

As your children get older, explain to them that money isn’t the most important thing in the world, but that it’s very difficult to get by without it. Explain to them what might happen if someone goes to the emergency room but doesn’t have health insurance. Gently describe to them what could happen if a parent doesn’t have life insurance.

See what you’d pay for life insurance

The most important piece to this though is to lead by example. “Do what I say and not what I do” is a very common phrase, but children learn best by watching. Remember, even if you don’t think they are watching or listening, they very well may be. How many times have you heard a little kid say something he wasn’t supposed to? And when you ask him where he learned it, chances are his response was “Mommy” or “Daddy.” Now, obviously, the child’s parents were not purposely teaching him to say it, little Jimmy just overheard it.

These little ones are the future and it’s your responsibility to teach them. It’s also your responsibility to protect them.

Term life insurance is affordable income replacement (one month’s premium is probably a lot less than that new video game.) Life insurance will ensure your child’s standard of living does not need to change if you are no longer around to provide for them. Like most types of insurance, term life insurance is something you hope to never have to use, but are grateful that it’s there just in case.

With your little ones running around, we know you’re busy. Getting a term life quote from Quotacy only takes 30 seconds and there is no need to give us any contact information until you’re ready to apply. After that, we take it from there so you have more time to spend with those you love most.

0 Comments