How much life insurance to get varies by person, depending on your family situation and financial goals. It’s also dependent on whether you plan on getting term life insurance, permanent life insurance, or a little of both.

The life insurance rule of thumb is to get enough coverage (or a large enough death benefit) to cover ten times your annual salary, but this isn’t the correct number for everyone. In this guide, we’ll help you determine how much life insurance you need.

Why Do I Need Life Insurance?

When you have a family, you have a responsibility to take care of them. Your income provides for their standard of living. If you die, what happens to them? This is when life insurance becomes life-saving for your loved ones.

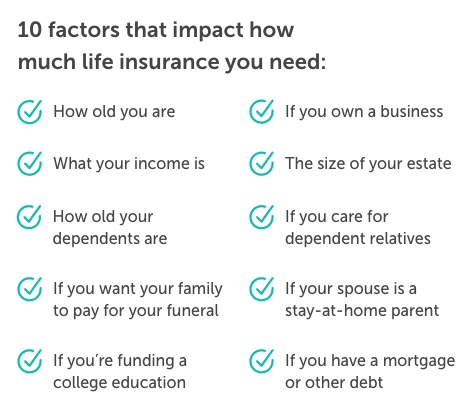

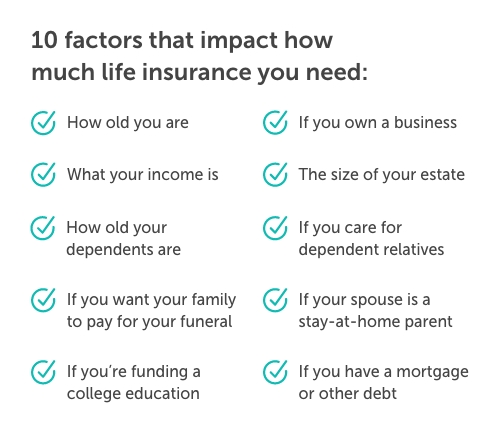

Life insurance needs vary by your circumstances. Do any of the following pertain to you? The more that apply, the more life insurance you need.

- Are you married?

- Do you have a mortgage?

- Do you have children?

- Do you plan on paying for your children’s college education?

- Is your spouse a stay-at-home parent?

- Do you own a business?

- Do you have debt that becomes someone else’s responsibility if you die?

- Do you take care of any aging or dependent relatives?

- Is your estate large enough to wind up owing taxes?

Basically, if anyone depends on you, then you need life insurance.

Not sure how much term life insurance you need?

Calculating Life Insurance Needs: What Should I Consider?

As you’re planning on buying life insurance, take a moment to review what your income currently provides. Then contemplate what your family will need money for in the future. These needs add up.

Where you are in life impacts how much life insurance you need.

How old are you?

Life insurance’s income replacement protection is most important during your working years. The 20-30 years where much of your earnings go toward caring for and supporting loved ones.

For most people, as you get closer to retirement, your life insurance needs decrease. If you’re in your prime working years, you’ll need more life insurance because you have more financial responsibilities. The good news is that the younger you are, the cheaper life insurance is.

How old are your dependents?

Dependents are anyone who relies on you. Children are obvious, but your spouse may also depend on you financially. If you care for aging relatives, they are recognized as dependents, too.

The younger these dependents are, the longer your life insurance needs last. For example, you should consider at least a 20-year term length if you have an infant.

The more dependents you have, the more coverage you need. For example, if you’re married with three children and helping care for your parents, you have many financial responsibilities. Your coverage needs can easily reach one million dollars in life insurance.

What is your income?

The primary purpose of life insurance is to replace your income so your loved ones aren’t suddenly thrown into financial turmoil after your death.

The rule of thumb for life insurance is to buy 10 times your income. They suggest this because it allows your family to pay off end-of-life expenses and ensures their standard of living won’t change too much as they’re navigating their lives without you.

However, as with most general advice, a one-size-fits-all strategy doesn’t account for your specific life circumstances.

For example, a single 35-year-old earning an annual salary of $75,000 who doesn’t want children most likely does not need $750,000 in life insurance coverage. Yet, on the opposite end of the spectrum, a stay-at-home parent who technically doesn’t have a salary may need extra coverage since they save the family thousands of dollars in child care every month.

Are you funding a college education?

If you have kids and plan to contribute to their college education costs, factor these amounts in when buying life insurance. You’ll also want to make sure the term length you choose is long enough to cover them through their college years.

Do you have a mortgage or other debt?

Your mortgage is the most critical debt to account for when buying life insurance. If you die unexpectedly, you don’t want your family to have to choose between keeping their home and paying your debt. Selling a home under duress on top of the emotional turmoil of losing a spouse and parent would be devastating.

Do you have student loans that a loved one would inherit? Your spouse may become responsible for the balance if you live in a community-property state. If someone cosigned your loans, they become liable. Student loan debt can be substantial. Factor this amount in when buying life insurance.

Other types of debt to keep in mind when buying life insurance include car loans, credit card balances, personal loans, and home equity loans. Essentially, any debt that is passed onto someone else when you pass on.

How large is your estate?

For 2023, the federal exemption limit for an estate is $12.92 million. If your estate exceeds that limit, your loved ones will be on the hook for hefty estate taxes when you die.

Life insurance can be used to help offset this cost. It can pay the taxes, so the amount isn’t taken from your heir’s inheritance. Work with an estate planning attorney if you have a large estate.

Learn more about life insurance and estate planning.

Do you want your family to pay for your funeral?

Dying isn’t free. Whether you want to be cremated, buried, or donated to science, funeral arrangements cost money. If you don’t want your family to reach into the savings account to pay for end-of-life expenses, include these costs when buying life insurance coverage.

How Much Life Insurance Can I Get?

You can’t buy as much life insurance as you want. Everyone has an insurability limit. But most people don’t need the maximum amount of life insurance they can get anyway.

Life Insurance Limits

A person’s insurability limit is the total insurance amount that can be inforce at any given time across all the policies that insure their life. For example, if a person’s life insurance limit was $1,000,000, and they already had an inforce policy for $750,000, another company would not issue a $500,000 policy on top of the existing coverage without changes in coverage or surrender of that policy.

Just as a car insurance policy can only cover the value of a car and no more, a life insurance policy can only cover up to the maximum value of the person being covered.

An insurer looks at your current income, net worth, and any other assets or income streams you have to determine the maximum amount of coverage they’re willing to offer.

Financial Justification

Insurance companies require a financial justification for large policies because life insurance is meant to replace wealth, not increase it.

But there are many cases where individuals need large face amounts. People may have multiple financial obligations that the life insurance policy needs to cover.

Your life insurance agent can help by sending a cover letter to the insurance company with detailed explanations of why the amount you’re applying for is in line with your needs.

See what you’d pay for life insurance

How to Calculate Coverage Needs

Our life insurance needs calculator provides a quick and easy way to estimate your needs. You can also talk to a Quotacy agent who will conduct a needs analysis with you free of charge.

Below are different methods people use to calculate their life insurance needs.

Life Insurance Rule of Thumb

With this method, you multiply your annual income by 10 to find your coverage amount. By multiplying a provider’s income by 10, a family can theoretically continue to pay typical expenses and maintain the same standard of living for the 10 years following the provider’s death.

Example: You earn $75,000 annually. 75,000 x 10 = 750,000. You apply for a $750,000 life insurance policy.

- Pro: The most basic way to calculate how much life insurance you need.

- Con: It doesn’t account for inflation.

- Con: It doesn’t acknowledge individual circumstances, such as age, occupation, children, or debt.

Goals-Based Approach

With this approach, you purchase enough life insurance to cover specific goals. These goals are often your reasons to buy life insurance in the first place.

Example: You have a family and a mortgage. If you die tomorrow, you want your family to remain in their home and provide for your children’s college education.

Remaining mortgage: $200,000

In-state 4-year college tuition and fees: ($11,000 x 4 years) = $44,000 x two children = $88,000

Total life insurance needs to cover goals = $288,000

- Pro: It’s simple and easy to calculate.

- Con: It fails to address many financial needs.

Income Replacement Approach

This method uses human life value, which accounts for after-tax income, inflation, and growth rates. Essentially, this approach says that the amount of life insurance coverage you need equals how much you will earn until you retire.

Example: Your gross annual income is $50,000. You plan on working for 20 more years.

Using a financial calculator with inputs of a 5% return on investments, a 2.9% inflation rate, and 3% income growth, your human life value/life insurance need is $1,042,423.

- Pro: It factors in inflation.

- Con: It doesn’t anticipate family assets, additional income, investments, or Social Security survivor benefits.

- Con: It doesn’t leave room for expenses that occur after the death of a provider (medical, funeral, estate settlement, and debt expenses).

Needs-Based Approach

This approach suggests you first add all your debts, final expenses, and the income you need to replace. It’s assumed that your income covers everyday things such as food, clothing, utility bills, and transportation.

Then, subtract assets your family could access, such as savings, stocks, bonds, mutual funds, and existing coverage, such as group life insurance or voluntary life insurance through your employer.

Example:

Debts and Expenses:

Mortgage = $200,000

Children’s college: $88,000

Credit card debt = $10,000

Funeral expenses = $20,000

Total: $318,000

Annual income: $75,000 (then divide by 4%, which is a conservative interest rate for investments)

Total: $1,875,000

So far, life insurance needs equal $2,193,000 (318,000 + 1,875,000).

Subtract the funds you currently have in savings, investments, and the face amounts of any other life insurance policies you may have.

Assets:

Savings Account = $10,000

CDs = $15,000

Group life insurance = $75,000

401(k) = $80,000

Total: $180,000

Your life insurance needs equal $2,013,000 ($2,193,000 – $180,000).

- Pro: This method provides a relatively accurate life insurance needs analysis. It’s more customized to an individual’s situation.

- Con: It’s time-consuming to calculate.

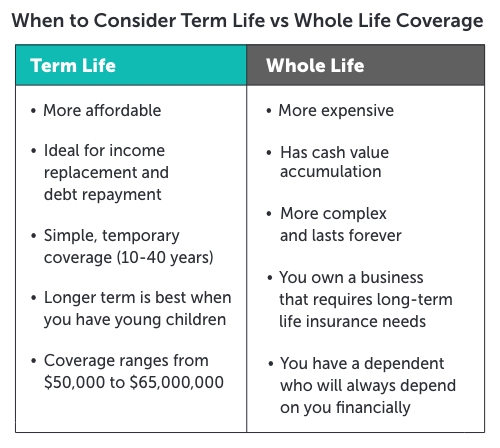

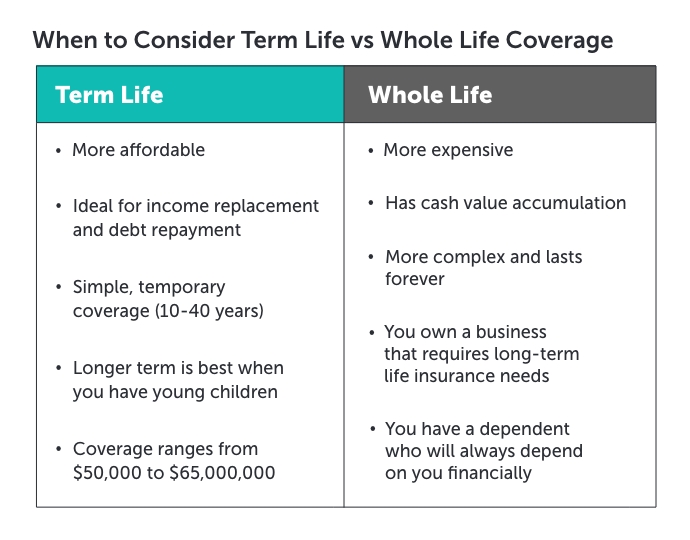

Term vs Whole Life Insurance Coverage Amounts

Term life insurance is simple, temporary coverage. Whole life insurance is more complex and lasts forever. Each addresses different life insurance needs.

How Much Term Life Insurance Do I Need?

For most individuals and families, term life insurance is the best option because it’s much more affordable than whole life. And most people need life insurance for income replacement and debt repayment, which term life insurance is ideal for.

Term life insurance can be customized according to your needs and financial goals. Coverage can last anywhere from 10-40 years. And coverage amount options range from $50,000 to $65,000,000.

Generally, a longer term is best when you have young children (or don’t yet have them but plan to) and are far from retirement. A shorter term is best when your children are close to college, and you are near retirement.

In some cases, buying more than one term policy makes the most sense and saves you money. This strategy is called laddering.

Laddering life insurance policies can mean buying more than one policy at a time with varying term lengths and coverage amounts, or it can mean owning more than one policy and purchasing them at different intervals.

Answer these three questions to start figuring out how much term life insurance you need:

- Do you have debt? How many years until it’s paid off?

- How much income do you provide annually? How many years do you think it would take for your family to become financially stable after you die?

- How many children do you have? How many years until they’re financially independent?

Term life insurance can often be converted into whole life insurance, allowing policyholders to transition their temporary coverage into a permanent policy without undergoing a new health examination, thereby securing lifelong protection.

Learn more about getting a term life insurance policy through Quotacy.

How Much Whole Life Insurance Do I Need?

The features of whole life insurance may be attractive to some people. While the premiums are much higher than term life insurance, this policy lasts your entire life and has cash value accumulation. Participating whole life policies even have dividend earning potential.

Using whole life insurance for all your life insurance needs is not cost-effective. For example, your mortgage loan payments won’t last forever. If you have a 30-year $350,000 mortgage loan, buying a $350,000 whole life insurance will be about 10-15 times more expensive than buying a $350,000 term policy with a 30-year term.

Unsure if you need whole life? Consider the following:

- Do you want to provide an inheritance to heirs?

- Do you have a large estate that will be subject to state, federal, or inheritance taxes?

- Do you have a business that requires long-term life insurance needs?

- Are you caring for someone who will be financially dependent on you their entire life?

- Have you maxed out 401K and IRA contributions and are looking to add to your financial portfolio?

If you answered yes to any of these questions, you might need some whole life insurance.

Learn more about getting a whole life insurance policy through Quotacy.

Do I Need Some of Each?

If you have both temporary and permanent insurance needs, think about buying some of each.

Purchase enough term life insurance coverage for your big-ticket financial responsibilities (such as the mortgage and providing for your children from infancy to adulthood). Then, supplement it with a small permanent life insurance policy to cover final expenses and leave some money behind for your loved ones.

Work with Quotacy to Get the Best Policy at the Best Price

If you have a financial planner, this person will help you determine your life insurance needs. They are knowledgeable in the different calculation methods.

However, we don’t all have financial planners. At Quotacy, our life insurance agents can help you determine your life insurance needs at no extra charge.

Everyone deserves financial security. We’ll help you find a life insurance policy that works for you and your loved ones. Get a quote today.

I have a heart condition and a pacemaker and defibrillator on a fixed social security. I’m a female age 60. Are there any life policies out there that I can afford ?

Hi Jackie, I recommend that you apply for life insurance. If the final offer from the insurance company is too high, you can choose to not accept the policy and you won’t be charged anything.